What To Do Before Withdrawing From Your 401

Even if you qualify for an early distribution, you should be wary of withdrawing from your 401.

So before borrowing from your 401, where should you look for money? The first and obvious place to look is liquid, cash savings, Levine says. Ideally, everyone would have an emergency fund for situations like this.

If you dont have enough saved up, then take a look at your current spending you may find areas where you can scale back to save money while times are tough.

Do you have a car payment or lease that you could reasonably get rid of by buying a cheaper or used car? Are you living in a rental that you could move out of and into something cheaper? Those are obviously serious steps, and just examples, but withdrawing from a 401 will permanently reduce your savings, says Renfro.

If you cant cut anything out of your budget, you could try to get discounts. Levine suggests calling providers, like your cable and insurance companies, and explaining that you need to cut back due to coronavirus-related cash flow issues. Theyll almost definitely offer a discount, he says.

You could also consider taking out a small loan, but be careful not to get yourself further behind with a high-interest debt payment, Renfro says.

Can I Cash Out My 401 Without Quitting My Job

You donât need to quit your job to cash out a 401. Most plans allow access to a 401 to their current employees. Knowing your options will help you choose the best one.

Cashing out a 401 may be tempting, especially if youâre facing financial difficulties or a significant medical emergency or repair. Most 401 participants only access their 401s when they leave a job.

Normally you can’t cash out your 401 without quitting your job. However, some plans allow participants to cash out their 401s via a 401 loan or through a hardship withdrawal. A 401 loan will prevent you from having to pay taxes and penalties, but the loan plus interest will need to be repaid into the account. Hardship withdrawals are categorized by the IRS. Youâll still need to pay taxes however, youâll be exempt from the 10% penalty tax.

Retirement accounts are built and intended to help you save a nest egg to last throughout your retirement years. The best advice is to simply leave it to grow. But if you need access to your 401, it may not be necessary for you to quit your job to do so.

Find The Mortgage Option Thats Right For You

Your 401 account may seem tempting as an untapped source of cash, especially if youre struggling to come up with the money for a down payment on your new home. While this is a viable option, and there are ways to mitigate the penalties, it should only be used as a last resort. Consider applying for a low down-payment loan like an FHA or VA loan, or, if you have one, making a withdrawal from your IRA.

Whatever you decide, make sure you consult with a mortgage specialist before committing to an option. Rocket Mortgage® has experts waiting to help you navigate the tricky waters of home loans. If youre ready to take that next step toward a mortgage, then get started with our experts today.

Take the first step toward the right mortgage.

Apply online for expert recommendations with real interest rates and payments.

Read Also: Can A Small Business Owner Have A 401k

Taking 401 Distributions In Retirement

The 401 withdrawal rules require you to begin depleting your 401 savings when you reach age 72.

At this point, you must take a required minimum distribution each year until your account is depleted. If you are still working for the employer beyond age 72, you may be able to delay required minimum distribution until you stop working if your plan allows this delay. The delay option is not available to you if you own 5% or more of the business.

You have until April 1 of the year after you turn 72 to take your first required minimum distribution. After that, you must take a minimum amount by December 31 each year. Your 401 plan administrator will tell you how much you are required to take each year.

The amount is based on your life expectancy and your account balance. If you dont take your required minimum distribution each year, you will have to pay a tax of 50% of the amount that should have been taken but was not. If you participate in more than one employer plan, you must take a required minimum distribution from each plan.

Key Considerations With 401 Loans

- Some plans permit up to two loans at a time, but most plans allow only one and require it be paid off before requesting another one.

- Your plan may also require that you obtain consent from your spouse/domestic partner.

- You will be required to make regularly scheduled repayments consisting of both principal and interest, typically through payroll deduction.

- Loans must be paid back within five years .

- If you leave your job and have an outstanding 401 balance, youll have to pay the loan back within a certain amount of time or be subject to tax and early withdrawal penalties.

- The money you use to pay yourself back is done with after-tax dollars.

Although getting a loan from your 401 is relatively quick and easy, the benefit of paying yourself back with interest will likely not make up for the return on investment you could have earned if your funds had remained invested.

Another risk: If your financial situation does not improve and you fail to pay the loan back, it will likely result in penalties and interest.

You May Like: Can I Contribute To Traditional Ira And 401k

How To Make An Early Withdrawal From A 401

When you have determined your eligibility and the type of withdrawal you want to make, you will need to fill out the necessary paperwork and provide the requested documents. The paperwork and documents will vary depending on your employer and the reason for the withdrawal, but when all the paperwork has been submitted, you will receive a check for the requested funds, hopefully without having to pay the 10% penalty.

How Long Can A Company Hold Your 401 Funds When You Withdraw

When you leave a job, you can decide to cash out your 401 money. Generally, when you request a payout, it can take a few days to two weeks to get your funds from your 401 plan. However, depending on the employer and the amount of funds in your account, the waiting period can be longer than two weeks.

Each company has different time frames for making distributions when you request a payout. Check the waiting period of your employerâs 401 plan by checking the summary plan description given by the company. The waiting period starts when you request a payout up to when you receive the cash distribution, or funds are rolled over to an IRA or 401.

Also Check: How To Transfer 401k Accounts

A Note About The Cares Act

Signed into law on March 27, 2020, the $2 trillion dollar Coronavirus Aid, Relief and Economic Security Act emergency stimulus bill was drafted to help those affected by the coronavirus pandemic. Under the act, 401 account owners can make a hardship withdrawal of up to $100,000 without paying the 10% penalty. The bill also grants the account holder 3 years to pay the income tax, rather than it being due within that same year.

Make A 401 Withdrawal

Your second option would be to make a direct withdrawal from your 401 account. As mentioned above, this is the less desirable of the two options.

An early withdrawal would be classified as a hardship withdrawal. The IRS considers any emergency removal of funds from a 401 to cover an immediate and heavy financial need as a hardship withdrawal. Whether or not the purchase of a home using your 401 counts as a hardship withdrawal is a determination that falls to your employer, and you will need to present evidence of hardship before the withdrawal can be approved.

Regardless, you will still likely incur the 10% early withdrawal penalty. There are exemptions in place for specific circumstances, including home buying expenses for a principal residence. Qualifying for such exemptions is difficult by design, however. If you possess other assets that could be used for your home purchase, then you likely wont qualify for an exemption. Even if you do, your withdrawal will still be taxed as income.

Read Also: What Should You Invest Your 401k In

Withdrawing From Your 401 Before Age 55

You have two options if you’re younger than age 55 and if you still work for the company that manages your 401 plan. This assumes that these options are made available by your employer. You can take a 401 loan if you need access to the money, or you can take a hardship withdrawal., but only from a current 401 account held by your employer. You can’t take loans out on older 401 accounts.

However, you can roll the funds over to an IRA or another employer’s 401 plan if you’re no longer employed by the company. But these plans must accept these types of rollovers.

Think twice about cashing out. You’ll lose valuable creditor protection that stays in place when you keep the funds in your 401 plan at work. You could also be subject to a tax penalty, depending on why you’re taking the money.

What Determines How Long A Company Can Hold Your 401 After Leaving A Job

The retirement money you have accumulated in your 401 is your money. This gives you the freedom to change jobs without worrying that your savings may get lost in the process. The money can stay in your employerâs retirement plan for as long as you want, but there are certain cases when an employer may force a cash out or rollover the funds into another retirement account.

These factors may determine how long an employer can hold your 401 money after you leave the company:

You May Like: How To Change A 401k To A Roth Ira

Borrowing From Your 401k Without Penalty

You may be wondering, how can I use my 401k to buy a house? There are two possible options: 401k withdrawals and 401k loans. Conventional wisdom advises against withdrawing funds from your 401k early. However, borrowing from yourself is different from withdrawing funds permanently and does not incur the same tax penalties as withdrawing funds.

In taking a 401k loan to purchase a home, you wont incur the same penalties. If you fail to repay your loan within the allotted time frame, however, it will be treated as a taxable withdrawal.

Find Out What’s Happening In Larchmont

“But it is MY money,” I have heard. “I’ll just pay the penalty.” Unfortunately it does not work that way. The IRS governs how these accounts operate and stipulates that, for a current employee, withdrawals can be made only for hardship reasons. They outline the reasons as follows:

- Expenses for medical care previously incurred by the employee, the employee’s spouse, or any dependents of the employee or necessary for these persons to obtain medical care

- Costs directly related to the purchase of a principal residence for the employee

- Payment of tuition, related educational fees, and room and board expenses, for the next 12 months of postsecondary education for the employee, or the employee’s spouse, children, or dependents

- Payments necessary to prevent the eviction of the employee from the employee’s principal residence or foreclosure on the mortgage on that residence

- Funeral expenses or

- Certain expenses relating to the repair of damage to the employee’s principal residence.

Further, the employee must provide proof to the employer plan trustee substantiating the request. There are, of course, additional rules and requirements as defined by the IRS and the employer.

You May Like: How To Collect Your 401k From Previous Employer

Options For Borrowing From A 401 While Still Working

If youre still in the workforce and need to access your 401 funds for one reason or another, you may still have options. These pre-retirement withdrawal options include in-service distributions, hardship withdrawals, and plan loans.

In-service distributions allow you to withdraw your vested money before retirement and are sometimes referred to as an early retirement option in the plan. This is generally allowed at age 59 ½ because distributions of your 401 deferrals before that age are subject to a 10 percent penalty tax.

Hardship distributions are allowed for special reasons such as medical care, purchase of your home, tuition, funeral expenses, payments to prevent eviction, and damage to your principal residence. The distribution is limited to the amount you need, and your employer will need to see some proof of the hardship. Hardship distributions are subject to income tax and the 10 percent penalty tax for distribution before 59 ½.

Plan loans occur when you borrow money from your 401 balance, but the amount you can withdraw is limited to the half of your vested balance and cannot be more than $50,000. The loan will have to be paid back to the plan with interest, and the loan period cannot exceed five years in most cases. That being said, loans taken out for principal residence can be longer than five years.

Learn About The Changes To Iras 401s Rmds And More

The Setting Every Community Up for Retirement Enhancement Act of 2019, better known as the SECURE Act, which originally passed the House in July 2019, was approved by the Senate on Dec.19, 2019, as part of an end-of-year appropriations act and accompanying tax measure, and signed into law on Dec. 20, 2019, by President Donald Trump. The far-reaching bill includes significant provisions aimed at increasing access to tax-advantaged accounts and preventing older Americans from outliving their assets.

Read Also: How Do You Move Your 401k When You Change Jobs

Making A Hardship Withdrawal

Drawbacks To Using Your 401 To Buy A House

Even if it’s doable, tapping your retirement account for a house is problematic, no matter how you proceed. You diminish your retirement savingsnot only in terms of the immediate drop in the balance but in its future potential for growth.

For example, if you have $20,000 in your account and take out $10,000 for a home, that remaining $10,000 could potentially grow to $54,000 in 25 years with a 7% annualized return. But if you leave $20,000 in your 401 instead of using it for a home purchase, that $20,000 could grow to $108,000 in 25 years, earning the same 7% return.

Don’t Miss: How To Find Old 401k Plans

Dividing Your 401 Assets

If you divorce, your former spouse may be entitled to some of the assets in your 401 account or to a portion of the actual account. That depends on where you live, as the laws governing marital property differ from state to state.

In community property states, you and your former spouse generally divide the value of your accounts equally. In the other states, assets are typically divided equitably rather than equally. That means that the division of your assets might not necessarily be a 50/50 split. In some cases, the partner who has the larger income will receive a larger share.

For your former spouse to get a share of your 401, his or her attorney will ask the court to issue a Qualified Domestic Relations Order . It instructs your plan administrator to create two subaccounts, one that you control and the other that your former spouse controls. In effect, that makes you both participants in the plan. Though your spouse cant make additional contributions, he or she may be able to change the way the assets are allocated.

Your plan administrator has 18 months to rule on the validity of the QDRO, and your spouses attorney may ask that you not be allowed to borrow from your plan, withdraw the assets or roll them into an IRA before that ruling is final. Once the division is final, your former spouse may choose to take the money in cash, roll it into an IRA or leave the assets in the plan.

K Withdrawal Rules: How To Avoid Penalties

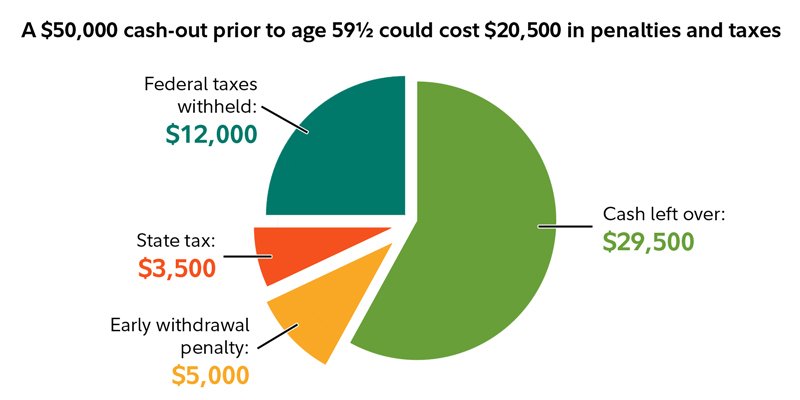

401k plans, IRAs and other tax-advantaged retirement savings accounts are common ways to save for retirement, and millions of Americans pour money into them every year. Its generally wise to avoid withdrawing money from your 401k, as there are often hefty penalties and taxes to consider for early withdrawals.

Sometimes, however, unplanned circumstances force people to withdraw funds from their 401k early. So if you find yourself in a place where you need to tap your retirement funds early, here are some rules to be aware of and some options to consider.

Don’t Miss: Can You Leave Money In 401k At Your Old Job