You Have Four Main Options For An Old 401 Thats Tied To A Former Employer

At Capitalize we help our users move their legacy 401 account into an IRA. Dont worry if you dont already have one our online rollover process guides you through your different IRA options and helps you pick one thats right for you.

Vesting: What Does Vested Balance Mean

Were here to help! First and foremost, SoFi Learn strives to be a beneficial resource to you as you navigate your financial journey.Read moreWe develop content that covers a variety of financial topics. Sometimes, that content may include information about products, features, or services that SoFi does not provide.We aim to break down complicated concepts, loop you in on the latest trends, and keep you up-to-date on the stuff you can use to help get your money right.Read less

Your 401k vested balance refers to how much of your contributions you own and would if you left your company. Contributions that employees make to their 401 accounts are always 100% vested they own them outright.

However, this is not always true of the money employers put into their employees accounts, including matching funds. Those contributions may only belong to an employee after theyve worked for the company for a certain amount of time, the companys vesting period.

If you were to leave your job before reaching that milestone, you could forfeit some or all of the employer-contributed money in your account. The amount that you get to keep is the vested balance. Other qualified defined contribution plans, such as 401 or 403 plans may also be subject to vesting schedules.

Heres a deeper look at what being vested means and the effect it can have on your retirement savings.

S To Take Now To Improve Your Retirement Readiness

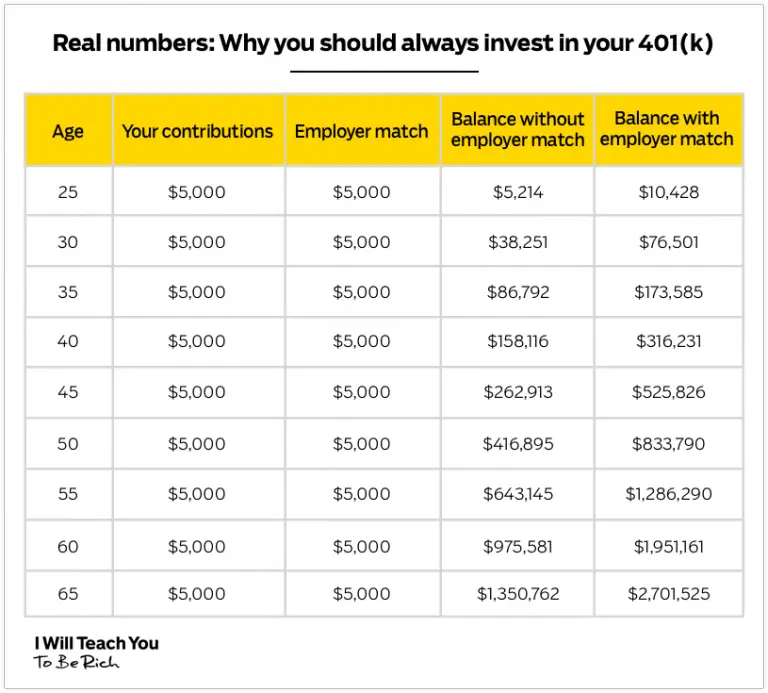

While the average 401k balance at pre-retirement age is around $600K, that balance still falls far below even the no growth column of the savings potential chart for the same age. And while $600,000 is no chump change, its also probably not enough to retire comfortably for most people.

Needless to say, many people are falling way below their savings potential. But the good news is, its not too late to turn things around.

Also Check: How To Take My Money Out Of 401k

Make Sure You Actually Contributed

Before you go through the hassle and process of calling the HR department at your old employer, or searching through databases, its a good idea to verify that you contributed to the plan.

If you are unsure if you contributed to a 401 plan, you can check your previous year tax return and old W-2. Any contribution will be in Box 12 of the W-2.

ERISA, or the Employee Retirement Income Security Act of 1974, sets minimum standards for retirement plans, and protects retirement savings from abuse or mismanagement.

Among other things, employees are required to make annual reports

A National Database To Find Forgotten 401s And Pensions Could Be On The Way But Savers Should Take Action Now To Locate Any Missing Retirement Accounts

At a time when many Americans are worried that they wont have enough money to retire comfortably, thousands have lost track of billions of dollars in savings.

There are more than 24 million forgotten 401 accounts containing some $1.35 trillion in assets, according to a report from Capitalize, which helps workers roll over their retirement plans when they change jobs. Companies are also holding on to billions in unpaid pension payments earned by former employees.

The problem is so widespread that Congress is considering legislation to address it. SECURE Act 2.0, which includes a wide range of benefits and protections for retirement savers , would create a national online lost-and-found database to help people track down these orphaned plans.

Brian Stivers, owner of Stivers Financial Services, in Knoxville, Tenn., says he typically meets one to two new clients a month who are in this situation. Most of the time, theyve changed jobs and forgotten about an old plan, usually because it had a small balance. Retirement plans are also misplaced when one spouse dies and the survivor is unaware of accounts with his or her former employers.

Read Also: How Do You Split A 401k In A Divorce

How To Invest Your 401

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

The investing information provided on this page is for educational purposes only. NerdWallet does not offer advisory or brokerage services, nor does it recommend or advise investors to buy or sell particular stocks or securities.

Nothing is more central to your retirement plan than your 401. It represents the largest chunk of most retirement nest eggs.

Finding the money to save in the account is just step one. Step two is investing it, and thats one place where people get tripped up: According to a 2014 Charles Schwab survey, more than half of 401 plan owners wish it were easier to choose the right investments.

Heres what you need to know about investing your 401.

How To Find An Old 401 And What To Do With It

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandheres how we make money.

The investing information provided on this page is for educational purposes only. NerdWallet does not offer advisory or brokerage services, nor does it recommend or advise investors to buy or sell particular stocks or securities.

There are billions of dollars sitting unclaimed in ghosted workplace retirement plans. And some of it might be yours if youve ever left a job and forgotten to take your vested retirement savings with you.

But no matter how long the cobwebs have been forming on your old 401, that money is still yours. All you have to do is find it.

You May Like: How To Move 401k To Cash

How To Figure Out Your 401k Expenses

Also, I ran across a nice 401K expense calculator in Money magazine this month that I thought I would share.

Step 1: Tally Administrative Costs

- Go to your plans summary annual report. Find the basic financial statement section.

- Subtract benefits paid from total plan expenses.

- Divide that number by the total value of the plan.

- This number is your plans administrative cost.

Step 2: Calculate Investment Fees

- Multiply your fund expense ratio by your balance in the fund.

- Divide those total fees by your total balance.

- This number is your investment expense.

- *If you have only one fund , your investment expense ration is the ratio on this one fund.

Step 3: Add Administrative and Investment Fees

So what are your thoughts about 401K fees and the rating system provided by BrightScope? Let me hear from you in the comments below

What Happens If I Have Unclaimed 401 Funds From A Previous Job

The majority of unclaimed money comes from brokerage, checking, and savings accounts, along with annuities, 401s, and Individual Retirement Accounts. Once an account is considered inactive or dormant for a period of time , companies are required by law to mail abandoned funds to the owners last known address. If theyre returned, or the owner cant be reached, the assets must be relinquished to the state.

Recommended Reading: Can I Move My 401k To An Ira

Contact The 401 Plan Administrator

If your employer is no longer around, try getting in touch with the plan administrator, which may be listed on an old statement.

If youre unable to find an old statement, you still may be able to find the administrator by searching for the retirement plans tax return, known as Form 5500.

You can find a 5500s by the searching the name of your former employer at www.efast.dol.gov.

If you locate a Form 5500 for an old plan, it should have the contact information on it.

If Youve Ever Had A 401 Account With An Employer And Lost Track Of It After Youve Left Youre Not Alone

We estimate that there are over 25 million orphaned 401 accounts just like yours. These are accounts tied to former employers that continue to have money in them, but are not actively being monitored or used.

At Capitalize, we help people find these old, orphaned 401 accounts and consolidate them into a new retirement account for free. This helps them better keep track of their retirement savings over time.

The money youve put away in a 401 account remains yours even after youve left that job. Most of the time its still at the same financial institution that managed it while you had it. This financial institution is known as a 401 provider. Its a company engaged by your former employer to hold and manage your 401 assets. You can see a full list of 401 providers here.

Some of the time, though, your money has been transferred to a new institution. That generally happens in one of three cases:

- Your former employer changes their 401 provider when this happens your 401 account will be transferred over to the new institution.

- Your former employer is acquired by another company when this happens your account usually gets transferred to the 401 provider used by the acquiring company.

- Your account balance was under $5,000 and was transferred to an IRA at a different institution this is known as a forced rollover and is allowed by some 401 plans.

Read Also: How To Avoid Taxes On 401k

Leave It With Your Former Employer

If you have more than $5,000 invested in your 401, most plans allow you to leave it where it is after you separate from your employer. If it is under $1,000, the company can force out the money by issuing you a check, says Bonnie Yam, CFA, CFP, CLU, ChFC, RICP, EA, CVA, CEPA, Pension Maxima Investment Advisory Inc., White Plains, New York. If it is between $1,000 and $5,000, the company must help you set up an IRA to host the money if they are forcing you out.

If you have a substantial amount saved and like your plan portfolio, leaving your 401 with a previous employer may be a good idea. If you are likely to forget about the account or are not particularly impressed with the plans investment options or fees, consider some of your other options.

When you leave your job and you have a 401 plan which is administered by your employer, you have the default option of doing nothing and continuing to manage the money as you had been doing previously, says Steven Jon Kaplan, CEO, True Contrarian Investments LLC, Kearny, New Jersey. However, this is usually not a good idea, because these plans have very limited choices as compared with the IRA offerings available with most brokers.

Specifying a direct rollover is important. That means the money goes straight from financial institution to financial institution and doesn’t count as a taxable event.

How Do Employer 401 Matching Contributions Work

Some employers offer to match their employees 401 contributions, up to a certain percentage of their salary. One common approach involves an employer matching employee contributions dollar-for-dollar up to a total amount equal to 3 percent of their salary. Another popular formula is a $0.50 employer match for every dollar an employee contributes, up to a total of 5 percent of their salary.

Continuing our example from above, consider the impact on your 401 savings of a dollar-for-dollar employer match, up to 3 percent of your salary. If you contribute 5 percent of your annual pay and receive $2,000 every pay period, with each paycheck you would be contributing $100 and your employer would contribute $60.

When starting a new job, find out whether your employer provides matching 401 contributions, and how much you need to contribute to maximize the match.

If they do, you should at a minimum set your 401 contribution level to obtain the full match, otherwise youre leaving free money on the table.

Don’t Miss: How Do You Rollover Your 401k To A New Employer

Why Employers Offer 401s

In 1978, when the law authorizing the creation of the 401 was passed, employers commonly attracted and retained talent by offering a secure retirement through a pension . The 401 created an entirely new system, with more flexibility for both employer and employee. One of the ways it did so was by giving employers the option to match employee contributions.

Matching is a very transparent process: for every dollar you put into your 401, your employer also puts in a dollar, up to a certain amount or percentage of your income. Theres no mystery here. If your employer promises to match all 401 contributions up to 5% of your income, and you contribute that amount every month, your employer will match you dollar for dollar, every month. Its a win-win situation. You are doubling your money, and your employer is building a happy workforce.

How Does Epf Work

As mentioned earlier, both the employer and the employee contribute 12% of the basic monthly wages towards EPF. While the employees 12% contribution goes fully towards the EPF, the employers 12% contribution is divided as follows:

- 33% towards Employee Pension Scheme

- 67% towards Employee Provident Fund

- 1% towards EPF Administration Charges

- 5% towards Employee Deposit Linked Insurance

- 01% towards EDLI Administration Charges

Over the years, EPF rules have changed with regards to coverage, contribution rules, withdrawal procedures, etc. Some significant rule changes occurred in September 2014, with a few more in February 2016. To keep our readers updated about the latest EPF rules, we have listed the main revisions at the end of this page. We will continue to update these as and when rule changes occur. Check back frequently to ensure that youre up-to-date with the latest rules related to EPF.

You May Like: How To Get A Loan From My 401k

Private Sector Employees Can Invest For Retirement With A 401 Plan

A retirement plan may be one of the most valuable benefits of employment. Used effectively, it can deliver a long-term impact on your financial well-being. See how a retirement plan works and learn about the power you have to control your financial future.

In general, a 401 is a retirement account that your employer sets up for you. When you enroll, you decide to put a percentage of each paycheck into the account. These contributions are placed into investments that youve selected based on your retirement goals and risk tolerance. When you retire, the money you have in the account is available to support your living expenses.

Types Of Vesting Schedules

Employers can use a variety of approaches to vesting.

100% Immediate Vesting

When money is 100% immediately vested, you own that money without needing to wait or work additional hours. Two of the most common types of immediately vested balances include:

- Safe Harbor: If your employer uses a Safe Harbor contribution , those contributions are fully vested immediately.

- Employee salary deferral: Again, the money you voluntarily contribute to the plan is 100% immediately vested. You cannot forfeit that money to your employer, although the value may rise and fall if your investments gain or lose value.

6-Year Graded

A 6-year graded vesting schedule is another popular option. With that approach, your vested portion increases by 20% each year. You start with 0% vesting after your first year, and vesting begins after that.

- Year 2: 20%

- Year 6: 100%

Cliff Vesting

Cliff vesting is more generous, although it does not work well for employees who only work for a brief period. After your first and second year, youre 0% vested. But after your third year, you are 100% vested.

Other Schedules

As long as a vesting schedule is at least as generous than the IRS specifies, employers may be able to get creative. For example, some employers set vesting at 25% per year. If their guideline is to be less restrictive than the 6-year graded schedule, this might be allowed. Ultimately, its up to employers to decide if they want to be more generous.

Whats a Year?

You May Like: How Does A 401k Work When You Change Jobs