Who Pays Tax On Divorce Settlement

State laws ultimately control the distribution of marital assets in a divorce, except for eligible retirement plan assets protected by the Employee Retirement Income Security Act .

When it comes to who gets anything when a marriage ends, state laws vary dramatically. If the divorce takes place in an equal distribution state or a community property state affects the asset division.

Nine states have community property laws, while the other 41 have common law laws.

The courts determine what is a fair, rational, and equal division of assets in the 41 equitable distribution states. A court may grant a spouse anything from 0% to 100% of the propertys worth.

The length of the marriage, the property brought into the marriage by each party, the earning power of each spouse, the obligations of each spouse in raising their children.

Also, the amount of retraining required to make a spouse employable, the tax effects of asset distribution, and debt allocation are all considerations considered by the courts.

The spouse has more say in how the property is shared whether they signed a prenuptial agreement or an agreement during the marriage. The following are some other elements of a fair distribution that should not be overlooked:

- Any wealth gained during the marriage that is not protected by a prenuptial agreement would be divided.

- The name on the asset title or the source of funds used to purchase assets is not influencing factors.

Should You Stop Contributing To A 401 During Divorce

The choice is up to you, but you will first need to check your plan to see if you are within the time frames that let you change your plan enrollment status or contribution amounts. Some people find that stopping retirement contributions when a divorce is pending helps to free up cash for bills and attorneys fees.

However, keep in mind that whatever you invest after the date of separation is likely your separate property.

Cost Of Dividing A 401k Because Of Divorce

The division of your 401k account is one piece of your bigger financial picture. Simply dividing your 401k in half may be the most costly and inefficient option available.

When you divide a 401k , you need to complete a Qualified Domestic Relations Order . This is a legal document that tells your plan administrator how to divide the assets and that the division is pursuant to a divorce. As a QDRO is a legal document you guessed it there is typically a cost for a lawyer to create this document.

Even if you create a simplified form, which is becoming more common on human resource websites, there is typically a fee applied by the human resource department to implement your decision. If you can avoid this cost, yet still reach your desired outcome, I suggest you consider it.

Recommended Reading: Can You Pull From 401k To Buy A House

How Do I Divide An Ira In Divorce

The spouse who will receive a portion of the IRA will need to have an IRA in their own name. The easiest way to do this is to open an account with the custodian where the IRA being split is held. A custodian is a company who holds the account.

Once the account is open, the final divorce decree and related paperwork is sent to the custodian and tells them how the IRA is supposed to be split.

Assuming all the paperwork is in good order, the funds should be transferred directly into the recipient spouses IRA. That could take anywhere between a couple of days up to a few weeks.

Once the transfer is complete, the recipient spouse can leave the IRA with the custodian it is at or transfer it to the custodian of their choice.

NOTE: It is possible to transfer an IRA directly from one custodian, where the owner spouse holds their IRA to a different custodian of the recipient spouses choice. That can be done instead of the recipient spouse opening a new account where the IRA is initially held. In my experience, this can add quite a bit of complexity and delay the transfer as different custodians have different rules surrounding transfers incident to divorce.

Can I Split A 401k In My Divorce Without Paying Taxes

Divorcing Tennessee spouses who must split 401K retirement accounts should learn about the qualified domestic relations order.

When getting a divorce, many people in Tennessee end up having to split their 401K account assets with their spouse. This has become a relatively common part of many property division settlements today, especially as a retirement account may be one of a couples most valuable assets.

However, as with other elements of a property division agreement, there may be tax implications of splitting a 401K account. Before proceeding, people should understand what is involved in this split in order for them to assess what is in their best interest. It is also wise to learn about the ways to potentially avoid being hit with a large tax bill.

The qualified domestic relations order

The U.S. Department of Labor explains that when a person withdraws money from a 401K account for any non-retirement purpose, both taxes and early withdrawal penalties may apply. The use of a qualified domestic relations order may help people prevent both of these things. This is essentially a way for people to maximize the amount of money they preserve from their hard-earned savings.

With a QDRO, the spouse who does not own the account can be named as an alternate payee on the account. This then allows them to receive distributions directly as per the QDRO and divorce decree. The plan participant is therefore not taxed nor assessed any fees.

Child support and spousal support

You May Like: How To Find Out If You Have A 401k Account

Will I Get Half Of His 401 If We Have Been Married For Three Years

If you have only been married for three years and you want to get a divorce, you can still get a share of the 401 and other marital property that has accrued during the marriage. includes real property and personal property acquired during the marriage but before separation.

For example, if your spouse has accumulated $1,000,000 in his/her 401 over their 30 years of employment, and only $30,000 was contributed during the marriage, you can only get a share of the $30,000 401 savings and not the $1,000,000. Therefore, you can get up to 50% of the $30,000 i.e. $15,000. However, depending on your state division rules, it may not be an automatic 50-50 split.

Defer Payments Until Account Owner Retires

If your plan administrator allows it, your ex can leave his or her share invested in the plan and wait until you retire to begin taking distributions. This might make sense if your ex is younger than 59.5 and doesnt immediately need the funds. However, he or she would need to start taking required minimum distributions upon reaching age 70.5.

Also Check: How Much Will My 401k Grow If I Stop Contributing

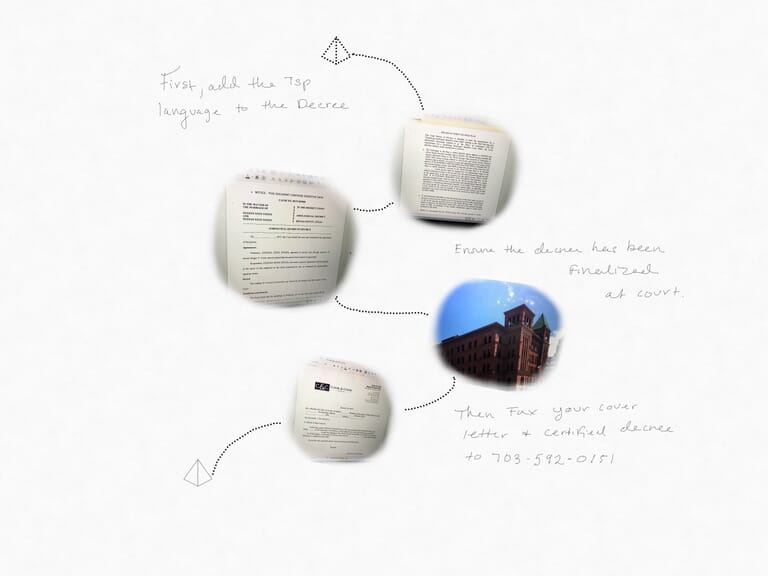

How Long Does A Qdro Take

Typically, a QDRO can take anywhere from two months to three months from the time it is drafted to when it is executed. Sometimes, if there are submission errors or if the divorce is final, it can take several more months or years to split the 401 money between the spouses.

When drafting a QDRO, both spouses should involve divorce attorneys to ensure that they comply with all retirement plan requirements. Once both parties agree on the QDRO terms, they must submit it to the court for signature and filing. A certified copy of the signed order is then sent to the 401 plan administrator, who must deem the order as qualified and issue an interpretation letter.

After approval, the funds can take anywhere from two weeks to five weeks to reach the spouse’s account. The spouse can opt to receive part of all of the transfer as a cash distribution, or choose to rollover the 401 into a 401 or IRA.

Tags

Include The Detailed Agreement In Your Separation Agreement

Make sure that you identify the exact plan name in the agreement. It’s common for companies to have more than one plan available to employees. I cannot tell you how many agreements I’ve seen where the plan name is not correctly identified. If the agreement has the wrong name, it will likely be used in the QDRO, and the plan will reject the document.

Remember to include all the details of your agreement, including who is responsible for the QDRO preparation and its cost, as well as a deadline for completion.

I’ve had several clients contact me years after their divorce settled about their QDROs because there was no specific timeline identified in their agreement and/or there was no person identified as the responsible party. This can lead to a lot of costly problems.

Read Also: How To Collect Your 401k From Previous Employer

Benefits Of 401k Withdrawal Due To Divorce

The cost and complexity of the division of a 401k in divorce is only one part of the consideration. There are potential benefits to using proceeds from a 401k in divorce. For example, if cash is needed, you may be able to avoid the early withdrawal penalty tax if money is withdrawn as part of the divorce decree and withdrawal is done by use of a QDRO.

There is no perfect or standard answer to dividing 401ks in divorce. However, if you take the time to consider the specifics of your situation, and evaluate all the financial tools available, you may find a better solution for your financial divorce than the one you originally considered.

As a Certified Divorce Financial Analyst, I can help. Please if you have questions about how your 401k divorce decisions will affect your financial life during and after your divorce is finalized. Uninformed decisions can be costly and in most cases, are not reversible. It is best to figure out your options as soon as you are considering divorce.

How Are 401s Split During A Divorce

The way divorcing couples split 401s depends on several factors, including where they live, the balance of each 401, how the government taxes the 401, and the value of other marital assets.

Most states follow marital property law, which requires marital property to be divided equitably, although not necessarily equally. Community property states require that all marital assets be divided 50/50 in a divorce. Note that the key here is assets. In both types of states, any money you put into your 401 before you got married isn’t considered marital or community property and isn’t subject to division in a divorce.

If one spouse has significantly more savings than the other, a court may order the one with more savings to give some to the other. But that doesn’t necessarily mean you have to liquidate your 401 and hand part of it over to your ex.

Read Also: Is A 401k Worth It Anymore

How Are Retirement Accounts Handled In Divorce

Retirement accounts are treated as marital assets in divorce and must be divided in an appropriate way as part of the settlement process.

On the surface, this sounds simple enough, but there are several rules, laws and procedures that must be followed so that the division is done properly.

Some of the important elements that impact how funds are divided include when the asset started to accrue, what type of retirement asset it is, and what the marital cut-off date is so that a proper value on the account can be established.

There are two types of retirement accounts:

A defined contribution plan is also referred to as a savings plan.

These types of retirement accounts are characterized by the employee, the employer, or both making contributions to a retirement account in the name of the employee.

The most common of these is a 401 plan, although other defined contribution plans include 403, 457, IRA, Profit Sharing Plan, etc.

A defined benefit plan is a company retirement plan, such as a pension, that pays a benefit that is based on an employees years of service to a company and their salary history.

Defined benefit plans start paying monthly benefits when an employee retires. Those payments will continue for the rest of the employees life and may include survivor benefits.

To divide a retirement asset, the first thing that should happen is that a value must be placed on the asset.

In community property states, that split will be 50/50.

Withdrawal Due To Divorce

A 401 plan is designed to remain in place until you reach retirement age, at which point youll begin taking distributions, and those withdrawals will be taxed as ordinary income. The minimum age to take distributions on a 401 account is 59½. So whatever tax bracket youre in at the time will be the amount you pay. If you take the money out early, though, youll be subject to a 10 percent penalty, which could pull thousands of dollars from your earnings, depending on how much is in the account.

But there are exceptions to this penalty. One of those exceptions is when the early distribution is part of a divorce settlement. Youll still each pay income tax on any amount that is withdrawn, but you wont have to worry about the penalty. However, in order to divide your 401 without this penalty, youll need a Qualified Domestic Relations Order, which is issued by the court. The receiving spouse will also have to withdraw the funds properly to avoid the penalty.

You May Like: Where Do I Go To Withdraw My 401k

Contact Accomplished Scottsdale Divorce Attorneys For Help Protecting Retirement Savings

From the Scottsdale, Arizona office of Clark & Schloss Family Law, P.C., our attorneys help divorcing spouses protect 401 savings and other retirement funds. To schedule a free initial consultation with our office, call or contact us online.

TESTIMONIALS

-

I found Mr. Schloss through the recommendation of my father. I was involved in a very serious matter. – Joseph

-

Mr. Schloss has been an immense help to my family and me. I have known him since 2006, after seeking legal representation in a custody case regarding my son. –read more

-

I feel so fortunate to have hired Michael Schloss to assist me with my divorce and child support. – Dawn

-

I can’t begin to say how pleased I am with the firm’s service Mike is truly an amazing attorney with family law matters. – Rob

Why Splitting Retirements Assets In A Divorce So Complicated

Property distribution is a complicated aspect of divorce, and high-value retirement assets are often a subject of dispute. Divorcing spouses face unique challenges concerning valuation, the timing of distributions, tax consequences, and other issues related to retirement. It is critical to strategically address these issues and their long-term consequences when dividing property in a divorce.

Recommended Reading: Can I Keep My 401k After I Leave My Job

Direct Or Indirect Rollover To An Ira

Your ex spouse can initiate a direct rollover of her proper share of your 401 into a personal IRA. The transfer itself wont trigger any taxes on your part or that of your ex. But if your ex makes a withdrawal before reaching age 59.5, he or she would generally owe a 10% early withdrawal penalty in addition to regular income tax.

Keep in mind, however, that these rules apply to direct rollovers. This means a direct plan-to-plan rollover. So, your ex may want to open an IRA before the plan administrator approves the QDRO. One can easily open an IRA at most banks and investment firms.

With an indirect rollover, however, the plan administrator sends a check to your ex in the amount of his or her proper share. Your ex then generally has 60 days to deposit the funds in another plan without facing some serious tax penalties.

Property Division And Divorce Attorneys In Fairfax Va You Can Trust

If youre going through a divorce and want to speak with an experienced attorney about dividing retirement accounts, we are here for you. The legal team at Kearney, Freeman, Fogarty & Joshi, PLLC, has served Northern Virginia for over 30 years from our office in historic downtown Fairfax, and we are ready to provide you with quality legal services, too. To get started on your case, call our office at 877.652.1553 or live chat with us on our website.

|

Related links: |

Read Also: What Happens To Your 401k When You Leave A Company

What Is An Ira

An Individual Retirement Account is a tax-advantaged investing tool that is used to set aside funds for retirement savings. There are several kinds of IRAs, each with different possible tax liabilities, depending on a persons employment status.

If you take money from an IRA prior to age 59 ½, in most cases, youll be subject to a 10% withdrawal penalty.

An individual who has earned income can contribute up to $6,000 in 2020 to an IRA.

Depending on what you earn, you may be able to deduct all or part of your contribution on your tax return. If you are receiving spousal support that is taxable to you at the federal level, you are considered to have earned income to contribute to an IRA.

The funds deposited into the IRA will grow tax-deferred until Required Minimum Distributions are mandatory. That takes place when the account owner turns 70 ½, except for a Roth and an inherited IRA.

When the funds are withdrawn, the individual who owns the account pays income tax on the amount taken out. It is a great strategy to wait until retirement to take distributions since most people are in a lower tax bracket once they stop working.

Skilled Scottsdale Divorce Lawyers Protect 401 And Retirement Investments

After youve spent years building your 401 fund, it may have become one of your most valuable assets. Losing your retirement savings in a divorce may seem unfathomable, but it is possible. Arizonas community property law gives spouses equal ownership of money added to either spouses 401 during a marriage. At Clark & Schloss Family Law, P.C., our divorce lawyers in Scottsdale, Arizona develop strategic agreements to help divorcing workers and retirees hold onto their fair share of the retirement accounts that provide financial security for the future.

Don’t Miss: Can I Borrow From My 401k