At What Age Is It Best To Start Withdrawing Money From My 401

So, you know when you have to start withdrawing money from your 401 at age 70 ½. But when should you start withdrawing before then, or should you wait?

That answer is going to vary depending on your individual financial situation. There are several factors you should take into consideration before making that decision.

If You Are 59 1/2 Or Older

Once you are six months away from your 60th birthday, you can begin making withdrawals from your Fidelity 401k without having to worry about any additional tax penalties. Your 401k is now money thats there for you to start preparing for the next stage of your life as you put the finishing touches on your career and prepare to start drawing Social Security benefits.

However, that doesnt mean you dont have to worry at all about taxes. Money withdrawn from your 401k is taxable income, so you should be careful to consider just how much you need to withdraw in any given tax year to ensure youre not hitting a higher tax bracket and seeing more of your hard-earned money lost to taxes. If you have a Roth IRA or Roth 401k, though, you can make tax-free withdrawals from those, so you can balance withdrawals to minimize the tax impact.

Your Fidelity 401k comes with the option to schedule regular withdrawals so that you can do the paperwork for your withdrawal once and then set up a recurring payment. With structured, regular withdrawals, you can set up a budget that will limit your withdrawals to what you need, and youll be able to have checks showing up on a set schedule.

Making A Hardship Withdrawal

You May Like: Should I Transfer My 401k To A Roth Ira

Retirement Plan And Ira Required Minimum Distributions Faqs

Information on this page may be affected by coronavirus relief for retirement plans and IRAs.

The Setting Every Community Up for Retirement Enhancement Act of 2019 became law on December 20, 2019. The Secure Act made major changes to the RMD rules. If you reached the age of 70½ in 2019 the prior rule applies, and you must take your first RMD by April 1, 2020. If you reach age 70 ½ in 2020 or later you must take your first RMD by April 1 of the year after you reach 72.

For defined contribution plan participants, or Individual Retirement Account owners, who die after December 31, 2019, , the SECURE Act requires the entire balance of the participant’s account be distributed within ten years. There is an exception for a surviving spouse, a child who has not reached the age of majority, a disabled or chronically ill person or a person not more than ten years younger than the employee or IRA account owner. The new 10-year rule applies regardless of whether the participant dies before, on, or after, the required beginning date, now age 72.

Your required minimum distribution is the minimum amount you must withdraw from your account each year. You generally have to start taking withdrawals from your IRA, SEP IRA, SIMPLE IRA, or retirement plan account when you reach age 72 . Roth IRAs do not require withdrawals until after the death of the owner.

For more information on IRAs, including required withdrawals, see:

How To Withdraw Money From Your 401

The 401 has become a staple of retirement planning in the U.S. Millions of Americans contribute to their 401 plans with the goal of having enough money to retire comfortably when the time comes. Whether youve reached retirement age or need to tap your 401 early to pay for an unexpected expense, there are various ways to withdraw money from your employer-sponsored retirement account. A financial advisor can steer you through these decisions and help you manage your retirement savings.

Don’t Miss: How Do I Cash Out My 401k With Fidelity

What You Should Know About Withdrawing Retirement Funds Early

Is your retirement money only for retirement? Ideally, yes. But its your money, so the decision of what to do with is ultimately yours. During financially challenging times, its easy to understand the temptation to tap into retirement funds earlier than planned. But heres what you should know before you consider accessing retirement savings early.

How Much Money Should You Have In Your 401k When You Retire

If you are earning $50,000 by age 30, you should have $50,000 banked for retirement. By age 40, you should have three times your annual salary. By age 50, six times your salary by age 60, eight times and by age 67, 10 times. 8 If you reach 67 years old and are earning $75,000 per year, you should have $750,000 saved.

Read Also: Should I Invest In 401k

Ira Rollover Bridge Loan

There is one final way to borrow from your 401k or IRA on a short-term basis. You can roll it over into a different IRA. You are allowed to do this once in a 12-month period. When you roll an account over, the money is not due into the new retirement account for 60 days. During that period, you can do whatever you want with the cash. However, if its not safely deposited in an IRA when time is up, the IRS will consider it an early distribution. You will be subject to penalties in the full amount. This is a risky move and is not generally recommended. However, if you want an interest-free bridge loan and are sure you can pay it back, its an option.

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

Don’t Miss: What Percent To Put In 401k

When Should You Start Spending Retirement Savings

Retirement income planning and spending depends in large part on the accounts you have, the goals youve set and the timing you put in place.

Saving for retirement requires decades of hard work and discipline. When its time to finally spend those savings, some people find it difficult to dip into their accounts. Others simply have questions about retirement income planning and how much they can and should spend.

When should you start spending retirement savings? Follow these tips.

How Is The Amount Of The Required Minimum Distribution Calculated

Generally, a RMD is calculated for each account by dividing the prior December 31 balance of that IRA or retirement plan account by a life expectancy factor that IRS publishes in Tables in Publication 590-B, Distributions from Individual Retirement Arrangements . Choose the life expectancy table to use based on your situation.

- Joint and Last Survivor Table – use this if the sole beneficiary of the account is your spouse and your spouse is more than 10 years younger than you

- Uniform Lifetime Table – use this if your spouse is not your sole beneficiary or your spouse is not more than 10 years younger

- Single Life Expectancy Table – use this if you are a beneficiary of an account

See the worksheets to calculate required minimum distributions and the FAQ below for different rules that may apply to 403 plans.

You May Like: Is There A Max Contribution To 401k

Contributions And The Age 705 Rule

The IRS prevents contributions to your traditional IRA once you reach age 70.5 or after. Usually, once you begin to take the RMD for your employer sponsored 401 you cannot contribute any more money to it. If you reach 70.5 and have not yet retired, you and your employer are still allowed to make contributions to your 401 account. However, the mandatory distribution requirement for that particular 401 account is waived.

You Can Only Withdraw From Your Current 401

Penalty-free early withdrawals are limited to funds held in your most recent companys 401 or 403 under the rule of 55.

Even if youre 55 or older, you cant reach back to old 401s and use that money, says Luber. Additionally, this rule doesnt apply to individual retirement accounts , so you need to leave your IRA alone if you want to avoid the penalty.

If youre actively planning how to retire early, Roger Whitney, certified financial planner and host of the Retirement Answer Man Show, suggests rolling retirement funds from old jobs and other retirement accounts into your current 401 before you leave. This way, you can get access to they money with the rule of 55.

Read Also: How To Avoid Penalty On 401k Withdrawal

Withdrawing Funds From A 401 At 55

The rule of 55 allows 401 participants to withdraw money from the retirement plan penalty-free at age 55. The IRS requires that an employee must have left their employer, either by being laid off, fired, or simply quitting, in the calendar year they turn 55 to get a penalty-free distribution. If you lost your job at 54, you do not qualify to withdraw money tax-free from the 401 when you attain age 55.

The Rule of 55 does not apply to the old 401s left with former employers it only applies to the current 401 with your current employer. If you still have money in the old 401s of a former employer, and you were not yet 55 when you left, the rule of 55 does not apply. You will have to wait until you are 59 ½ to start taking withdrawals from the old 401s without paying a penalty tax. Still, you can roll over the old 401s into your current 401 before you are 55 so that you can take a distribution penalty-free.

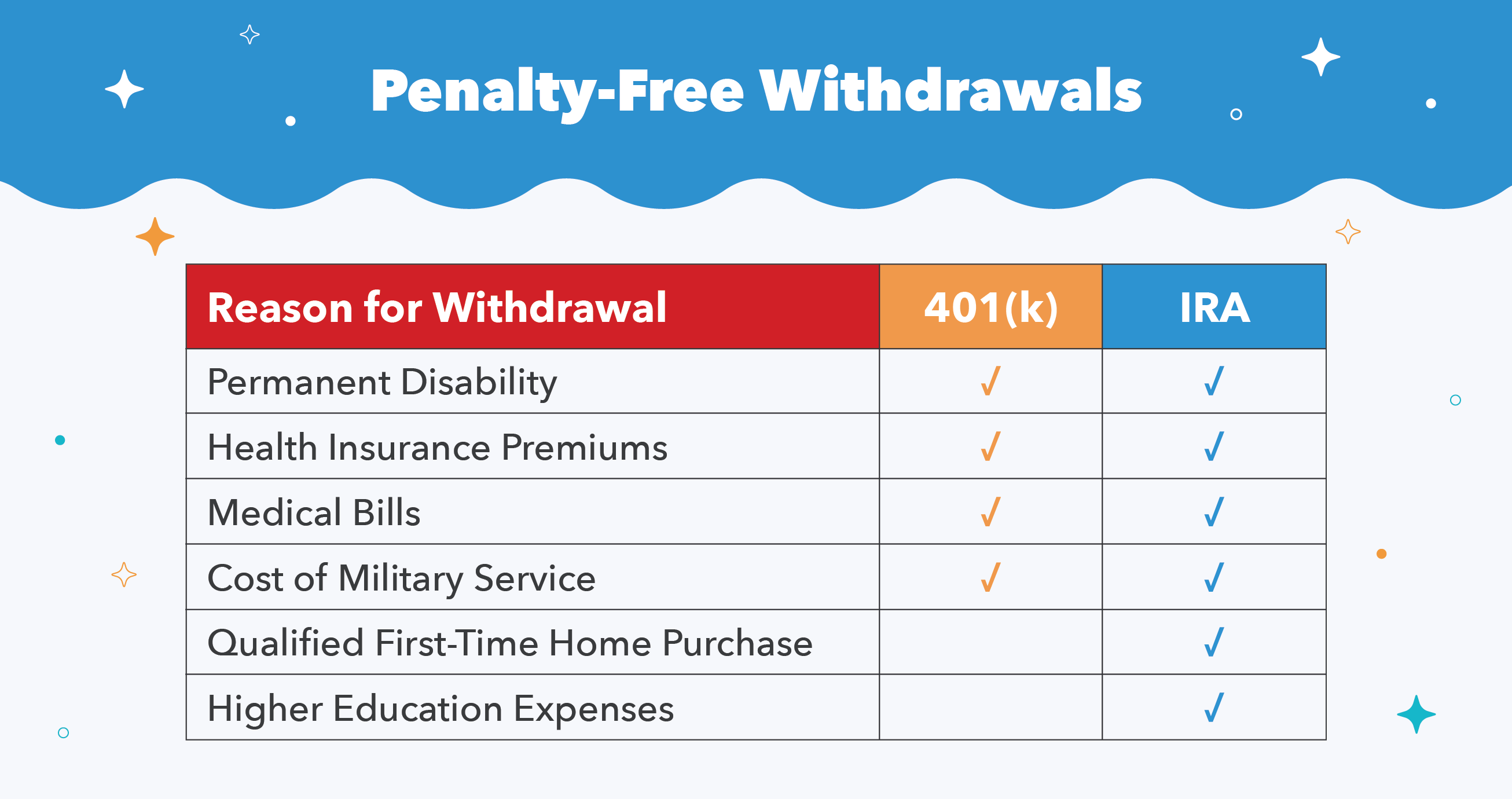

Withdrawing Funds From A 401 Before 55

If you are younger than 55, you may still qualify to withdraw money without quitting your current job. You can take a hardship withdrawal if you have a qualified expense. For example, you can take a hardship withdrawal to pay qualified educational fees, medical expenses, alimony and child support, repair of damage to your residence or to purchase your principal residence. You will owe income tax on the amount you take out from your retirement savings as a hardship withdrawal.

Don’t Miss: How Do I Get A 401k Plan

What Are Rules For Withdrawing From A 401k After Age 60

Owners of 401 accounts can make penalty-free withdrawals any time after age 59 1/2, although they must pay income taxes on the distributions unless they roll the money into other retirement accounts within 60 days. Most account owners must start taking minimum distributions by April 1 of the year after they turn 70 1/2, according to the Internal Revenue Service. Some accounts postpone the minimum distribution requirement for current employees, and the requirement begins once they retire.

Account owners can take 401 withdrawals as occasional lump-sum distributions or as scheduled installment payments, notes the IRS. When owners schedule direct transfers from a 401 plan to another retirement account, such as a traditional IRA, account administrators dont withhold income taxes. However, when account owners take cash distributions, administrators must withhold 20 percent to cover possible taxes.

Once retired people take their first required minimum distributions after age 70 1/2, they have until Dec. 31 of each following year to take the remaining distributions. The IRS bases the distribution amount on the account balance and the owners life expectancy, explains Bankrate. Account owners who fail to take timely minimum distributions face a 50 percent tax on the tardy withdrawals in addition to regular income taxes.

How Contributions Affect Rmds

When you calculate an employee’s RMD, consider any contributions that you make for that employee. For defined contribution plans, calculate the RMD for an employee by dividing his or her prior December 31 account balance by a life expectancy factor in the applicable table in Appendix B of Pub. 590-B. A defined benefit plan generally must make RMDs by distributing the participant’s entire interest as calculated by the plan’s formula in periodic annuity payments for:

- the participant’s life,

Recommended Reading: Can I Rollover 401k To Ira While Still Employed

Age 72 And Over: Required Minimum Withdrawals Are Mandatory

Once you turn 72 , you must start taking annual Required Minimum Distributions from your Traditional IRA. Your first RMD must be taken by April 1 of the year following the year you reach age 72. Every year thereafter you must take an RMD by December 31. The amount of your RMD is calculated by dividing the value of your Traditional IRA by a life expectancy factor, as determined by the IRS. You can always withdraw more than the RMD, but remember that all distributions are taxed as income. If you dont make withdrawals, youll have to pay a 50% penalty on the amount you shouldve withdrawn. Learn more about RMDs.

Taking 401 Distributions In Retirement

The 401 withdrawal rules require you to begin depleting your 401 savings when you reach age 72.

At this point, you must take a required minimum distribution each year until your account is depleted. If you are still working for the employer beyond age 72, you may be able to delay required minimum distribution until you stop working if your plan allows this delay. The delay option is not available to you if you own 5% or more of the business.

You have until April 1 of the year after you turn 72 to take your first required minimum distribution. After that, you must take a minimum amount by December 31 each year. Your 401 plan administrator will tell you how much you are required to take each year.

The amount is based on your life expectancy and your account balance. If you dont take your required minimum distribution each year, you will have to pay a tax of 50% of the amount that should have been taken but was not. If you participate in more than one employer plan, you must take a required minimum distribution from each plan.

Don’t Miss: How Often Can I Rollover 401k To Ira

Taking 401k Distributions In Retirement

Once you are older than 59-1/2 and are ready to take withdrawals, you typically can take a lump-sum distribution or periodic distributions. A lump-sum distribution may give you a big chunk of cash right away, but youll pay income taxes on the entire amount right away. That can take a big bite out of your nest-egg all at once. If you wish to keep your money in your 401K plan , you can typically select an amount to receive monthly or quarterly. Youre allowed to change that amount once a year, although some plans allow you to make changes more frequently. The key, of course, is to manage your distributions so you dont outlive your money.

Heres What You Need To Know:

There are many IRS rules governing distributions. These are the key ones:

-

Traditional 401 and 403 accounts:

- Distributions are taxable.

- You may begin taking distributions without penalty once you are age 59-1/2 or because of disability or death.

- If you leave your company at age 55 or older, you may be able to begin taking penalty-free withdrawals right away.

- If you take a distribution before age 59-1/2 and do not qualify for an early withdrawal exception, you will have to pay a 10% federal tax penalty.

Roth 401 and 403 accounts:

You can, of course, withdraw more than your RMD, but you may want to consider leaving as much of your retirement savings in your account as possible. This way, your remaining savings have the opportunity to continue growing.

Also Check: Should I Move 401k To Ira