Current Outstanding Loan Balance

If the plan allows an employee to have more than one loan outstanding at a time, the limits are applied on an aggregate basis. In other words, the amount available for a new loan is reduced by any loan balances already outstanding.

Confused yet? If so, youre not alone. This is confusing stuff. To translate it into something a little more useful, weve got a couple of examples for you.

Keep Your Money Where It Is

Keep your savings invested in your former employer’s retirement plan.

- Your savings stay invested, with the same tax advantages

- You continue with the plan’s investment options

- You can’t make additional contributions

- Your past employer may decide to make changes to the plan that impact your account

- Loans aren’t allowed, but you may be able to withdraw money before you retire under certain circumstances

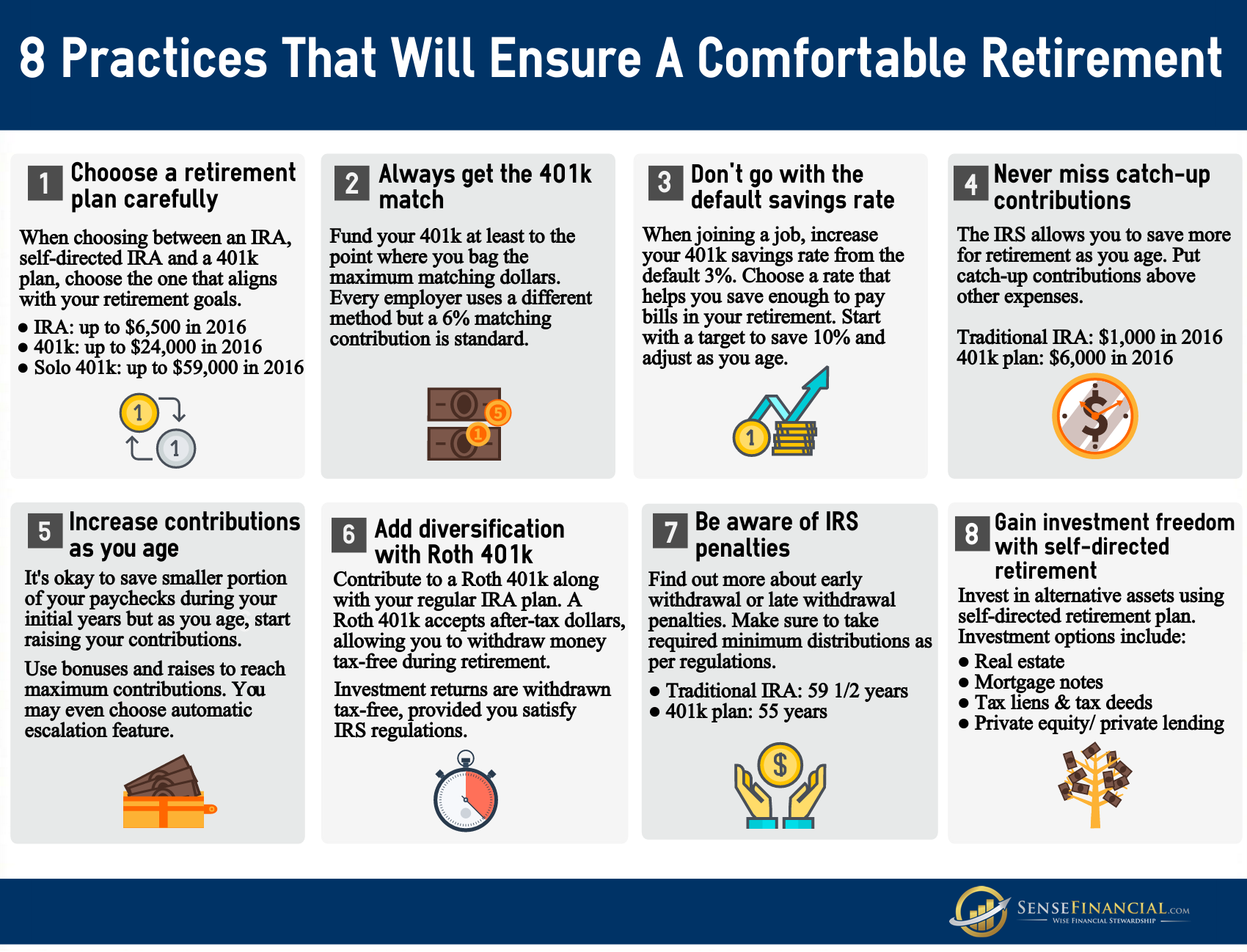

How Much Should I Be Putting Into My 401k

Aim to save between 10% and 15% of your income toward retirement. Another piece of general advice is to put all of those funds into your 401k up until your employer’s matching contribution amount. Once that has been reached, maxed out your Roth IRA contribution. If there are funds leftover then consider putting those funds into your 401k.

Another way to determine how much you will need to save is to look at what income amount you will need in retirement. Fortunately, there are a lot of calculators out there that will help you figure out your magic number. Here are two of our favorites.

-

Nerdwallet provides a great basic calculator that lets you play with different contributions and matching amounts.

-

CalcXL makes a recommendation on how much you should be saving based on projected inflation. Tip: You should aim for a retirement income of roughly 80% of your current salary.

Recommended Reading: Can You Convert A Roth 401k To A Roth Ira

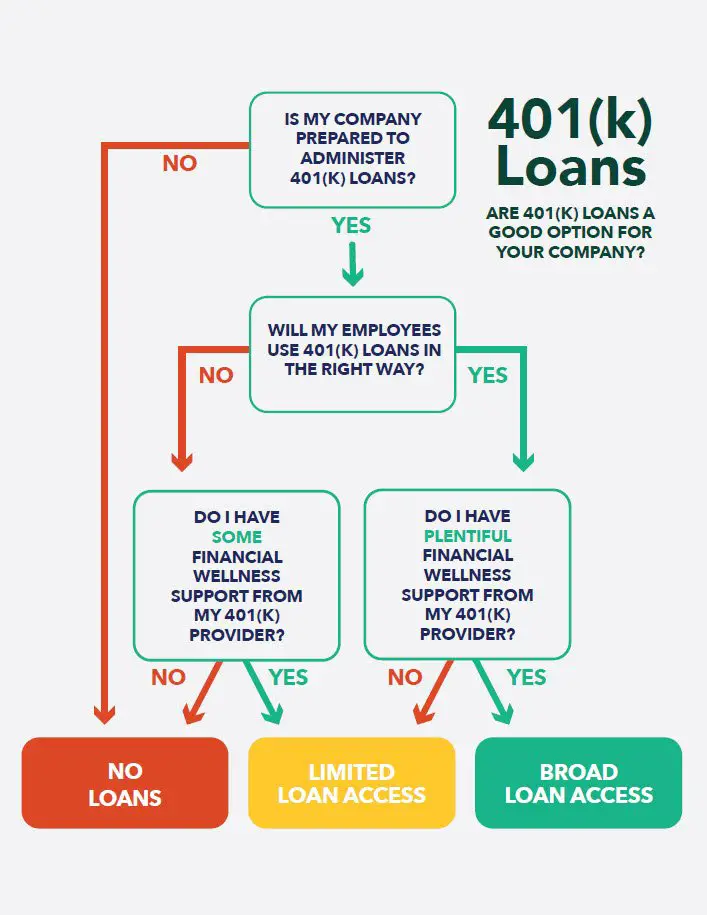

Is It A Good Idea To Borrow From Your 401

Using a 401 loan for elective expenses like entertainment or gifts isn’t a healthy habit. In most cases, it would be better to leave your retirement savings fully invested and find another source of cash.

On the flip side of what’s been discussed so far, borrowing from your 401 might be beneficial long-termand could even help your overall finances. For example, using a 401 loan to pay off high-interest debt, like credit cards, could reduce the amount you pay in interest to lenders. What’s more, 401 loans don’t require a credit check, and they don’t show up as debt on your credit report.

Another potentially positive way to use a 401 loan is to fund major home improvement projects that raise the value of your property enough to offset the fact that you are paying the loan back with after-tax money, as well as any foregone retirement savings.

If you decide a 401 loan is right for you, here are some helpful tips:

- Pay it off on time and in full

- Avoid borrowing more than you need or too many times

- Continue saving for retirement

It might be tempting to reduce or pause your contributions while you’re paying off your loan, but keeping up with your regular contributions is essential to keeping your retirement strategy on track.

Long-term impact of taking $15,000 from a $38,000 account balance

Contributing To A 401 Plan

A 401 is a defined contribution plan. The employee and employer can make contributions to the account up to the dollar limits set by the Internal Revenue Service .

A defined contribution plan is an alternative to the traditional pension, which is known in IRS lingo as a defined-benefit plan. That is, an employer who offers a pension is committed to providing a specific amount of money to the employee for life during retirement.

In recent decades, 401 plans have become more common, and traditional pensions have become rare as employers shifted the responsibility and risk of saving for retirement to their employees.

Employees also are responsible for choosing the specific investments within their 401 accounts, from a selection their employer offers. Those offerings typically include an assortment of stock and bond mutual funds as well as target-date funds that are designed to reduce the risk of investment losses as the employee approaches retirement.

They may also include guaranteed investment contracts issued by insurance companies and sometimes the employer’s own stock.

Don’t Miss: How To Tell If You Have A 401k

How To Bring 401ks And Iras To Canada

The way to bring a 401 to Canada is to rollover the 401 to an IRA and have it managed from Canada. If an individual works with an advisor who is licensed in Canada and the US , they can do this rollover before they move to Canada, or once they are in Canada. Multiple 401s can be rolled into one IRA to make retirement planning easier when planning income streams and when one needs to take Required Minimum Distributions .

Determine How Much You Can Contribute

Workers under 50 can contribute up to $19,500 to a 401 in 2020, but how much you actually earmark for the account depends on your income, debt level and other financial goals. Still, financial experts advise contributing as much as you are able to, ideally between 10% to 15% of your income, especially when you are young: The sooner you start investing, the less you’ll have to save each month to reach your goals, thanks to compound interest.

“That’s your company literally saying: ‘Hey, here’s some free money, do you want to take it?'” financial expert Ramit Sethi told CNBC Make It. “If you don’t take that, you’re making a huge mistake.”

You May Like: Can I Rollover My 401k Into My Spouse’s Ira

Minimize Your Retirement Tax Burden As A Dual Citizen

The main tactics to prevent overpaying taxes as a dual citizen are:

- Minimize exposure to anything the IRS sees as a Passive Foreign Investment Company %20is%20a%20corporation%2C,related%20to%20regular%20business%20operations.” rel=”nofollow”> PFIC) as this causes increased reporting and potential taxes.

- Keep investments in an IRA and have it managed from Canada rather than transferring to a RRSP.

- Work with an advisor that knows the investments that are beneficial to a Canadian resident and do not cause an additional IRS tax liability.

- Work with an accountant familiar with both Canadian and U.S. tax obligations, foreign tax credits, and who understands the Canada-U.S. Income Tax Treaty.

Rollovers As Business Start

ROBS is an arrangement in which prospective business owners use their 401 retirement funds to pay for new business start-up costs. ROBS is an acronym from the United States Internal Revenue Service for the IRS ROBS Rollovers as Business Start-Ups Compliance Project.

ROBS plans, while not considered an abusive tax avoidance transaction, are questionable because they may solely benefit one individual â the individual who rolls over his or her existing retirement 401 withdrawal funds to the ROBS plan in a tax-free transaction. The ROBS plan then uses the rollover assets to purchase the stock of the new business. A C corporation must be set up in order to roll the 401 withdrawal.

Also Check: What Is Qualified Domestic Relations Order 401k

Give Your Employees More Retirement Security

It shouldnt hurt to do a good thinglike providing a defined benefit pension plan, nonqualified plan or employee stock ownership plan with your defined contribution plan.

The Principal Total Retirement SuiteSM combines services for multiple retirement plans, so you add to your benefits package, but not necessarily to your workload.

Youre Our First Priorityevery Time

NerdWallet, Inc. is an independent publisher and comparison service, not an investment advisor. Its articles, interactive tools and other content are provided to you for free, as self-help tools and for informational purposes only. They are not intended to provide investment advice. NerdWallet does not and cannot guarantee the accuracy or applicability of any information in regard to your individual circumstances. Examples are hypothetical, and we encourage you to seek personalized advice from qualified professionals regarding specific investment issues. Our estimates are based on past market performance, and past performance is not a guarantee of future performance.

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Don’t Miss: Can You Transfer 403b To 401k

Using Life Insurance For Sustainable Wealth

Many people like to fund whole life insurance during their career instead of maxing out 401 contributions. High cash values in life insurance can be valuable when opportunities arise where 401 funds are off-limit.

For example, my brothers run a metal fabrication business and recently had an opportunity to buy a machine shop for only $50,000 on a special liquidation deal. This equipment would have run close to $250,000 if they had to buy it piecemeal at used prices.

They were able to get a policy loan against their whole life insurance policies and take advantage of this deal quickly.

Some people like to fund whole life insurance with money from a 401, so they have a permanent death benefit and accessible cash values going into their golden years.

If they need more money during retirement 10-15+ years later, they can withdraw more than they paid for the policy or roll a policy to an annuity to create guaranteed passive income for the rest of their life. A high percentage of this income is usually tax-free.

Owning life insurance can also help with estate planning needs or as a volatility buffer where a policy owner can take a loan or withdrawal to cover lifestyle expenses in times when volatile market investments are down. This can allow time for the market to recover instead of further drawing down assets in an invested account.

How Do 401 Required Minimum Distributions Work

Holders of both traditional 401s and Roth 401s are required to take RMDs. The amount of your RMDs is based on your age and the balance in your account. As the name suggests, an RMD is a minimumyou can withdraw as much as you wish from the account each year, either in one lump sum or in a series of staggered withdrawals. As noted above, RMDs from a traditional 401 are included in your taxable income, while RMDs from Roth 401s are not.

Also Check: Should I Do Roth Or Traditional 401k

Matching Contributions And Vesting

Some employers grant 401 matching contributions that vest over time. Under a vesting schedule, you gradually take ownership of your employers matching contributions over the course of several years. If you remain with the company for the entire vesting period, you are said to be fully vested in your 401 account.

Employers impose a vesting schedule to incentivize employees to remain with the company.

For example, imagine that 50% of your employers matching contributions vest after youve worked for the company for two years, and you become fully vested after three years. If you were to leave the company and take a new job after two years, you would pass up owning half of the matching contributions pledged by your employer.

Keep in mind, however, that you always maintain full ownership of contributions you have made to your 401. Vesting only involves the employers matching contributions.

Options When Leaving An Employer

Upon leaving their employer, GRSP participants have several options.

-

They can convert or rollover their GRSP balance to an individual RRSP account. If they go to work for a new employer who offers a GRSP there is the possibility that this money can become part of that plan as well.

-

If they withdraw the funds, the money will be subject to taxes.

-

GRSP funds must be converted out of the plan by age 71. You can enroll in a Registered Retirement Income Fund or RRIF or into some other similar type of tax sheltered account.

Don’t Miss: How To Take Out 401k Money For House

Contact Your Former Employer

The first place you should look is your prior employer. Contact their human resources department. There, they should have all of the information as to the whereabouts of the 401 account you had with them.

They should send you the proper paperwork and be able to facilitate the transfer of your funds to whatever account you choose.

If they are unable to locate any information on your account, they should be able to provide you the contact information of the administrator who handled your 401 on their behalf.

Let the administrator know your situation, and just like the HR department, should be able to assist you in moving your money properly.

Prior Outstanding Loan Balance

The participants highest outstanding loan balance during the twelve-month-period ending on the day before the date a new loan is issued must be taken into account. That amount is applied to reduce the overall cap of $50,000, so it primarily comes into play only when a participant is seeking a fairly sizeable loan. This is true even if the previous loan has been paid in full.

However, that does not mean we can ignore it in the case of smaller loans. Weve seen a number of situations in which a participant has taken out a $50,000 loan to meet a short-term need and repaid it just a few months later. If that same participant then requests another loan less than 12 months later, he or she would not be able to take it even if it is a small amount. Why? Because the overall limit of $50,000 is reduced by the highest balance the participant had in the trailing twelve months, which in this case, is also $50,000.

You May Like: What Happens To Your 401k When You Leave A Company

Roll Your 401 Into An Ira

The IRS has relatively strict rules on rollovers and how they need to be accomplished, and running afoul of them is costly. Typically, the financial institution that is in line to receive the money will be more than happy to help with the process and avoid any missteps.

Funds withdrawn from your 401 must be rolled over to another retirement account within 60 days to avoid taxes and penalties.

How Much Should I Contribute To My 401

Most financial experts say you should contribute around 10%-15% of your monthly gross income to a retirement savings account, including but not limited to a 401.

There are limits on how much you can contribute to it that are outlined in detail below.

There are two methods of contributing funds to your 401.

The main way of adding new funds to your account is to contribute a portion of your own income directly.

This is usually done through automatic payroll withholding ).

The system mandates that the majority of direct financial contributions will come from your own pocket.

It is essential that, when making contributions, you consider the trajectory of the specific investments you are making to increase the likelihood of a positive return.

The second method comes from deposits that an employer matches.

Usually employers will match a deposit based on a set formula, such as 50 cents per dollar contributed by the employee.

However, employers are only able to contribute to a traditional 401, not a Roth 401 plan.

This is especially important to keep in mind if you want to utilize both types of plans.

A key variable to keep in mind is that there are set limits for how much you can add to a 401 in a single year.

For employees under 50 years of age, this amount is $19,500, as of 2020. For employees over 50 years of age, the amount is $25,000.

If you have a traditional 401, you can also elect to make non-deductible after-tax contributions.

Plan in Advance

You May Like: How To Transfer 401k From Charles Schwab To Fidelity

How To Avoid 401 Early Withdrawal Penalties

There are certain exceptions that allow you to take early withdrawals from your 401 and avoid the 10% early withdrawal tax penalty if you arent yet age 59 ½. Some of these include:

Medical expenses that exceed 10% of your adjusted gross income

Permanent disability

If you leave your employer at age 55 or older

A Qualified Domestic Retirement Order issued as part of a divorce or court-approved separation.

Even if you can escape the additional 10% tax penalty, you still have to pay taxes on your withdrawal from a traditional 401. owner owes no income tax and the recipient can defer taxes by rolling the distribution into an IRA.)

What You Need To Know To Avoid Costly Mistakes

In an ideal world, everybody would leave their 401 funds alone until they need the money for retirement. That might mean rolling your account over to an Individual Retirement Account , but it also means not cashing out the funds prior to reaching retirement age, to allow the money to grow to its maximum potential amount. In investing, time truly is your best asset. At some point though, you will begin taking distributions, and here’s what you need to know.

The best way to take money out of your 401 plan depends on three things:

You May Like: Can I Keep My 401k After I Leave My Job

Eligibility For A Hardship Withdrawal

The Internal Revenue Service ‘s immediate and heavy financial need stipulation for a hardship withdrawal applies not only to the employee’s situation. Such a withdrawal can also be made to accommodate the need of a spouse, dependent, or beneficiary.

Immediate and heavy expenses include the following:

- Certain medical expenses

- Home-buying expenses for a principal residence

- Up to 12 months worth of tuition and fees

- Expenses to prevent being foreclosed on or evicted

- Burial or funeral expenses

- Certain expenses to repair casualty losses to a principal residence

You wont qualify for a hardship withdrawal if you have other assets that you could draw on to meet the need or insurance that will cover the need. However, you needn’t necessarily have taken a loan from your plan before you can file for a hardship withdrawal. That requirement was eliminated in the reforms, which were part of the Bipartisan Budget Act passed in 2018.

The $2-trillion coronavirus emergency stimulus bill signed into law on March 27, 2020, allows those affected by the coronavirus situation a hardship distribution to $100,000 without the 10% penalty those younger than 59½ normally owe account owners have three years to pay the tax owed on withdrawals, instead of owing it in the current year.