How Do They Work

When you set up a Solo 401K, you are both the employee and the employer. In other words, you make both contributions, but one comes from your earnings and the other from your profit-sharing.

Employees can contribute as much as $19,500 per year toward your retirement account. If you make less than $19,500, you may contribute 100% of your earnings and again, if youre over 50-years old, you may contribute the extra $6,500.

You also contribute as the employer. This money comes from your companys profit sharing. Youll need the following equation to determine how much you may contribute as the employer:

- 25% x you earned income ½ of your self-employment tax

- The maximum contribution is $57,000 as an employer.

To Roll Over Other Plan Assets

If you already have a retirement savings plan for your business, you may be able to roll over or transfer existing plan assets to a Self-Employed 401. Consult with your tax advisor or benefits consultant prior to making a change to your retirement plan.

Assets from the following plans may be eligible to be rolled over into a Self-Employed 401:

- Profit Sharing, Money Purchase, and 401 plans

Identify Your Goals For The 401

Before you begin to build your retirement plan, its a good opportunity to take a step back and think about your specific goals for it, including:

- Youd like to save more for retirement: As a business owner, youre interested in saving more money, and you know that a 401 can help you save more for retirementup to $57,000 in 2020 and when paired with a Cash Balance plan, up to $240,000all tax-deferred.*

- Youd like to pay less in taxes: Your business has become more and more profitable, and you know that a 401 can help you lower your taxable income with deductible employer contributions and plan expenses.

- Youd like to help your employees save: You want to help your employees prepare for retirement when the time comes.

- Youd like to increase employee retention: You need to attract and retain talent, and good 401 benefits can mean landing your next key employeeor losing them to the competition.

*Assumes annual 401 maximum contribution of $19,500 $6,500 catch up $37,500 profit sharing

Recommended Reading: How To Find Out What You Have In Your 401k

How 401 Plans Work

The 401 plan was designed by Congress to encourage Americans to save for retirement. Among the benefits they offer is tax savings.

There are two main options, each with distinct tax advantages:

- A traditional 401 is deducted from the employee’s gross income. The employee’s taxable income is reduced by that amount and can be reported as a tax deduction for that year. No taxes are due on the money paid in or the profits it earns until the employee withdraws it, usually after retiring.

- A Roth 401 is deducted from the employee’s after-tax income. The employee is paying income taxes on that money immediately. When the money is withdrawn during retirement, no additional taxes are due on the employee’s contribution or the profits it earned over the years,

Not all employers offer the option of a Roth account.

If the Roth is offered, the employee can pick one or the other or a mix of both, up to annual limits on their tax-deductible contributions.

Attract And Retain Talent

Arguably the most obvious benefit of offering a 401 plan is that it makes your business more competitive in the hiring market. Charles Schwab reports that 88% of job seekers named a 401 plan as a must have benefit when considering a position. That desire for a retirement plan not only makes your business more attractive as a landing spot, but also adds another way to keep your current employees satisfied.

Don’t Miss: Who Has The Best 401k Match

How Much Of My Salary Can I Contribute To A 401 Plan

The amount that employees can contribute to their 401 Plan is adjusted each year to keep pace with inflation. In 2020 and 2021, the limit is $19,500 per year for workers under age 50 and $26,000 for those aged 50 and above.

If the employee also benefits from matching contributions from their employer, then the combined contribution from both the employee and the employer is capped at the lesser of $58,000 or 100% of the employees compensation for the year.

Kick Start Employee Participation

A good adviser will help you make sure that on day one of your plan, your employees are able to enroll in the plan, find answers to their questions about saving money and investing, and understand how to use their 401 plan to help them reach their own goals for retirement. Talk to your adviser about offering on-site support for enrollment day, including group presentations about the workings of your 401 plan, and one-on-one sessions for interested employees to share their private questions and concerns.

Setting up your new 401 is all about building a retirement plan your employees will use and appreciate, and aligning that plan with the goals for your business. As you review your adviser options and consider your needs, remember that by offering your new 401, youre giving your employees a new chance to prepare for the future as they work for you today.

Recommended Reading: Can I Use My 401k To Start A Business

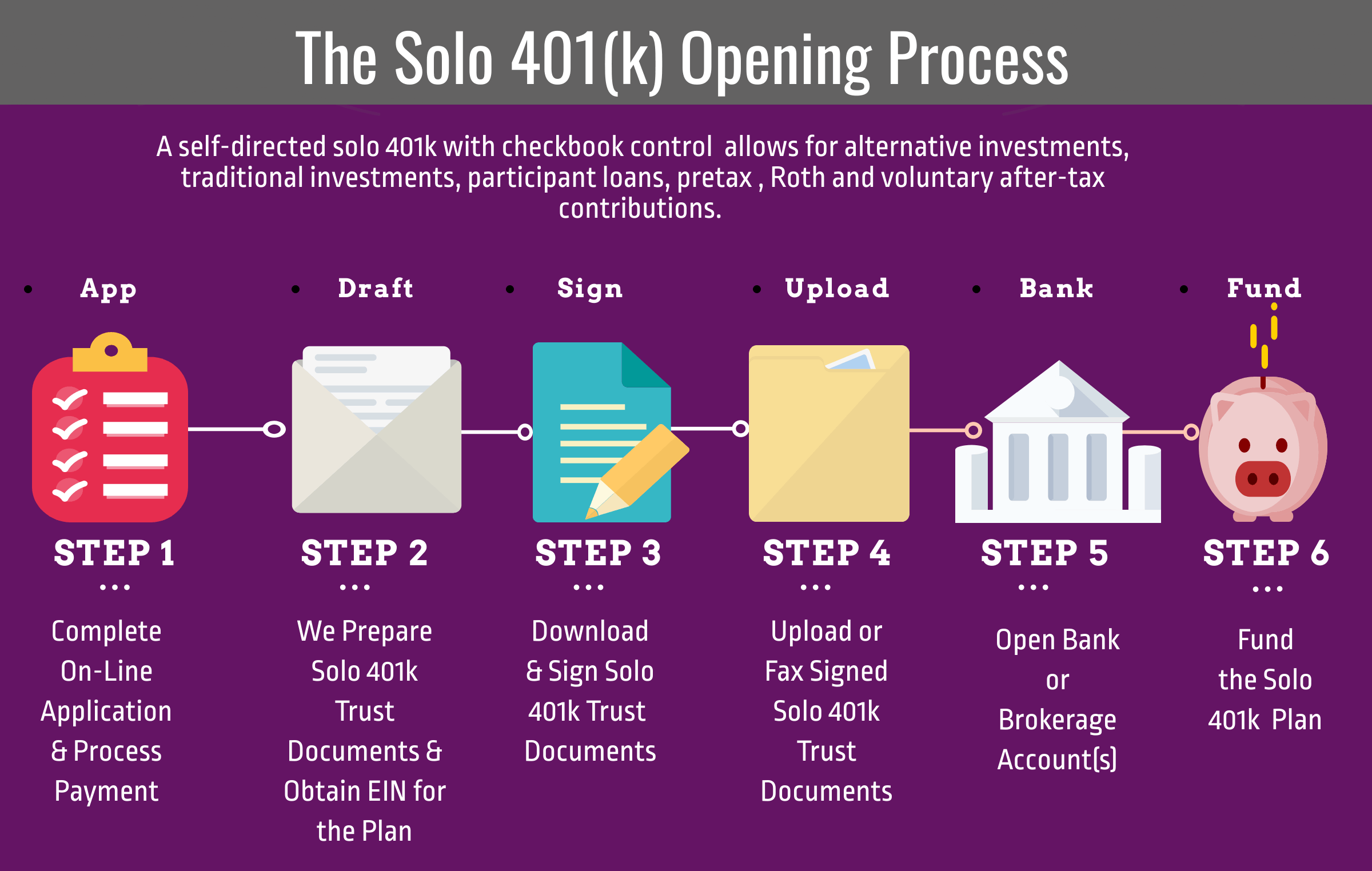

How Do You Open A 401

Do the following to open your 401:

Take Full Advantage Of The Company Match

The first place to look in your 401 information is your employer match. Employers typically match 3% to 6% of your salary, but that is contingent on your own contribution. Generally, employers match 50% or 100% of your contribution up to the salary limit. Hint: you should always contribute at least up to your employer match, your net worth depends on it.

For example, lets look at someone who earns $50,000 per year and has a 50% match up to 3% of their annual salary. To take full advantage of the employer match, the employee must contribute 6% of their salary, or $3,000 per year, to get the full employer match of $1,500. That $1,500 is like free money from your employer, so this person should be absolutely sure they are saving enough to get that full 3% match.

Combined, that is like contributing 9%, or $4,500 per year, to their 401. That is likely not enough to maintain the same standard of living in retirement, but it is a great start and more than what the average person is doing. Assuming a biweekly pay schedule with 26 annual pay periods, that contribution is only $115 per payday, and that $115 has a tax advantage. Not a bad deal to get $1,500 in free money for retirement.

You May Like: Should I Rollover My 401k Into An Ira

What Is A 401 Plan

A 401 plan is a retirement savings plan offered by many American employers that has tax advantages to the saver. It is named after a section of the U.S. Internal Revenue Code.

The employee who signs up for a 401 agrees to have a percentage of each paycheck paid directly into an investment account. The employer may match part or all of that contribution. The employee gets to choose among a number of investment options, usually mutual funds.

Why Choose A Plan

There are many options for setting up a Solo 401K account, but Vanguard offers a great option for side hustlers and those that own their own business.

Vanguard doesnt charge a setup fee for the account, but they do have some limitations. For example, you cant take a loan on your money, no matter the balance. The only way you could access your funds early is with a hardship withdrawal before the age of 59 ½, but you must qualify for it.

Vanguard does charge some trading fees, but they are minimal and some are avoidable. Most commonly, investors pay a $20 per fund annual fee. If you have several funds, youll pay the fee for every fund you have, which can take away from your profits, so keep that in mind when choosing your investments.

Read Also: How To Grow 401k Fast

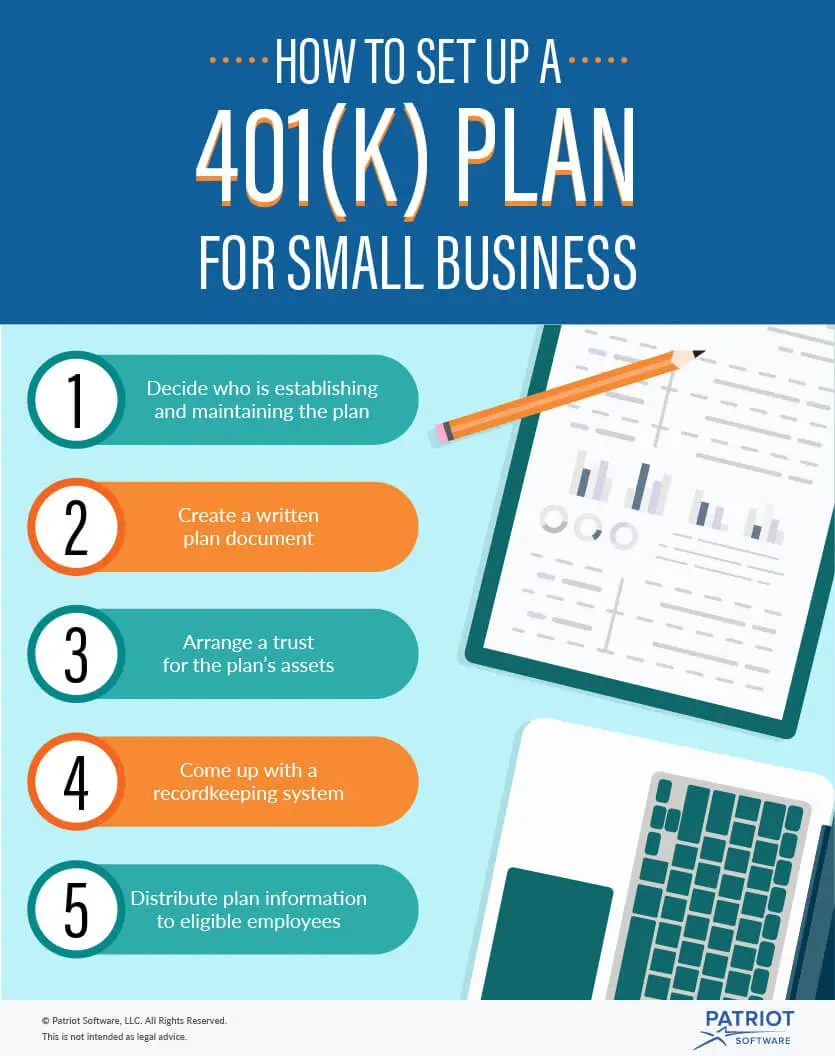

Two: Find The Right Team For Your 401 Plan

When learning how to set up 401 for a small business, an essential requirement is partnering with the right providers for your business. There are many different aspects of a 401 plan that makes it nearly impossible for business owners to do everything by themselves. Thats why these plans can involve a variety of partners, including:

- Recordkeepers in charge of processing withdrawals and tracking contributions, earnings, losses, plan investments, expenses, and benefit distributions.

- Advisors who help you select and maintain plan investments and potentially oversee the money management of the plan.

- Plan administrators who handle document preparation, transaction approval, compliance filing, and other behind-the-scenes tasks.

- Payroll providers who tie your payroll process to plan contributions and paycheck deductions.

With the right team, business owners can successfully implement a 401 plan. However, that doesnt necessarily mean that multiple providers for each role. Small businesses can choose to work with multiple vendors or find a partner like a Professional Employer Organization that can oversee and manage most, if not all, of the setup and administration for your plan.

What Are The Potential Tax Benefits Of A Solo 401

One of the potential benefits of a Solo 401 is the flexibility to choose when you want to deal with your tax obligation. In a Solo 401 plan all contributions you make as the “employer” will be tax-deductible to your business with any earnings growing tax-deferred until withdrawn. But for contributions you make as an “employee” you have more flexibility. Typically, your employee “deferral” contributions reduce your personal taxable income for the year and can grow tax-deferred, with distributions in retirement taxed as ordinary income. Or you can make some or all of your employee deferral contributions as a Roth Solo 401 plan contribution. These Roth Solo 401 employee contributions do not reduce your current taxable income, but your distributions in retirement are usually tax-free. Generally speaking, there are tax penalties for withdrawals from a Solo 401 before 59 1/2 so be sure to know the specifics of your plan.

You May Like: What Percentage Should I Be Putting In My 401k

Solo 401 Pros And Cons

At some point in everybodys life, you contemplate the dilemma of what retirement plan best suits your needs. Today, there are over 50 million individual retirement accounts. However, that doesnt necessarily mean the IRA is the right retirement strategy.

Determining whether you can enhance your retirement savings with a Solo 401 or self-directed 401 plan) completely depends on whether you are self-employed and have a business.

There are a number of significant advantage to establishing a Solo 401 over an IRA.

Enroll In Your Companys Plan

If your company offers a 401 plan, you may automatically have an account set up for you with a default contribution amount or percentage, which you can change.

If your employer doesnt automatically enroll you in the plan, youll need to contact your human resources department for instructions on setting up an account. You will also want to find out if your company has a waiting period for joining its retirement plan. The IRS stipulates that an employee must be permitted to participate in a qualified retirement plan once they have reached age 21 and have at least one year of service.

Also Check: Can You Convert Your 401k To A Roth Ira

Youre Our First Priorityevery Time

NerdWallet, Inc. is an independent publisher and comparison service, not an investment advisor. Its articles, interactive tools and other content are provided to you for free, as self-help tools and for informational purposes only. They are not intended to provide investment advice. NerdWallet does not and cannot guarantee the accuracy or applicability of any information in regard to your individual circumstances. Examples are hypothetical, and we encourage you to seek personalized advice from qualified professionals regarding specific investment issues. Our estimates are based on past market performance, and past performance is not a guarantee of future performance.

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Starting A 401 Without A Job

If you dont currently have a job, you may have some challenges. 401 plans are employer-sponsored plans, meaning only an employer can establish one. If you dont have your own organization and you dont have a job, you may want to evaluate contributing to an IRA instead. However, those accounts may require earned income during the year to contribute, so its not as simple as you might hope. That said, a spousal IRA may allow certain couples to contribute to a retirement account with no job.

You May Like: How Does A 401k Loan Work

What Percentage Of Your Income Will You Defer

Its always a good idea to sock away at least some of your income for retirement. The exact amount you should defer will vary depending on your personal financial landscape and goals.

If your employer offers a match, its wise to contribute at least up to that percentage unless youre dealing with extensive debt or other mitigating financial circumstances.

Finally, be aware of the maximum contribution limit which is $19,500 in elective deferrals for 2021 . Taking employer contributions into account, the limit is $58,000 per year. If you contribute more than the limit, the deferrals will count toward your taxable income and be taxed upon withdrawal.

Why Starting A 401 Plan For A Small Business Is Beneficial

Setting up a 401 plan can be an important part of your small business employee benefits package. A 401 plan can help attract and keep employees.

One study found that 31% of employees prefer a 401 plan or another retirement plan over a pay raise. Because contributions to a 401 plan are made on a pre-tax basis, each participating employee reduces their tax liability, which could mean more money in their pocket.

When you have a 401 plan at your small business, you will need to keep track of employee contributions. Simplify your recordkeeping responsibilities with Patriots online payroll software. Our software takes out deductions from employee wages so you dont have to. Try it for free today!

This is not intended as legal advice for more information, please

You May Like: Should I Rollover My Old 401k To An Ira

Can I Make Roth Contributions

Youve probably heard of a Roth IRA a retirement account that allows you to make taxable contributions today so you can take tax-free distributions later.

But did you know theres also such thing as a Roth 401?

If your company offers a Roth 401, it is possible to make contributions and its a lot more common than you might think, according to Malik S. Lee, certified financial planner and founder of Felton & Peel Wealth Management. Most employers plans have Roth 401s, but a lot of people dont know to ask for it or to look for it, he said, calling the Roth 401 a hidden gem.

As nice as it is to get a tax break today, tax-free retirement income is tempting, especially if youre planning to reach a higher tax bracket by the time you get there. plans.)

Establish A Trust Fund To Hold The Assets Of The Plan

Its essential that all plan assets are held in trust, so theyre used exclusively to benefit members and their beneficiaries. 401 trusts require at least one trustee to manage contributions, investments, and distributions. Therefore, choosing the right trustee is one of the most crucial decisions youll make when setting up a 401 because it impacts the plans financial security. If the plan has insurance, you dont need to worry about this step.

Don’t Miss: How To Opt Out Of Fidelity 401k

Why Are 401 Plans Beneficial To Small Businesses

Referencing the guide 401 Plans for Small Businesses from the U.S. Department of Labors Employee Benefits Security Administration and the Internal Revenue Service , these plans promote your employees financial security and bring you several advantages as a small business owner:

- 401s help you recruit and retain qualified employees, as mentioned above.

- If you contribute to an employees account, you can claim a tax deduction.

- Diversifying investment vehicles will allow the money contributed to grow.

- Employer contributions are deductible, and earnings and contributions are tax-deferred until distribution.

- When employees leave the company, their benefits follow them, reducing the amount of administrative work.

In light of these benefits, you may want to know how to set up a 401 for employees. Read on to learn.