Leave It In Your Current 401 Plan

The pros: If your former employer allows it, you can leave your money where it is. Your savings have the potential for growth that is tax-deferred, youll pay no taxes until you start making withdrawals, and youll retain the right to roll over or withdraw the funds at any point in the future.

The cons: Youll no longer be able to contribute to the plan, and the plan provider may charge additional fees because youre no longer an employee. Managing multiple tax-deferred accounts can also prove complicated. The IRS mandates required minimum distributions annually from all such accounts beginning at age 72 . Fail to calculate the correct amount across multiple accounts, and the IRS will slap you with a 50% penalty on the shortfall.

Cashing Out: The Last Resort

Avoid this option except in true emergencies. First, you will be taxed on the money. In addition, if you’re no longer going to be working, you need to be 55 to avoid paying an additional 10% penalty. If you’re still working, you must wait to access the money without penalty until age 59½.

Most advisors say that if you must use the money, withdraw only what you need until you can find another income stream. Move the rest to an IRA or similar tax-advantaged retirement plan.

Lower Invesment Fees And Costs

Another reason you should roll over your 401 to an IRA is to have better cost control. A 401 plan has a set fund structure that can potentially carry higher than average fees, eating into your portfolios return. Furthermore, plan administration and consultant fees are in addition to the plans total cost.

Rolling your 401 into an IRA would allow you to take advantage of dirt-cheap mutual funds or even trade individual stocks and bonds for free. You would also avoid administrative costs, significantly lowering your portfolios fees, which can add up over your career.

Read Also: Can I Borrow From My 401k

Also Check: Is It Good To Convert 401k To Roth Ira

How 401 Rollovers Work

If you decide to roll over an old account, contact the 401 administrator at your new company for a new account address, such as ABC 401 Plan FBO Your Name, provide this to your old employer, and the money will be transferred directly from your old plan to the new or sent by check to you , which you will give to your new companys 401 administrator. This is called a direct rollover. Its simple and transfers the entire balance without taxes or penalty. Another, even simpler option is to perform a direct trustee-to-trustee transfer. The majority of the process is completed electronically between plan administrators, taking much of the burden off of your shoulders.

A somewhat riskier method, Ford says, is the indirect or 60-day rollover in which you request from your old employer that a check be sent to you made out to your name. This manual method has the drawback of a mandatory tax withholdingthe company assumes you are cashing out the account and is required to withhold 20% of the funds for federal taxes. This means that a $100,000 401 nest egg becomes a check for just $80,000 even if your clear intent is to move the money into another plan.

When Not To Roll Over Your Retirement Account

There can be good reasons to NOT roll over an old 401 or 403 to an IRA. For tax reasons, its generally not a good idea to roll over company stock that has appreciated in value.

Second, if youre afraid of bankruptcy or are planning to retire early, leveraging your employers 401 or 403 provides additional protection from creditors and could allow you to take out funds before age 59 ½ without penalty.

Finally, while this is not a reason to avoid a rollover to an IRA, its important to note that many financial professionals will get a commission if you use them to roll your dollars to an IRA, but not if you roll your dollars to your new 401.

Don’t Miss: Should I Convert My 401k To A Roth Ira

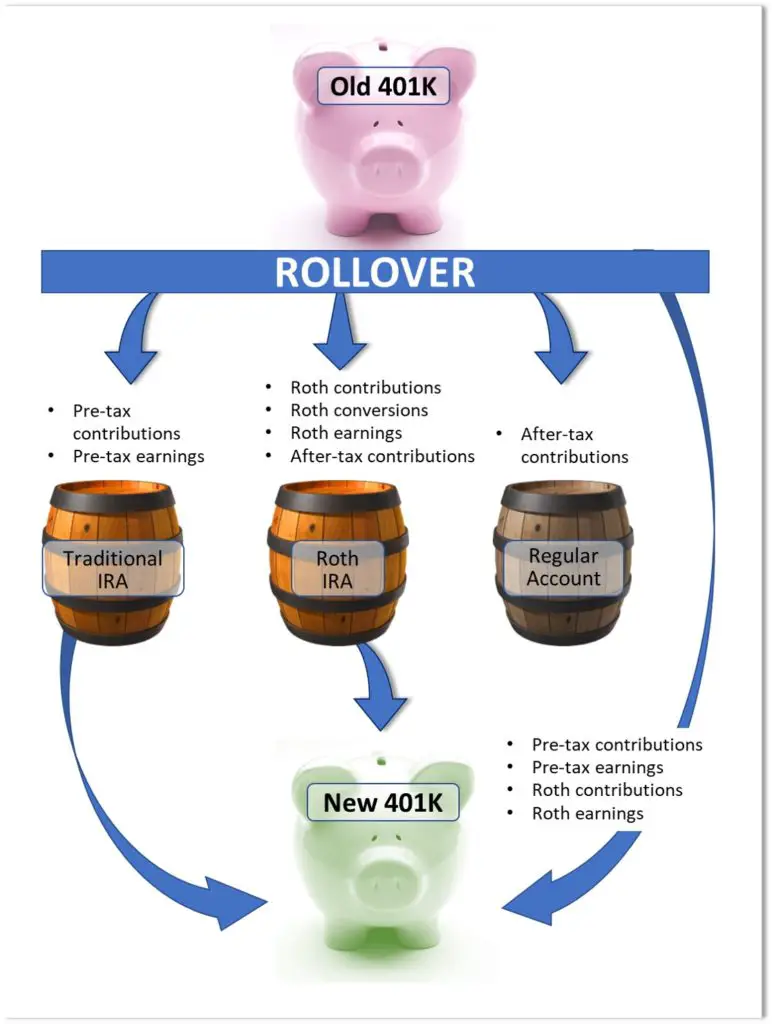

What Is A 401 Rollover

A 401 rollover is when you move the assets you accumulated in a previous employers 401 plan into a new employers 401 or into a traditional IRA. Its something you want to take advantage of when you leave your job. By rolling over your old 401 assets, you can keep your retirement savings all in one place, says Amy Richardson, CFP, Senior Manager and Financial Planner at Schwab Intelligent Portfolios Premium.

Moving your old 401 over helps keep your money in one place. Rather than have many different retirement accounts spread out everywhere, you can keep all your retirement money in one account. It makes it easier to keep track of. It also means you can avoid paying fees or charges twice, if both accounts charge them.

It also helps increase investment choices and ownership. Even if you dont move your 401 to your new employer, you can roll it over to an IRA. This gives you more ownership of your own account regardless of what happens with your new employer. If you ever leave in the future, your traditional or Roth IRA can stay with you.

Can You Be Required To Roll Over Your 401

Sometimes you have no choice in the matter. You might be required to roll over your 401 if:

You dont meet a minimum balance requirement. For example, if you have less than $5,000 in your 401, your employer can require you to roll your 401 into a different account.

Your old employer changes 401 providers. Depending on your company, your account may not be rolled over and your existing provider may not continue service. If your account is rolled over, the new provider might have requirements you cant meet, or they might not provide the services you want.

Recommended Reading: What Happens To My 401k After I Quit

How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

Changing Jobs Know Your 401 Options

If you are changing jobs, or youve lost your job, you may be wondering what to do with your 401 plan account. Its important to understand your options.

What will I be entitled to?

If you leave your job , youll be entitled to a distribution of your vested balance. Your vested balance always includes your own contributions and typically any investment earnings on those amounts. It also includes employer contributions that have satisfied your plans vesting schedule. In general, you must be 100% vested in your employers contributions after 3 years of service , or you must vest gradually, 20% per year until youre fully vested after 6 years . Plans can have faster vesting schedules, and some even have 100% immediate vesting. Youll also be 100% vested once youve reached your plans normal retirement age. Its important for you to understand how your particular plans vesting schedule works, because youll forfeit any employer contributions that havent vested by the time you leave your job. Your summary plan description will spell out how the vesting schedule for your particular plan works. If you dont have one, ask your plan administrator for it. If youre on the cusp of vesting, it may make sense to wait a bit before leaving, if you have that luxury.

Dont spend it

Should I roll over to my new employers 401 plan or to an IRA?

Reasons to consider rolling over to an IRA:

Reasons to consider rolling over to your new employers 401 plan :

What about outstanding plan loans?

You May Like: How To Invest In A 401k For Dummies

Roll It Into A Traditional Individual Retirement Account

The pros: Because IRAs arent sponsored by employersyou own them directlyyou wont have to worry about making changes to your account should you change jobs again in the future. IRA providers may also offer a wider array of investment options and services than either your old or new employer-sponsored plan.

The cons: Once you roll your funds into an IRA, they may no longer be eligible for a future rollover into a 401 plan, and RMDs apply at age 72, regardless of whether youre employed. Also, youll need to specify how the funds in your traditional IRA are to be invested. Until you do so, the money will remain in cash or a cash equivalent, such as a money market account, rather than invested.

If Youre Thinking Of Quitting Your Job

Timing is important here. If your company offers matching contributions, dont walk away and leave that money on the table. Check your plans vesting schedule to see whether working longer will let you vest more in your employer contributions. Also, find out when matching contributions are deposited into your account. Some companies make the deposit every pay period some only once a year. If you leave before that years contribution is made, youll lose it. *

Also Check: Can I Transfer My Ira To My 401k

Dont Ever Do Option #4

Option #4 is cashing out your 401k. Dont ever do this option. First, you will be subject to all kinds of taxes and penalties on the money, which makes it just not worth it. Second, it is so easy to just transfer your account to an IRA, so just do it!

Readers, what has been your experience rolling over your 401k?

Robert Farrington is Americas Millennial Money Expert® and Americas Student Loan Debt Expert, and the founder of The College Investor, a personal finance site dedicated to helping millennials escape student loan debt to start investing and building wealth for the future. You can learn more about him on the About Page, or on his personal site RobertFarrington.com.

He regularly writes about investing, student loan debt, and general personal finance topics geared towards anyone wanting to earn more, get out of debt, and start building wealth for the future.

He has been quoted in major publications including the New York Times, Washington Post, Fox, ABC, NBC, and more. He is also a regular contributor to Forbes.

Editorial Disclaimer:

Roll The Assets Into An Ira

Your 401 assets are already in a tax advantaged account and rolling your 401 into an IRA will keep your investments growing with the same tax advantages and you will avoid the 10% early withdrawal penalty.

Possible Advantages: In addition to avoiding the 10% early withdrawal penalty and maintaining tax advantages, there are several other important benefits to rolling your 401 into an IRA. The biggest advantage is that you control your investment options and you are no longer limited to the investment options in your old or new 401 plan. This is important because you can limit your expenses and you maintain control over your accounts. Some companies change trustees and it is not your old companys duty to notify you of any changes, it is up to you to keep track. Keep in mind that rolling your 401 assets into an IRA plan isnt final you may be able to roll it into your new 401 plan later. You also maintain flexibility for beneficiaries.

Possible Disadvantages: You will not be able to take loans from your IRA as you would be able to if you rolled it into your new employers plan. There are also several disadvantages regarding withdrawals from an IRA vs. a 401 in certain circumstances, 401 plans have a little more flexibility.

Don’t Miss: Can You Convert A 401k Into A Roth Ira

Convert Into A Roth Ira

The pros: Withdrawals are entirely tax-free in retirement, provided youre over age 59½ and have held the account for five years or more. Roth IRAs are also exempt from RMDs.

The cons: Because Roth IRAs are funded with after-tax dollars, youll have to pay taxes on your existing 401 funds at the time of the conversion. A Roth IRA must be open for five years in order to withdraw earnings tax-free, and youll be subject to a 10% penalty if you withdraw any money before youre 59½ without an exemption.

Choose Which Type Of Ira Account To Open

An IRA may give you more investment options and lower fees than your old 401 had.

-

If you do a rollover to a Roth IRA, youll owe taxes on the rolled amount.

-

If you do a rollover to a traditional IRA, the taxes are deferred.

-

If you do a rollover from a Roth 401, you won’t incur taxes if you roll to a Roth IRA.

Read Also: How To Open 401k Solo

Update Your Financial Plan

Changing jobs is a good time to revisit your financial plan, especially if youre gaining a welcome income jump. If you have a bigger paycheck, be wary of lifestyle creep where the more you make, the more you spend, Winston says.

You should consider the differences in investment options and risks, fees and expenses, tax implications, services and penalty-free withdrawals for your various options. There may be other factors to consider due to your specific needs and situation. You may wish to consult your tax advisor or legal counsel. The subject matter in this communication is educational only and provided with the understanding that Principal® is not rendering legal, accounting, investment or tax advice. You should consult with appropriate counsel, financial professional or other advisors on all matters pertaining to legal, tax, investment or accounting obligations and requirements.

Principal® does not make available products related to Health Savings Accounts.

Disability insurance has exclusions and limitations. Costs and coverage details can be obtained from your financial professional.

Investment advisory products offered through Principal Advised Services, LLC. Principal Advised Services is a member of the Principal Financial Group®, Des Moines, IA 50392.

Dont Miss: How To Diversify 401k Portfolio

Make The Best Decision For You

When it comes to deciding what to do with an old 401, there may be factors that could be unique to your situation. That means the best choice will be different for everyone. One thing to remember is that the rules among retirement plans vary so it’s important to find out the rules your former employer has as well as the rules at your new employer.

Do also compare the fees and expenses associated with the accounts you’re considering. If you find it confusing or overwhelming, speak with a financial professional to help with the decision.

Also Check: Can I Check My 401k Online

What Are The Advantages Of Rolling Over A 401 To An Ira

Doing a 401 rollover to an IRA offers perks that can include more diverse investment selections than a typical 401 plan, perhaps cheaper investments and lower account fees. It’s also a way to keep your retirement funds organized and ensure you have easy access to them. And while some 401 plans pass account management fees along to the employees, many IRAs charge no account fees.

In summary, it’s a good way to save money, stay organized and make your money work harder.

When Youre Between Jobs:

-

Stick to your budget. When you dont have a paycheck coming in, the last thing you want to do is run up debt . Do your best to stick to the budget youve laid out for yourself while between jobs, even if it means cutting back on fun. In the long run, youll be glad you did.

-

If youre planning to roll your 401 over into an IRA, get the process started. Contact your new plan administrator to set up an IRA account and begin the rollover. Remember that if your old plan administrator cuts you a check with the proceeds from your 401 plan, you only have 60 days to deposit it into your rollover IRA to avoid substantial taxes and early withdrawal penalties. If you decide a rollover is right for you, were here to help. Call a Rollover Consultant at .

Dont Miss: How Many Loans Can I Take From My 401k

Also Check: When Can You Use Your 401k

Contact New Plan Sponsor

The first step is to talk to the new plan sponsor or human resources manager to know what new employees require when enrolling in the retirement plan. Since not all employers accept old 401 transfers, you should ask the plan sponsor if the transfer option is available to new employees. If the new employer accepts 401 transfers, you will be required to fill transfer forms to initiate the transfer.

Transfer Your 401 To Your New Job

Transferring your 401 to your new job is like a 401 to 401 rollover. Depending on the set up of your new plan, its probably a better option than leaving it behind but might not be as beneficial as rolling your 401 to an IRA. Check the plan documents of your new employers 401 to confirm the plan accepts incoming rollovers.

by Rob Yeend | Sep 30, 2021 | Articles, blog, For Individuals, Latest News, Newsletter Article, Personal

Leaving one job for another can be an exciting move, but changing companies can present some logistical challenges, such as what to do with your old 401 plan. While you have options to choose from, some may be better than others.

Don’t Miss: Can I Borrow Money From 401k