How Much Risk Are You Comfortable With

Some people can easily ignore the day-to-day changes in account balance that sometimes come with more aggressive investments. Instead, they focus on the overall progress toward their goal. Others lie awake at night fretting about what their investments will do tomorrow.

It won’t do you any good to constantly worry about your investment decisions, and it probably won’t be much fun either. So choose a level of risk you know you can live with.

Use Balanced Funds For A Middle

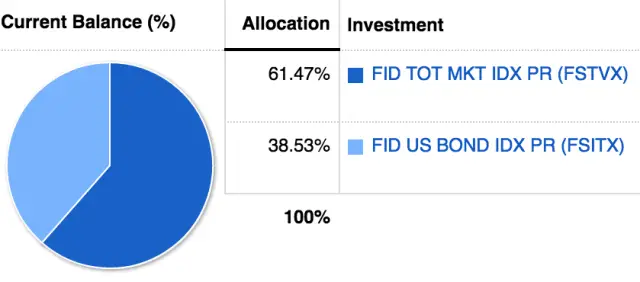

A balanced fund allocates your 401 contributions across both stocks and bonds, usually in a proportion of about 60% stocks and 40% bonds. The fund is said to be “balanced” because the more conservative bonds minimize the risk of the stocks. This means that when the stock market is quickly rising, a balanced fund usually will not rise as quickly as a fund with a higher portion of stock. When the stock market is falling, expect that a balanced fund will not fall as far as funds with a higher portion of bonds.

If you dont know when you might retire, and you want a solid approach that is not too conservative and not too aggressive, choosing a fund with balanced in its name is a good choice . This type of fund, like a target-date fund, does the work for you. You can put your entire 401 plan in a balanced fund, as it automatically maintains diversification and rebalances your money over time to maintain the original stock-bond mix).

Want Your Money To Grow

See how I can help you to make your money work for you

Managed Investment Accounts unlock the power of professional asset management. Let me make you money while you enjoy your life.

Stock and Futures Market Research use my technical and fundamental analysis to pick up swing trades with the best risk/reward ratio.

You May Like: Can I Check My 401k Online

Keep An Eye On Investment Costs

Countless studies have supported that low investment costs are a key factor in determining investment success. One study by Vanguard indicated that an annual 2 percent increase in your investing costs could erode 40 percent of the final value of your nest egg over a 25-year period.

Costs are just as important as proper allocation and risk tolerance, said Wayne Bland, financial advisor and retirement consultant with Metro Retirement Plan Advisors. Consider low-cost index funds or ETF options if offered by your plan. If your plan doesnt offer them, contact your benefits and request they add these options to your plan.

Look At Your Debt Situation

Once you have an emergency fund established, youll need to ask yourself the following questions to figure out where to next allocate your extra cash flow:

- Do I have any debt?

- If so, at what interest rates?

If the answer to the first question is yes, read this post on debt payoff. As a general rule, if you have high interest bad debt you want to pay it off before investing in anything else. The one exception to this rule would be if you have an employer match on contributions to your 401K, with the match rate being higher than your bad debt rate. If this is the case, you may be better off getting your match and then fighting your debt, but not everyone agrees on this point.

There is more of a consensus that if you have good debt at a low interest rate, then youre probably better off paying your minimum monthly payments and investing your leftover money.

Don’t Miss: How Do You Get 401k

Summary: Keeping Your 401k Safe

Finally, history proves stock market crashes are rare events that long-term market gains will make up.

If you can time the market to avoid the worst of a crash, then this is a good option.

Secondly, another way to keep your 401K safe is to keep your money in the market and use dollar-cost averaging to your advantage. Notably, the stock market erased all the losses from the 2007-2008 crash by October 2012, just four years later, and if you had doubled down on your investing during the worst periods of the crash, you would have a chance to outperform the market.

- Highly Recommended Reading: Fact-Based Research of 6 Major Stock Market Crashes & What Caused Them. The Facts About The Impact of Crashes & How To Avoid & Profit From Them.

This is not specific financial advice I am not a registered financial advisor I am a market analyst. If you are concerned about your investments, seek the help of a registered financial advisor who can provide tailored advice to suit your specific risk and portfolio requirements.

Pro Rata Vs Per Capita

Pro rata and per capita are the two most common methods for allocating general administrative expenses among plan participants. To help choose the most equitable method, FAB 2003-3 provides the following guidance:

The pro rata method would appear to be an equitable approach for allocating most general administrative fees, but its not the only permissible method.

The per capita method may also be reasonable for allocating certain fixed administrative fees related to record keeping, legal, auditing, annual reporting and claims processing.

The per capita method would appear to be an arbitrary method for allocating fees determined on a plan assets basis, such as plan-level investment advice.

The pro rata or per capita may be a justifiable method for allocating fees related to participant investment advice, without regard to the actual utilization of the service.

Recommended Reading: How To Pull From 401k

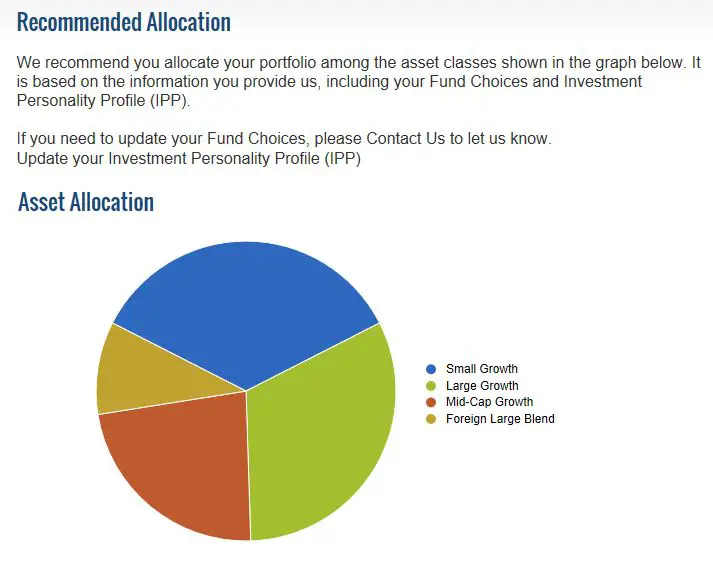

Start With Your Climate Not Your 5

Asset allocationthe way you divide your portfolio among asset classesis the first thing you should consider when getting ready to purchase investments, because it has the biggest effect on the way your portfolio will act.

Just like it’s not a great idea to base your relocation on a current run of nice weather in a random city, choosing investments on a whim is unlikely to be a winning strategy over the long term.

Different asset classes tend to act in specific ways, kind of like the investing climate they inhabit. By choosing how to divide your portfolio, you have a certain amount of control over the experience you’ll have as an investor.

There’s no “best” asset allocation, just like there’s no “perfect” climate for everyoneit all depends on what makes you comfortable and gives you a good shot at meeting your goals.

Use Model Portfolios To Allocate Your 401 Like The Pros

Many 401 providers offer model portfolios that are based on a mathematically constructed asset allocation approach. The portfolios have names with terms like conservative, moderate, or aggressive growth in them. These portfolios are crafted by skilled investment advisors so that each model portfolio has the right mix of assets for its stated level of risk.

Risk is measured by the amount the portfolio might drop in a single year during an economic downturn.

Most self-directed investors who aren’t using one of the above two best 401 allocation approaches or working with a financial advisor will be better served by putting their 401 money in a model portfolio than trying to pick from available 401 investments on a hunch. Allocating your 401 money in a model portfolio tends to result in a more balanced portfolio and a more disciplined approach than most people can accomplish on their own.

Also Check: How Does 401k Work At Retirement

How Important Is Asset Allocation

Extensive research has shown that, if you have a diversified portfolio, a whopping 88% of your experience can be traced back to your asset allocation.*

In other words, your experience will be very consistent with that of any other diversified investor with the same asset allocation, no matter which specific investments they choose.

In the same way, if you move to San Diego, your overall weather will be very similar to that of someone living in Los Angeles. It won’t matter very much which of those cities you choose or what month you move therewhat’s important is that you’re living in Southern California and not New England.

So What Is Asset Allocation

Think of asset allocation as your mix of these ingredients. It uses the benefit of diversificationthats the idea that asset classes dont move in sync, so one or more may grow while others decline. Winston adds, The end goal is to have longer, more consistent growth by investing within and across a variety of asset classes.

So, how to determine what investments are best for you? Its typically based on how much time you have until you need to dip into these investments and your comfort with risk.

Don’t Miss: How To Cancel 401k Plan

You Are Leaving The Wells Fargo Website

You are leaving wellsfargo.com and entering a website that Wells Fargo does not control. Wells Fargo has provided this link for your convenience, but does not endorse and is not responsible for the content, links, privacy policy, or security policy of this website.

Retirement may seem a long way off and far removed from your day-to-day concerns. And yet, this is actually the best time to start planning and saving that is, when you still have time to accumulate the money youll need.

Here are some common mistakes that throw people off course in their retirement planning. Knowing these pitfalls should help you steer clear and save more.

Mistake #: Getting Out Of The Market After A Downturn

When the market takes a big hit, you may be tempted to pull out all the stocks in your retirement portfolio. If you do, youll miss the gains if the market turns around. You want to keep a good mix of asset classes in your portfolio: stocks, bonds, and cash. And once a year, you should rebalance to keep your asset allocation on track.

You May Like: How Much Does A 401k Cost A Small Business

Allocate Money In Target Date Funds

It is always advisable to allocate the amount in your 401 money in ‘Target Date Funds,’ the target date means your targeted retirement date. You will get to know about these funds, when you see the name of these funds in the calendar year, such a T.

So, when you allocate the money in these target-date funds, they make your long-term investment very easy. You can decide the approximate date for your retirement, and then you can easily pick up the funds which are close to your retirement date.

Let’s say for example if you have planned to get retirement at about 25 years from today then you will need to select the funds which will get mature at about 25 years from now, or close to your retirement date and you can pick the target fund with the appropriate name.

So, if you have opted to invest in these target date fund then it will spread your money from 401 plan to various asset classes like – large company stocks, small company stocks, bonds, emerging market stocks, real estate stocks, etc. The target date fund automatically chooses how much of the which asset class should be own.

When you are nearing retirement date, these target date fund progressively becomes more conservative, and start owning less stock and fewer bonds. The main motive behind this is that to reduce the risk you are taking as you are nearing your retirement date and where you would be more likely to use your money for the retirement.

Rolling Over To A New 401

The first step in transferring an old 401 to a new employer’s qualified retirement plan is to speak with the new plan sponsor, custodian, or human resources manager who assists employees with enrolling in the 401 plan. Because not every employer-sponsored plan accepts transfers from an outside 401, it is imperative for a new employee to ask if the option is available from the new employer. If the plan does not accept 401 transfers, the employee needs to select one of the three other options for the 401 account balance.

If the new employer plan accepts 401 transfers from other companies, there is often a substantial amount of paperwork that must be completed by the employee. The paperwork is provided by the new plan sponsor or human resources contact and requires the name, date of birth, address, Social Security number, and other employee identifying information.

In addition, the 401 transfer form must provide details of the old employer plan, including total amount to be transferred, investment selections held in the account, date contributions started and stopped, and contribution type, such as pre-tax or Roth. A new plan sponsor may also require an employee to establish new investment instructions for the account being transferred on the form. Once the transfer form is complete, it can be returned to the plan sponsor for processing.

A transfer from one 401 to another is a tax-free transaction, and no early withdrawal penalties are assessed.

You May Like: How Do You Pull Out Your 401k

What Is An Aggressive 401 Investment

When experts speak of being aggressive, they generally mean how much of your assets are in stocks or stock funds. Stocks are an attractive long-term investment, but they fluctuate a lot in the short term. Thats problematic, especially for soon-to-retire investors. If all or almost all of your retirement account is in stocks or stock funds, its aggressive.

While being more aggressive can make a lot of sense if you have a long time until retirement, it can really sink you financially if you need the money in less than five years. To reduce risk, investors can add more bond funds to their portfolio or even hold some CDs.

A large downturn in the market immediately preceding retirement can have devastating effects on an individuals standard of living in retirement, says Dr. Robert Johnson, finance professor at Creighton Universitys Heider College of Business.

Johnson points to those who retired at the end of 2008 and who were invested only in the Standard & Poors 500 Index , which contains hundreds of top companies. If they were invested in the S& P 500, they would have seen their assets fall by 37 percent in one year, he says.

But those who had some investments in other assets such as bonds or even cash would have seen a much lower overall decline. Of course, any money in the S& P 500 would have declined by a similar amount, but by having fewer eggs in that basket, their overall portfolio declined less.

What Is A Good Rate Of Return On A 401

How you define a good rate of return depends on your investment goals. Average 401 returns typically range between 5% and 10% depending on market conditions and risk profile. If you’re playing catch-up, you may want higher returns. If you have a long way until retirement and a low tolerance for risk, you might be comfortable with a lower return.

Read Also: What To Know About 401k

What Is The Average Return For An Aggressive 401

Theres no hard and fast rule for what you can earn on an aggressive portfolio. The return always depends on the performance of the stocks or stock funds in the portfolio. Stocks can fluctuate a lot, but historically a broadly diversified portfolio of stocks has shown strong gains.

For example, the Standard & Poors 500 index has returned about 10 percent annually. The best mutual funds have done even better recently, with some topping over 20 percent annually.

But thats the level of return you can achieve only if youre fully invested in the most aggressive kind of portfolio all stocks. If you need a portion of your portfolio to be more conservative, perhaps because youre nearing retirement, youll probably want to add safer but lower-yielding bonds to the mix. In that case you should expect your overall returns to be lower.

And its worth repeating that stocks fluctuate, so you have to hold on or you wont get these returns.

Ways To Battle The Effects Of Inflation In Your 401k

With everything from used cars to building materials costing more, the Labor Departments announcement last month that consumer prices continued their rapid ascent held little surprise to consumers.

The real debate is whether current inflation is caused by temporary conditions such as supply chain concerns, or a more long-term phenomenon due to the massive increase in monetary supply due to last years stimulus.

I am firmly in the latter camp. In 2020, the monetary supply increased a staggering 20%, according to Deloitte, much higher than the typical 5% to 7% rate. This year will likely be no different, as increases in government spending for everything from infrastructure to student loan forgiveness will only add to the pile of money and debt the U.S. is accumulating.

Looking at it another way, it isnt that consumer products, housing, and other assets are more expensive. It could be that a vastly diluted dollar just wont buy what it used to. Fortunately, there are some definite steps 401k plan participants can do as we pivot to a future of higher inflation.

Don’t Miss: Can You Use Your 401k To Start A Business

Investing In Your 401

The variety of investments available in your 401 will depend on who your plan provider is and the choices your plan sponsor makes. Getting to know the different types of investments will help you create a portfolio that best suits your long-term financial needs.

Among the most importantand perhaps intimidatingdecisions you must make when you participate in a 401 plan is how to invest the money you’re contributing to your account. The investment portfolio you choose determines the rate at which your account has the potential to grow, and the income that you’ll be able to withdraw after you retire.