Contribute Enough To Get Any Employer Match

Even the priciest 401 plan can have some redeeming qualities. Free money via an employer match is one of them. Contributing enough money to get the match is the bare minimum level of participation to shoot for. Beyond that, it depends on the quality of the plan.

A standard employer match is 50% or 100% of your contributions, up to a limit, often 3% to 6% of your salary. Note that matching contributions may be subject to a vesting period, which means that leaving the company before matching contributions are vested means leaving that money behind. Any money you contribute to the plan will always be yours to keep.

If your company retirement plan offers a suitable array of low-cost investment choices and has low administrative fees, maxing out contributions in a 401 makes sense. It also ensures you get the most value out of the perks of tax-free investment growth and, depending on the type of account or the Roth version), either upfront or back-end tax savings.

How To Make An Esignature For The Prudential 401k Withdrawal Form On Android Devices

Despite iPhones being very popular among mobile users, the market share of Android gadgets is much bigger. Therefore, signNow offers a separate application for mobiles working on Android. Easily find the app in the Play Market and install it for eSigning your prudential withdrawal form.

In order to add an electronic signature to a prudential 401k withdrawal, follow the step-by-step instructions below:

If you need to share the prudential hardship withdrawal form with other parties, you can easily send it by electronic mail. With signNow, you are able to eSign as many files in a day as you need at a reasonable cost. Start automating your signature workflows today.

Make Your 401 Selections With A Pro

Whether youre just starting to invest in your 401 or youve had one for years, an experienced professional can help you navigate your options and outline a strategy to meet your retirement goals.

Looking for the right investing pro? Try our SmartVestor program! Its a free, easy way to find qualified pros in your area. A SmartVestor Pro will help you understand your investment selections so you can make informed decisions about your future.

About the author

Ramsey Solutions

Ramsey Solutions has been committed to helping people regain control of their money, build wealth, grow their leadership skills, and enhance their lives through personal development since 1992. Millions of people have used our financial advice through 22 books published by Ramsey Press, as well as two syndicated radio shows and 10 podcasts, which have over 17 million weekly listeners.

Read Also: How To Transfer 401k From Fidelity To Vanguard

Compliance And Funding Questions

The final section covers important compliance information for the IRS. Question 9 asks whether participants had any participant loans against the plan. Section 10 and 11 both ask about minimum funding requirements and waivers to those requirements.

Most Solo 401k plans that we recommend will help self-employed people steer clear of these requirements. This means youll be able to answer No to these questions. If youre subject to minimum funding requirements you will, unfortunately, have to complete Form 5500 to answer the questions.

How Much Of My Salary Can I Contribute To A 401 Plan

The amount that employees can contribute to their 401 Plan is adjusted each year to keep pace with inflation. In 2021, the limit is $19,500 per year for workers under age 50 and $26,000 for those aged 50 and above. In 2022, the limit is $20,500 per year for workers under age 50 and $26,500 for those aged 50 and above.If the employee also benefits from matching contributions from their employer, the combined contribution from both the employee and the employer is capped at the lesser of $58,000 in 2021 or 100% of the employees compensation for the year .

Read Also: How To Roll 401k Into Roth Ira

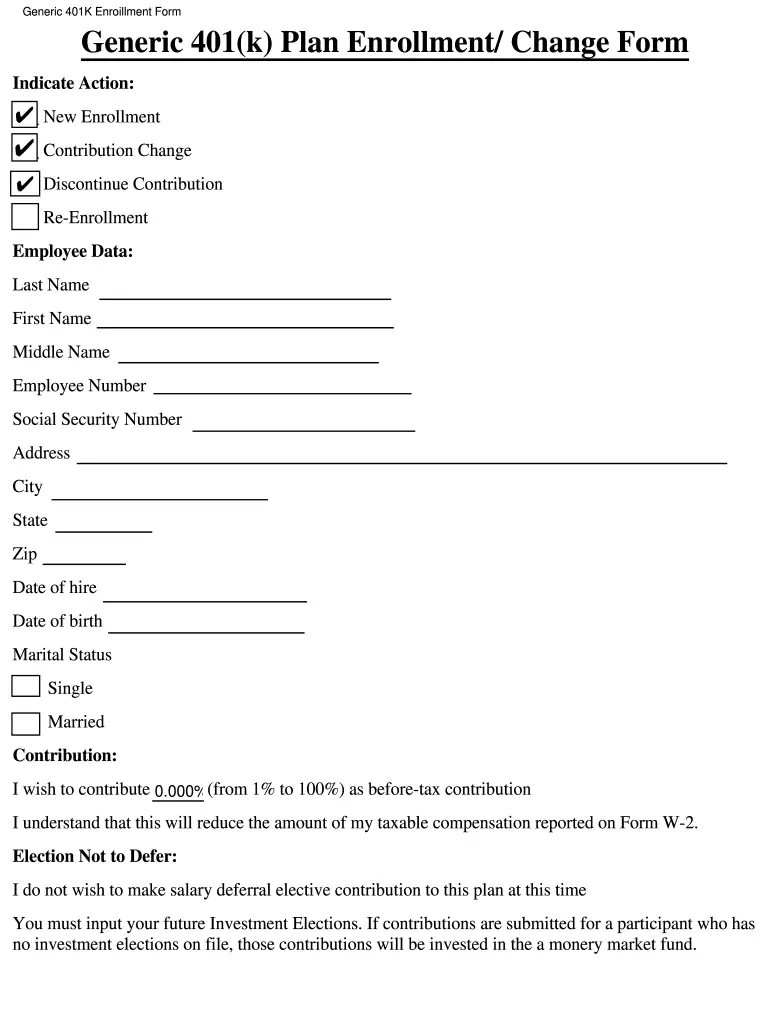

How To Fill Out And Sign Enrollment Online

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

Finding a authorized expert, making a scheduled visit and going to the workplace for a personal conference makes completing a Generic 401K Enroillment Form – 401k Network from beginning to end exhausting. US Legal Forms lets you rapidly make legally valid papers according to pre-constructed web-based blanks.

Perform your docs in minutes using our simple step-by-step guideline:

Easily create a Generic 401K Enroillment Form – 401k Network without needing to involve experts. There are already more than 3 million customers benefiting from our rich library of legal forms. Join us right now and get access to the top catalogue of browser-based samples. Test it yourself!

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

How To Make An Esignature For The Prudential 401k Withdrawal Form Right From Your Smart Phone

Mobile devices like smartphones and tablets are in fact a ready business alternative to desktop and laptop computers. You can take them everywhere and even use them while on the go as long as you have a stable connection to the internet. Therefore, the signNow web application is a must-have for completing and signing prudential withdrawal form on the go. In a matter of seconds, receive an electronic document with a legally-binding eSignature.

Get prudential 401k withdrawal signed right from your smartphone using these six tips:

The whole procedure can take less than a minute. As a result, you can download the signed prudential hardship withdrawal form to your device or share it with other parties involved with a link or by email. Due to its universal nature, signNow works on any gadget and any OS. Choose our eSignature solution and forget about the old times with security, affordability and efficiency.

Also Check: Can You Have A Roth Ira And A 401k

Quick Guide On How To Complete 401k Form

Forget about scanning and printing out forms. Use our detailed instructions to fill out and eSign your documents online.

SignNow’s web-based service is specifically made to simplify the organization of workflow and enhance the process of competent document management. Use this step-by-step instruction to complete the Generic 401 k enrollment form purpose quickly and with ideal accuracy.

Annual Return Identification Information

The annual return identification information gives the IRS basic information about the filing. The first question here is one of the most important. Filers will need to indicate the following:

A1: Is this the first year filing for this plan?A2: Is this filed as an amended return?A3: Is this the last year a return will be filed for the plan A4: A year in which the plan had less than 12 months of filing.

Its important to note that you can check ANY or NONE of the boxes.

You May Like: How To Increase 401k Contribution Fidelity

Traditional 401 Vs Roth 401

When 401 plans became available in 1978, companies and their employees had just one choice: the traditional 401. Then, in 2006, Roth 401s arrived. Roths are named for former U.S. Senator William Roth of Delaware, the primary sponsor of the 1997 legislation that made the Roth IRA possible.

While Roth 401s were a little slow to catch on, many employers now offer them. So the first decision employees often have to make is between Roth and traditional.

As a general rule, employees who expect to be in a lower after they retire might want to opt for a traditional 401 and take advantage of the immediate tax break.

On the other hand, employees who expect to be in a higher bracket after retiring might opt for the Roth so that they can avoid taxes on their savings later. Also importantespecially if the Roth has years to growis that there is no tax on withdrawals, which means that all the money the contributions earn over decades of being in the account is tax-free.

As a practical matter, the Roth reduces your immediate spending power more than a traditional 401 plan. That matters if your budget is tight.

Since no one can predict what tax rates will be decades from now, neither type of 401 is a sure thing. For that reason, many financial advisors suggest that people hedge their bets, putting some of their money into each.

S Two And Four: Income And Assets

Questions 3244 ask for the students and spouses income and assets . Step Four collects similar information about parent income and assets, so the following discussion also applies to parents.

If the student or his or her parent wasnt married in 2019 but is married when the application is signed, the student also needs to provide income and asset information for the new spouse. If the student or their parent was married in 2019 but is separated, divorced, or widowed when the application is signed, the student or parent excludes the income and assets for that spouse even though the information may be on the 2019 tax forms.

The FAFSA form asks for income and taxes paid according to lines on the IRS tax forms for 2019, the base year for 20212022. Data from the completed tax year is used as a predictor of the familys financial situation for the current year. In the rare instance that 2019 tax data is not available yet, best estimates can be used on the application. However, the student is asked to correct this information later when the tax return is filed.

When a student or parent has returns from both a foreign nation and the United States for the same tax year, they should use the data from the U.S. return when filling out the FAFSA form.

You May Like: How To Pull Out Of 401k

K Contribution Enrollment Deferral Change Form

401k Enrollment. Here are a number of highest rated 401k Enrollment pictures on internet. We identified it from well-behaved source. Its submitted by government in the best field. We tolerate this kind of 401k Enrollment graphic could possibly be the most trending topic when we share it in google gain or facebook.

Network.artcenter.edu is an open platform for users to share their favorite wallpapers, By downloading this wallpaper, you agree to our Terms Of Use and Privacy Policy. This image is for personal desktop wallpaper use only, if you are the author and find this image is shared without your permission, DMCA report please Contact Us

How To Create An Electronic Signature For The Prudential 401k Withdrawal Form In The Online Mode

Are you looking for a one-size-fits-all solution to eSign prudential withdrawal form? signNow combines ease of use, affordability and security in one online tool, all without forcing extra ddd on you. All you need is smooth internet connection and a device to work on.

Follow the step-by-step instructions below to eSign your prudential 401k withdrawal:

After that, your prudential hardship withdrawal form is ready. All you have to do is download it or send it via email. signNow makes eSigning easier and more convenient since it provides users with a number of additional features like Add Fields, Merge Documents, Invite to Sign, and so on. And due to its multi-platform nature, signNow can be used on any device, desktop or smartphone, regardless of the operating system.

Read Also: How To Withdraw My 401k

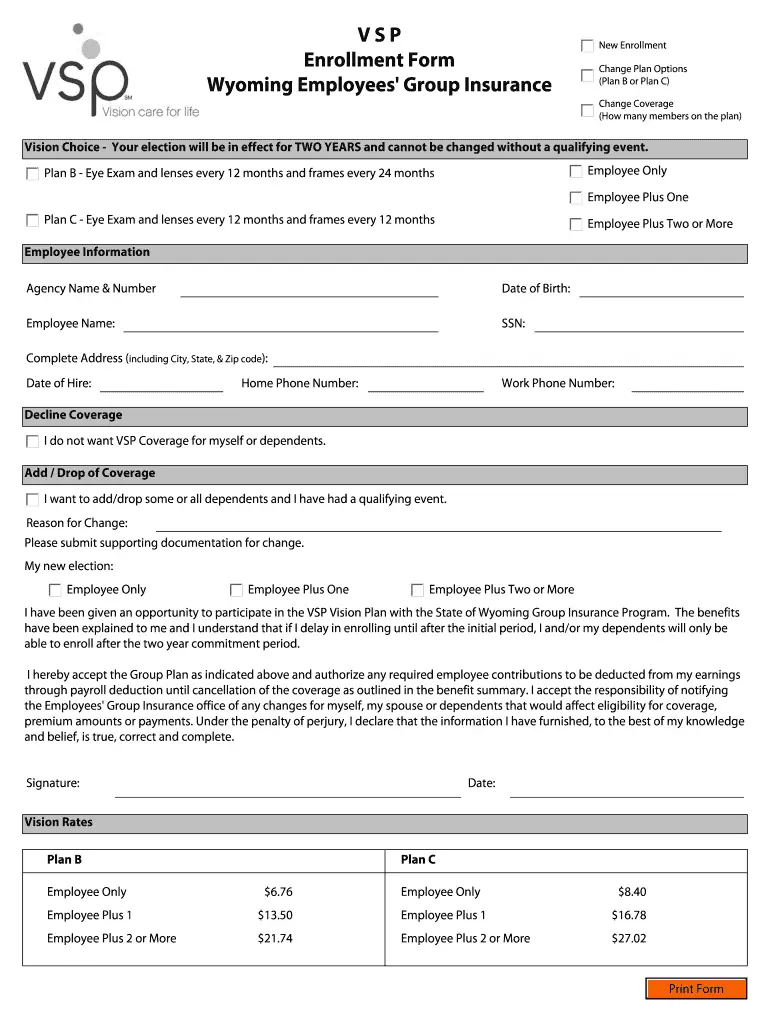

How To Fill Out And Sign Allocated Online

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

Are you trying to find a fast and practical tool to fill out 401k Fidelity Enrollment Form at a reasonable cost? Our service gives you a rich library of templates that are offered for submitting online. It only takes a couple of minutes.

Keep to these simple instructions to get 401k Fidelity Enrollment Form prepared for submitting:

Filling out 401k Fidelity Enrollment Form doesn?t have to be stressful anymore. From now on simply cope with it from home or at the office straight from your mobile device or desktop computer.

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

How To Make Your 401 Selections

8 Minute Read | September 27, 2021

If you value your companys 401 benefit, the day you receive your enrollment package is an exciting one. Soon youll be building your retirement nest egg with the help of your employers 401 match and the right investment selectionsyou cant wait to get started!

So you rip open your envelope and glance over the contents: forms, a nice-looking brochure, and maybe a letter from your employer welcoming you to the companys 401. Once youve read the letter, however, the rest of the materials simply dont make a lot of sense. Theres information about vesting, beneficiaries, equities, risk assessments, and 401 selectionsbut nothings clicking.

The only thing that seems clear is that investing in a 401 is important business. Your ability to retire depends on you getting it right. But how can you make such major, long-term decisions when you dont even understand what the choices are?

Understanding your workplace 401 is the first step toward the retirement of your dreams, so let’s get started.

Don’t Miss: Can I Rollover My 401k To A Mutual Fund

How To Generate An Esignature For The Generic 401k Enrollment Form In Google Chrome

The guidelines below will help you create an eSignature for signing 401 k enrollment form in Chrome:

Once youve finished signing your 401k enrollment form purpose, decide what you wish to do next – save it or share the file with other parties involved. The signNow extension offers you a range of features for a much better signing experience.

Leave Your 401 With The Old Employer

In many cases, employers will permit a departing employee to keep a 401 account in their old plan indefinitely, although the employee can’t make any further contributions to it. This generally applies to accounts worth at least $5,000. In the case of smaller accounts, the employer may give the employee no choice but to move the money elsewhere.

Leaving 401 money where it is can make sense if the old employer’s plan is well managed and the employee is satisfied with the investment choices it offers. The danger is that employees who change jobs over the course of their careers can leave a trail of old 401 plans and may forget about one or more of them. Their heirs might also be unaware of the existence of the accounts.

Don’t Miss: What Is The Max Percentage For 401k

Should I Hire Outside Filing Help

The Form 5500-EZ should be simple enough for most people to complete without the help of a professional. However, you may choose to hire an accountant or bookkeeper to file on your behalf. Some accountants may bundle this filing requirement with annual tax preparation. Also, many of the self-directed solo 401k plans like MySolo401k will handle preparation of this form for you.

A more common reason to seek outside help is in regards to account valuations. If your account includes only stocks and bonds, you can easily figure out the value on your own. However, plans that hold real estate or other difficult-to-value assets may need to hire a professional to appraise the portfolio value each year.

A professional appraisal report will typically count as acceptable proof of valuation should the IRS choose to audit the report.

Taking Withdrawals From A 401

Once money goes into a 401, it is difficult to withdraw it without paying taxes on the withdrawal amounts.

“Make sure that you still save enough on the outside for emergencies and expenses you may have before retirement,” says Dan Stewart, CFA®, president of Revere Asset Management Inc., in Dallas. “Do not put all of your savings into your 401 where you cannot easily access it, if necessary.”

The earnings in a 401 account are tax-deferred in the case of traditional 401s and tax-free in the case of Roths. When the traditional 401 owner makes withdrawals, that money will be taxed as ordinary income. Roth account owners have already paid income tax on the money they contributed to the plan and will owe no tax on their withdrawals as long as they satisfy certain requirements.

Both traditional and Roth 401 owners must be at least age 59½or meet other criteria spelled out by the IRS, such as being totally and permanently disabledwhen they start to make withdrawals.

Otherwise, they usually will face an additional 10% early-distribution penalty tax on top of any other tax they owe.

Some employers allow employees to take out a loan against their contributions to a 401 plan. The employee is essentially borrowing from themselves. If you take out a 401 loan, please consider that if you leave the job before the loan is repaid, you’ll have to repay it in a lump sum or face the 10% penalty for an early withdrawal.

Don’t Miss: How Much Should I Put In My 401k Per Paycheck