Contribution Effects On Your Paycheck

An employer-sponsored retirement savings account could be one of your best tools for creating a secure retirement. It provides two important advantages:

- All contributions and earnings are tax-deferred. You only pay taxes on contributions and earnings when the money is withdrawn.

- Many employers provide matching contributions to your account, which can range from 0% to 100% of your contributions.

Use this calculator to see how increasing your contributions to a 401 can affect your paycheck as well as your retirement savings.

This calculator uses the latest withholding schedules, rules and rates .

How Much Can I Contribute Into A Solo 401k Sep Ira Defined Benefit Plan Or Simple Ira

Using the retirement calculator you can calculate the maximum annual retirement contribution limit based on your income. Enter your name, age and income and then click Calculate.

The result will show a comparison of how much could be contributed into a Solo 401k, SEP IRA, Defined Benefit Plan or SIMPLE IRA based on your income and age.

Note: If you are taxed as a sole proprietorship use your NET income when using the calculator. If you are incorporated, then only use your W-2 wages when using the calculator. For example, S corporation K-1 distributions are not included when making the contribution limit calculation.

When Does The Year End For A 401 Match

In terms of IRS contribution limits, the year resets on January 1. Any contributions and matches made during the year count toward your total contribution limit for the year. Your employer might choose to deposit its match each time you withhold your contribution from your paycheck, or it may deposit it at less frequent intervals, say, quarterly or yearly.

The Balance does not provide tax, investment, or financial services or advice. The information is being presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors. Past performance is not indicative of future results. Investing involves risk, including the possible loss of principal.

Also Check: How Can I Find My 401k

Do 401 Contribution Limits Include The Employer Match

Employees are allowed to contribute a maximum of $19,500 to their 401 in 2020, or $26,000 if youre over 50 years of age. The good news is employer contributions do not count towards the $19,500 limit. Instead, employer matching contributions are subject to the lesser known $57,000 limit on all contributions made to a 401 account .

Your 401 can receive no more than $57,000 in contributions in a single year, whether those contributions are made by you or by your employer. That limit is three times the contribution limit for employees, so your employer would need to offer a 200% 401 employer match on all contributions you make for you to reach the limit.

The $57,000 limit mostly affects small business owners and the self-employed who pay themselves and make retirement contributions as both the employee and the employer. Most people who work for regular companies will never have to worry about the $57,000 overall limit.

Solo 401k Contribution Example: Sole Proprietor

First, input your business entity type as the contribution limits vary slightly based on your business structure.

If you are a sole proprietor, this is the net compensation you were paid from your business. Generally this will show up on Line 31 in Schedule C of your income tax return.

Lets say your business earns a gross revenue of $250,000. You typically have about $95,000 in expenses, which leaves $155,000 as your net income as shown on Schedule C of your IRS Form 1040 tax return.

Input $155,000 into the calculator.

Finally, input your age. If you are age 50 or older, you get an extra $6,000 of catch-up contributions you can make to the Solo 401k plan. (Contribution limits have gone up slightly for 2020 cost of living increase. This blog post will use 2019 figures as many Solo 401k account holders are still making contributions for the 2019 tax year.

Also Check: How Do You Roll A 401k Into An Ira

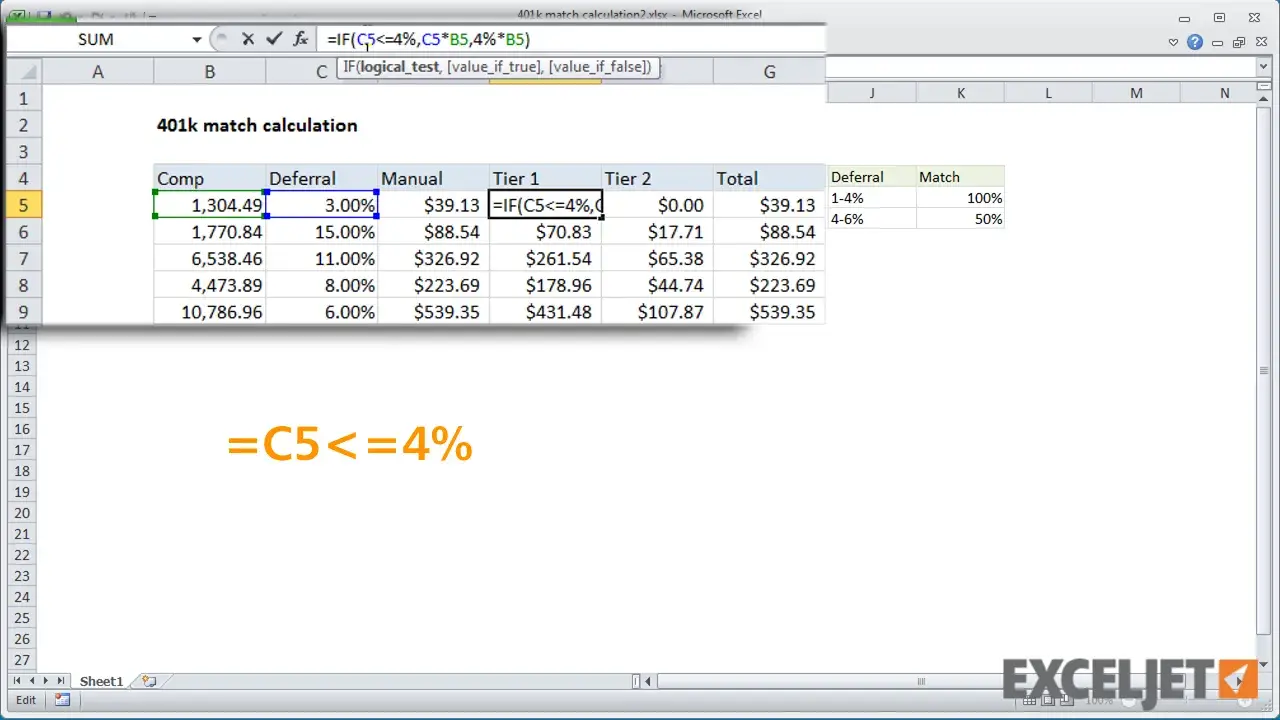

What Is Considered A Good 401 Matching Contribution

Many employers and employees consider a good 401 match to be an employer contribution of 50 cents for each dollar an employee contributes for up to 6% of the employees pay, which is why this is the most common 401 matching contribution. This is typically considered a generous matching contribution since the average matching contribution is 4.3% of an employees salary.

Solo 401k Contribution Calculator: S

Lets go over another example where your business is a corporation, with you and your spouse both as members. Start by selecting Single-owner corporation if your business is an LLC taxed as an S-Corp, a multi-member LLC, an S-corp or a C-corp.

Your business will file IRS tax form 1120 and each partner will receive a W-2. According to the IRS, all Solo 401k contributions from your S-corp must come from your W-2 wages .

For purposes of this example, lets assume the wages on your W-2 is $90,000 and wages on your spouses W-2 is $55,000. Well start with your contribution calculation first input $90,000 into the calculator since that is the net compensation listed on your W2.

Then, input your age

With the Solo 401k, you can contribute $47,500 .

The Math:

$6,000 Catch-up contribution because you are over age 50$22,500 employer contribution

Total: $47,500 in tax-deductible contributions

Now lets calculate your wifes contribution. Remember, she made $55,000 in net compensation on her W2.

Based on her net earnings, your wife is able to contribute $32,750.

The Math:

$13,750 Employer contribution

Total: $32,750

With your combined net compensation of $145,000 , you are able to make a grand total tax deductible contribution of $80,250! That will make a huge dent in your remaining taxable income.

Also Check: Can I Invest My 401k In Gold

Matching Contributions For A Roth 401

If you choose to save money in a Roth 401, matching contributions must be allocated to a separate traditional 401 account. This is because IRS rules require you to pay regular income tax on employer contributions when they are withdrawnand Roth 401 withdrawals arent taxed in all but a few cases.

Remember, with a traditional 401 account, your contributions are made pre-tax, and you pay regular income tax on withdrawals. And with a Roth 401 account, your contributions are made using after-tax dollars, and qualified withdrawals are generally tax free.

Matches And Roth 401s

A growing number of employers offer a Roth 401 option, where employees make contributions with after-tax moneyand neither the contributions nor any earnings they generate are taxed down the road when the money is withdrawn. While employers can match Roth-directed contributions, IRS rules require that all matched funds reside in a pre-tax account, just like employer-contributed matching funds in a traditional 401 account.

As a consequence, the matching funds your employer contributes to your Roth 401 will be taxed as ordinary income when you withdraw them. If you contribute to both a Roth and a traditional 401, the match is applied first to the traditional 401 amount and then, if necessary, to any Roth-directed funds.

Recommended Reading: Should I Move 401k To Ira

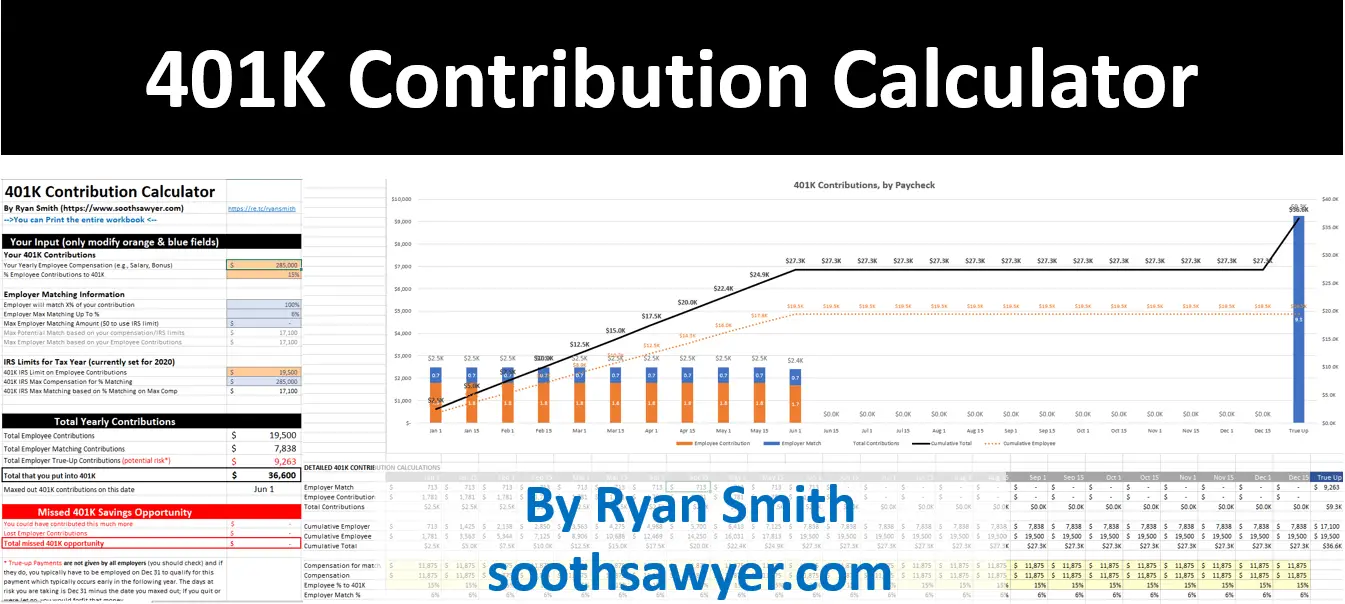

Maximize Employer 401 Match Calculator

Contribution percentages that are too low or too high may not take full advantage of employer matches. If the percentage is too high, contributions may reach the IRS limit before the end of the year. As a result, employers will not match for the rest of the year. This calculation can show the contribution percentage window in order to take full advantage of the employer’s matching contributions.

How Much Will Safe Harbor Contributions Cost

It may seem counterintuitive, but the 3% non-elective contributions can be cheaper than the 4% match at a certain point. The overall participation and savings rate will influence the total cost of the plan.

To calculate how much a safe harbor matching contribution will cost, run this formula:

# employees x % employees participating x $ average salary x % safe harbor contribution = $$

Lets consider a few different scenarios for an employer with 50 employees whose average salary is $40,000.

- Basic 4% Match, 60% participation rate: The employer contribution will cost $48,000 a year.

- 3% Nonelective contribution for all employees: The employer pays $60,000 a year.

- Basic 4% Match, 100% participation rate: With everybody saving, your 4% match costs $80,000.

Choosing which safe harbor contributions to make is a personal decision based on the unique factors of your business. Contact Ubiquity, a low-cost, flat-fee 401 administrator, to explore your options.

Read Also: Can I Pull Out My 401k

What Percentage Of My Income Should I Contribute To My 401

401 contributions are different for everyone, which means what works for some might not work for all. Earl Johnson, senior vice president and wealth manager at EverGreen Capital Management, said this figure is based on each person.

I dont usually discuss any rules of thumb because most peoples situations are so different, Johnson said. But I would say the first deciding factor is if your employer provides a matching contribution, you must contribute enough to get all matching funds.

Johnson said that instead of creating a budget line item for your 401 contributions, your budget should start when your paycheck hits your bank account after your contributions have been made. This should be used as a guide no matter what your income is.

Other Benefits Of A 401

Even for employers who do not offer any matching program, every employer with a 401 plan is responsible for administering the plan. That may seem like its no big deal, but it actually saves quite a bit of trouble for the employees. As an employee in a 401 plan, you dont have to worry about the complicated rules and regulations that need to be followed, or about making arrangements with the funds in which you invest your moneyyour employer takes care of all of that for you. Thats quite a bit of saved paperwork.

At the same time, employees who participate in a 401 maintain control over their money. While employers provide a list of possible investment choices, most commonly different sorts of mutual funds, employees have quite a bit of freedom to decide their own strategy. Whether you are willing to take on a little more risk with your investments, or if you would rather play it safe, theres probably an option for you.

Don’t Miss: How Much Will My 401k Grow If I Stop Contributing

Timing Payments For The Most Money

Some employers will pay their match no matter how many paychecks it takes for you to reach your allowed amount for the year. But many companies will make a contribution only during the pay periods when 401 money is taken from your paycheck. You can avoid leaving employer money on the table by putting in smaller amounts each pay period. That way, your employer will put money into your account in every period.

Let’s say you’re paid twice a month, and your employer will only add money into your 401 when you do. If you reach your $19,500 limit at the end of November, you’ve missed out on two chances for your employer to make its match. In this case, you’d be earning much more than $50,000 a year, but this issue could apply no matter how much you earn if you put too much money into your 401 too soon.

Your plan manager can help you manage your 401 account to make the most of your employer match. You can also use an online calculator to figure out how much you should put in from each paycheck.

Why Do Employers Offer Profit

For financially stable organizations, profit-sharing plans can serve as a powerful incentive for employees and owners alike. As is the case with a 401 plan, many employers use a profit-sharing plan to recruit and retain employees, in addition to the great tax benefits for both the employer and employees. Its a plan that serves to reward all employees as well as owners and managers, which is a great motivator and concrete way to thank everyone for contributing to the businesss overall success.

Many employers believe it will encourage employees to work harder or foster a sense of pride among employees from knowing that their efforts might help to lead to a profit-based contribution to their retirement nest egg. This type of plan requires considerable administrative upkeep, but also offers great flexibility for employers because the amountand act of contributingis at the employers discretion and can be adjusted based on cash flow.

Research indicates that profit-sharing plans are increasing in popularity 21% of the organizations in a survey conducted by WorldatWork said they used profit-sharing plans. Here is an interesting article on FastCompany that describes an example case: Tower Paddle Boards started letting employees leave by lunchtime and offering 5% profit-sharing.

Read Also: Can You Merge 401k Accounts

Sign Up For Automatic 401 Contributions

Enroll in automatic payroll deductions, so contributions are deposited in your 401 each pay period without any further action by you.

One of the advantages of these plans is the power of payroll deduction, said Young. You pay yourself first, automatically, every paycheck, making retirement savings easy.

Use Vanguards plan savings calculator to find out how a given level of contributions will impact your paycheck, and how much you could be earning for your retirement with an employers match.

How Can I Take Advantage Of 401 Matching

401 matching is designed to be easy to take advantage of. All you have to do is make contributions to your 401 and youll get extra money from your employer automatically.

If you want to max out the benefit, make sure that youre contributing enough to get the full match that your employer offers. If you get a 50% match, thats like earning a 50% return on investment immediately and with no risk. Youll be hard-pressed to find a better deal elsewhere.

Even if your employers 401 has high fees, it is worth contributing up to the matching limit for the immediate return. Once youve hit the matching limit you can consider whether other savings strategies, such as opening an IRA may be better for you.

If youre concerned about how fees will affect your retirement plans, take a look at Personal Capitals Retirement Fee Analyzer.

401 matching is like getting more money from your employer for free. Taking full advantage of this benefit can make a huge difference in the size of your nest egg and the security of your retirement.

You can run your own numbers on InvestmentZens 401 calculator to see how 401 matching can help your retirement.

Also Check: How To Borrow Money From 401k Fidelity

What About Matching Contributions To Your 401

Matching contributions can be one of the biggest differentiators to your work-sponsored 401 plan. While its important to contribute as much as you can, employer matches can sometimes double your retirement savings.

If youre contributing 3% and your employer matches 3% dollar for dollar, you are in essence putting away 3% of your salary pre-tax for the benefit of a 6% contribution to your 401, Johnson said. For a person making $50,000 thats a $3,000 annual contribution that literally cost you only $1,170 per year.

Matching comes in a few different forms, like dollar-for-dollar matching and partial matching. Dollar-for-dollar matching is when your employer matches 100% of your contribution up to a certain percent. Partial matching is when your employer matches a portion of your contributions. While youre still getting money from your job, its not as much as a dollar-for-dollar match.

While having an employer match is one of the biggest benefits of a 401, not all companies offer this. Ask your company if they have a matching program and how you can take advantage of it.

Employer Contribution Tax Planning Among Owners

However, what about the situation where there are two or more owners or an owner and a spouse where one owner earns a higher salary or share of the earned income than the other. Well, some very interesting tax planning opportunities present themselves that are not widely unknown except to tax and pension plan experts.

Lets take the example of Jen and Bill. Assume Jen earns $220,000 of W-2 income from an S Corp and Bill earns just $60,000 in 2021. Both Jen and Bill are under 50. Lets assume both Jen and Bill make $19,500 employee deferral contributions and also want to make employer contributions as well. We know that Jen will be able to hit the maximum IRC 415 amount of $58,000 since 25% of $220,000 is $55,000. Hence, Jen will only be able to use $38,500 of the $55,000 available.

We also know that employer profit sharing contribution rules hold that the maximum employer profit sharing contribution for the business is 25% of all W-2 $220,000 + $60,000 or $280,000. Thus, in the aggregate, the business is able to make employer profit sharing contributions in the amount of $70,000 . Jen was able to use $38,500 out of the $70,000, therefore, so long as your plan documents allow for it, Bill would be able to be allocated by the business $31,500 in employer profit sharing contributions for a total of $51,000 including employee deferrals. Since that number is less than what he earned, or the 415 limit, the allocation will be respected.

You May Like: What Age Can You Start A 401k

Implementing & Maintaining A Solo 401 Plan

Implementing a solo 401 plan is pretty straight forward, and most brokerage firms offer them at very low annual costs. If youre establishing a brand new plan, it must be done by December 31st of the tax year youd like to contribute for. Fortunately, as long as you establish the plan by that date, you have some flexibility over when your contributions are actually deposited.

Elective deferrals may be deposited any time before your tax filing deadline. This is usually April 15th for sole props, single member LLCs, and C-Corps, and March 15th for multi-member LLCs, partnerships, and S-Corps. This deadline includes extensions too, which could push your deadline out another six months to September 15th or October 15th.

Although your contributions may be deposited any time before your tax filing deadline, they need to be reported on your W-2 by January 31st. Since your employee deferrals will show up as a deduction from your wages in box 12, this notifies the IRS that youre electing to defer a portion of your comp, and will have the deposit made by your tax filing deadline. Logistically, best practice is to let your bookkeeper or accountant know that youd like to make a contribution. They can then handle the reporting for you on your books and payroll files.

As for profit sharing contributions, they may be made any time before your tax filing deadline, plus extensions. Youll claim the deduction for the contribution on either your business or personal return.