Medical Expenses Or Insurance

If you incur unreimbursed medical expenses that are greater than 10% of your adjusted gross income in that year, you are able to pay for them out of an IRA without incurring a penalty.

For a 401k withdrawal, if your unreimbursed medical expenses exceed 7.5% of your adjusted gross income for the year then the penalty will likely be waived.

Recommended Reading: How To Put 401k Into Ira

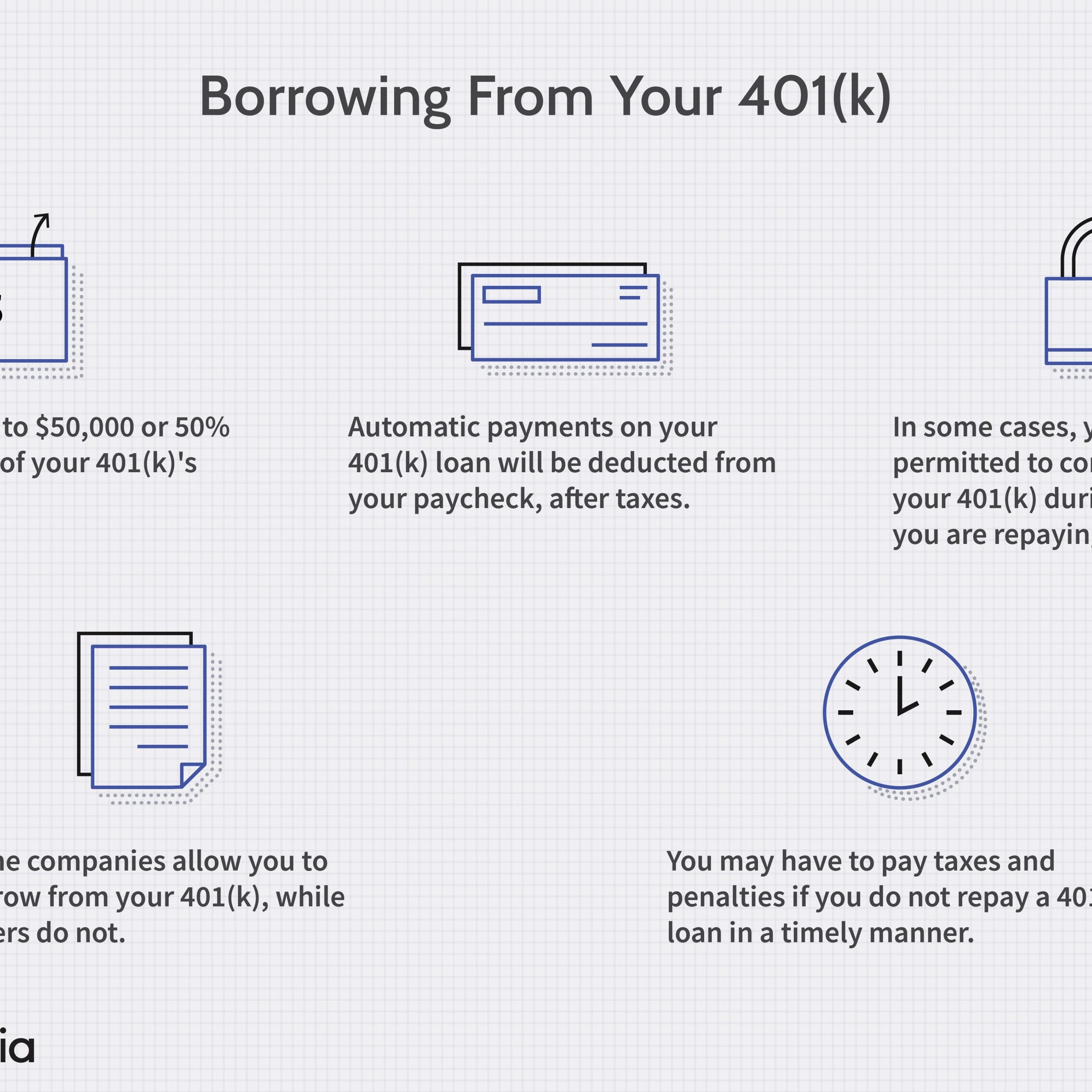

What Happens If You Default On A 401 Loan

When you default on a 401 loan, it’s usually treated as an early withdrawal. Each plan can set its own rules, so you should check with your 401 company to see whether it handles the situation differently. When the remaining loan balance is reclassified as a “deemed distribution,” you will owe all the penalty and income taxes you would owe on any early 401 withdrawal.

Does A 401 Loan Or Withdrawal Make More Sense

When you consider the potential tax consequences associated with an early withdrawal, a 401 loan may seem more attractive. Of course, there’s one drawback with both options: you’re diminishing your retirement savings.

With a 401 loan, you’d have the ability to replace that money over time. If you’re cashing out an old 401, however, there’s no way to put that money back. In both cases, you’re missing out on the power of compound interest to grow your retirement wealth over time.

One upside of deciding to borrow from a 401 for a housewhether you take a loan or make a withdrawalis that it may allow you to avoid paying private mortgage insurance if you offer the lender a large enough down payment. Private mortgage insurance protects the lender, and it’s typically required if you’re putting less than 20% down on a conventional mortgage. Private mortgage insurance can be eliminated when you reach 20% equity in the home, but it can add to the cost of homeownership in the early years of your mortgage.

You May Like: How To Transfer A 401k Account

Dividing Your 401 Assets

If you divorce, your former spouse may be entitled to some of the assets in your 401 account or to a portion of the actual account. That depends on where you live, as the laws governing marital property differ from state to state.

In community property states, you and your former spouse generally divide the value of your accounts equally. In the other states, assets are typically divided equitably rather than equally. That means that the division of your assets might not necessarily be a 50/50 split. In some cases, the partner who has the larger income will receive a larger share.

For your former spouse to get a share of your 401, his or her attorney will ask the court to issue a Qualified Domestic Relations Order . It instructs your plan administrator to create two subaccounts, one that you control and the other that your former spouse controls. In effect, that makes you both participants in the plan. Though your spouse cant make additional contributions, he or she may be able to change the way the assets are allocated.

Your plan administrator has 18 months to rule on the validity of the QDRO, and your spouses attorney may ask that you not be allowed to borrow from your plan, withdraw the assets or roll them into an IRA before that ruling is final. Once the division is final, your former spouse may choose to take the money in cash, roll it into an IRA or leave the assets in the plan.

Borrowing From Your 401 To Buy A House

Doretha Clemons, Ph.D., MBA, PMP, has been a corporate IT executive and professor for 34 years. She is an adjunct professor at Connecticut State Colleges & Universities, Maryville University, and Indiana Wesleyan University. She is a Real Estate Investor and principal at Bruised Reed Housing Real Estate Trust, and a State of Connecticut Home Improvement License holder.

Buying a home is an exciting milestone, but it often requires a significant financial investment. While its important to calculate how much home you can afford and how your monthly mortgage payments will affect your budget, there are other costs to consider.

Two of the most important are your down payment and closing costs. According to the National Association of Realtors, the median home down payment was 12% of the purchase price in 2019. That would come to $24,000 for a $200,000 home. Closing costs, which include administrative fees and other costs to finalize your mortgage loan, add another 2% to 7% of the homes purchase price.

While the seller may pay some of the closing fees, youre still responsible for assuming some of the costs. You can borrow from a 401 to buy a house if you dont have liquid cash savings for the down payment or closing costs. Heres what to consider before you make that move.

Dont Miss: How Much Money Should I Put In My 401k

Also Check: What Is The Difference Between 401k And 403b

How To Borrow From A Pension Or Retirement Savings

Your 401 or individual retirement account enables you, and possibly your employer, to make pretax contributions that can compound throughout your working years. Generally, the Internal Revenue Service doesnt allow penalty-free withdrawals from retirement accounts until youre age 59 1/2, although some special circumstances apply, such as hardship withdrawals and fund rollovers. However, in some cases, you may be able to borrow against your 401 or IRA.

Also Check: Can You Withdraw Your 401k If You Quit Your Job

What Qualifies As A Hardship Withdrawal For 401k

Hardship distributions

A hardship distribution is a withdrawal from a participants elective deferral account made because of an immediate and heavy financial need, and limited to the amount necessary to satisfy that financial need. The money is taxed to the participant and is not paid back to the borrowers account.

Don’t Miss: What Is Asset Allocation In 401k

Retirement Savings Can Benefit

As you make loan repayments to your 401 account, they usually are allocated back into your portfolio’s investments. You will repay the account a bit more than you borrowed from it, and the difference is called “interest.” The loan produces no impact on your retirement if any lost investment earnings match the “interest” paid ini.e., earnings opportunities are offset dollar-for-dollar by interest payments.

If the interest paid exceeds any lost investment earnings, taking a 401 loan can actually increase your retirement savings progress. Keep in mind, however, that this will proportionally reduce your personal savings.

I Need Emergency Funds

- Remove funds from your 401 and be subject to penalties and fees.

- Stunt the growth of your retirement funds and impact your ability to retire.

- Provide proof of hardship, like medical insurance documents, in a complex process.

You just received an enormous medical bill, signed your child up for an essential therapy your insurance doesnt cover, or feel desperate to make your way out of debt. But there are ways to uncover emergency funds without dipping into your retirement savings.

Recommended Reading: How Do You Withdraw From 401k

Be Aware Of Potential Penalties

As mentioned earlier, there are also potential penalties to consider.

The U.S. Chamber of Commerce explains, If you leave your job or your employment is terminated, you will have to repay the loan or pay the tax consequences of early withdrawal.

Lets say you cant handle working and running a new business, so you quit. Youll have to pay back the loan much sooner.

The same rule applies if you change jobs or get laid off.

Under the Tax Cuts and Jobs Act passed in 2017, 401 loan borrowers have until the due date of their tax return for the year of distribution to pay it back.

In the event you cannot repay the total loan balance in the mandated time frame, the loan will be treated as an early withdrawal.

If this happens, in addition to having to pay the 10% early withdrawal penalty if you are under age 59½, youll also owe income taxes on the full balance of the loan.

You May Like: Can You Rollover A 401k To Another 401 K

Borrowing From Your Retirement Fund: What You Need To Know

Even with the best financial planning, unexpected emergencies still arise in our lives. If you find yourself in need of cash quickly, you may be hesitant to dip into your retirement savings.

There’s a good reason to be hesitant. If you touch the money you have saved for retirement it can have unwanted consequences. But many people may not realize they can also borrow money from their 401. When done for the right reasons, taking out a 401 loan can help you get out of a tough financial situation.

A Husband and wife review their options for borrowing from their retirement fund.

Beacon Financial Services

Recommended Reading: Can I Transfer My Work 401k To A Roth Ira

Using Your 401 For A First

If youre still thinking that you might want to go this route, its important to consider all the costs that will be part of owning a home, to make sure that youre not using your 401 as a way to fund a purchase that might be difficult to maintain. Looking at your retirement account balance might make you feel as though you have more money than you actually have coming in on a regular basis.

Buying a home might be the biggest purchase you make, but its important to remember that its not a one-time expense. Owning a home means regular costs for maintenance, upkeep, insurance, property taxes and much more. Its easy to get caught up in the excitement of house hunting and inadvertently make a first-time home buyer mistake that leaves you without sufficient funds to pay the ongoing expenses a home requires.

What Are The Cons

Besides the fees, your employer will likely stop their side of the match, if they were making one. Even when youre paying yourself back, your employer wont consider those funds a new contribution and therefore wont match it. It also might make it more difficult to qualify for a mortgage, as it can affect your debt-to-income ratio you should still be sure to shop around to find a lender that can offer you the best program that fits your financial needs. And of course, youll lose out on the compound interest your money would have been earning if youd left it in the account.

Of course, if you decide to withdraw rather than borrow from your 401, the main con is the giant tax hit youll suffer.

Recommended Reading: How To Get Old 401k Money

Those Who Can Stomach The Loss In Stock Value

Because a 401 is an investment account, you should also consider the trade-off of missing the market rebound if you withdraw funds right now. Any money that you borrow from your 401 now wont be there when the market turns around, Renfro says. This would compound the adverse effects of an early 401 withdrawal if you dont truly need one.

Echoing that, Levine says many 401 balances have been hit hard, and taking a loan while theyre down essentially locks in the losses.

Taking an early withdrawal from your 401 can have long-term adverse effects on your financial health. However, so can the ramifications of COVID-19, especially if youve been particularly affected by the disease. The CARES Act gives options to those who need it most. Theres no right answer, but in times of uncertainty and struggle, those options can be a life raft.

Why Borrow From A 401

If you are hesitant about tapping into your retirement fund, there are a few benefits you should be aware of. Because there are no required credit checks, a 401 is convenient and quick, so you’ll get money in your pocket quickly. Additionally, you are afforded some flexibility when paying back your loan. In many cases, your 401 plan will allow you to make payments via payroll deductions, and you can pay it back as quickly as you like with no prepayment penalties.

Compared to a consumer loan, you will not be paying back high levels of interest. Though you will need to pay back a 401 loan with interest, this interest is paid back into your own account. In some cases, because you’re paying back a little more than you borrowed, you can increase your retirement savings.

Read Also: How Do I Sign Up For 401k

Can A Loan Be Taken From An Ira

Loans are not permitted from IRAs or from IRA-based plans such as SEPs, SARSEPs and SIMPLE IRA plans. Loans are only possible from qualified plans that satisfy the requirements of 401, from annuity plans that satisfy the requirements of 403 or 403, and from governmental plans. Reg. Section 1.72-1, Q& A-2)

What Is A 401 Loan

A 401 loan is a loan you take out from your workplace retirement plan. Youre essentially borrowing money from your future self. Youll still get charged interest on the loan, and loan fees may apply, but the principal balance comes from your account.

Terms for 401 loans can vary based on what your plan allows, but in most cases borrowers are given up to five years to put the money back into the account. If you dont repay your loan on time, the outstanding balance is treated as a distribution. That means youll owe income taxes and have to pay a 10% early withdrawal penalty.

Pre-coronavirus, you could borrow upwards of $50,000 from your 401, or 50% of your vested account balance, whichever was lower. But with the CARES Act, that rule and others have changed.

Read Also: Can I Borrow From My 401k

Do You Pay Taxes On A 401k Loan

Any money borrowed from a 401 account is tax-exempt, as long as you pay back the loan on time. You do not have to claim a 401 loan on your tax return. As long as the loan is paid back in a timely manner, the interest attached to certain plans is the only tax consequence.

Alternatives To A 401 Loan

Although 401 borrowing has some advantages, including not having to jump through hoops for a commercial loan or undergoing a check of your credit score, there are downsides that discourage many would-be borrowers from using their retirement money in the present. Here are a few:

- Tax penalty for not repaying the loan on schedule.

- Loss of growth. 401 money could be invested in a mutual fund and grow tax free for many years until you retire. Money borrowed doesnt grow, and the loss of compounding growth can make a big difference in your older years.

- You could get in the habit of using your 401 as a piggy bank, defeating its value as a savings tool.

- While you are paying back what you borrowed, you might not have the money to add to your account, further reducing its future value.

- 401 accounts are protected in bankruptcy. If you borrow money to help pay off a big debt and then discover that you still cant avoid bankruptcy, you will lose whatever you withdrew. Not touching the 401 safeguards the money for your retirement.

After considering the drawbacks, many would-be 401 borrowers decide to look elsewhere for the money they need. Here are a few options:

Read Also: What Year Did 401k Start

Is It Smart To Borrow From 401k

Key Takeaways. When done for the right reasons, taking a short-term 401 loan and paying it back on schedule isnt necessarily a bad idea. Reasons to borrow from your 401 include speed and convenience, repayment flexibility, cost advantage, and potential benefits to your retirement savings in a down market.

Do The New Rules Apply To You

Before you make any moves, youll have to find out if your employer has adopted the new relaxed CARES Act provisions in your 401 or 403 plan. loan rules.) Some plans also limit the number of loans a participant has outstanding at one time. Employers can amend the rules at their discretion.

Borrowers also must show that they qualify for loans under the new rules. That means that you or a member of your family is diagnosed with Covid-19 and/or are experiencing financial hardships related to the pandemic.

More from HerMoney:

Also Check: How To Make A 401k

Those Who Can Pay Themselves Back

Its not free money. You have to pay it back or risk getting hit with a hefty tax bill, says Jeff Levine, of Nerds Eye View, an online news source that caters to financial planners.

Someone who may not be able to pay it back should think a little harder about whether they should tap into their retirement assets or not, Pfau says.

Another thing to keep in mind is how close you are to retirement. For many people, this could force them into an early retirement. Borrowing from their 401 may just be a way of actually starting to take distributions for retirement earlier, Pfau says. You just have to recognize the trade-offs, like not having as much money for retirement down the road.

Reasons To Borrow From Your 401

Although general financial wisdom tells us we shouldnt borrow against our future, there are some benefits to borrowing from your 401.

- With a loan from a commercial lender such as a bank, the interest on the loan is the price you pay to borrow the banks money. With a 401 loan, you pay the interest on the loan out of your own pocket and into your own 401 account.

- The interest rate on a 401 loan may be lower than what you could obtain through a commercial lender, a line of credit, or a credit card, making the loan payments more affordable.

- There are generally no qualifying requirements for taking a 401 loan, which can help employees who may not qualify for a commercial loan based on their credit history or current financial status.

- The 401 loan application process is generally easier and faster than going through a commercial lender and does not go on your credit report.

- If you are taking a loan to buy a home, you can have up to 30 years to repay the loan with interest.

- Loan payments are generally deducted from your paycheck, making repayment easy and consistent.

- If you are in the armed forces, your loan repayments may be suspended while you are on active duty and your loan term may be extended.

Read Also: Are Part Time Employees Eligible For 401k