What If I Have Employer Stock In My Employer

You can choose to roll company stock into an IRA or a taxable brokerage account. If you decide to roll the stock to an IRA, its full value will be taxed as income at your regular rate if you move the stock to a taxable brokerage account, you might be able to save money by paying capital gains taxes on the difference between the stocks value and the price you paid for it. There are tax benefits to each, so consult your tax advisor and ask about the net unrealized appreciation strategy.

How Do I Rollover If I Receive The Check

If you receive a distribution check from your 401 rollover to a Roth IRA, then chances are good they will hold around 20% for taxes. If you want a direct 401 rollover to a Roth IRA, you may want to send that check back to your employer 401 provider and ask to be sent all of your eligible retirement distribution directly to your new Rollover IRA account .

You have 60 days upon receiving the check to get the money into the Roth IRA- no exceptions! So dont procrastinate on this one.

Paying Taxes On Your 401 To Roth Ira Conversion

Roth retirement accounts are funded with after-tax dollars, while traditional 401s are funded with pre-tax dollars, so you must pay taxes on your 401 to Roth IRA conversions. In most cases, the funds you’re converting count toward your taxable income, but you must complete your conversion by Dec. 31 if you want it to go on this year’s tax bill.

The effect on your tax bill depends on how much you’re converting and how much other taxable income you’ve earned during the year. If you’re not careful, your 401 to Roth IRA conversion could push you into a higher tax bracket, meaning you’ll lose a higher percentage of your income to the government. You can avoid this by staying mindful of your tax bracket throughout the year and striving to keep your total taxable income, including conversions, under your bracket’s upper limit.

You may not owe taxes on the full amount of your 401 to Roth IRA conversion if you’ve made nondeductible 401 contributions in the past. But that’s where things get a little hairy. Nondeductible 401 contributions are funds you contribute to a traditional 401 but don’t get an immediate tax break for. You pay taxes on your contributions, but earnings grow tax deferred until you withdraw them.

Don’t Miss: How To Rollover Old 401k To New 401k

Question 5 Of : Can You Convert 401 To Roth After Retirement

Which One Do You Choose

Where are you now financially compared to where you think youll be when you tap into the funds? Answering this question may help you decide which rollover to use. If youre in a high tax bracket now and expect to need the funds before five years, a Roth IRA may not make sense. Youll pay a high tax bill upfront and then lose the anticipated benefit from tax-free growth that wont materialize.

If youre in a modest tax bracket now but expect to be in a higher one in the future, the tax cost now may be small compared with the tax savings down the road. That is, assuming you can afford to pay taxes on the rollover now.

Bear in mind that all withdrawals from a traditional IRA are subject to regular income tax plus a penalty if youre under 59½. Withdrawals from a Roth IRA of after-tax contributions are never taxed. Youll only be taxed if you withdraw earnings on the contributions before you’ve held the account for five years. These may be subject to a 10% penalty as well if youre under 59½ and dont qualify for a penalty exception.

Its not all or nothing, though. You can split your distribution between a traditional and Roth IRA, assuming the 401 plan administrator permits it. You can choose any split that works for you, such as 75% to a traditional IRA and 25% to a Roth IRA. You can also leave some assets in the plan.

Don’t Miss: When Can I Draw From My 401k Without Penalty

You Might Want A Roth Account

If your 401 plan doesnt provide a Roth 401 option, you might choose to roll your retirement savings into a Roth IRA. Advantages of a 401-to-Roth IRA rollover include:

Avoiding Roth IRA income restrictions. Even if your annual income is above the thresholds for Roth IRA contributions, youre still allowed to roll your 401 savings into a Roth IRA. This move is commonly referred to as a backdoor Roth IRA conversion, and it can grant you the benefits of tax-free withdrawals in retirement.

No required minimum distributions . With a 401or even a traditional IRAyoure subject to RMDs, or the mandated annual withdrawals from your retirement savings once you reach age 72. Roth IRAs are free of RMDs, providing you with more control over your retirement savings.

Tax-free withdrawals in retirement. When you roll over a traditional 401 into a Roth IRA, youll probably end up paying some taxes on the amount youre converting. But these taxes may be less than what youd pay if you took regular withdrawals from a traditional 401 in retirement.

Access to additional death benefits. Because there are no lifetime distribution requirements, you can pass down your Roth IRA to your heirsalthough beneficiaries need to draw down the account within 10 years.

Henderson cautions that you must be aware of the immediate tax consequences when you roll your money from a 401 to a Roth account, however.

Defining Terms: What’s A 401

A 401 plan is a tax-advantaged retirement account typically sponsored by an employer.

The traditional form of the 401 works much like a traditional IRA: Your contributions in a given year reduce taxable income for that year. In a simplified example, if you earn $75,000 and contribute $10,000, your earnings fall to $65,000, saving you tax dollars up front. Your withdrawals will eventually be taxed, though.

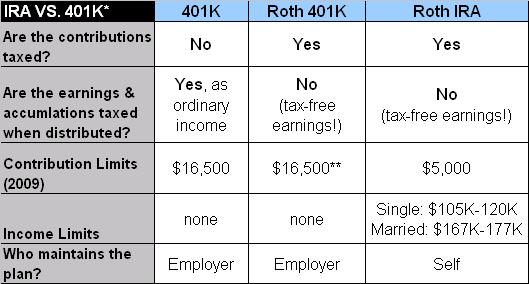

401s differ in a few meaningful ways from IRAs:

- Contribution limits: 401s have much higher contribution limits. These typically change annually, but generally you can contribute about three times as much money to a 401 as an IRA.

- Investment options: 401s typically provide limited investment options, with most offering a dozen or fewer mutual funds. In IRAs opened at brokerages, you can invest in virtually any stock exchange-traded fund , or mutual funds.

- Matching funds: Many employers match employee 401 contributions up to a certain percentage of pay.

You May Like: How To Pull From 401k

Question 6 Of : How Do I Roll Over A Simple Ira To A Roth Ira

Question 3question 3 Of : Can Anyone Roll Over Into A Roth Ira

Read Also: Can I Borrow From My 401k Without Penalty

Rollover Into A New Companys 401 Plan

A rollover into your new companys 401 plan may be the easiest option for you. Youll keep all the money in one place, and you may be able to access some professional advice as part of your new plan, too. So a rollover to a new 401 is a winner for convenience. Its a winner from a tax perspective, too, because you wont incur any new taxes as long as you transfer to the same type of 401 at your new employer.

In addition, having all your money in a 401 protects you from the pro-rata rule. This rule could really trip you up and limit the effectiveness of a backdoor Roth IRA, which is a useful strategy if you earn too much to contribute directly to a Roth IRA.

One downside, however, is that your new plan may not have particularly attractive investment choices, for example, offering expensive funds. So youll want to consider your investment options, too.

What Kind Of Plan Is It And Have You Already Started Withdrawing From It

If the client has already started withdrawing from the plan, she cannot transfer it into an RRSP, says Power. She adds 401s that have been rolled over into annuities cannot be transferred.

There are considerations for each plan. For 401s, only the employee-contributed amounts can be transferred to an RRSP without using up RRSP room. Any employer contributions can still be transferred, but the client needs commensurate RRSP room. To get around that, We always recommend converting from a 401 to an IRA first, says Altro. Thats not a taxable event, he adds, and it allows both portions to be transferred to an RRSP without using up contribution room.

Another reason to convert is if a client was a Canadian resident while she participated in the 401 planfor instance, a cross-border commuter, says Wong. Thats because shes ineligible for a direct 401 to RRSP transfer.

For IRA-to-RRSP transfers, Wong says that the transferred value cannot include amounts contributed from someone other than the taxpayer or taxpayers spouse, such as employer pension amounts.

With 401s, the employer plan administrator is responsible for keeping track of the after-tax and pre-tax contributions. With IRAs s are rolled over to IRAs), that tracking responsibility shifts to the individual, says Altro. Advisors must ask clients if they have any after-tax contributions in their U.S. plans.

Also Check: Can I Use My 401k To Buy A Second Home

Recordkeeping For Roth Ira Contributions

You do not have to report your Roth IRA contribution on your federal income tax return. However, it is highly advisable for you to keep track of it, along with your other tax records for each year. Doing so will help you demonstrate that youve met the five-year holding period for taking tax-free distributions of earnings from the account.

Each year that you make a Roth IRA contribution, the custodian or trustee will send you Form 5498, IRA Contributions. Box 10 of this form lists your Roth IRA contribution.

What Are Roth 401 Contribution Limits

For 2021, the 401 contribution limit is $19,500. This contribution limit applies to your 401 contributions, whether theyre in a Roth or traditional 401. That means if youre contributing to both, the combined total of your contributions cant exceed that amount.6 And in case you were wondering, your employers contributions do not count toward the limit.

If youre 50 or above, the contribution limit increases to $26,000.7

Read Also: Whats The Most You Can Contribute To A 401k

Recommended Reading: Who Do I Call About My 401k

Can I Contribute To A 401k And An Ira

It is a question that comes up frequently when it comes to retirement planning: Can I contribute to a 401k and an IRA? The simple answer is yes, you can. However, there are some caveats when it comes to deducting your IRA contributions if you participate in both types of plans.

Fortunately for your retirement nest egg, you can contribute to both types of retirement accounts. In fact, both workplace and individual retirement accounts represent important building blocks in your retirement savings. Supplementing your workplace retirement account is a great way to boost your retirement savings and put even more of your money to work in tax-advantaged accounts.

An added bonus: IRAs also often offer more investment options than the typical 401k plan. Just as with your traditional 401k, you may contribute pretax dollars to a traditional IRA and then benefit from tax-deferred growth and distributions. As I later cover, be aware that you can only contribute pretax dollars up to certain income levels.

Read Also: How To Make 401k Grow Faster

Contact Your Current 401 Provider And New Ira Provider

Ideally, you want a direct rollover, in which your old 401 plan administrator transfers your savings directly to your new IRA account. This helps you avoid accidentally incurring taxes or penalties. However, not every custodian will do a direct rollover.

In many cases, youll end up with a check that you need to pass on to your new account provider, Henderson says. Open your new IRA before starting the rollover so you can tell the old provider how to make out the check.

The goal, Henderson says, is to avoid having to ever put the money into your personal bank account.

You only have 60 days to complete the transaction to avoid it being a taxable event, and its best to have everything set up before getting that check, Henderson says.

Read Also: Is Rolling Over 401k To Ira Taxable

Employer Matches Are Pre

One of the best features of a 401 is the match program. This is when an employer matches an employees 401 contributions up to a certain percentage.

Match programs vary, so youll need to speak with your employer to understand how their specific program works.

Your company may offer a dollar-for-dollar match up to a percentage of your gross income.

Once you hit this threshold, match contributions stop until the next year. Then again, your company may only offer a 50 percent match up to a percentage.

Lets assume you earn $40,000 a year and you contribute 5 percent of your income. If your employer offers a 50 percent match, theyll contribute $1,000 to your account annually.

This is free money that you shouldnt turn down, especially if youre a low income earner. When you cant contribute much, a match program helps grow your retirement savings faster.

Keep in mind that company matches are always made with pre-tax dollars.

This applies even with a Roth 401.

Interestingly, if you have a Roth, matching funds are put into a traditional 401.

These funds grow tax-deferred and youll owe income tax on these withdrawals in retirement.

You do not get to deduct the company match from your income. Your employer enjoys the tax benefits.

What Is The Roth Conversion

The Roth conversion is an optional decision to change an existing qualified retirement plan, such as a 401 or traditional IRA, into a Roth IRA. In this way, you take money that is now treated as deferred taxes and convert it into an account that increases without tax. However, to make such a conversion, you must pay taxes on the converted amount.

Don’t Miss: Can You Use Your 401k To Pay Off Debt

Question 8 Of : How Do I Avoid Taxes On A Roth Ira Conversion