Automatic Ira Rollovers For Terminated And Abandoned 401k Plans

Mergers, acquisitions and business closures often result in the termination or abandonment of employer retirement plans. Custodians are left holding assets without the authority to terminate plans or distribute benefits of so-called ‘orphaned plans.’ In response, the Employee Benefits Security Administration has established rules to provide for winding up the affairs of abandoned retirement accounts and the distribution of benefits.

A plan is considered abandoned if no contributions to, or distributions from, have been made for a period of at least twelve consecutive months and efforts to locate the plan sponsor have been unsuccessful because the entity no longer exists, cannot be located or is unable to maintain the plan. EBSA regulations provide for the appointment of a QTA – Qualified Termination Administrator – to take custody of the dormant assets. The QTA is an eligible IRA custodian: bank, trust company, broker dealer or insurance company.

How Can Plan Sponsors Avoid Having The Issue Of Lost Participants In The First Place

One of the most effective steps is to distribute benefits to former employees as soon as possible after termination of employment, before they have an opportunity to become missing.

The IRS has rules in place that dictate when terminated participants can/must take distributions of their account balances from 401 plans. Embedded within those rules are certain options that can facilitate the efficient payout of smaller balances to many former employees.

- Balance Over $5,000: Generally, a participant who has a vested account balance in the plan of at least $5,000 is permitted to keep their money in the plan as long as they wish, subject to Required Minimum Distributions on attainment of age 70 ½.

- Balance Under $5,000: Participants with balances below that threshold can be forced to take their money out of the plan as long as they are given appropriate notice 30 to 60 days prior to the payment.

For plans with $5,000 force-out option, it is important these are processed on a consistent and timely basis such as each quarter.

If A Claim Has More Than One Owner

If there is more than one claimant, all claimants information needs to be provided, including their signatures and other documentation to support their identity and balance entitlement.

- An unclaimed balance held by two or more names joined by or, may be claimed in its entirety by any of the balance holders or by the estates of any deceased balance holders, if applicable.

- An unclaimed balance held by two or more names joined by and, will be split equally between the living holders and the estates of any deceased balance holders, if applicable.

In either case, when a claim is made on behalf of a deceased balance holder, the claimant must be an authorized representative of the deceased balance holder.

You May Like: How Do You Move Your 401k When You Change Jobs

Plan For Your Retirement Over Your Career

Remember that retirement planning is not a singular event, but rather something you do over the course of your career.

Keep this mindset and continually review your retirement planning progress and account balances. If you havent started to save for retirement, its never too late.

Talk to your HR department about retirement planning options, or open up an IRA, or even basic savings account to get started putting money aside for your future.

Thursday, 21 Oct 2021 11:13 PM

Advertiser Disclosure: Many of the offers appearing on this site are from advertisers from which this website receives compensation for being listed here. This compensation may impact how and where products appear on this site . These offers do not represent all account options available.

Editorial Disclosure: This content is not provided or commissioned by the bank advertiser. Opinions expressed here are authors alone, not those of the bank advertiser, and have not been reviewed, approved or otherwise endorsed by the bank advertiser. This site may be compensated through the bank advertiser Affiliate Program.

User Generated Content Disclosure: These responses are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all posts and/or questions are answered.

Search The National Registry

Still not having any luck? Past employers may list you as a missing participant if you no longer work for the company but left your 401 behind. The National Registry of Unclaimed Retirement Benefits is a nationwide, secure database listing retirement plan account balances that have been left unclaimed .

Don’t Miss: How Much Income Will My 401k Generate

Tips To Avoid Losing Retirement Account Funds

Its a great idea to roll over your old 401 funds to an IRA or to the 401 plan at your new company.

If you roll over your funds, you wont have to worry about losing track of your old 401 or remembering to reallocate your portfolio. You also wont have to face the hassles of tracking everything down if your former company goes out of business.

However, if you decide to leave your 401 account with your old company which can sometimes make a lot of sense there are a few best practices.

First, if you change your address or phone number, make sure you update your old company. Second, keep all your retirement plan documents and tax returns together. That will help you track down your money in the future.

Looked For Unclaimed Money

“Ghosted” 401 money certainly qualifies as missing money, and it could be uncovered on digital money-funder platforms like missingmoney.com.

The site, run by the National Association of Unclaimed Property Administrators, runs free searches for not just retirement funds, but for money in old bank accounts, safe deposit boxes, escrow accounts, and insurance policies. According to the website’s directions, if you get a “hit” on the site, just claim the property and fill out the requested details, then submit and you will receive instructions on the next steps from the state where you made the claim.

Also Check: How Do I Find An Old 401k

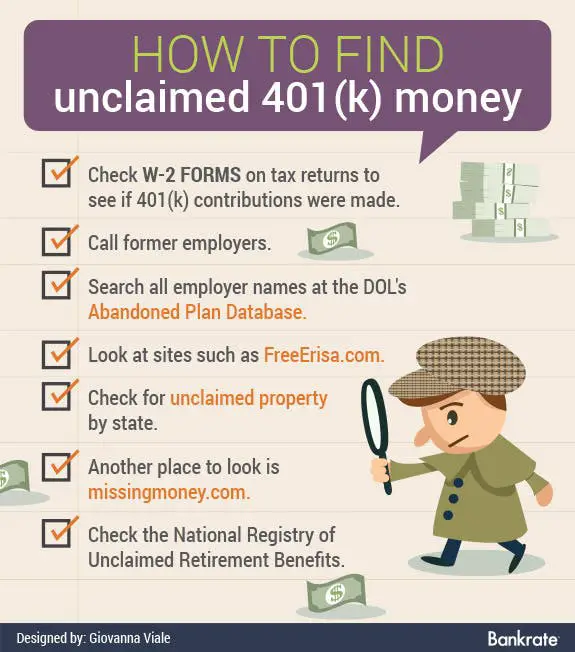

How To Search For Unclaimed Retirement Benefits: 401

You can take a few steps to search for your unclaimed 401 retirement benefits. The first step is to gather as much information as you can about your former employer. If your employer is still in regular operation, there is a chance that your 401 is still in the account that you had when you were with the company.

If you need to do a bit more digging, here are some steps you can take.

Tracking Down Transferred Or Missing Small 401 Plan Assets

The search for old 401 assets gets extra tricky if your accounts had less than $5,000 in them. It turns out you may no longer be searching for an old 401, but rather an Individual Retirement Account. Federal law allows retirement plans to transfer balances up to $5,000 to IRA- without additional consent from the participant. While there is no paperwork on the forced rollover, many firms require additional paperwork to update or change your account in any way.

If your old 401 was automatically rolled over to an IRA there is a place to look online. Abandoned Plan Seach, is a database of companies that accept transfers of small balances from 401 plans. However, the best place to start your search is the investment company that held the 401. If your old 401 was at Fidelity or Vanguard, your IRA is still likely at the same company.

Also Check: Do I Have To Pay Taxes On 401k Rollover

Organize And Rebalance Your Accounts

Now that youve found your old 401k plans, its time for a review. After years of neglect, your forgotten retirement accounts may not be properly balanced. This means there may be too much emphasis on one type of investment, or not enough on another.

If you plan to keep the IRA or company plan open, you may want to consider diversification, so theres the right amount in stocks, bonds, U.S. investments or international exposure thats appropriate for your investment goals and risk tolerance.

Youll need to check each account individually at first. However, if you can list them all in one place, youll see how your combined investment diversification stands up. An online tracking service can continue to monitor your accounts, possibly flagging you if you need to consider rebalancing again.

Online tracking services cant do the rebalancing for you, youll have to go to each individual account to manage the rebalancing. And if the diversification seems off but its not time for you to rebalance, youll have to look at each individual account to determine which one may be out of balance the most.

The Final Form 5500 For A Terminating Plan Cant Be Filed Until All Balances Have Been Paid What Happens If All Of These Options Have Been Exhausted But There Are Still Some Missing Participants

If the above actions do not result in a current location, the DOL provides several options for how to handle the plan balances. The preferred option is to rollover the account into an IRA in the participants name. This would work just like the automatic IRAs that are set up under themandatory cash-out rules, and if the plan already has an automatic IRA provider, that same provider should be able to help here.

You May Like: Can I Rollover 401k To Ira While Still Employed

Find A Lost Pension Plan

Thankfully, tracking down an old pension is a bit easier than other types of accounts as long as your pension plan paid guaranty premiums to the Pension Benefit Guaranty Corporation. The PBGC is very similar to the FDIC in that the pension pays what amount to insurance premiums to the corporation and in return the value of those pension payments is guaranteed.

This also makes the PBGC a handy place to find an old pension you have left behind. The US Agency has a handy search tool to find unclaimed pensions that lets you search by Last Name, by Company, or by State. If you have an old pension left out in the wild, do a thorough search with the tool and hope that your pension was part of the PBGC.

What Is A 401 Account

A 401 plan, named for the section of tax code that governs it, is a retirement plan sponsored by an employer, allowing employees to save a portion of their paycheck for retirement.

The advantage to employees of saving with a 401 plan is they are able to save funds they have earned, before taxes are deducted from a paycheck.

Many employers offer a company match meaning whatever the employee contributes, the company matches.

Although 401 plans were originally born as a supplement to pension plans, they are now often the sole retirement plans offered at companies.

Also Check: What Is The Minimum 401k Distribution

The Magnitude Of The Missing Participant Problem

Other key findings from the Missing Participant Survey:

- 1 of 5: Re-locations will result in a missing participant

- One-third: Participants learn of a retirement account with a previous employer they did not realize they had

- 60%: Participants who prefer an automated process to update address or consolidate accounts

- 23%: Would utilize a lost & found database to locate a stranded account

- 9%: Participants who would not verify their address if asked by a former employer

Now, suggests that there could be an even larger problem with stale addresses for terminated participants with no obvious “red flags” . For participants whose addresses were previously believed to be “good” — the study revealed twice the incidence of stale addresses than were expected.

Use Resources To Discover Unclaimed Assets

Once you use these resources to locate your funds, you can use the following resources to get access to your unclaimed assets.

Also Check: How Do I Start My Own 401k

S To Find Your Old 401

Its not all that uncommon to lose a 401 especially if you didnt have much invested to begin with. Its possible you were automatically enrolled in a 401 by your old employer and didnt know the account existed. Or maybe you got caught up in the process of switching jobs and forgot to tie up loose ends.

Whatever the case, you can rest assured that your retirement funds arent gone, and youre entitled to them. Its a simple matter of tracking them down and you can start by contacting your old employer.

1. Contact your old employer

Start your search by reaching out to the human resources department of your previous employer. If you dont have HRs email address or phone number on hand, reach out to any company employees youre still in touch with to request the information.

In most cases, it shouldnt be too hard to reconnect with your old employer, but if your company merged with another firm or went out of business, you may need to move on to step two.

2. Speak to the plan administrator

Now lets say you havent had much luck reaching your old company. The next point of contact will be the plan administrator, which is the investment company responsible for managing the investments in your old 401 account.

3. Search national databases

If you follow these steps and still come up short, try a national database. There are numerous sites and services designed to connect former employees with lost retirement savings.

How To Reclaim Your Retirement Plan With A Previous Employer

- Retirement Planning

- How to Reclaim Your Retirement Plan with a Previous Employer

Millions of Americans accidentally or unknowingly leave money in retirement plans with previous employers. According to a study by the National Association of Unclaimed Property Administrators, Americans lost track of more than $7.7 billion in retirement savings in 2015.

If you’ve left a retirement plan with a previous employer, not to worry. Here are 6 tips you can follow to reclaim your money.

Also Check: How Much Should I Put In My 401k

Tracking Down A Lost 401

Its easy to understand why some workers might lose track of an old 401: Those born between 1957 and 1964 held an average of 12.4 jobs before the age of 54, according to the Bureau of Labor Statistics. The more accounts you acquire, the more challenging it is to keep track of them all.

Perhaps this is why there are some 24 million forgotten 401s holding assets in excess of $1.3 trillion.1 Left unattended too long, old accounts can be converted to cashand even transferred to the state as unclaimed propertyforgoing their future growth potential.

If youre among those with misplaced savings, heres how to locate and retrieve them:

Best Practices For Finding Missing Participants

For example, consider the following three scenarios:1. Participant is well in advance of a normal distribution event.Search approach: 2. Participant is nearing a distribution event. Search approach: 3. Participant is at, or past a distribution event.Search approach: Missing Participants Best Practices for Pension Plans

Recommended Reading: How To Check My 401k Plan

How To Find Out If I Have A 401

The best way to make sure you donât lose track of your 401 is to periodically keep tabs on it. Although, checking your retirement accounts too frequently can lead to overkill and alarm if the market takes a dive. Aim for quarterly or semi-annual checks of your funds to make sure everything is in order.

Actively managing your 401 is a good habit to get into. Making sure your retirement accounts are being properly funded and youâre on track to meet your retirement goals should be etched into your overall personal finance plan.

However, if youâve let it slip for the past couple of years, no need to worry. Contact your human resources department to get information on how you can monitor your account.

You may be given access to an online portal for you to log in and manage your account.

Verify your statements are being sent to the correct address. Bookmark the account information so you always know where to log into your account from. Also, consider updating your login and password to make sure your account is more secure.

What Is Unclaimed Money

Unclaimed money is money that oftentimes has simply been forgotten about, in one way or another, and tends to wind up being held at a state agency until it is rightfully claimed. Accounts may be considered unclaimed or abandoned in as short as a year called the dormancy period if theyve been unused or the institution has been unable to contact the account owner.

After the dormancy period and efforts to find the rightful owner have been made, the institution can declare it unclaimed and send the money to state agencies in charge of unclaimed money. As part of this process, the institution has to include any identifying information it has.

Financial accounts can often be forgotten about, especially during the inheritance process. If all a decedents accounts are not listed during the process of estate planning, it can be very easy for an heir to overlook an account. The account may then sit dormant for years, if not decades, accumulating interest, dividends or capital gains.

Many types of unclaimed accounts exist, including:

- Retirement accounts, such as 401, 403 and IRAs.

- Insurance accounts or annuities.

- Forgotten savings bonds.

- Accounts from bank or credit union failures.

Unclaimed money can also take other forms, so if you know theres money out there with your name on it , youll need to contact the right agency.

Don’t Miss: Where To Move Your 401k Money