Changing Jobs Consider Rolling Over Your 401

Changes to your employment also mean changes to your 401 plan. If you are transitioning to a new employer, you should consider the best way to handle the money in your old 401 plan.

Labor Changes, Finance Changes

With the onset of COVID-19, many of us were forced to adjust quickly as furlough and unemployment rates skyrocketed. But as summer progressed, reports showed signs of some economic recovery. In July, the U.S. Bureau of Labor reported that unemployment hit 10.2 percent. Furlough rates also improved with the total number of furloughed workers dropping from 18 million in April to 9 million in July. This means that Americans are finding new jobs, despite COVID.

A new job relieves the uncertainty of unemployment and brings a new sense of excitement, but if you had a 401 plan with your former employer, you need to consider how to manage these funds before moving onto this new chapter. Though some people leave their accounts with their former employer, adopting this set it and forget it approach is not necessarily the best option.

Rollover, Rollover Send My Money Right Over

When deciding what should come next for your 401 plan, youll want to consider all your options however, in many cases, rolling over your funds could be the best strategy to keep your retirement goals on target. There are two ways to rollover your 401:

New Employer Plan

Technological Advancements

Protection From Market Downturns

In a fixed annuity or fixed index annuity, you will not lose money due to market downturns. If the markets have a down year, you earn zero interest. In exchange for this protection, you are limited on the upside you can get each year, unlike an individual stock through a mutual fund.

A variable annuity will provide unlimited upside potential with no protection from volatile market conditions. However, adding a Guaranteed Lifetime Withdrawal Benefit can protect the annuitant from running out of money due to a stock market crash.

Lower Invesment Fees And Costs

Another reason you should roll over your 401 to an IRA is to have better cost control. A 401 plan has a set fund structure that can potentially carry higher than average fees, eating into your portfolios return. Furthermore, plan administration and consultant fees are in addition to the plans total cost.

Rolling your 401 into an IRA would allow you to take advantage of dirt-cheap mutual funds or even trade individual stocks and bonds for free. You would also avoid administrative costs, significantly lowering your portfolios fees, which can add up over your career.

Read Also: Can I Borrow From My 401k

Rolling Over To A New 401

The first step in transferring an old 401 to a new employer’s qualified retirement plan is to speak with the new plan sponsor, custodian, or human resources manager who assists employees with enrolling in the 401 plan. Because not every employer-sponsored plan accepts transfers from an outside 401, it is imperative for a new employee to ask if the option is available from the new employer. If the plan does not accept 401 transfers, the employee needs to select one of the three other options for the 401 account balance.

If the new employer plan accepts 401 transfers from other companies, there is often a substantial amount of paperwork that must be completed by the employee. The paperwork is provided by the new plan sponsor or human resources contact and requires the name, date of birth, address, Social Security number, and other employee identifying information.

In addition, the 401 transfer form must provide details of the old employer plan, including total amount to be transferred, investment selections held in the account, date contributions started and stopped, and contribution type, such as pre-tax or Roth. A new plan sponsor may also require an employee to establish new investment instructions for the account being transferred on the form. Once the transfer form is complete, it can be returned to the plan sponsor for processing.

A transfer from one 401 to another is a tax-free transaction, and no early withdrawal penalties are assessed.

How To Roll Over Your 401

So, how do you transfer your 401 to a new job? If you decide to roll your funds into your new employers 401, youll most likely need to:

1. Contact the plan administrator to arrange the rollover. You may need to choose the types of investment you would like before you initiate the rollover. If not, you can take a lump-sum transfer and allocate the funds gradually to different investments of your choosing.2. Complete any forms required by your employer for the rollover. 3. Request that your former plan administrator send the fund via electronic transfer or a check so you can move the funds directly to the administrator of the new plan.

Its possible that you might have to wait until your employers next open enrollment period to complete the rollover, but you might consider using that time to research the plans investment options so youll be ready when the time comes.

Also Check: Is An Ira Better Than 401k

Please Do Not Do An Indirect Rollover

You do NOT want to have the check made payable to you. It may seem counterintuitive, as it is your money. However, if the check is made payable to you, the IRS could treat this as a distribution to you.

Your employer is required to withhold 20% for taxes automatically. On top of that, you have 60 days to put the money back into IRA or 401. So, if you want your account to maintain at least the same level of value, you would need to come up with that 20% withholding. The 20% is withheld for taxes and will NOT roll over.

If you cannot come up with that 20% withholding, the IRS will count that as a withdrawal, which might carry an additional 10% penalty. Avoid this potentially costly and annoying mistake by paying attention to the details and conducting a direct rollover.

As you can see, an indirect rollover is potentially expensive and not helpful to you. Please avoid doing it. Even if you get that 20% withholding back, it takes forever, and you miss out on participating in the market.

Source: Internal Revenue Service

Changing Jobs The Ins And Outs Of A 401 Rollover

Thomas J Catalano is a CFP and Registered Investment Adviser with the state of South Carolina, where he launched his own financial advisory firm in 2018. Thomas’ experience gives him expertise in a variety of areas including investments, retirement, insurance, and financial planning.

If you’ve decided to leave your current job for another, you will need to decide what to do with the money that you have invested in your current company’s 401 plan. Options typically include leaving it where it is, rolling it over to a new employer’s plan, or opting for an IRA rollover.

If you are about to change jobs, here’s what you need to know about rolling over your funds into a new employer’s 401 plan and the ins and outs of other options.

Read Also: How To Switch 401k To Ira

Cashing Out A 401 Is Popular But Not So Smart

Intellectually, consumers know that cashing out retirement accounts isnt a smart move. But plenty of people do it anyway. As discussed, you may be forced out of your former plan based on your account balance, but that doesnt mean you should cash the check and use it for non-retirement related purposes. In the long run, your financial future will be better served by rolling the money over into an IRA or if applicable, your new employers 401 plan.

A 2020 survey by Alight, a leading provider of human capital and business solutions, found that 4 out of 10 people cashed out their balances after termination between 2008 and 2017. About 80 percent of those who had an account balance of less than $1,000 cashed out, while 62 percent who had balances between $1,000 and $5,000 did the same.

Based on historical rates of return, a $3,000 cash out at age 24 leads to a $23,000 difference , in your projected account balance at age 67, so even a small amount of money invested into a retirement vehicle today can make a big difference in the long run.

Why You Should Roll Over Your 401 To An Ira

When you leave your job, you need to consider whether you should roll over your 401 to a new employer or an IRA. The reasons why you should roll over your 401: more cost control, more investment options, the potential for professional advice, fewer rules, consolidation, and control over taxes.

Unless you have an incredible 401 plan featuring very cheap options, you are better off with an IRA. Remember, the best part of a 401 plan is the match. After you change jobs, your old employer wont continue to match your contribution, so you are better off moving your retirement savings elsewhere.

Also Check: Can You Transfer Your 401k

You Have Options But Some May Be Better Than Others

After you leave your job, there are several options for your 401. You may be able to leave your account where it is. Alternatively, you may roll over the money from the old 401 into either your new employers plan or an individual retirement account . You can also take out some or all of the money, but there can be serious tax consequences.

Make sure to understand the particulars of the options available to you before deciding which route to take.

What Will I Do With My 401

Actually, I havent decided yet. My goal for this month is to investigate my new 401 plan and compare it to my old companys 401 plan and determine the best option for me. Personally, I think I will either roll it into my new companys plan, or I will roll it over into an IRA. I prefer to limit the total number of accounts I have because it makes it easier to balance my portfolio and keep track of everything.

You May Like: How Much Income Will Your 401k Provide

Withdraw The Assets In A Lump Sum

Withdrawing your assets from your 401 plan is not something most people will recommend because you will be hit with taxes and early withdrawal penalties, which could eat up nearly a third of your total assets to that point.

Possible Advantages: Your assets will be available for immediate use.

Disadvantages: You will face the immediate tax impact of paying income taxes on the lump sum of the assets you withdraw , and you will also have to pay a 10% early withdrawal penalty if you are under age 59½. You will also lose tax deferral benefits on your funds, miss out on potential future earnings, and you will lock in any market losses that had occurred up to that point. Most importantly, you can severely reduce the amount of money you have for retirement.

You can change your mind within 60 days. Your old fund manager is required to deduct 20% for taxes when you withdraw your funds. If you change your mind and decide to roll the funds over, there is the 60-day rollover rule which allows you to roll the money into an IRA within 60 days. However, you will be required to come up with the 20% difference to reinvest the entire amount and avoid paying income taxes. You will get the 20% back when you file taxes the following year as long as you complete the rollover within 60 days.

Transfer Your 401 To Your New Job

Transferring your 401 to your new job is like a 401 to 401 rollover. Depending on the set up of your new plan, its probably a better option than leaving it behind but might not be as beneficial as rolling your 401 to an IRA. Check the plan documents of your new employers 401 to confirm the plan accepts incoming rollovers.

Don’t Miss: What Is A 401k Vs Roth Ira

Best Options For Your 401 When You Change Jobs

by Rob Yeend | Sep 30, 2021 | Articles, blog, For Individuals, Latest News, Newsletter Article, Personal

Leaving one job for another can be an exciting move, but changing companies can present some logistical challenges, such as what to do with your old 401 plan. While you have options to choose from, some may be better than others.

Questions To Ask About Your New Employers Plan

Employers typically include 401 plan information in a new hire package. You should get a letter outlining the specifics of your companys plan, and maybe a brochure with investment options and other details. Most 401 providers have websites that will walk you through an introduction. Take a few minutes to skim and read the details and get to know a little bit about the plan.

Look for answers to the following questions, when reviewing the plan details:

Is there an employer matching program? More than 95% of large U.S. companies match the contributions that employees make to a 401. The average employer contribution amount is 4.5% of salary some companies contribute up to 6%. Think of it as a 6%, tax-free bonus and you get why an employer match is not a benefit to be missed.

Whats the vesting schedule? Many employers offer a vested match, which means that although the company is contributing up to six percent of your match, your access to that money is given on a timeline. After year one or two, you get 25% of the money, then 50%, until you receive the full 100% match after five or more years.

Getting started on a vesting schedule is one of the reasons its important to sign up for the 401 as soon as you can. Youll optimize the funds the company matches if you enroll at the earliest possible date.

Read Also: How Can I Take Money Out Of My 401k

Second 401 And 403 Have Limited Investment Options

Some employer plans offer fewer than ten investment options. Some offer more, but few that are low fee.

For example, there may be some index fund options that have fees under 0.3%, but Target-date fund options with expense ratios over 1%.

Since Target Date funds are the better option for hands-off investors, this can force you to choose between the right options for you and minimizing your fees.

In addition, if you want to invest in socially good funds or adopt another custom strategy, you probably wont have access through your employer plan.

When Changing Jobs Is This Your Best Option

When an employee leaves a job due to retirement or termination, the question about whether to roll over a 401 or other employer-sponsored plan quickly follows. A 401 plan can be left with the original plan sponsor, rolled over into a traditional or Roth IRA, distributed as a lump-sum cash payment, or transferred to the new employers 401 plan.

Each option for an old 401 has advantages and disadvantages, and there is not a single selection that works best for all employees. However, if an employee is considering the option of transferring an old 401 plan into a new employer’s 401, certain steps are necessary.

You May Like: How To Get Your 401k Without Penalty

Options For Your 401 Or 403

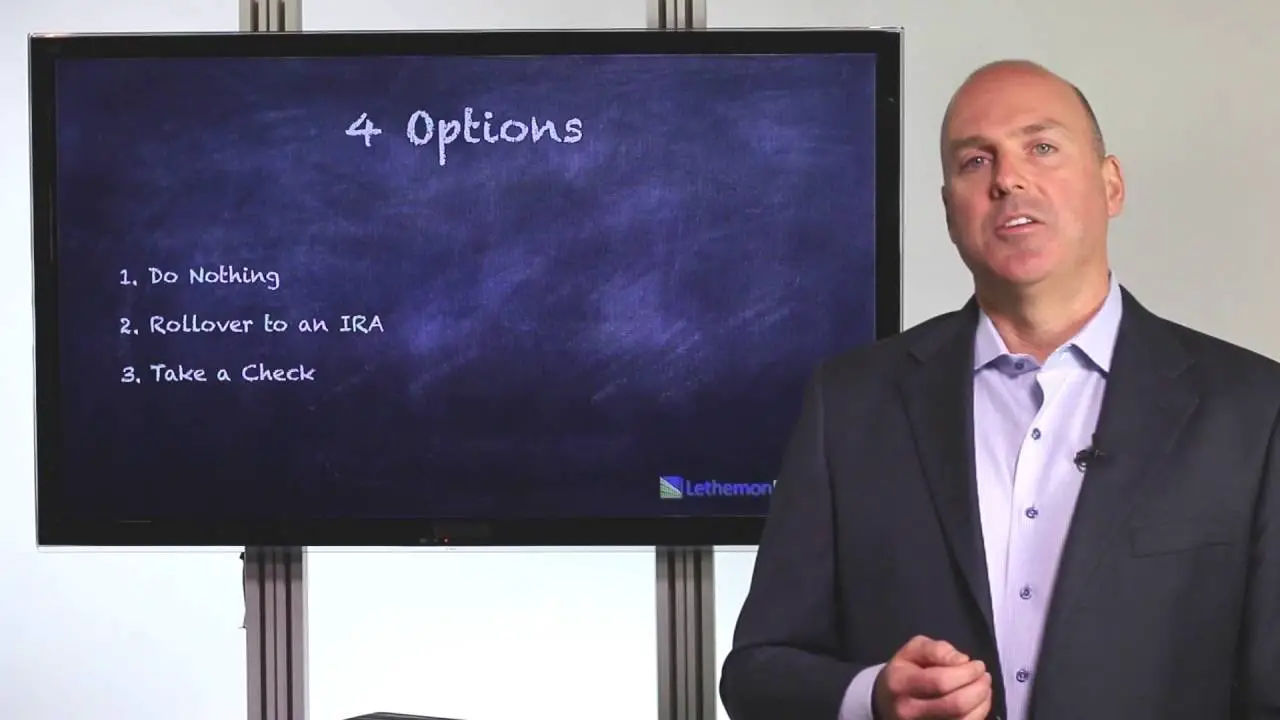

When you leave your job, you have four options for what to do with your 401 or 403:

Before going into these options, its important to note that a 401, 403 or an IRA is an account.

Within these accounts, you can choose between a variety of investment options with varying fees, risk profiles, and returns .

You can think of an IRA or a 401 like choosing the restaurant where you want to eat. Once youre there, you have a variety of menu options at different price points, flavor profiles, and nutritional value.

An employer-sponsored plan offers curated investing options. When youre in an employer-sponsored plan, you dont get to choose the restaurant.

If your employer has chosen Chipotle, you can choose a Carnitas burrito or a vegetable burrito bowl. But youre out of luck if youre in the mood for tomato bisque.

In contrast, choosing an IRA gives you the choice of what restaurant to go to. And what menu options to select.

You can choose to go to Whole Foods where you can affordably eat sushi, pizza, or the hot food bar. But you can also choose a fancy restaurant at a higher price point but with more personal attention.

Returning to the four options for your old 401 or 403, cashing it out is the worst option.

Option : Roll Over Your Old 401 Into An Individual Retirement Account

Still another option is to roll over your old 401 into an IRA. The primary benefit of an IRA rollover is having access to a wider range of investment options, since youll be in control of your retirement savings rather than a participant in an employers plan. Depending on what you invest in, a rollover can also save you money from management and administrative fees, costs that can eat into investment returns over time. If you decide to roll over an old 401 into an IRA, you will have several options, each of which has different tax implications.

You May Like: How To Take Out A Loan Against 401k