Major Differences Between Annuities And 401s

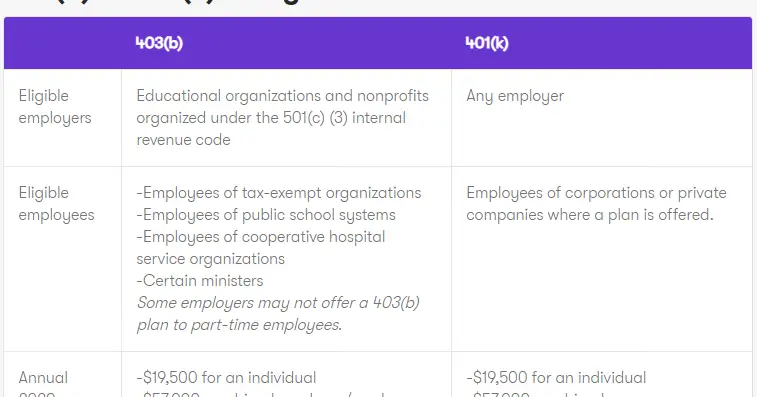

While anybody can buy an annuity, only people whose employers have 401 plans can contribute to one. If your employer doesnt have a 401 program, you cannot contribute to one. Anyone whos self-employed can set up his or her own 401, though.

Fees are another major differentiator. Its typically quite easy to check the fees youre paying for your 401. To do this, simply ask your plan administrator for an explanation of any fees charged to your account. Annuity fees are much harder to figure out and are often significantly higher. In particular, you may pay steep sales commission fees for an annuity, benefit rider fees and more.

If you withdraw funds from your 401 before age 59.5, you may have to pay a 10% early withdrawal penalty in addition to the income tax due on the amount you withdrew. Annuities have their own early withdrawal fees, as well as annuity surrender fees. Annuity surrender fees are reduced as time goes by, meaning theyll usually disappear after five years.

Another way annuities and 401 accounts differ is that you can borrow from your 401, while you cant from an annuity. Plus, most annuities provide unchanging regular payments, which means you wont have inflation protection.

How Do Annuities Work

With an annuity, you pay the annuity company premiums for a period of time, and then the annuity company starts paying you.

In general, there are two stages in the life of an annuity:

Advantages And Disadvantages Of Buying An Annuity Within Your 401

All of this means that there are a number of factors on both sides to consider when thinking about whether it makes sense to hold an annuity in your 401.

-

You may get a higher payout than from other annuities.

-

Fees negotiated by your employer may be more reasonable.

-

The annuity provider is likely to have been carefully vetted by your employer, which has fiduciary responsibility for the security of your plan.

-

Women won’t pay more for the same coverage.

-

Lower interest rates, meaning money will likely grow more slowly than if you’d invested in stocks or ETFs.

-

Putting already-tax deferred 401 funds into tax-deferred annuity accounts yields no additional benefit.

-

Funds in annuities can’t be left to heirs unless riders are available and exercisedand having those reduces the payout.

-

Men might pay more for the same coverage.

-

Riders that provide inflation protection also reduce the payout.

Read Also: Can Anyone Have A 401k

Taxation Of 401 Withdrawals

When you take money out of a 401, the entire withdrawal is taxable. When you take money out of an annuity, only the investment gains are taxable. Since you funded the annuity with after-tax money, you get your contributions back tax-free.

Both accounts penalize early withdrawals. If you take money out when you are younger than 59 1/2, you will likely owe an extra 10 percent penalty. Once again, this penalty applies to the entire 401 withdrawal, whereas it only applies to your annuity gains.

Changing Or Cancelling An Annuity

When you buy an annuity, you enter into a contract with the annuity provider. Typically, once you buy an annuity, you cant change the terms of the contract. This means you cant switch to a different type of annuity or get your money back.

Your annuity contract may have a cooling-off period. This means that you can cancel the contract without a penalty within a specific amount of time. Be sure to read your annuity contract carefully to see if it includes a cooling-off period.

The contract may give the option to cancel within a certain time period after you start receiving payments. There is usually a fee to do this which can be a percentage of the purchase price.

Contact your annuity provider for more information about the contract and your rights to change or cancel an annuity.

If you are thinking about buying an annuity, speak with a financial professional. They can help you figure out whats right for you, when to buy it and when to start getting payments.

Also Check: How To Make More Money With My 401k

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our investing reporters and editors focus on the points consumers care about most how to get started, the best brokers, types of investment accounts, how to choose investments and more so you can feel confident when investing your money.

Are Pension Annuities Worth It

Annuities have had a bad press, but are still the main way to secure a guaranteed income for the whole of your life from your retirement savings. Annuities may seem poor value for a number of reasons, not least increasing longevity. The key thing to remember is that an annuity is insurance against outliving your money.

You May Like: How To Find Where Your 401k Is

Why Do People Buy Annuities

People typically buy annuities to help manage their income in retirement. Annuities provide three things:

- Periodic payments for a specific amount of time. This may be for the rest of your life, or the life of your spouse or another person.

- Death benefits. If you die before you start receiving payments, the person you name as your beneficiary receives a specific payment.

- Tax-deferred growth. You pay no taxes on the income and investment gains from your annuity until you withdraw the money.

Is An Annuity Right For You

When is the right time to stop working and retire? Will your money last as long as you need it to? How can you protect your retirement income from losses?

These are key questions to discuss with an Ameriprise advisor, who will provide you with personalized advice to help you achieve your financial goals.

Also Check: How To Set Up A 401k Plan

How Life Insurance Works

Life insurance provides valuable financial protection for those that mean the most to you. A life insurance policy provides your beneficiaries with a cash payout when you pass away. Your loved ones can use the money as they see fit to provide for their needs, including maintaining their standard of living, paying off the mortgage or funding education. In general, you pay a monthly premium for life insurance .

So Youre A South African Living Abroad What Exactly Can You Do With Your Annuities

South African Living Annuities: the essential facts

Capital: You are notpermitted to access the capital as lump sum unless it reaches the nominal limitof R50 000 and not even financial emigrationwill allow you to touch that capital.

- This means you can invest the entire amount in a foreign currency denominated investment portfolio as this will give you the best chance at growth in a stable currency, protecting your capital against the volatility of the South African Rand.

Income: The income you would receive from yourannuity is paid out in South African currency and must be converted intoforeign currency before it can be transferred abroad.

- Your income level and pay-out frequency can be altered annually on your policy maturity date.

- You will need a South African bank account and will have to consider the cost of international transfers when setting the payout frequency, and it is wise to consider capital preservation when selecting your income withdrawal level.

Full policy cash out: Once your living annuity contains less than R50 000 you can cash out. While you can reduce your capital amount through anaccelerated depletion strategy, this move will be subject to tax.

Recommended Reading: How To Take Money From 401k Without Penalty

The Fixed Index Annuity: Recession

Shawn Plummer

CEO, The Annuity Expert

What is a fixed index annuity? This guide will explain everything a fixed index annuity can provide when saving before and during retirement. This is ideal for:

- Moderate and conservative investors wanting safe stock market growth for their 401 or IRA with added protection from a stock market crash.

- Consumers wanting to guarantee a future fixed income starting today.

- Investors wanting to receive regular income in retirement for as long as they live.

- New retirees wanting their savings to continue to grow while providing regular income.

- Investors wanting to lock in their interest so they can leave money to their heirs.

- Pre-retirees that have maxed out their 401 and IRA and want to save even more with tax deferral.

Tips To Plan For Your Retirement

- Finding a qualified financial advisor doesnt have to be hard. SmartAssets free tool matches you with up to three financial advisors in your area, and you can interview your advisor matches at no cost to decide which one is right for you. If youre ready to find an advisor who can help you achieve your financial goals, get started now.

- Dont forget to integrate Social Security payments into your retirement plans. While they may not have a monumental effect on your finances in retirement, they can provide you with some extra cash at a time when youll need it most. To gain some insight into what you can expect from this government program, take a look at SmartAssets Social Security calculator.

You May Like: What Is The Minimum Withdrawal From 401k At Age 70.5

The Overall Price You Pay For An Annuity Can Vary Between Providers

Annuity providers may offer you different income payments for the same type of annuity.

This is because providers calculate the amount of monthly income they can provide based on many factors such as:

- the type of your annuity

- the term of your annuity

- your age and gender

- their operating costs

- the return they expect to receive on their investments

Before buying an annuity, ask for the list of fees and commissions. Make sure you understand the contract restrictions, including penalties and administrative fees.

Once you know what kind of annuity you are interested in buying, compare similar products from several providers.

South African Life Annuities: The Essential Facts

In this case, your income level will befixed and will increase on an annual basis according to the method you selectedon signing up for this product.

Capital: It is not possible to access your capital under any circumstances.

Income: Youll have to think carefully about the payment frequency you want.Depending on how you plan to access income in South Africa, it is worthwhileconsidering limiting the number of international transfers, given the costsinvolved bank charges, commissions, SWIFT fees and the like. A smartworkaround is selecting the option of having your income paid as an annualinstalment in advance. The result is that you will receive your retirement income from SouthAfrica once a year and only a single offshore transfer is necessary to get yourhands on it.

Also Check: Where To Find My 401k

Are Annuities A Good Idea

Whether annuities are a good idea depends on your circumstances, your needs and whether the particular annuity type is a good fit.

If you already have a healthy pension or another source of income sufficient to support your everyday needs in retirement, you may not need an annuity.

If you dont have a guaranteed stream of retirement income, you should consider buying an annuity. An annuity is a good source of lifetime income.

How Much Do You Need To Start An Annuity

Each annuity has different fees and restrictions. Different companies set different investing requirements.

But in deciding whether you have enough money to invest in an annuity, it may be best to consider what kind of return your annuity purchase might bring.

Lets take a fixed, immediate annuity with a 5 percent payout rate as an example. That means, each year, you will receive payments totaling an amount equivalent to 5 percent of your investment.

| Fixed Annuity Purchase at 5% | Yearly Payment |

|---|

You May Like: Can You Roll A 401k Into A Self Directed Ira

How Do 401s And Iras Work

A 401 is an employer-sponsored retirement savings plan that allows employees to save pre-tax money from their paychecks, often with a partial match from their employers. Money deposited into 401 accounts is not taxed until it is withdrawn. It gets its name from the section of the tax code that covers it.

An IRA is an individual retirement account in which the saver directly deposits pre-tax funds. Often, individuals who leave companies where they had 401 plans will roll the funds from them into IRAs.

Regardless of whether you own a 401k or an IRA, once a distribution is taken, it is taxable as ordinary income. Additionally, if you are withdrawing money prior to the age of 59½, then the IRS levies an additional 10 percent penalty tax. The same rules of taxation apply when you roll a 401 plan or an IRA into an annuity.

Should You Roll Over Your 401 To An Annuity

When considering whether you should roll over your 401 balance into an annuity, be sure to discuss the pros and cons with a financial planner.

According to Malcolm Ethridge, a certified financial planner at CIC Wealth in Rockville, Md., a partial rollover might be a good solution, depending on the individuals financial circumstances, but he doesnt advise rolling over your entire 401 balance into an annuity.

Annuities in general are extremely illiquid and oftentimes come with steep penalties for accessing the funds in them within the first seven years of purchase, said Ethridge. They also come with higher fees than simply investing in the same ETFs or mutual funds without using the annuity to do it. The higher fees are associated with the cost of the guarantees embedded within the annuity contract.

For instance, Ethridge warned that an income guarantee or a death benefit that returns your original principal to your beneficiaries could cost you anywhere from 0.10% up to 2.00% in fees. But if youre a person who needs that income guarantee to sleep at night, the added fees could be a reasonable trade-off, he said.

Chelsea Nalley, a wealth advisor at TrueWealth Management in Atlanta, also warned of the high fees that come with annuities. But according to Nalley, for some savers the peace-of-mind that comes with longevity insurance can be worth it.

Don’t Miss: How Many Loans Can I Take From My 401k

What Is The Formula For Annuity Due

Each week, Zacks e-newsletter will address topics such as retirement, savings, loans, mortgages, tax and investment strategies, and more. However, as required by the new California Consumer Privacy Act , you may record your preference to view or remove your personal information by completing the form below. Use your estimate as a starting point for conversation with a financial professional. Discuss your quote with one of our trusted partners, who can explain the present value of your payments in more detail.

Retirement accounts are a good example of an ordinary annuity. Here you receive a fixed or variable amount at regular intervals and at the end of a period. A mortgage on a home is also an example of an ordinary annuity. Likewise, interest on bonds and stock dividends are an example of an ordinary annuity. The bond issuer usually pays twice a year and that also at the end of the period. Payment of car loan, payment of mortgage and coupon bearing bonds are some examples of an ordinary annuity.

How Interest Credits Is Determined

Now that you have an idea of earning interest with indexing strategies, you need to understand how the net interest is credited to your account. Since a major tradeoff with indexed annuities is participating in some of the upside, a measurement tool must dictate the portion that is credited to you.

Indexing Term

The index term is the period over which index-linked interest is calculated the interest is credited to your fixed index annuity at the end of a term. Terms are generally from one to ten years, with six or seven years being most common. Some annuities offer single terms, while others offer multiple, consecutive terms. If your fixed index annuity has multiple terms, there will usually be a window at the end of each term, typically 30 days, during which you may withdraw your money without a penalty. For installment premium annuities, the payments of each premium may begin a new term for that premium.

Cap Rate

A cap is the ceiling an indexed annuity owner can earn in any given interest crediting method. Some annuities may put an upper limit, or cap, on the index-linked interest rate. This is the maximum rate of interest the annuity will earn.

Not all annuities have a cap rate.

While a cap limits the amount of interest you might earn each year, annuities with this feature may have other product features you want, such as annual interest crediting or the ability to take partial withdrawals. Also, annuities that have a cap may have a higher participation rate.

The Floor

You May Like: How To Find Out If You Have Unclaimed 401k Money

Why Would You Want An Annuity In Your 401

One of the biggest concerns for a retiree is running out of money. In a 2018 survey by Aegon, 52% of respondents expressed this fear. Annuities are an appealing solution to this problem because they can provide a lifetime of guaranteed income, depending on the kind of annuity you buy. In an era when defined-benefit pensions have largely been replaced by defined-contribution plans, such as 401s, the opportunity to create a self-funded pension with an annuity may be reassuring to many retirees.

While 401 plan providers have found ways to make it easy for workers to save for retirement through automatic plan enrollment, matching contributions, and default investments, they have not made it easy for workers to turn their savings into a steady, enduring stream of retirement income. It is up to retirees to decide how to draw down their assets and how to change their asset allocation throughout retirement. Many plans offer target-date funds that can simplify the process.

The Boston College Center for Retirement Research published a study in October 2019 theorizing that buying an immediate life annuity would give a 65-year-old male the most income among the available options. There is a strong case made for traditional annuities by showing how annuitization is superior to investing with 3% returns, taking annual withdrawals based on remaining life expectancy, and taking required minimum distributions . It would also prevent the retiree from running out of money.