Taking 401 Distributions In Retirement

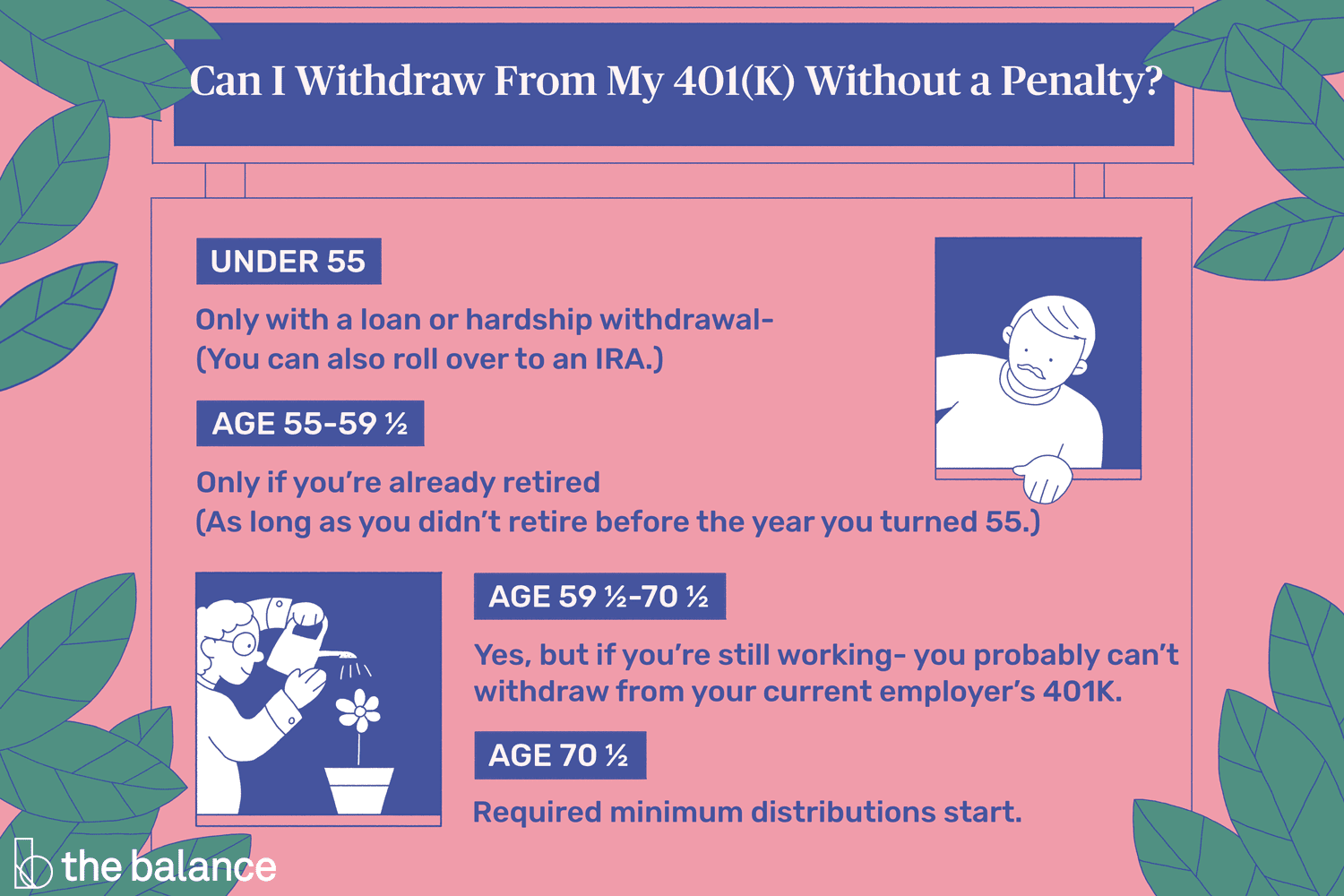

The 401 withdrawal rules require you to begin depleting your 401 savings when you reach age 72.

At this point, you must take a required minimum distribution each year until your account is depleted. If you are still working for the employer beyond age 72, you may be able to delay required minimum distribution until you stop working if your plan allows this delay. The delay option is not available to you if you own 5% or more of the business.

You have until April 1 of the year after you turn 72 to take your first required minimum distribution. After that, you must take a minimum amount by December 31 each year. Your 401 plan administrator will tell you how much you are required to take each year.

The amount is based on your life expectancy and your account balance. If you dont take your required minimum distribution each year, you will have to pay a tax of 50% of the amount that should have been taken but was not. If you participate in more than one employer plan, you must take a required minimum distribution from each plan.

How Much Should You Contribute To A 401

When you start a new job and sign up for your companys 401 plan, you will need to decide how much to contribute to the account. This seemingly simple decision will affect how much is withheld from your paychecks, your annual income tax bill and how much money you will have in retirement.

Heres how to determine the amount to save in your 401 plan:

The 401 contribution limit is $20,500 in 2022.

Workers age 50 and older can contribute an additional $6,500 in 2022.

Qualifying for a 401 match is the fastest way to build wealth for retirement.

Many financial advisors recommend saving more than 10% of your income for retirement.

Remember to increase your savings rate over time.

Starting to save at a young age gives your investments more time to compound.

Maxing out your 401 helps reduce your current tax bill.

How Much Can You Contribute to a 401?

You can defer paying income tax on up to $20,500 that you save in a 401 plan in 2022. Workers age 50 and older can make catch-up contributions of up to an additional $6,500 in 2022, for a maximum possible 401 contribution of $27,000. Maxing out your 401 helps you save money on taxes while saving for retirement. A worker in the 24% tax bracket who saves $20,500 in a 401 plan will reduce his tax bill by $4,920. However, income tax will be due on traditional 401 withdrawals in retirement.

Qualify for the 401 Match

Aim to Save More Than 10%

Increase Your Savings Rate Over Time

Factor in Your Age

How to Max Out Your 401

How Long Do You Have To Repay A 401 Loan

Generally, you have up to five years to repay a 401 loan, although the term may be longer if youre using the money to buy your principal residence. IRS guidance says that loans should be repaid in substantially equal payments that include principal and interest and that are paid at least quarterly. Your plan may also allow you to repay your loan through payroll deductions.

The CARES Act allows plan sponsors to provide qualified borrowers with up to an additional year to pay off their 401 loans.

The interest rate youll pay on the loan is typically determined by the plan administrator based on the current prime rate, but it and the repayment schedule should be similar to what you might expect to receive from a bank loan. Also, the interest isnt paid to a lender since youre borrowing your own money, the interest you pay is added to your own 401 account.

Don’t Miss: How Do You Move Your 401k When You Change Jobs

Rollover Over To An Ira

If you want to diversify your investments, you can transfer your savings to an IRA to enjoy more investment options. You can also find better-performing investments that pay higher returns than the investment options available in a 401.

If you have other old 401 plans with former employers, you can do a direct rollover to your IRA to make it easier to manage your retirement savings in a single account. A direct rollover helps you avoid paying taxes and penalties on the distribution.

Ira Rollover Bridge Loan

There is one final way to borrow from your 401k or IRA on a short-term basis. You can roll it over into a different IRA. You are allowed to do this once in a 12-month period. When you roll an account over, the money is not due into the new retirement account for 60 days. During that period, you can do whatever you want with the cash. However, if its not safely deposited in an IRA when time is up, the IRS will consider it an early distribution. You will be subject to penalties in the full amount. This is a risky move and is not generally recommended. However, if you want an interest-free bridge loan and are sure you can pay it back, its an option.

Read Also: How To Open A 401k Plan

So How Much Should You Invest In Your 401k

Okay. So, while investing is highly personal and financial goals should be personalized, you are here so we can teach you to be rich. We have some advice to get you started.

How much you should actually be investing each month depends on a system we call the Ladder of Personal Finance. Check out this video, or read about the Ladder below:

1. Your employers 401k match. Each month you should be contributing as much as you need to in order to get the most out of your companys 401k match. That means if your company offers a 5% match, you should be contributing AT LEAST 5% of your monthly income to your 401k each month.

Weve already discussed the importance of this dont throw away free money and the returns from that free money.

2. Whether youre in debt. Once youve committed yourself to contributing at least the employer match for your 401k, you need to make sure you dont have any debt. Remember, if you have employee matching, you are effectively earning a 100% return on every penny you invest in your 401k that is significantly more than the interest you would save by paying down your debt.

If you dont, great! If you do, thats okay. You can check out my system on eliminating debt fast to help you.

Alternatives To Tapping Your 401

If you must tap into retirement savings, it’s better to look at your other accounts firstspecifically IRAsespecially if you’re buying a first home .

Unlike 401s, IRAs have special provisions for first-time homebuyerspeople who haven’t owned a primary residence in the last two years, according to the IRS.

First, look to take a distribution from your IRAif you have one. You may be able to withdraw IRA contributions without penalty due to a qualified financial hardship. You can also withdraw up to $10,000 of earnings tax-free if the money is used for a first-time home purchase. As a first-time homebuyer, you can take a $10,000 distribution without owing the 10% tax penalty, although that $10,000 would be added to your federal and state income taxes. If you take a distribution larger than $10,000, a 10% penalty would be applied to the additional distribution amount. It also would be added to your income taxes.

Recommended Reading: How Can I Find All Of My 401k Accounts

Are You Still Working

You can access funds from an old 401 plan after you reach age 59 1/2 if you’re still working, but you may not have the same access to the funds at the company for which you currently work if you’ve changed jobs.

Check with your 401 plan administrator to find out whether your plan allows what’s referred to as an in-service distribution at age 59 1/2. Some 401 plans allow this, but others don’t.

How Long Can A Company Hold Your 401 Funds When You Withdraw

When you leave a job, you can decide to cash out your 401 money. Generally, when you request a payout, it can take a few days to two weeks to get your funds from your 401 plan. However, depending on the employer and the amount of funds in your account, the waiting period can be longer than two weeks.

Each company has different time frames for making distributions when you request a payout. Check the waiting period of your employerâs 401 plan by checking the summary plan description given by the company. The waiting period starts when you request a payout up to when you receive the cash distribution, or funds are rolled over to an IRA or 401.

Read Also: Can You Rollover A 401k To Another 401 K

You May Have To Sell Investments At A Bad Time

Pulling cash out of investment accounts after the market has fallen means youre locking in any losses youve incurred. Even if you reinvest these funds down the road, youll have missed reaping any gains those investments would have seen in the interim.

In 2020, the S& P 500 had its largest first-quarter decline in history, finishing down 20%. Stats like this can lead to panic selling, or, coupled with the loosened withdrawal rules, may tempt you to dip into retirement accounts to prevent further losses.

But remember: You havent lost anything until you sell. So if your cash crunch isnt an emergency, you can avoid losses by riding out the storm, and benefit from the rebound whenever it eventually occurs.

What Qualifies As A Hardship Withdrawal For 401k

Hardship distributions

A hardship distribution is a withdrawal from a participants elective deferral account made because of an immediate and heavy financial need, and limited to the amount necessary to satisfy that financial need. The money is taxed to the participant and is not paid back to the borrowers account.

You May Like: Can I Switch My 401k To A Roth Ira

What Is A 401k

A 401k allows you to dedicate a percentage of your pre-tax salary to a retirement account.

Employers can also choose to match some or all of the contributions, but this isn’t required so it’s not guaranteed.

There are two basic types of 401ks – traditional and Roth – with the main difference being how they’re taxed.

In a traditional 401k, employee contributions reduce their income taxes for the year they are made, but they’ll pay tax when they withdraw cash.

What Is A 401 Early Withdrawal

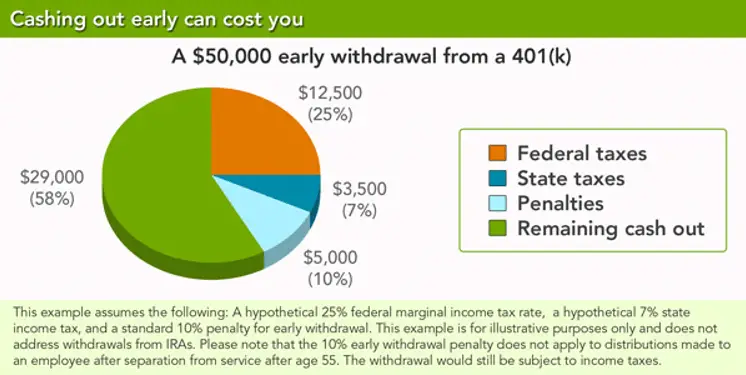

First, lets recap: A 401 early withdrawal is any money you take out from your retirement account before youve reached federal retirement age, which is currently 59 ½. Youre generally charged a 10% fee by the Internal Revenue Service on any withdrawals classified as earlyon top of any applicable income taxes.

If youre making an early withdrawal from a Roth 401, the fee is usually just 10% of any investment growth withdrawncontributions are not part of the early withdrawal fee calculation for this type of account.

But the entire account balance counts for calculating the fee if youre making an early withdrawal from a traditional 401. These rules hold true for early distributions from a traditional IRA as well.

Don’t Miss: What Is The Interest Rate On A 401k

Hardship Distributions From 401k Plan

If you are younger than 59 ½, youre going to have to demonstrate that you have an approved financial hardship to get money from your 401k account. And thats only if your employers retirement plan allows it. They are not required to offer hardship distributions, so the first step is to ask the Human Resources department if this is even possible.

If it is, the employer can choose which of the following IRS approved categories it will allow to qualify for hardship distribution:

- Certain medical expenses

- Certain expenses for repairs to a principal residence

The only other way to get access to your funds is to leave your employer.

Using Your 401 For A First

If youre still thinking that you might want to go this route, its important to consider all the costs that will be part of owning a home, to make sure that youre not using your 401 as a way to fund a purchase that might be difficult to maintain. Looking at your retirement account balance might make you feel as though you have more money than you actually have coming in on a regular basis.

Buying a home might be the biggest purchase you make, but its important to remember that its not a one-time expense. Owning a home means regular costs for maintenance, upkeep, insurance, property taxes and much more. Its easy to get caught up in the excitement of house hunting and inadvertently make a first-time home buyer mistake that leaves you without sufficient funds to pay the ongoing expenses a home requires.

Read Also: Can You Convert A Roth 401k To A Roth Ira

How Much Should You Have In Your 401k By Age

Now that we have established that you need a 401k in your life and explained how much you can contribute, lets talk cash. Aside from investing enough to meet your employer match, how much should you have in your 401k, really?

One way to answer that question is to look at your age.

While there is no one-size-fits-all answer to the question, How much should I have in my 401k? there are some best practices you can keep in mind to guide your efforts. Yes, while you should start investing in a 401k as soon as possible, some people might not get that opportunity right away and thats okay. The point is to do it when you can.

When you do finally start investing, there are a few good rules of thumb to help you make a sound decision on how much you should have in your 401k.

Taking Money Out Of A 401 Once You Leave Your Job

If you no longer work for the company that sponsored your 401 plan, first contact your 401 plan administrator or call the number on your 401 plan statement. Ask them how to take money out of the plan.

Since you no longer work there, you cannot borrow your money in the form of a 401 loan or take a hardship withdrawal. You must either take a distribution or roll your 401 over to an IRA.

Any money you take out of your 401 plan will fall into one of the following three categories, each with different tax rules.

Recommended Reading: Can I Roll A 401k Into A Roth Ira

Withdrawing From Your 401 Before Age 55

You have two options if you’re younger than age 55, and if you still work for the company that manages your 401 plan. This assumes that these options are made available by your employer. You can take a 401 loan if you need access to the money, or you can take a hardship withdrawal. but only from a current 401 account held by your employer. You can’t loans out on older 401 accounts. You can roll the funds over to an IRA or another employer’s 401 plan if you’re no longer employed by the company. But these plans must accept these types of rollovers.

Think twice about cashing out. You’ll lose valuable creditor protection that stays in place when you keep the funds in your 401 plan at work. You could also be subject to a tax penalty, depending on why you’re taking the money.

Borrow From Your 401k

We strongly suggest that you dont withdraw funds from your 401K. Withdrawing funds before you are of retirement age can leave you with a large tax liability plus a 10% penalty. That down payment on your home could suddenly get really expensive.

Instead, we suggest that you borrow from your 401K. In essence, you give yourself a loan. You will pay interest on the loan, but youll pay the interest to yourself, not a lender. You may be eligible to borrow the lesser of $50,000 or half of your 401K balance. If you borrow the funds, you wont pay taxes or penalties for early withdrawal.

You May Like: How Can I Get Access To My 401k

The 5 Different 401k Retirement Options

Next, lets look at what choices Owen will have when he retires. The decision will largely be his. The law allows for five different alternatives for a 401k account at retirement. The options include lump-sum distribution, continue within the plan, roll the money into an IRA, take periodic distributions, or use the money to purchase an annuity. Owens particular plan will allow for some or all of them.

The fastest way for Owen to get his big wad of money is to take a lump-sum distribution. Hell get the money quickly. But there are two disadvantages. First, hell pay ordinary income taxes on the entire amount withdrawn. Second, the money will no longer be growing tax-free.

If Owen does take a lump-sum distribution, hell be subject to 20% withholding. That means the IRS will take 20% of the money distributed now and apply to his tax bill next April. Owen can thank the Unemployment Compensation Amendments Act of 1992 for that idea.

Owen could decide to leave the money in the account. It will continue to grow tax-free. That can make a big difference in how much is available to him during retirement. Many retirees choose to live off of and spend taxable accounts first saving IRAs and 401ks until they need the money or are forced by law to begin distributions.

Another possibility would be to roll the 401k into an IRA. That would give Owen the largest number of investment options. He could still withdraw the money when he wants or choose to let it grow tax-free.