How Much Do I Have To Withdraw Each Year

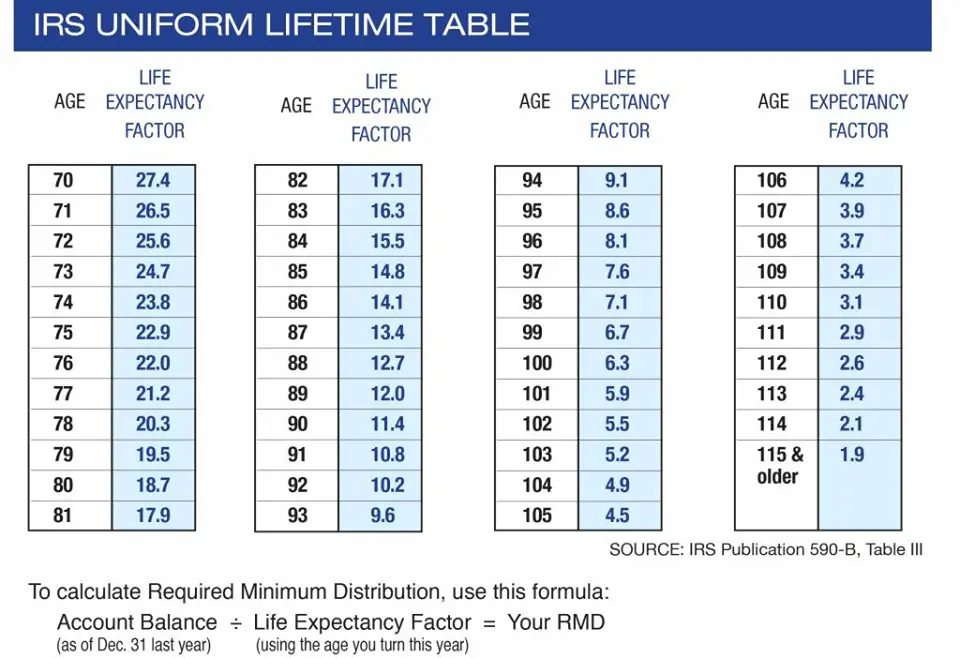

The amount changes each year, according to your age. Start by calculating how much you had in all your tax-deferred accounts as of December 31 of the previous year. Next, find your age on the IRS uniform lifetime table for 2021 and the corresponding distribution period. The distribution period is an estimate of how many years youll be taking RMDs. If youre 72, for example, the distribution period is 25.6 years, based on your life expectancy. Then divide your balance by the distribution period. Lets say you have a combined $100,000 in your tax-deferred retirement accounts. $100,000 divided by 25.6 is $3,906.25, which is the amount you must withdraw. If you are in the 25 percent combined state and local tax bracket, youll owe $976.56 in taxes on your RMD.

You can take your RMD out of one account, or take bits from each one, so long as you withdraw the required minimum.

Join today and get instant access to discounts, programs, services, and the information you need to benefit every area of your life.

Joint Life And Last Survivor Expectancy Table

On the other hand, if your spouse is 10 years younger than you, and is the sole beneficiary of your retirement account, you must use the IRS Joint Life and Last Survivor Expectancy table to calculate RMD withdrawals. Under this table, your life expectancy factor is based on you and your spouses age. Unlike the Uniform Lifetime table, this table usually results in lower RMDs.

Below is a section of the Joint Life and Last Survivor Expectancy table for account holders between 70 to 79 years old. The ages on top refers to your age , while the ages listed vertically on the left represents your spouses age . For example, if youre 73 years old and your spouse is 58 years old, your distribution period is 28.3.

| Your Age | |

|---|---|

| 30.2 | 30.1 |

To understand how RMD is calculated, lets take the following example. Suppose youre turning 73 in October 2021 and you want to know the minimum distribution you can withdraw. By December 31, 2020, your IRA account had a balance of $110,000. For this example, your spouse is only 4 years younger than you. Thus, you must use the Uniform Lifetime table to calculate your RMD. The distribution factor for 73 is 24.7.

RMD = $110,000 / 24.7RMD = $4,453.44

For 2021, you must withdraw a minimum of $4,453.44 from your IRA account.

RMD = $110,000 / 28.3 RMD = $3,886.93

In this example, you must withdraw a minimum of $3,886.93 in 2021 from your IRA account.

The following chart shows your projected RMDs and account balance till you turn 100:

| Age | |

|---|---|

| $5,508 | $30,581 |

Can I Reinvest My Required Minimum Distribution

Yes, an RMD does not need to be spent. You can simply pull the money out of your IRA, pay the tax on it, and invest the rest in a taxable account. Nobody is making you spend it. Also, bear in mind, if you are a high-income professional, that you likely saved 32-37% when you put that money in and you are likely pulling it out at rates of 0-24%. Saving at 37% and paying at an effective rate of 15% is a winning combination, even if the tax bill is larger on an absolute basis due to a few decades of compounding.

Also Check: When Can You Use Your 401k

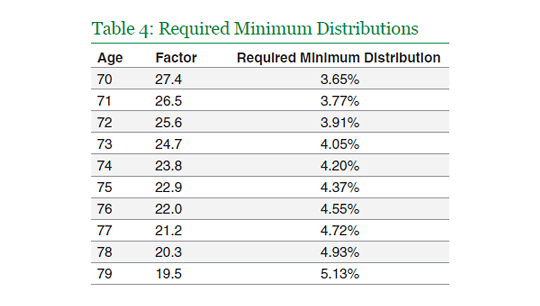

Rmd Percentages By Age

Now we need to look at RMD withdrawal rates at each age based on life expectancy. Again, using the uniform life expectancy table, I divided each life expectancy into 100. The RMD percentage table here shows the RMD as a withdrawal rate at each age.

These numbers actually go out for several more values. I have rounded here to two decimals.

| Age |

| 52.63% |

Calculating The Required Minimum Distribution

The required minimum distribution for any year is the account balance as of the end of the immediately preceding calendar year divided by a distribution period from the IRSs Uniform Lifetime Table. A separate table is used if the sole beneficiary is the owners spouse who is ten or more years younger than the owner. In this regard, the following materials will be useful to you in determining required distribution amounts and payout periods:

- worksheets to calculate the required amount

- tables to calculate the RMD during the participant or IRA owners life:

- Uniform Lifetime Table -for all unmarried IRA owners calculating their own withdrawals, married owners whose spouses arent more than 10 years younger, and married owners whose spouses arent the sole beneficiaries of their IRAs

- Table I is used for beneficiaries who are not the spouse of the IRA owner

- Table II is used for owners whose spouses are more than 10 years younger and are the IRAs sole beneficiaries

Inherited IRAs – if your IRA or retirement plan account was inherited from the original owner, see “required minimum distributions after the account owner dies,” below.

Don’t Miss: How Much Should You Put In Your 401k

What Types Of Retirement Plans Require Minimum Distributions

The RMD rules apply to all employer sponsored retirement plans, including

profit-sharing plans, 401 plans, 403 plans, and 457 plans. The RMD rules also apply to traditional IRAs and IRA-based plans such as SEPs, SARSEPs, and SIMPLE IRAs.

The RMD rules also apply to Roth 401 accounts. However, the RMD rules do not apply to Roth IRAs while the owner is alive.

When Must I Start Taking Required Minimum Distributions

Many taxpayers won’t have to take their first RMDs until April 1 of the year after they reach age 72, but the rule wasn’t always this generous.

It was age 70½ before the passage of the Setting Up Every Community for Retirement Enhancement Act in December 2019. Anyone who is covered by the old rules has already begun paying RMDs and must continue to do so. Everyone else can wait until April 1 of the year following the year in which they reach age 72.

If you wait until the last minute for your first RMD, you will effectively have to take two RMDs in the same calendar year. That’s because the deadline for your first RMD is April 1, but all subsequent RMDs are due December 31. Therefore, if you turn 72 in 2021 wait until March 31, 2022 to make your first RMD, you’ll have to take another RMD in December 2022.

You May Like: How Much Should I Have In 401k

Tips On Retirement Income Planning

- A financial advisor can be a big help in putting together a retirement income plan that accounts for living expenses, taxes and other considerations. SmartAssets free tool matches you with up to three financial advisors in your area, and you can interview your advisor matches at no cost to decide which one is right for you. If youre ready to find an advisor who can help you achieve your financial goals, get started now.

- To avoid a stiff penalty, make sure you withdraw your RMDs by the appropriate deadline. But dont worry. Most people satisfy their RMDs and then some within a given year. And to help you avoid some pitfalls, our retirement experts published a report on tips for understanding required minimum distribution rules.

Required Minimum Distributions For Ira Beneficiaries

Information on this page may be affected by coronavirus relief for retirement plans and IRAs.

| IRA owner dies on or after required beginning date |

Spouse may treat as his/her own, or Distribute over spouses life using Table I*

Distribute based on owners age using Table I

|

Distribute using Table I

|

Table I |

Don’t Miss: Can You Take Out Your 401k To Buy A House

Donate Your Rmd To Charity

If you are charitably inclined, consider a qualified charitable distribution, or QCD. This move allows IRA owners age 70½ or older to transfer up to $100,000 directly to charity each year. The QCD can count as some or all of the owners RMD, and the QCD amount wont show up in adjusted gross income.

The QCD is a particularly smart move for those who take the standard deduction and would miss out on writing off charitable contributions. But even itemizers can benefit from a QCD. Lower adjusted gross income makes it easier to take advantage of certain deductions, such as the write-off for medical expenses that exceed 7.5% of AGI in 2020. Because the QCDs taxable amount is zero, the move can help any taxpayer mitigate tax on Social Security or surcharges on Medicare premiums.

Say your RMD is $20,000. You could transfer the whole $20,000 to charity and satisfy your RMD while adding $0 to your AGI. Or you could do a nontaxable QCD of $15,000 and then take a taxable $5,000 distribution to satisfy the RMD.

The first dollars out of an IRA are considered to be the RMD until that amount is met. If you want to do a QCD of $10,000 that will count toward a $20,000 RMD, be sure to make the QCD move before taking the full RMD out.

Of course, you can do QCDs in excess of your RMD up to that $100,000 limit per year.

Youre Our First Priorityevery Time

NerdWallet, Inc. is an independent publisher and comparison service, not an investment advisor. Its articles, interactive tools and other content are provided to you for free, as self-help tools and for informational purposes only. They are not intended to provide investment advice. NerdWallet does not and cannot guarantee the accuracy or applicability of any information in regard to your individual circumstances. Examples are hypothetical, and we encourage you to seek personalized advice from qualified professionals regarding specific investment issues. Our estimates are based on past market performance, and past performance is not a guarantee of future performance.

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Also Check: Can You Have Your Own 401k

Required Minimum Distribution Calculator

SECURE Act Raises Age for RMDs from 70½ to 72: The Setting Every Community Up for Retirement Enhancement Act of 2019 raised the age when you must begin taking RMDs from a traditional 401 or IRA from 70½ to 72. If you turned 70½ years old on or after January 1, 2020, this laws changes apply to you and you do not have to begin taking RMDs until April 1 of the year following the year that you turn age 72. If you turned 70½ years old in 2019, the law’s changes do not apply to you.

Note: If your spouse is more than ten years younger than you, please reviewIRS Publication 590-Bto calculate your required minimum distribution.

Can I Donate My Rmd To Charity And Avoid The Taxes

Yes. A qualified charitable distribution is not subject to ordinary federal income taxes the amount is simply excluded from your taxable income. In general, QCDs must be reduced by deductible IRA contributions made for the year you reach age 70½ or later. If you’ve made deductible IRA contributions for the year you turn 70½ or later, consult a qualified tax advisor prior to taking a QCD to determine the amount by which your QCD must be reduced.

Making QCDs can be a great strategy for anyone who’s charitably minded and doesn’t need his or her full RMD. In many cases, it’s more advantageous than taking the withdrawal and then donating it, because cash donations have deductibility limits.

Recommended Reading: What Age Can You Take Out 401k

What If You Dont Hit The Required Minimum Distribution Amount

You will have to pay a fairly significant tax penalty if you do not take the minimum distribution. Youll pay a 50% tax rate on required money that was not withdrawn.

However, there are steps you can take to fix a missed RMD deadline. The first step is to correct your mistake by taking the RMD amount that you previously failed to take. Next, you need to notify the IRS of your mistake by filing IRS Form 5329 and attaching a letter explaining why you failed to take the required withdrawal. The IRS will consider waiving the penalty tax due to a reasonable error, which may include illness, a change in address or faulty advice on your distribution.

Calculate The Required Minimum Distribution From An Inherited Ira

If you have inherited a retirement account, generally you must withdraw required minimum distributions from an account each year to avoid IRS penalties. RMD amounts depend on various factors, such as the beneficiary’s age, relationship to the beneficiary, and the account value. If inherited assets have been transferred into an inherited IRA in your name, this tool may help determine how much you need to withdraw and which distribution method might work best for your unique situation. Get started below.

Read Also: Can I Take 401k Money To Buy A House

What Are Required Minimum Distributions

Required Minimum Distributions generally are minimum amounts that a retirement plan account owner must withdraw annually starting with the year that he or she reaches 72 , if later, the year in which he or she retires. However, if the retirement plan account is an IRA or the account owner is a 5% owner of the business sponsoring the retirement plan, the RMDs must begin once the account holder is age 72 , regardless of whether he or she is retired.

Retirement plan participants and IRA owners, including owners of SEP IRAs and SIMPLE IRAs, are responsible for taking the correct amount of RMDs on time every year from their accounts, and they face stiff penalties for failure to take RMDs.

Those Waived 2020 Rmds

Generally speaking, if you already were taking RMDs before 2020 i.e., you had already reached age 70½ you would simply resume those distributions this year, using the current life expectancy tables, your age and your account balance at the end of 2020, Slott said.

“Some may be surprised and find their RMD is bigger,” Slott said. “Their balance on Dec. 31, 2020, may have been much higher , so their RMD is higher.”

If you turned 70½ in the first half of 2019 and planned to take advantage of the April 1, 2020, deadline for taking out the RMD and did not do it due to the federal waiver this will be your first year of taking RMDs, Slott said. It must be taken by Dec. 31.

“They caught a break by procrastinating,” Slott said. “Their first two RMDs were waived, so this will be their first year of taking it.”

If you turn 72 this year, you have until April 1, 2022, of course, to take your 2021 RMD. Be aware, however, that delaying it would not mean it can be subject to the updated life expectancy tables that take effect next year, Slott said. Your 2022 RMD would use the new measurements.

“You’d have two tables to use: the current table for the 2021 RMD and the new one for the 2022 RMD,” Slott said.

Be aware that you must calculate the RMD for each retirement account subject to the withdrawal rules.

Read Also: Can I Open A 401k Without An Employer

Why Do Required Minimum Distributions Exist

Investment gains within a retirement account aren’t taxed until they’re withdrawn. If you have other sources of income, and if RMDs didn’t exist, you could hypothetically live off your other sources of income and never pay taxes on the retirement account gainsthey could potentially be passed onto family or friends as an inheritance without creating a taxable scenario.

Enforcing RMDs is the government’s way of making sure the IRS receives taxes on the gains held within a retirement account.

Account-holders are therefore required to withdraw a minimum amount from their retirement fundsand pay tax on that moneyeach year after they reach a certain age. You must do so by April 1 of the year following the year in which you reach age 72. After the first RMD, you must continue taking RMDs annually by December 31.

Are There Penalties For Not Taking My Rmd

The penalty for not taking a required minimum distribution is a tax of 50% on any amounts that were not withdrawn in time. The penalty can be waived, however, if you can establish that you failed to take the RMD due to reasonable error and that you’ve taken steps to correct the situation. You can file Form 5329 with the IRS to request a waiver from the penalty, along with a letter explaining what went wrong.

Also Check: Where Can I Get 401k Plan