Watch Out For Penalties

If you retire before traditional retirement age, youll need to be extra careful where you withdraw the money from.

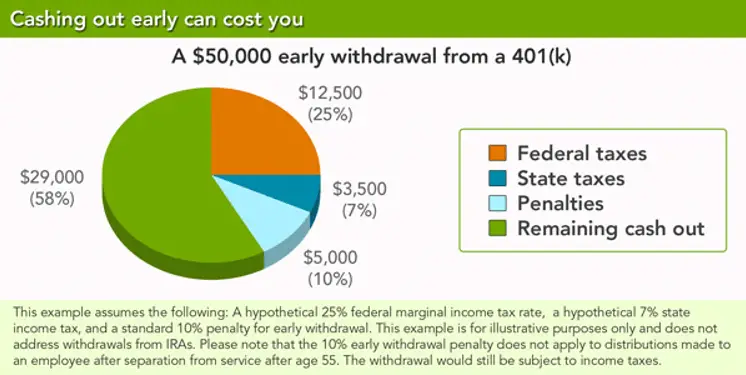

Withdrawing from certain accounts before you reach the retirement age required could result in a 10% penalty for early withdrawals or early distributions.

In general:

You can withdraw money from IRAs and 401s without a penalty after reaching age 59 ½. Withdrawing before that age could result in penalties on 401 and IRA distributions.

There is a special rule for 401 accounts that may allow you to withdraw funds at age 55 without an early withdrawal penalty.

If you were still working at the employer that held your 401 in the calendar year you turn age 55 and retire, quit or are fired, you can withdraw money from that account without penalties.

This only works for money in the 401 at that employer, though.

Whats The Perfect Way To Withdraw Funds

The perfect way to withdraw the money needed to fund your retirement is a unique solution for you.

Remember to take RMDs if youre required to.

After that, there are plenty of options you can mix and match based on the types of accounts you hold.

Keep in mind:

Youll need the money to fund your entire retirement.

Dont use up all of your tax advantages in the beginning unless thats what makes the most financial sense for you.

What Are The Disadvantages Of Borrowing Money From Your 401

- If you don’t repay your plan loan when required, it will generally be treated as a taxable distribution.

- If you leave your employer’s service and still have an outstanding balance on a plan loan, you’ll usually be required to repay the loan in full within 60 days. Otherwise, the outstanding balance will be treated as a taxable distribution, and you’ll owe a 10 percent penalty tax in addition to regular income taxes if you’re under age 59½.

- Loan interest is generally not tax deductible .

- In most cases, the amount you borrow is removed from your 401 plan account, and your loan payments are credited back to your account. You’ll lose out on any tax-deferred investment earnings that may have accrued on the borrowed funds had they remained in your 401 plan account.

- Loan payments are made with after-tax dollars.

You May Like: How Much You Should Contribute To 401k

When You Don’t Take An Rmd

If you are subject to RMDs, it is extremely important to withdraw this money by the deadlines.

If you dont take an RMD:

Youll be subject to a penalty of 50 percent of the value of the RMD, which is basically giving money away.

You dont have to spend the money, but you do have to remove it from the retirement plan it is in according to the rules.

You can learn more about RMDs, how theyre calculated in regards to life expectancy and everything else you need to know at the IRSs RMD resource page.

After you take your RMD, you have a few other places you can withdraw money from, as well.

Early Withdrawals From Roth Retirement Accounts

You may be able to withdraw funds from Roth retirement accounts early without penalties, too.

In general, you can withdraw only the money you contributed without paying taxes or penalties. This is because you already paid income taxes on this money.

Things get more complicated if you withdraw earnings early. In some cases, you can withdraw earnings penalty and income tax free, too.

To withdraw earnings from a Roth IRA without paying penalties or income tax, you must take the withdrawal:

- at least five years or more after you open the account, and

- be withdrawing money because you suffered a disability, or

- youre using up to $10,000 for a first home purchase within 120 days of withdrawal.

Also Check: How Much In 401k To Retire

At What Age Can You Withdraw From 401k

You can withdraw your money at any age, but if most people do so before age 55 , then theyâll have to pay a penalty on their withdrawal. There are also other exceptions to the age 50 rule including those with total and permanent disability and medical expenses exceeding 7.5% of your adjusted gross income. You can also make withdrawals without penalty because of an IRS levy plan, qualifying disaster distributions and your status as active duty military or a qualified reservist.

What Qualifies For A Hardship Withdrawal From A 401

If your 401 plan allows hardship distributions, they can only be made if the distribution is due to a heavy and immediate financial need. The distribution is also limited to the amount necessary to meet that need. Immediate financial needs include medical care expenses, costs related to buying a home, tuition and fees for higher education, payments to prevent eviction or foreclosure, funeral expenses, and certain expenses for repairing a home. You may need to document the expense so the plan knows it only distributed the amount necessary to cover the need.

Also Check: How Much Will I Have When I Retire 401k

How Much Can You Withdraw

Generally, you can’t withdraw more than the total amount you’ve contributed to the plan, minus the amount of any previous hardship withdrawals you’ve made. In some cases, though, you may be able to withdraw the earnings on contributions you’ve made. Check with your plan administrator for more information on the rules that apply to withdrawals from your 401 plan.

What Is A 401k Cares Act Withdrawal

Normally, participants who withdraw money from a tax-deferred retirement account before reaching age 59½, must pay a 10% early withdrawal penalty in addition to including the distribution in their taxable income for the year.

There are a few exceptions to the rule, including one for hardships, such as avoiding foreclosures, repairing your home after a disaster, or covering out-of-pocket medical expenses. However, these hardship withdrawals are normally limited to the amount needed to meet a limited list of hardships.

The CARES Act provided more flexibility for making emergency withdrawals from a tax-deferred retirement account by eliminating the 10% early withdrawal penalty. Participants are allowed to withdraw up to $100,000 per person without being subject to a tax penalty. Any early withdrawals above that amount dont qualify for special tax treatment.

It is important to note that the withdrawal is taxable income the special tax treatment waives the tax penalty but not the taxable event. However, the CARES Act allows people who take hardship distributions to elect to pay federal income taxes on the distribution over a three-year period or repay the distribution amount over a three-year period and avoid tax consequences entirely. The three-year repayment period starts on the day of the distribution.

Don’t Miss: What Happens To My 401k If I Switch Jobs

Withdrawing When You Retire

After you reach the age of 59 1/2, you may begin taking withdrawals from your 401. If you leave your job in the calendar year when you turn 55 or later, you can also begin taking penalty-free withdrawals from the 401 you had with that current company. If you are a public safety worker, this rule takes effect at the age of 50.

Once you reach 72, you are actually obligated to begin making required minimum distributions or RMDs.

Follow The Required Minimum Distribution Rules

Before the SECURE Act took effect on Jan. 1, 2020, the age at which you needed to withdraw required minimum distributions, or RMDs, from your IRA and other retirement plans was 70 1/2. You now are not required to withdraw from those plans until youre 72, which affords you a few extra years of tax-deferred growth.

If you dont take RMDs at the required age, you could face issues such as the excess accumulations penalty. This means youd have to pay a penalty of 50% excise tax for any years that you fail to take your required distributions.

Recommended Reading: Is A 401k Considered An Annuity

Cashing Out A : What A 401 Early Withdrawal Really Costs

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

The investing information provided on this page is for educational purposes only. NerdWallet does not offer advisory or brokerage services, nor does it recommend or advise investors to buy or sell particular stocks or securities.

Contributing to a 401 can be a Hotel California kind of experience: Its easy to get your money in, but its hard to get your money out. That is, unless youre at least 59½ years old thats when the door swings wide open for a 401 withdrawal. But try cashing out a 401 with an early withdrawal before that magical age and you could pay a steep price if you dont proceed with caution.

Follow The Rules For Rmds

RMD stands for required minimum distribution, and once you hit age 72, youll have to start taking this minimum amount of money from many retirement accounts, such as a traditional IRA or 401 plans.

You must take RMDs annually by April 1 of the year after you turn 72 and by Dec. 31 in subsequent years. In other words, if you turn 72 in 2021, you have until April 1, 2022, to take your first RMD.

The penalty for not following the rules is severe. Failure to make on-time RMDs triggers a whopping 50 percent excise tax.

Thats true if you underpay, too. Lets say your RMD for the year is $20,000 but you take only a $5,000 distribution because of a miscalculation. The IRS will levy the 50 percent penalty in this case $7,500, or half of the $15,000 you failed to withdraw.

When you calculate your RMD, be aware that it will change from year to year. Thats because its determined by your age, life expectancy and account balance, which will be the fair market value of the assets in your accounts on Dec. 31 the year before you take a distribution.

Check out the Uniform Life Table in IRS Publication 590-B to help figure what you must withdraw from your account.

Recommended Reading: Does Mcdonald’s Offer 401k

Withdrawal Taxes And Early Distributions

You might find yourself in a situation where you need the money in your 401 before you reach 59 1/2 years of age. The account is designed to be part of your retirement plan, but circumstances come up where you cant avoid dipping into the money for other reasons. Down payments, emergency medical bills and education costs are a few examples of expenses some people pay with 401 funds.

If this is the case for you, expect to pay a 10% penalty fee. This is on top of the income tax youll pay for withdrawing the funds. Remember, even if its paying for an emergency, its still counted for tax purposes as income. Youll want to run the numbers, adding the tax and penalty tax, to see if it makes sense to pull money out early. Its also important to factor in the opportunity cost of pulling your investments out of the market.

In some cases, there is an exception to the 10% additional tax. The IRS lists the circumstances where the tax doesnt apply. Losing your job at 55, or starting a SOSEPP plan are two examples. Youll still be on the hook for income taxes, of course.

Given the tax hit and opportunity cost of early withdrawals, its not ideal solution. Before you commit to a penalized withdrawal, consider if borrowing the money from your 401 might be a better solution.

How Much Tax Do I Pay On 401k Withdrawal

When you make an early withdrawal from a 401 account, youâll have to pay the normal taxes on that income. If you are working, that additional taxable income can put you in a higher tax bracket than you would have been if you had withdrawn the funds after retirement, which would have defeated much of the advantage of using the 401 in the first place.

Also Check: How Do I Know If I Have A 401k

What Is A 401k

A 401k allows you to dedicate a percentage of your pre-tax salary to a retirement account.

Employers can also choose to match some or all of the contributions, but this isn’t required so it’s not guaranteed.

There are two basic types of 401ks – traditional and Roth – with the main difference being how they’re taxed.

In a traditional 401k, employee contributions reduce their income taxes for the year they are made, but they’ll pay tax when they withdraw cash.

Retirement Savings Can Benefit

As you make loan repayments to your 401 account, they usually are allocated back into your portfolio’s investments. You will repay the account a bit more than you borrowed from it, and the difference is called “interest.” The loan produces no impact on your retirement if any lost investment earnings match the “interest” paid ini.e., earnings opportunities are offset dollar-for-dollar by interest payments.

If the interest paid exceeds any lost investment earnings, taking a 401 loan can actually increase your retirement savings progress. Keep in mind, however, that this will proportionally reduce your personal savings.

Also Check: When Can I Draw From My 401k Without Penalty

How Is Your 401 Taxed When You Retire At 60

Traditional 401 plans offer tax-deferred savings, which means that since the contributions are never included in your taxable income, you have to pay taxes on the withdrawals. For example, if you withdraw $15,000 from your 401 plan before age 60, that’s an additional $15,000 that will be included in your taxable income.

Loans To Purchase A Home

Regulations require 401 plan loans to be repaid on an amortizing basis over not more than five years unless the loan is used to purchase a primary residence. Longer payback periods are allowed for these particular loans. The IRS doesn’t specify how long, though, so it’s something to work out with your plan administrator. And ask whether you get an extra year because of the CARES bill.

Also, remember that CARES extended the amount participants can borrow from their plans to $100,000. Previously, the maximum amount that participants may borrow from their plan is 50% of the vested account balance or $50,000, whichever is less. If the vested account balance is less than $10,000, you can still borrow up to $10,000.

Borrowing from a 401 to completely finance a residential purchase may not be as attractive as taking out a mortgage loan. Plan loans do not offer tax deductions for interest payments, as do most types of mortgages. And, while withdrawing and repaying within five years is fine in the usual scheme of 401 things, the impact on your retirement progress for a loan that has to be paid back over many years can be significant.

If you do need a sizable sum to purchase a house and want to use 401 funds, you might consider a hardship withdrawal instead of, or in addition to, the loan. But you will owe income tax on the withdrawal and, if the amount is more than $10,000, a 10% penalty as well.

Don’t Miss: What Is The Minimum 401k Distribution

How Do I Avoid Taxes On My 401k Withdrawal

Heres how to minimize 401 and IRA withdrawal taxes in retirement:

Who Is Qualified For A 401 Qualified Disaster Distribution

Disaster relief is available to individuals who reside in FEMA declared disaster areas , such as areas impacted by hurricanes and wildfires that occurred after December 31st, 2019 through 60 days after the enactment of the law . An individual must have also suffered an economic loss due to the qualified disaster.

The Consolidated Appropriations Act also has provisions for disaster related hardship withdrawals:

Don’t Miss: Can You Have A Roth Ira And A 401k

How Long Does It Take To Get Your 401k Check From Merrill Lynch

Generally the review takes about 5-7 business days. If your application is approved, you will receive a notification that your promissory note and amortization schedule are available for your review. Once the promissory note terms have been accepted, it takes about 2-3 business days for the check to be mailed out.

Finding A Good Withdrawal Rate

One widely used rule of thumb on withdrawal rates for tax-deferred retirement accounts states that withdrawing slightly more than 4% annually from a balanced portfolio of large-cap equities and bonds would provide inflation-adjusted income for at least 30 years.

However, some experts contend that a higher withdrawal rate may be possible in the early, active retirement years if later withdrawals grow more slowly than inflation. Others contend that portfolios can last longer by adding asset classes and freezing the withdrawal amount during years of poor performance. By doing so, they argue, “safe” initial withdrawal rates above 5% might be possible.

Don’t forget that these hypotheses were based on historical data about various types of investments, and past results don’t guarantee future performance. There is no standard rule of thumb that works for everyoneâ your particular withdrawal rate needs to take into account many factors, including, but not limited to, your asset allocation and projected rate of return, annual income targets , and investment horizon.

You May Like: How To Roll Your 401k From Previous Employer

Heres What You Need To Know:

There are many IRS rules governing distributions. These are the key ones:

-

Traditional 401 and 403 accounts:

- Distributions are taxable.

- You may begin taking distributions without penalty once you are age 59-1/2 or because of disability or death.

- If you leave your company at age 55 or older, you may be able to begin taking penalty-free withdrawals right away.

- If you take a distribution before age 59-1/2 and do not qualify for an early withdrawal exception, you will have to pay a 10% federal tax penalty.

Roth 401 and 403 accounts:

You can, of course, withdraw more than your RMD, but you may want to consider leaving as much of your retirement savings in your account as possible. This way, your remaining savings have the opportunity to continue growing.