How To Set Up A Simple 401

A SIMPLE 401 can only be set up if an individuals employer offers the plan. While its a great idea to enroll, individuals should be careful to read the fine print for any fees they may incur.

Chad Parks, founder and CEO of Ubiquity Retirement + Savings, and a finance veteran with more than 21 years of experience in the industry, says any type of retirement plan can come with a wide range of fees, including management, participant and administrative fees.

You need to ask the questions and say, what investments are you using? And how much do those costs as a percentage of my assets? Is there or is there not a flat participant fee? says Parks. And the range is very broad. I mean theres very inexpensive and affordable plans and then there is very expensive and not so affordable plans.

While experts agree that enrolling in any employer-sponsored retirement plan with matching contributions is a great idea, individuals should always be aware of how much those plans are costing them.

Switching To A Regular 401 Plan

In general, SIMPLE plans are meant for companies with 100 or fewer employees. But as your workforce grows, it becomes increasingly important to reconsider the pros and cons of switching to a regular 401 plan. The higher contribution limits and greater potential for employer matching are reasons that your employees will be just as eager to make the change.

First things first: You cant have a SIMPLE IRA and a 401 plan within the same yearmeaning you cant switch to a new plan before the next January 1. It also means that you need to evaluate your plan design options well in advance of year-end.

Once youve decided to take the leap, youll need to let employees know by . You should also inform your payroll provider so it can cancel employee contributions to your soon-to-be defunct SIMPLE IRA going into the new year.

Thats what you need to consider when switching off of a SIMPLE IRA. Switching from a SIMPLE 401 to traditional plan tends to be an easier proposition. Why? Think of your SIMPLE 401 as a traditional plan with a special provisions attached.

While you still cant switch until January, changing the plan to a regular 401 plan requires adopting an amendment on or before the last day of the current year and providing a restated summary plan description to all employees. Work with your retirement provider or financial advisor to make these adjustments.

What Happens To My 401k If I Change Jobs

You have a couple of options, but the one most would recommend is a 401k rollover. A 401k rollover is when you transfer your funds from your employer to an individual retirement account or to a 401k plan with your new employer. A much less popular option is to cash out your 401k, but this comes with massive penalties income tax, and an additional 10% withholding fee.

Also Check: How Do I Change My 401k Contribution Fidelity

What Is The Major Limitation Of A Simple Retirement Plan

biggestSIMPLE401, and those 50 or older will get a $26,000 maximum.

What is simple 401k?

A SIMPLE 401 plan is a mix between a SIMPLE IRA and a traditional 401 plan. It has similar benefits to a regular 401 plan, but it works for smaller companies that can’t take on big retirement plans for their employees. To qualify for a SIMPLE 401, your company needs to: Have 100 employees or less.

Do all employees have to participate in a Simple IRA?

All employees who received at least $5,000 in compensation from you during any 2 preceding calendar years and who are reasonably expected to receive at least $5,000 in compensation during the calendar year, are eligible to participate in the SIMPLE IRA plan for the calendar year.

A Guide To Simple 401 Plans

A Savings Incentive Match Plan for Employees, or SIMPLE plan, can come in the form of an IRA or a 401. While both SIMPLE plans are a lot alike, the 401 plan is a little easier to understand and put into place for employers. So if youre a small business owner, you may want to consider setting up a SIMPLE 401 plan for your company and employees. Below, we go over the pros and cons of SIMPLE 401 plans, as well as other important characteristics and alternatives.

You May Like: Do I Have A 401k From A Previous Employer

What Will Be The Future Value Of Your 401k

Will your 401k savings be enough to secure your financial future?

The last thing you’d want is to reach retirement age realizing that you’re going to need to work for another 20 years.

Proper financial planning results in a secure future, and your 401k can be a key contributor. This simple 401k Calculator will show what role your 401k will play in plotting your path to your golden years.

What Is A Simple 401 Plan & How Do You Utilize It

Were here to help! First and foremost, SoFi Learn strives to be a beneficial resource to you as you navigate your financial journey.Read moreWe develop content that covers a variety of financial topics. Sometimes, that content may include information about products, features, or services that SoFi does not provide.We aim to break down complicated concepts, loop you in on the latest trends, and keep you up-to-date on the stuff you can use to help get your money right.Read less

The Savings Incentive Match Plan for Employees 401, otherwise called a SIMPLE 401, is a simplified version of a traditional 401. SIMPLE plans were created so that small businesses could have a cost-efficient way to offer a retirement account to their employees.

SIMPLE plans were created so that small businesses could have a cost-efficient way to offer a retirement account to their employees.

SIMPLE 401 plans do not require annual nondiscrimination tests, which ensure that a plan is in line with IRS rules. This type of testing usually has to be done by professionals, which can be prohibitively expensive for small employers, preventing them from using other types of 401s.

For employees whose employer already offers a SIMPLE 401, getting to know the ins and outs of the plan can help to understand the role they play in saving for retirement.

Also Check: How To Rollover 401k To Charles Schwab

Rollovers As Business Start

ROBS is an arrangement in which prospective business owners use their 401 retirement funds to pay for new business start-up costs. ROBS is an acronym from the United States Internal Revenue Service for the IRS ROBS Rollovers as Business Start-Ups Compliance Project.

ROBS plans, while not considered an abusive tax avoidance transaction, are questionable because they may solely benefit one individual â the individual who rolls over his or her existing retirement 401 withdrawal funds to the ROBS plan in a tax-free transaction. The ROBS plan then uses the rollover assets to purchase the stock of the new business. A C corporation must be set up in order to roll the 401 withdrawal.

What Are The Pros Of A Simple 401 Plan

SIMPLE 401s offer a number of benefits that make them attractive to employers and employees.

Simplified rules: While large companies may have the money and staff to devote to nondiscrimination testing, smaller companies may not have the same resources. SIMPLE 401 do not have these compliance rules, making them more accessible for small employers. Whats more, the straightforward benefit formula is easy for employers to administer. Free money: Employees are guaranteed employer contributions to their retirement account, whether via 3% matching contributions or 2% nonelective contributions. Fully-vested contributions: All contributionsthose made by employees and their employersare fully vested immediately. Employees who qualify for distributions can take money out whenever they need it. While this can be good news for employees, for employers it removes the option to incentivize workers to stay in their job longer by having their contributions vest several years into their tenure with the company. Loans and hardship withdrawals: While withdrawals made before age 59 1/2 are subject to tax and a possible 10% early withdrawal penalty, employees can take out loans against their SIMPLE 401 just as they can with a traditional 401. These options add flexibility for individuals who need money in an emergency. Its important to note that 401 loans come with strict rules for paying them back. Failing to follow these rules may result in stiff penalties.

Don’t Miss: How To View Your 401k

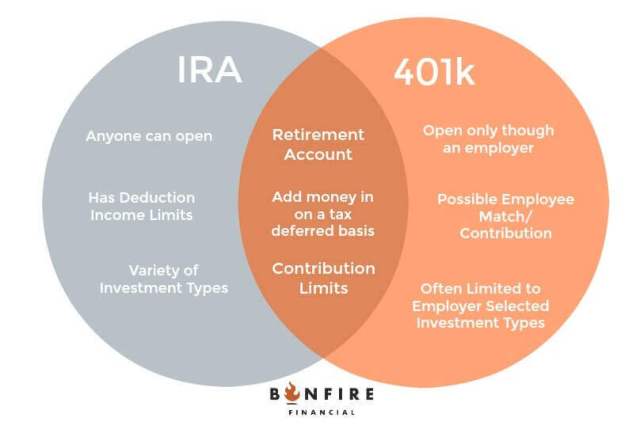

How 401s And Simple Iras Work

To start, it helps to understand how these plans are the same.

Both plans allow employees to automatically contribute a percentage of each paycheck to a retirement investment account. This contribution is not subject to IRS income taxes when its deposited, nor is it subject to capital gains taxes as it grows. The money gets to grow tax-free until the employee withdraws during retirement.

Both plans also allow employers to make a tax-advantaged contribution to their employees accounts.

So at their core, 401s and SIMPLE IRAs are very similar. Where they differ is in the details. Well take a look at those next.

Rules For Simple Ira Rollovers To 401 Plans

Transferring your SIMPLE IRA assets to a 401 is straightforward. But you must complete the rollover within the terms of your SIMPLE IRA plan and the IRS rules to ensure that the rollover qualifies as a tax-free, penalty-free trustee-to-trustee transfer.

You can only make a tax-free rollover from a SIMPLE IRA to a 401 following a two-year period. The clock starts running from the date you first participated in the plan .

You will have to pay taxes if you don’t comply with the two-year rule. Within the two-year period, if you proceed to roll over your SIMPLE assets into a 401 plan, the amount will be treated as a withdrawal, and you will have to include the withdrawal in your taxable income for that year. You would, therefore, be taxed on the amount.

You may be on the hook for an increased age-related penalty. The 10% penalty you’d pay if you’re younger than 59.5 increases to 25% if you roll over your SIMPLE IRA within the two-year period unless you qualify for an exception. Changing jobs in itself is not considered an exception however, you may qualify for an exception if the amount you withdraw is less than the amount you pay for health insurance while you’re unemployed.

Your SIMPLE IRA must be in place for at least two years from the date of plan participation to qualify for a tax-free rollover to a 401.

Also Check: How To Claim 401k From Previous Employer

Not A Math Whiz No Worries

You can find out how much your 401k will grow without the help of a financial wizard. Simply provide the required inputs variables and quickly calculator what your 401k will grow to in the future.

Play around with the actuals and the extras to model various what if scenarios to reach your financial goals. This Simple 401k Calculator can be your best tool for creating a secure retirement. The following step-by-step procedure will show you how

Calculating the compound interest growth and future value of your monthly contributions is as simple as entering your beginning balance, the combined contributions , an estimate of your return on investment, and the number of years until retirement.

Related:5 Financial Planning Mistakes That Cost You Big-Time Explained in 5 Free Video Lessons

Administration More Rules Means More Responsibilities

Because 401s are so much more flexible than SIMPLE IRAs, it should come as no surprise theyre also subject to more complicated rules. Employers have a fiduciary responsibility to ensure these rules are met.

As you might imagine, being a plan fiduciary includes a lot of administrative responsibilities. These include

- Sending notices and enrolling new employees as they become eligible

- Depositing contributions into participant accounts in a timely manner

- Running annual nondiscrimination testing to ensure the plan doesnt favor high-earners

- Filing Form 5500 with the IRS at the end of every year

- …and much more.

The good news? A competent 401 provider will complete the more difficult and time-consuming tasks for you and provide simple direction for you to complete the rest.

Depending on the size of your business, how often you hire new employees, how often you run payroll, as well as which 401 provider you work with, this might take you no more than 16-20 hours a year.

If keeping your plan administration responsibilities to a minimum is a high priority for you, a SIMPLE IRA might be a better option.

| 401 vs SIMPLE IRA – Administrative Responsibilities |

|

Administrative simplicity isnt the only advantage of a SIMPLE IRA – they can oftentimes be cheaper than 401 plans as well.

You May Like: How To Transfer 401k From Fidelity To Vanguard

Variables To Consider And Not

To many, what matters most is getting a ballpark figure of how much money they will have when they hit their 60s â a simple and matter-of-fact figure in dollars!

While there are only four input variables in this calculator, it’s important to consider how you arrive at each variable. For example, when figuring out your total monthly contributions, include:

- Your average monthly contributions.

- Your employer’s average monthly contributions â sometimes called a match.

- Any catch-up contributions in order to reach your desired future goal.

- Limitations due to being a highly-compensated employee.

Only focus on the variables presented in this calculator. Never go into the details of something that is completely out of your control like inflation, salary growth, changes in federal law, or changes in employment policies.

This 401k contribution calculator helps streamline the process of figuring out how much you should contribute toward your 401k to meet your future goal. It simulates that if you contribute X that you’ll end up with Y in a future date, without unnecessary complication.

Simply take a few moments to run a couple of scenarios and figure out how much you should be contributing toward your 401k â preparing now will result in a more rewarding retirement later.

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

Don’t Miss: How To Roll An Old 401k Into A New 401k

Should You Choose A Simple Ira

If your employer offers a SIMPLE IRA and youre eligible for the plan, its a good idea to participate, especially if the employer provides matching contributions. Matching contributions are free money, and with a SIMPLE IRA that money is immediately yours as soon as it hits your account.

If youre an employer with 100 or fewer employees and want to provide an employee retirement benefit, a SIMPLE IRA can be a solid choice that allows you to attract high-quality workers without some of the paperwork and hassle that can come with a 401. However, its important to review your options and consider whether it makes sense for you. Remember that youll likely have to provide some amount of employer contribution as long as you have a SIMPLE IRA retirement plan.

Sales Loads Severely Reduce Contributions

These are basically sales commissions, usually paid to a broker. They work by taking a percentage of the money invested – either when it is first put into the fund or when its taken out .

For example, some providers might take a front-end load of up to 5.75% from SIMPLE IRA participants every time they put money into their accounts.

Not only can fees like these completely eradicate the SIMPLE IRA match, but they can also put a huge dent in participants accounts over time thanks to the power of compound interest.

Because 401s are more strictly regulated, their investments are less likely to include sales loads.

However, thats not to say that 401s are without their own hidden dangers…

Don’t Miss: How Much Is 401k Taxed

Heres How To Establish A Simple Ira

Opening a SIMPLE IRA is similar to opening a traditional IRA. However, if youre a business owner, there are additional reporting requirements and documents you must fill out to establish the plan. Most IRA providers offer SIMPLE IRAs that you can open online.

There are three steps to setting up a SIMPLE IRA plan:

Pick the type of SIMPLE IRA plan you want to use by filing either IRS Form 5305-SIMPLE or IRS Form 5304-SIMPLE .

Provide eligible employees information about the SIMPLE IRA plan.

If you work at a company that offers a SIMPLE IRA, your employer will have you fill out one of the forms above to establish an individual account.

S Offer Higher Elective Deferral Limits

With 401s, employees can defer up to $19,500 per year.

With SIMPLE IRAs, elective deferrals max out at $13,500.

Catch-up contributions also follow this trend. SIMPLE IRAs allow an additional $3,000 for employees over the age of 50, while 401s allow for over twice that amount at $6,500.

The 401s larger employee contribution limit translates to greater savings and a lower taxable income for plan participants. Not only does this make 401 plans more powerful for business owners who want to maximize their retirement savings, but it also makes the benefit more attractive to employees and job candidates who want to do the same.

The higher savings potential of a 401 doesnt end there.

Read Also: How To Transfer 401k From Vanguard To Fidelity