The Basics Of 401 Withdrawal Taxes

If you are wondering whether your 401 withdrawals are taxed, the short answer is yes your 401 distributions are likely taxable.

This may come as a surprise, because there is some confusion around how retirement accounts work. People often refer to retirement accounts like 401s as tax-advantaged, or tax-deferred. This means investments within your 401 or IRA grow tax-free. Unlike taxable investment accounts, you wont be charged income tax or capital gains tax as your 401 account grows each year.

As an example, if you earn $1,500 before taxes per paycheck, and you contribute $300 of that money to your 401, then you will only be taxed on $1,200. For reference, 401 account holders can contribute up to $19,500 in 2021 , and $26,000 for those 50 and older.

This tax advantage, however, changes once an account holder starts receiving distributions from the 401. As you pull money out, youll owe income taxes on the funds. Some 401 plans will automatically withhold 20% or so of your account to pay for taxes. Youll want to check with your plan provider to see how your particular 401 works.

Wondering when you can start cashing out? Once you reach age 59.5 you can withdraw money from your 401. If you dont need the money yet, you can wait until you reach age 72 to withdraw funds. However, once you reach 72, its no longer a choice to withdraw from your 401, its mandatory. The IRS has defined required minimum distributions for certain retirement accounts, including 401s.

Important Tax Considerations For Lump

If you choose to withdraw your STRS Ohio account, there are important tax implications.

If you choose to have your withdrawal paid directly to you:

- Your payment will be taxed in the year it is issued.

- STRS Ohio will withhold federal tax at a rate of 20%.

- If you receive the payment before age 59-1/2, you may have to pay a 10% tax penalty for an early withdrawal.

You may roll over your withdrawal amount to an eligible retirement account that will accept your rollover and:

- Your payment will not be taxed in the current year and no taxes will be withheld.

- The funds rolled over will be taxed when removed from the account to which they were deposited.

Beginning in the year you reach age 72 or terminate employment, whichever is later, a certain portion of your payment cannot be rolled over because it is a required minimum payment that must be paid to you. STRS Ohio can tell you if your payment includes amounts that cannot be rolled over.

There are other tax implications if you withdraw your STRS Ohio account. Review our brochure titled

How To Minimize Taxes On 401 Withdrawals

Now that youre finally taking withdrawals from that 401 youve been contributing to for decades, how are 401 withdrawals taxed? Withdrawalsdistributions, in retirement-plan speakrequire you to pay taxes on what you take out, in most cases, effectively reducing your nest egg. What do you do? Here are several ways to minimize taxes on withdrawals.

You May Like: What Should I Do With My Old Company 401k

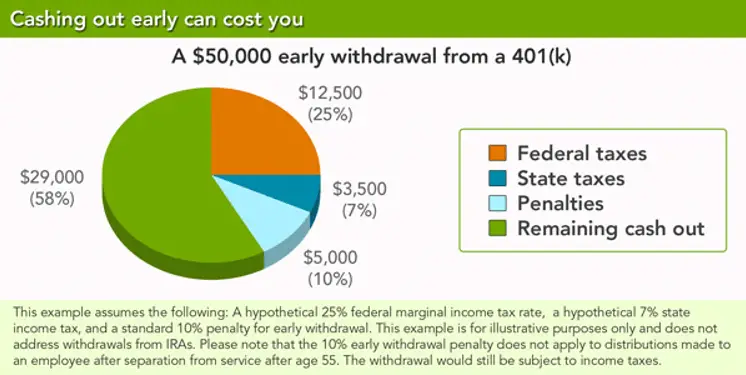

Calculating The Basic Penalty

Assume you have a 401 plan worth $25,000 through your current employer. If you suddenly need that money for an unforeseen expense, there is no legal reason you cannot simply liquidate the whole account. However, you are required to pay an additional $2,500 at tax time for the privilege of early access. This effectively reduces your withdrawal to $22,500.

Taxes Withheld From Distributions For Active Employees

When you take a distribution from your deferred compensation accounts, you will pay taxes on the distribution. The amount of tax you pay depends on several factors:

- The amount you withdraw in a calendar year, and your income in that year

- The type of Plan you have 401 or 457

- Your age and employment status

Basically, any amount you withdraw from your 401 account has taxes withheld at 20%, and if you’re under age 59½, you’ll be taxed an additional 10% when you file your return.

Any amount you withdraw from your 457 account has taxes withheld at 20%. However, if you select a periodic distribution over 10 years, then only 10% is withheld for taxes.

Employees Retirement System of Texas

Recommended Reading: How To Roll 401k Into New Job

See If You Qualify For An Exception To The 10% Tax Penalty

Generally, the IRS will waive it if any of these situations apply to you:

-

You choose to receive substantially equal periodic payments. Basically, you agree to take a series of equal payments from your account. They begin after you stop working, continue for life and generally have to stay the same for at least five years or until you hit 59½ . A lot of rules apply to this option, so be sure to check with a qualified financial advisor first.

-

You leave your job. This works only if it happens in the year you turn 55 or later .

-

You have to divvy up a 401 in a divorce. If the courts qualified domestic relations order in your divorce requires cashing out a 401 to split with your ex, the withdrawal to do that might be penalty-free.

Other exceptions might get you out of the 10% penalty if you’re cashing out a 401 or making a 401 early withdrawal:

-

You become or are disabled.

-

You rolled the account over to another retirement plan .

-

Payments were made to your beneficiary or estate after you died.

-

You gave birth to a child or adopted a child during the year .

-

The money paid an IRS levy.

-

You were a victim of a disaster for which the IRS granted relief.

-

You overcontributed or were auto-enrolled in a 401 and want out .

-

You were a military reservist called to active duty.

How Taxes And Rmds Affect Retirement Withdrawals

Generally, your first stop for withdrawals should be RMDs from tax-deferred accounts or any account that requires a lifetime RMD. That’s because any RMD that hasn’t been withdrawn for the year could be subject to a 50% tax penalty.3 This is where donating to charity, in other words a qualified charitable distribution , can both satisfy the RMD and avoid a taxable event.

Next, consider withdrawing from accounts that are taxable to youregardless of whether you spend or reinvest those distributions. Examples include capital gains, dividends, and interest.

For most retirees, withdrawing more than the RMD from tax-deferred accounts generally should be the last choice. This is due to the way these accounts are taxedevery dollar withdrawn from tax-deferred accounts is taxed as ordinary income.

However, if you’re in a year in which your overall income is lower than normal, or if you feel your future tax rate will go up, you may want to think differently. Consider drawing from tax-deferred money up until the point that it would push you into the next marginal tax bracket.

Update for 2020: Because of the CARES Act, which was passed in late March 2020, you can choose not to take your RMD this year, leaving your funds invested longer instead of taking a withdrawal in a volatile market.

Read Also: Who Do I Call About My 401k

Do You Need To Deduct 401 Contributions On Your Tax Return

You do not need to deduct 401 contributions on your tax return. In fact, there is no way for you to deduct that money.

When employers report your earnings at the end of the year, they account for the fact that you made 401 contributions. To give you an example, lets say you have a salary of $50,000 and you contribute $5,000 into a 401 account. Only $45,000 of your salary is taxable income. Your employer will report that $45,000 on your W-2. So if you try to deduct the $5,000 when you file your taxes, you will be double-counting your contributions, which is incorrect.

What Are The Rules For 403 B Withdrawals

Once youre eligible, you can withdraw as much or as little as you want from your 403 account until youre 70 1/2 ears old. After that, you have to withdraw at least a minimum amount each year or face a tax penalty. The minimum required distribution amount depends on the total account balance and your age.

You May Like: How To Calculate Employer 401k Match

Figuring Out Your Taxes On A Traditional 401

Distributions from a regular, or traditional, 401 are fairly simple in their tax treatment. Your contributions to the plan were paid with pre-tax dollars, meaning they were taken “off the top” of your gross salary, reducing your taxable earned income and, thus, the income taxes you paid at that time. Because of that deferral, taxes become due on the 401 funds once the distributions begin.

Usually, the distributions from such plans are taxed as ordinary income at the rate for your tax bracket in the year you make the withdrawal. There are, however, a few exceptions, including if you were born before 1936 and you take your distribution as a lump sum. In such a case, you may qualify for special tax treatment.

The situation is much the same for a traditional IRA, another tax-deferred retirement account that’s offered by some smaller employers or may also be opened by an individual. Contributions to traditional IRAs are also made with pre-tax dollars, and so taxes are due on them when the money’s withdrawn.

The federal income tax filing deadline for individuals has been extended from April 15, 2021, to May 17, 2021. Payment of taxes owed can be delayed to the same date. Your state tax deadline may not be delayed.

If you were affected by the Texas snowstorm disaster in February 2021, your deadline has been moved to June 15, 2021. If you don’t live in Texas but were affected by the storm, you may still be eligible for the delayed deadline.

Making Your 401 Last Through Your Retirement

As you plan for retirement, its important to keep in mind that youll likely owe a significant amount of your income in taxes. Thats why its a good idea to save aggressively now, while you still have time, so you have enough income to retire later on. Understanding how taxes will affect your income in retirement can be a powerful savings motivator.

If youre close to retirement age and your savings are not quite where they should be, check out these six last-minute retirement planning strategies to help you get on track.

Read Also: How Do I See How Much Is In My 401k

How Taxes Impact Your Total Income

Depending on your tax bracket, you could end up losing a substantial amount of your income. Under the new tax plan, there are seven tax brackets. If you withdrew $30,000 from your 401, you would fall into the 12% tax bracket, meaning youd have less than the original $30,000 after taxes.

| Single filers: $418,401 or more | Head of household: $444,551 or more |

Can I Leave My Money In My 401 Plan After I Terminate Employment

It depends upon your account balance and the terms of your 401 plan. The IRS allows 401 plans to automatically cash-out small account balances defined as less than $5,000 without the owners consent upon their termination of employment. Under these rules, account balances between $1,000 and $5,000 must be rolled over into a personal IRA for the benefit of the employee. Amounts below $1,000 can be paid out by check.

To find the cash-out limit applicable to your 401 plan, check your plans Summary Plan Description . If your account exceeds this limit, you can postpone withdrawals until the date you must start taking Required Minimum Distributions.

Also Check: When Can I Set Up A Solo 401k

What To Know About Early Withdrawals

Your 401 funds are meant to be your safety net in retirement, so taking money out before retirement isn’t a great idea. But if you’re in a financial pinch, you may not have another choice. Just know you will be responsible for paying taxes on your withdrawals, even if you’re not retired yet. This will raise your tax bill for the year, though how much depends on the size of your withdrawal and how much other income you earn during the year.

If you’re under 59 1/2 when you make your 401 withdrawal, you’ll also pay a 10% early withdrawal penalty unless you qualify for an exception. Exceptions include medical expenses that exceed 7.5% of your adjusted gross income , a first-home purchase, or becoming permanently disabled, among other life events. Note that these exceptions don’t get you out of paying taxes on your withdrawals they only eliminate the 10% penalty.

The federal government waived the 10% early withdrawal penalty in 2020 due to the COVID-19 pandemic. It has also given people who take withdrawals in 2020 up to three years to pay that money back, rather than making them pay taxes on the full sum when they file their 2020 return. These allowances have not been extended into 2021.

Early Withdrawal Calculator Terms & Definitions:

- 401k â A tax-qualified, defined-contribution pension account as defined in subsection 401 of the Internal Revenue Taxation Code.

- Federal Income Tax Bracket â The division at which tax rates change in the federal income tax system .

- State Income Tax Rate â The percentage of taxes an individual has to pay on their income according to the laws of their state.

- Lump-sum Distribution â The withdrawal of funds from a 401k.

- Rollover â Moving the 401k contribution to another retirement fund option, often an IRA.

- Penalties â The payment demanded for not adhering to set rules.

- Future Value Before Taxes â The value of oneâs asset at the end of the term before taxes are paid.

- Future Taxes to be Paid â The taxes that are required to be paid at the end of the term.

- Future Net Available â The amount left after taxes and penalties are deducted.

- Annual Rate of Return â The percentage earned every year by having funds in an account.

You May Like: How To Transfer Roth 401k To Roth Ira

Who Might Inherit Your Savings

You also may opt to draw from tax-deferred money for heirs likely to be in a high future tax bracket. It may benefit them to inherit taxable assets because those assets enjoy a step-up in basis. That means the capital gains tax on the assets are based on the value when inherited, not the original purchase price for the relative who bequeathed them. That can often result in a significant tax savings.

Tips To Help You Plan For Retirement

- Want to create a financial plan that grows your money and provides for a secure retirement? You might benefit from talking to a financial advisor. Finding a qualified financial advisor doesnt have to be hard. SmartAssets free tool matches you with up to three financial advisors in your area, and you can interview your advisor matches at no cost to decide which one is right for you. If youre ready to find an advisor who can help you achieve your financial goals, get started now.

- Your retirement plan should account for medical expenses. One option to help you plan for medical costs is a health savings account . HSAs are tax-deferred just like 401 plans. However, you dont have to pay any income taxes on withdrawals from an HSA as long as you use the withdrawals for medical expenses. Check out our guide to HSAs and whether you should consider one.

Don’t Miss: Can I Move Money From 401k To Roth Ira

Tax On A 401k Withdrawal After 65 Varies

Whatever you take out of your 401k account is taxable income, just as a regular paycheck would be when you contributed to the 401k, your contributions were pre-tax, and so you are taxed on withdrawals. On your Form 1040, you combine your 401k withdrawal income with all your other taxable income. Your tax depends on how much you withdraw and how much other income you have. If you have a $200,000 account, you could legally withdraw it all the year you turn 70. The amount of a 401k or IRA distribution tax will depend on your marginal tax rate for the tax year, as set forth below the tax rate on a 401k at age 65 or any other age above 59 1/2 is the same as your regular income tax rate.

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

Recommended Reading: How To Collect My 401k Money

How Much Does A 401k Withdrawal Get Taxed

| 401 withdrawals are taxed like ordinary income | |

|---|---|

| Tax rate | |

| Single filers: Up to $9,325 | |

| Tax rate: 15% | Single filers: $9,326 to $37,950 |

| Tax rate: 25% | Single filers: $37,951 to $91,900 |

Then, when can you withdraw from 401k tax free?

The IRS allows penalty–free withdrawals from retirement accounts after age 59 1/2 and requires withdrawals after age 70 1/2 . There are some exceptions to these rules for 401ks and other ‘Qualified Plans.

Additionally, do I have to pay state income tax on 401k withdrawal? Because payments received from your 401 account are considered income and taxed at the federal level, you must also pay state income taxes on the funds. The only exception occurs in states without an income tax. Your 401 plan may offer you the opportunity to have taxes automatically withheld from a withdrawal.

Secondly, how do I avoid taxes on my 401k withdrawal?

Avoid penalties and minimize taxes as you pull money out of your retirement accounts.