Do I Have To Pay A Penalty If I Withdraw From My 401k In 2021

Although the initial provision for penalty-free 401k withdrawals expired at the end of 2020, the Consolidated Appropriations Act, 2021 provided a similar withdrawal exemption, allowing eligible individuals to take a qualified disaster distribution of up to $100,000 without being subject to the 10% penalty that would

I Need Emergency Funds

Removing funds from your 401 before you retire because of an immediate and heavy financial need is called a hardship withdrawal. People do this for many reasons, including:

- Unexpected medical expenses or treatments that are not covered by insurance.

- Costs related to the purchase or repair of a home, or eviction prevention.

- Tuition, educational fees and related expenses.

- Burial or funeral expenses.

The IRS is making it easier to access the funds in your 401 by amending the rules around hardship withdrawals. But hardship withdrawals are a drain on your hard-earned retirement savings, and they stunt all the growth youve previously achieved. They can even impact your ability to retire when you want.

What Is The Covid

You’ll generally have to pay a 10% early withdrawal penalty if you take the cash out before you reach 59 1/2 years old.

You also have to pay normal income taxes on the withdrawn funds.

However, last March, former President Donald Trump signed an emergency stimulus bill that lets those affected by Covid withdraw up to $100,000 without the penalty, even if they’re younger than 59 1/2.

Account owners also have three years to pay the tax owed on withdrawals, instead of owing it in the current year.

Alternatively, you can repay the withdrawal to a 401k and avoid owing any tax.

To qualify for the exemption, you, your spouse or a dependent must’ve been diagnosed with Covid-19.

Alternatively, you must have experienced “adverse financial consequences” due to Covid, which could include a lay-off or reduced income.

There are also other exceptions to the penalty, such as using the funds to pay for your medical insurance premium after a job loss.

Plus, you can take penalty-free withdrawals if you either retire, quit, or get fired anytime during or after the year of your 55th birthday.

This is known as the IRS Rule of 55.

You May Like: Can I Start A 401k

How Long Does It Take To Get Money Out Of Your 401k

How long does it take to remove 401 after retiring? Depending on who manages your 401 account , it may take between three and ten working days for you to receive a check after deducting 401 .

Can I just withdraw money from my 401k?

Yes, you always have the right to deduct some or all of your contributions and their salaries, but it is not always black and white. All deductions you take will be subject to a tax deduction, and you may be liable for tax deduction as well.

How long does it take to get 401k withdrawal direct deposit?

The 401 credit system can be anywhere from the day if you do it online for a few weeks if done by hand. Once completed, it may take two to three days for the direct deposit to reach your account.

Calculating The Total Penalty

In the example above, assume your employer-sponsored 401 includes a vesting schedule that assigns 10% vesting for each year of service after the first full year. If you worked for just four full years, you are only entitled to 30% of your employer’s contributions.

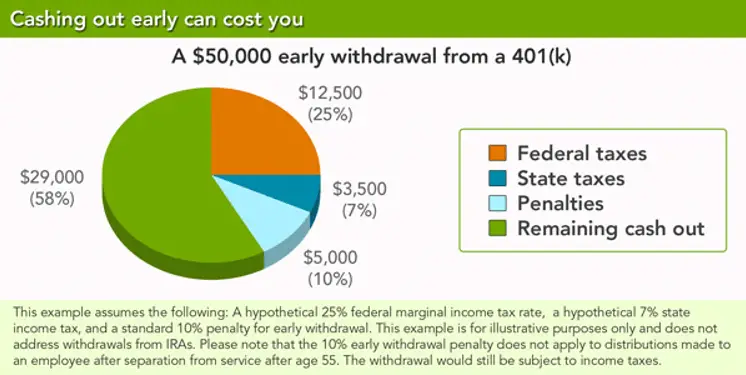

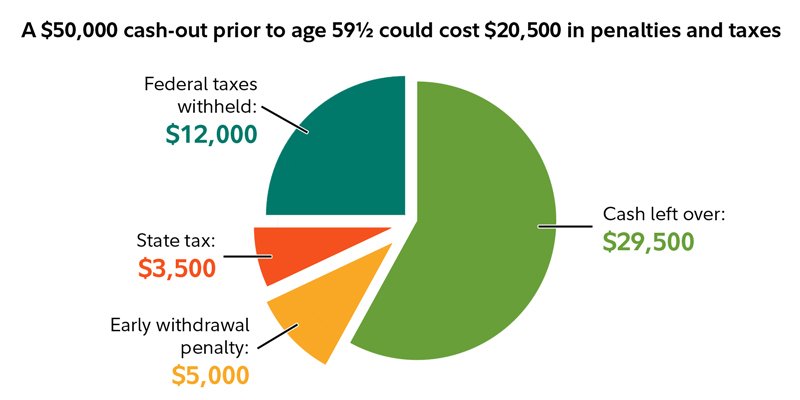

If you remove funds from your 401 before you turn age 59.5, you will get hit with a penalty tax of 10% on top of the taxes you will owe to the IRS.

If your 401 balance is composed of equal parts employee and employer funds, you are only entitled to 30% of the $12,500 your employer contributed, or $3,750. This means if you choose to withdraw the full vested balance of your 401 after four years of service, you are only eligible to withdraw $16,250. The IRS then takes its cut, equal to 10% of $16,250 , reducing the effective net value of your withdrawal to $14,625.

You May Like: Can I Rollover My 401k To A Money Market Account

Is It Worth Cashing Out 401k

Paying out a 401 gives you instant access to funds. If you lose your job and use the money to cover the cost of living until you start a new job, an early 401 withdrawal can help you avoid debt. Leaving money in your account instead of withdrawing it could help you achieve your financial goals.

How much do I lose if I cash out my 401K?

If you withdraw money from your 401 account before age 59 1/2, you must pay a 10% early withdrawal penalty, in addition to income tax, on the distribution. For someone in the 24% tax bracket, a $ 5,000 early 401 withdrawal costs $ 1,700 in taxes and penalties.

Can you cash out your 401K right now without penalty?

The CARES Act gave Americans financially injured by the pandemic a chance to retire without punishment, but that exception was lifted in 2020. say raid that account should be a last resort.

Is it worth taking money out of your 401K?

In general, it is not advisable to withdraw money early from your 401K. However, in some cases, especially financial difficulties or early retirement, an early withdrawal of your 401K can serve as a viable strategy.

Should You Take A Distribution From Your 401 Or Ira

Like the CARES Act, the Consolidated Appropriations Act allows you to withdraw funds from both a 401 and an IRA, as long as the amount is up to $100,000 across all accounts. If you are deciding whether to take a distribution from either your IRA or a 401, think about factors such as each of the account’s typical rules around penalties and taxes. F

You May Like: How Do You Take A Loan Out Of Your 401k

At What Age Can You Withdraw From 401k Without Paying Taxes

The IRS allows for the removal of the penalty-exempt from retirement accounts after the age of 59 ½ and requires removal after 72 years .

Do you pay taxes on 401k withdrawals after 65?

Tax on 401k Withdrawal after Sixty-Five Different Anything you take into your account 401k is a tax deduction, just like regular payments when you were contributing to 401k, your contributions were not yet taxable, and therefore you are exempt from tax deduction.

How can I get my 401k money without paying taxes?

You can rollover your 401 in IRA or new employer 401 without paying tax on your 401 fees. If you have $ 1000 to $ 5000 or more when you leave your job, you can rollover over money in the new retirement plan without paying taxes.

K Withdrawal Rules: How To Avoid Penalties

401k plans, IRAs and other tax-advantaged retirement savings accounts are common ways to save for retirement, and millions of Americans pour money into them every year. Its generally wise to avoid withdrawing money from your 401k, as there are often hefty penalties and taxes to consider for early withdrawals.

Sometimes, however, unplanned circumstances force people to withdraw funds from their 401k early. So if you find yourself in a place where you need to tap your retirement funds early, here are some rules to be aware of and some options to consider.

Read Also: How To Grow 401k Fast

Withdrawing Funds Between Ages 55 And 59 1/2

Most 401 plans allow for penalty-free withdrawals starting at age 55. You must have left your job no earlier than the year in which you turn age 55 to use this option. You must leave your funds in the 401 plan to access them penalty-free. But there are a few exceptions to this rule. This option makes funds accessible as early as age 50 for many police officers, firefighters, and EMTs.

Make sure to understand the rules around the age requirement for penalty-free withdrawals. For example, the age 55 rule won’t apply if you retire in the year before you reach age 55, and your withdrawal would be subject to a 10% early withdrawal penalty tax in this case.

The age 55 and up retirement rule won’t apply if you roll your 401 plan over to an IRA. The earliest age to withdraw funds from a traditional IRA account without a penalty tax is 59. 1/2.

You might retire at age 54, thinking that you can access funds penalty-free in one year. It doesn’t work that way. You must wait one more year to retire for this age rule to take effect.

It’s Better Than Falling Behind On Your Bills

Sometimes, you just don’t have a better option. If a 401 withdrawal is the only way that you can pay your bills without taking on costly credit card debt, do it. Leaving your retirement savings alone isn’t worth it if it threatens your current financial security and your ability to save more for retirement in the future.

Only withdraw as much as you need and keep seeking out alternative sources of funding. Look for a new job if you’ve lost yours, start a side hustle, or consider applying for a personal loan with a reasonable interest rate.

Also Check: Can I Borrow Money From 401k

Taking 401 Distributions In Retirement

The 401 withdrawal rules require you to begin depleting your 401 savings when you reach age 72.

At this point, you must take a required minimum distribution each year until your account is depleted. If you are still working for the employer beyond age 72, you may be able to delay required minimum distribution until you stop working if your plan allows this delay. The delay option is not available to you if you own 5% or more of the business.

You have until April 1 of the year after you turn 72 to take your first required minimum distribution. After that, you must take a minimum amount by December 31 each year. Your 401 plan administrator will tell you how much you are required to take each year.

The amount is based on your life expectancy and your account balance. If you dont take your required minimum distribution each year, you will have to pay a tax of 50% of the amount that should have been taken but was not. If you participate in more than one employer plan, you must take a required minimum distribution from each plan.

How Covid Retirement Plan Withdrawals Affect Your Taxes

Though you dont have to pay the 10% penalty on these withdrawals, youll still owe taxes on the money you withdraw. To make things a bit easier, though, the CARES Act allows you to spread the income over three different tax years.

For example, if you borrowed $30,000, you can apply $10,000 to your 2020 taxable income, $10,000 in 2021 and the last $10,000 in 2022. You must take at least one-third of the money in each year, though. You can also opt to take more in any year, including up to all of the money if you so choose.

If, in a later year, youve made back the money you withdrew, that is allowed. Youll have to file an amended return for any years with withdrawal money to get a refund. Again, the same rules apply for IRAs and 401s.

Recommended Reading: Can First Time Home Buyers Use 401k

What If You Are The Beneficiary Of A 401 Plan

If you are the beneficiary of a 401 plan, you’ll have a little bit different set of rules that apply to taking money out of the 401 plan. Your choices will depend on whether you were the spouse or non-spouse of the 401 plan participant and whether the 401 plan participant had reached age 70 1/2the age for required minimum distributions .

If you or your spouse turned 70 1/2 before Jan. 1, 2020, the age for RMDs is still 70 1/2. If you or your spouse turned 70 1/2 on or after Jan. 1, 2020, the age for RMDs is 72.

When You Leave A Job

When you leave a job, you generally have the option to:

- Leave your 401 with your current employer

- Roll over the funds to an IRA

- Roll over the funds to your new employer’s 401.

If you choose any of those options, you will not owe taxes or a 10% penalty. You can also take this money as a distribution, but this will trigger early withdrawal penalties if you are under 59 1/2 .

Read Also: How To Buy Gold In Your 401k

Our Take: When Can You Withdraw From Your 401k Or Ira Penalty

There are a number of ways you can withdraw from your 401k or IRA penalty-free. Still, we recommend not touching your retirement savings until you are actually retired. Compounding is a huge help when it comes to maximizing your retirement savings and extending the life of your portfolio. You lose out on that when you take early distributions. To see how much compounding can affect your 401k account balance, check out our article on the average 401k balance by age.

We understand that its always possible for unforeseen circumstances to arise before you reach retirement. Being aware of the exceptions allows you to make informed decisions and possibly avoid paying extra fees and taxes.

To take control of your finances, a good place to start is by stepping back, getting organized, and looking at your money holistically. Personal Capitals free financial dashboard will allow you to:

The content contained in this blog post is intended for general informational purposes only and is not meant to constitute legal, tax, accounting or investment advice. You should consult a qualified legal or tax professional regarding your specific situation. Keep in mind that investing involves risk. The value of your investment will fluctuate over time and you may gain or lose money.

Withdrawal Penalty Before Age 59

If you’re under age 59½, you may have to pay an additional 10% when you file your tax return. If you are still working when you are 59 ½, you can take money out of your 401.

You can take money from your 401 account if you are age 59½ or older. You will not have a penalty. Twenty percent is withheld for federal income taxes. You can also roll money from your 401 to IRA or other qualified plan. Funds that are rolled over are not subject to tax at that time.

Also Check: Can I Use My 401k To Purchase A Home

Alternatives To Rule Of 55 Withdrawals

The rule of 55, which doesnt apply to traditional or Roth IRAs, isnt the only way to get money from your retirement plan early. For example, you wont pay the penalty if you take distributions early because:

- You become totally and permanently disabled.

- You pass away and your beneficiary or estate is withdrawing money from the plan.

- Youre taking distributions to pay deductible medical expenses that exceed 7.5% of your adjusted gross income.

- Distributions are the result of an IRS levy.

- Youre receiving qualified reservist distributions.

You can also avoid the 10% early withdrawal penalty if early distributions are made as part of a series of substantially equal periodic payments, known as a SEPP plan. You have to be separated from service to qualify for this exception if youre taking money from an employers plan, but youre not subject to the 55 or older requirement. The payment amounts youd receive come from your life expectancy.

Youll Face A Hefty Tax Bill

On top of the 10% penalty, youâll owe taxes on the amount you withdraw from your 401.

Your plan administrator is required to withhold 20% of your withdrawal for taxes. However, depending on your income bracket, this may not cover your entire tax obligation.

If youâre unable to come with the rest when you file taxes, you may be left with more costly options to pay the remaining taxes.

Read Also: What To Look For In A 401k

How 401 Withdrawals Work

Normally, your contributions to a 401 retirement plan come out of pre-tax income. They then grow tax-free, and you pay taxes when you withdraw the money in retirement .

If you take a withdrawal before age 59 ½, itâs considered an early distribution of your retirement fund, and itâs subject to penalties. Typically, this means you’ll have to pay income tax and a 10% penalty on the withdrawal amount. There are some limited options for a âhardship withdrawalâ or “hardship distributions” that waive the penalty. From January 1-December 30, 2020, the CARES Act waived the 401 early withdrawal penalty. However the government did not extend this provision of the CARES Act for 2021.

The new legislation that does impact 2021 is called the Consolidated Appropriations Act, signed into law on December 27, 2020. Although it does not extend the time to take a coronavirus-related distribution from your 401, it does allow people to take distributions if they are affected by qualified disasters other than the pandemic. Qualified disasters include events that are declared disasters by the President between January 1, 2020 and 60 days after the enactment of The Act. You have 180 days from the enactment of The Act to take a qualified disaster distribution.

How Taking A 401 Distribution Affects Your Retirement

Time in the market and compounding interest are critical factors when it comes to your retirement savings. While investment returns will vary, in general more money in the market means more at retirement, while anything you withdraw now is that much less you’ll have for your golden years. Plus, taking money out means missing any potential gains your investments would have seen along the way, even if you reinvest the money down the road.

That’s why it’s important to carefully assess your situation if you’re experiencing a true emergency and your retirement is your only financial source, consider limiting the amount you take out to only what you need. If you’re certain that you can pay yourself back, there’s also less of a risk in going this route. But if you can go without touching your nest egg, over time you may be able to reap the rewards of compound interest and avoid any potential losses.

Read Also: How Do I Get A Loan From My 401k