What Is A Tiaa Cref Retirement Plan

What is a tiaa cref retirement plan? Because of its basic design features, TIAA-CREF can be framed as a pension plan providing lifetime income at retirement rather than as a tax-favored wealth accumulation vehicle for employees to defer current income as a personal supplement to retirement income.

What is a TIAA retirement plan? TIAA Traditional is a guaranteed annuity issued by Teachers Insurance and Annuity Association of America that is designed to be a core component of a diversified retirement savings portfolio. It has helped prepare millions of people like you with a solid foundation for retirement.

Is TIAA a good retirement plan? TIAA Personal Portfolio is a solid option for investors looking to engage in socially conscious investing through a financial institution with a long and stable history.

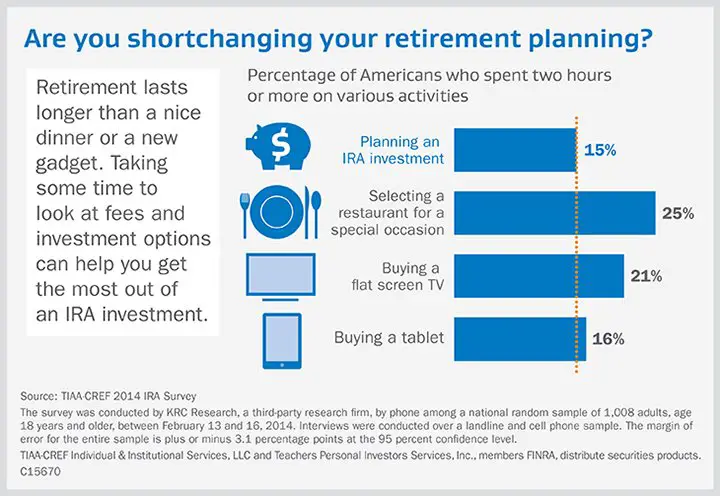

Is TIAA-CREF an IRA? Our IRAs can help complement your workplace plan and offer a variety of benefits, including: Advice and support. You can choose a TIAA IRA that offers advice and support to help you figure it all out which investments are right for you, how much to put in each, and how to receive income in retirement.

What Is The Teachers Insurance Annuity Association

The Teachers Insurance and Annuity Association is a financial organization that provides investment and insurance services for those working for organization in the nonprofit industry in academic, research, medical, government, and cultural fields. TIAA has a history that dates back to the late Andrew Carnegie, whose Carnegie Foundation for the Advancement of Teaching created the initial organization in order to service the pension needs of professors. The financial services company was founded in 1918 with a $1 million endowment from the Carnegie Foundation. It went by the name TIAA-CREF, short for Teachers Insurance and Annuity AssociationCollege Retirement Equities Fund, until 2016, when it rebranded under the shortened name of TIAA.

Start A Lifetime Or Fixed

There is absolutely no requirement that you must choose an annuity from TIAA. However, when you leave your employment with the university, you may choose to receive a lifetime or fixed-period annuity from TIAA at any age. The amount of the annuity will be calculated based on variables such as your life expectancy, your age at the time the annuity option is taken, and whether a spouse-survivor option is chosen. Ask TIAA to calculate various scenarios for you they will prepare the income projections at no charge. Alternatively, you may create your own custom income illustrations at the TIAA website.

You May Like: Can I Move My 401k To A Different Company

What Happens To My Tiaa

If you die before your retirement income begins, the current full value of your account balances in all investment funds will be payable to your beneficiary under any of the payment options elected by the beneficiary and allowed by the record keeper (subject to the federal income tax laws described in more detail below

Which Should You Pick Who Is Each Good For

One obvious choice lies in your occupation are you a teacher? Or someone who works in medical, research, or cultural fields? If so, youre likely to go for TIAA-CREF, as the infrastructure is already there for you to integrate your investments into your financial life.

Fidelity, on the other hand, is great for traders who want to be more aggressive and active with their portfolios. Theyve got the same low trade cost, along with a robust online trading platform, to help traders actively manage their funds in a way that allows them to gain substantial ROIs.

Unlike the comparatively old-fashioned approach of TIAA-CREF, Fidelity has a service-oriented approach to allow tech-savvy traders to maximize their profits on their platform. Youll get more of a focus on apps and other technology, and be generally more hands-on with your investing.

From a customer service perspective, investors have to choose between quantity or quality. TIAA-CREF only really offers limited phone support for customers, but in general theyre very responsive and helpful. Fidelity is slightly less responsive, but they offer more options for customer service .

Another thing to keep in mind is that, for the most part, TIAA-CREF and Fidelity have virtually identical commission rates. If you want to go for options trading as your primary mode of investment, Fidelity just edges out TIAA-CREF at $2 less per trade , but otherwise theyre set up pretty similarly.

Images by:

Don’t Miss: Should I Pay Someone To Manage My 401k

What Are The Types Of Retirement Plans

There are six main types of retirement plans:

How Much Can You Contribute To A Retirement Plan

The amount you can contribute to your retirement plan varies by what plans you have. For most plans, such as a 401 plan, you can contribute up to $19,500 per year as of 2021 and $20,500 for 2022. A traditional IRA has a limit of $6,000 per year, or $7,000 if youre age 50 or older, while SEP IRA limits are $58,000 , or 25% of your income. SIMPLE IRA plans come in at $13,500 for 2021 and $14,000 for 2022. These contribution limits can change from year to year and are established by the IRS.

Also Check: How Do I Take Money Out Of My Voya 401k

Determine What Plan You Want Next

Think about the kind of retirement plan you want to move to next. Do you want to move into a 401, Roth IRA, self-directed IRA, 403, etc.? Typically, transfers happen between two similar plans. But you may prefer other plans instead. In that case, you should prepare to do a rollover.

The kind of retirement plan you move to will depend on your retirement plans or whether you intend to work for another employer or become self-employed. For example, if you want to go into business for yourself, a solo 401 may work. On the other hand, if you prefer to work for a non-profit, you will most likely move to a 403 retirement plan.

The Best Retirement Plans Of 2021

Fidelity stands out as a top provider of retirement plans to large companies, small companies, and individuals. Fidelity offers 401 plans for large and small businesses SEP-IRA, SIMPLE IRA, and Self-Employed 401 for small businesses and individual retirement accounts including traditional, Roth, and rollover IRAs. While most people will probably manage their accounts online, Fidelity offers more than 200 retail locations for in-person help.

Unique retirement-focused offerings from Fidelity include its suite of retirement planning calculators and tools including the useful Fidelity Retirement Score, which helps you assess your retirement preparedness, and four mutual funds with no fees at all. For individual account holders, you generally wont pay any recurring account fees or have to worry about account minimums.

Stock and ETF trades are commission-free at Fidelity, which also offers more than 3,400 mutual funds with no transaction fees.

Putting it all together, Fidelity offers an excellent package of retirement accounts that can help you achieve your long-term retirement investing goals.

-

Wide variety of retirement accounts

-

Retail locations

-

Monthly fee for robo advisor for accounts with balances over $10,000

-

Fee for bonds and CD trades

Recommended Reading: How To Find Out If Someone Has A 401k

Best For Teachers: Tiaa

Teachers often have somewhat unique retirement needs compared to other professions. Their needs may include a pension plan, 403 or 457 plan. TIAA has worked with educators on retirement planning for more than 100 years. And while the company has grown in recent years to include non-retirement products and accounts outside of education, TIAA has maintained its educator-friendly plans for teachers, universities, and other schools looking for retirement options.

Employees with TIAA employer-sponsored retirement plans can choose between different investment options, which may include annuities. Small businesses and self-employed business owners can look to SEP or SIMPLE IRAs at TIAA. If youre on your own, a TIAA IRA includes online commission-free stock and ETF trades in addition to a list of mutual funds with no transaction fees if you hold them for at least six months. If you like keeping your money in-house, TIAA also runs its own family of mutual funds.

-

Long history of working with teachers

-

No transaction fees on many mutual funds if held for six months

-

Retirement options include annuities and other guaranteed-income products

Apply For Direct Transfer From New Investment Company

You can also apply to transfer your funds from your TIAA-CREF IRA to your new investment company, provided you have opened a compatible retirement account with them. In such a case, you should call the representative, tell them what you need and they will provide you with all the relevant instructions.

For example, suppose you want to perform a transfer or TIAA-CREF rollover to Fidelity to a new employer-sponsored plan. In that case, you will contact the latters representatives and request the appropriate form.

Ensure you fill in the transfer form with all the needed details and return it to Fidelity by mailing it physically or uploading it digitally, depending on what options are available. Your new custodian will process the transfer by sending the request to TIAA, who will then send your check together with the transfer request.

Once the transfer or rollover of TIAA to Fidelity process is complete, Fidelity will invest your IRA funds based on your instructions.

References

Read Also: Should I Rollover My 401k Into An Ira

Reasons Not To Borrow

The best way to have money for retirement is to fund a retirement account and forget about it, so financial experts advise against borrowing from a retirement account for most expenses. A childs wedding or college education should not be funded from a retirement account if it puts a parents retirement in jeopardy. When you take a loan from your retirement account, you lose out on any gains the funds would amass if they were invested. For example, TIAA reports that a $10,000 loan paid back over 5 years represents more than $3,500 in lost investment earnings, assuming the loan has a 6 percent interest rate and the return on investment averages 8 percent over the next 25 years.

According to TIAA, most people take out a loan against their retirement savings to pay off debt or for an emergency expense. Besides missing out on investment returns on the value of the loan, 403 and 401 borrowers often contribute less or stop contributing to their retirement savings while they are paying off their loans. Using emergency savings is usually preferable to borrowing from a retirement account.

What Other Options Are There If You Need Cash

- If you have a Roth IRA for five years, you can withdraw your original contributions at any age, free of federal taxes and penalties.

- For education expenses, explore scholarships or student loans. You can borrow for school but not for retirement.

- You can borrow against the value of your home with a home equity loan or home equity line of credit.

Don’t Miss: Can You Roll Over 401k To New Employer

How To Reset Password Of Tiaa Cref Banking Account

If you have forgotten the old password of your Tiaa Cref account. Then you will not be able to get your accounts information or interact with a financial advisor.

In such a scenario to resolve this problem, you will have to reset or regenerate your accounts password.

During this process, you will need the following things to verify your identity.

- You should have your Social Security Number .

- Your Username.

- Other basic information like your personal data.

Here are the step-by-step instructions to reset a new password for your account.

Step 1: To rest or regenerate a new password, you will have to visit the official website.

Step 2: On the homepage of Tiaa.org, there will be an option to reset the password.

Step 3: In the final step enter the above-mentioned required things and submit.

In this way, you can reset or regenerate a new password.

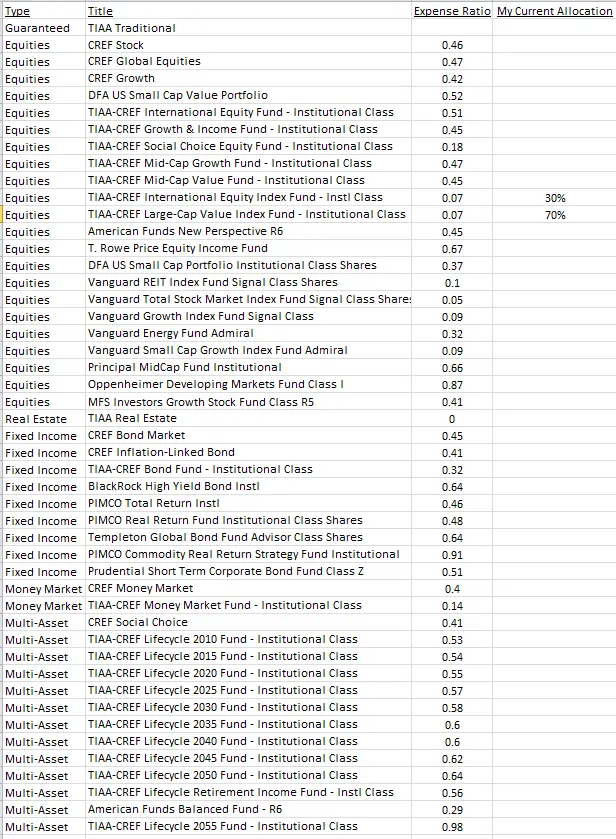

If You Bought In To Tiaa Based On Reputation Check Your Accounts

- Read in app

For years, TIAA has nurtured a perception among its clients that it is different from a typical profit-seeking financial services firm.

Its literature and advertising touted its mission-based approach and nonprofit heritage, leading many of its customers typically professors, private-school teachers, hospital employees and similar workers to believe TIAA took more benevolent approach.

But now, some of TIAAs business practices are being called into question, after several legal filings and a whistle-blower complaint accused the company of pushing its salespeople to promote its own products and services, which generate higher fees, according to a New York Times article published last month. The whistle-blower also asserted that TIAA advisers had been told to exploit customer fears.

In response, the New York attorney general has subpoenaed TIAA and has sought information related to its sales practices.

That has led some who hold accounts at TIAA to take a closer look at their own investments. As the largest administrator of retirement accounts known as 403 plans, TIAA hold $341 billion in assets 40 percent of the market, according to the data analytics firm Cerulli. These accounts are similar to 401s but used largely by workers in education, health care, religious institutions and other nonprofits.

Also Check: Is It Good To Convert 401k To Roth Ira

How Do Retirement Plans Work

A retirement plan is an investment account in which you can contribute funds, and in many cases tax-free funds, to be invested in a variety of ways. The goal is to grow the total value of the account. Some retirement plans, like 401s, allow you to invest tax-free funds for tax-deferred investments. Other accounts, like a Roth IRA, allow you to grow your account after youve paid taxes and withdraw tax-free once you reach the age of retirement.

Adding The College Retirement Equities Fund

While the creation of TIAA in 1918 as a means of providing guaranteed lifetime income and insurance was a groundbreaking new resource for teachers and educators, it was the establishment of the College Retirement Equities Fund in 1952 that started the company on the road to becoming a diversified financial services firm.

Citing rapidly increasingly life expectancies, CREF allowed individuals the opportunity to add equity investments to their personal portfolios through a variable annuity product. It was designed to use the higher expected returns of stocks to help stretch out the retirement income streams of workers. Fortune Magazine described CREF in 1952 as the biggest development in the insurance investment business since the passage of the Social Security Act in 1935. TIAA dropped CREF from its name in 2016.

Read Also: How Do I Know If I Have A 401k

Decide Where You Will Go

Before you transfer your IRA out of TIAA-CREF, you need to determine where you intend to take your assets. It would help if you researched the top retirement companies first. It would be best to do so while considering whether they offer the retirement plan you are interested in.

For example, if you want a solo 401 because you intend to run your own business, the top companies may include Charles Schwab, Fidelity Investments, Vanguard and TD Ameritrade, among others.

On the other hand, if you want to roll over TIAA CERF to IRAs, you would consider transferring your IRA to the top companies with these types of accounts, such as Betterment, E*TRADE and SoFi. When doing your research, pay close attention to:

- The transaction fees

- The kind of retirement investments they permit

Take Required Minimum Distributions

TIAA and Fidelity pay you the minimum amount of income you are legally required to take each year by the IRS under this payment program. The balance of your accumulations remains tax-deferred and continues to experience the investment returns of your chosen funds.

Questions About Your Benefits?

Limitations

The University of Michigan in its sole discretion may modify, amend, or terminate the benefits provided with respect to any individual receiving benefits, including active employees, retirees, and their dependents. Although the university has elected to provide these benefits this year, no individual has a vested right to any of the benefits provided. Nothing in these materials gives any individual the right to continued benefits beyond the time the university modifies, amends, or terminates the benefit. Anyone seeking or accepting any of the benefits provided will be deemed to have accepted the terms of the benefits programs and the university’s right to modify, amend, or terminate them. Every effort has been made to ensure the accuracy of the benefits information in this site. However, if any provision on the benefits plans is unclear or ambiguous, the Benefits Office reserves the right to interpret the plan and resolve the problem. If any inconsistency exists between this site and the written plans or contracts, the actual provisions of each benefit plan will govern.

Benefits Office

Read Also: How Does 401k Show On Paycheck