Taxes For Making An Early Withdrawal From A 401

The minimum age when you can withdraw money from a 401 is 59.5. Withdrawing money before that age results in a penalty worth 10% of the amount you withdraw. This is in addition to the federal and state income taxes you pay on this withdrawal.

There are exceptions to this early withdrawal penalty, though.

If you want to remove money from a 401 account without paying taxes, you will need to meet certain criteria. According to the IRS, you generally dont have to pay income tax or an early withdrawal penalty if you experience an immediate and heavy financial need. One situation where this may apply is when you have medical expenses that arent reimbursed by your insurance and which exceed 7.5% of your adjusted gross income . If this happens, you dont have to pay taxes on the money you withdraw to cover that financial need. There are also other exceptions, such as for disabled taxpayers. The IRS provides a more complete list of situations where you wont pay tax on early withdrawals.

The big caveat here is that the amount you can withdraw tax-free is exactly enough to cover the cost of this financial need. And youll still pay the full income tax on your withdrawal only the 10% penalty is waived.

Do 401 Contribution Limits Include The Employer Match

Employees are allowed to contribute a maximum of $19,500 to their 401 in 2020, or $26,000 if youre over 50 years of age. The good news is employer contributions do not count towards the $19,500 limit. Instead, employer matching contributions are subject to the lesser known $57,000 limit on all contributions made to a 401 account .

Your 401 can receive no more than $57,000 in contributions in a single year, whether those contributions are made by you or by your employer. That limit is three times the contribution limit for employees, so your employer would need to offer a 200% 401 employer match on all contributions you make for you to reach the limit.

The $57,000 limit mostly affects small business owners and the self-employed who pay themselves and make retirement contributions as both the employee and the employer. Most people who work for regular companies will never have to worry about the $57,000 overall limit.

Do You Need To Deduct 401 Contributions On Your Tax Return

You do not need to deduct 401 contributions on your tax return. In fact, there is no way for you to deduct that money.

When employers report your earnings at the end of the year, they account for the fact that you made 401 contributions. To give you an example, lets say you have a salary of $50,000 and you contribute $5,000 into a 401 account. Only $45,000 of your salary is taxable income. Your employer will report that $45,000 on your W-2. So if you try to deduct the $5,000 when you file your taxes, you will be double-counting your contributions, which is incorrect.

Recommended Reading: How Do I Open A Roth 401k

Do My 401 Payments Come Out Of My Paychecks

When you land your first job with an employer that offers a 401 plan, you’ll need to know how the plan works and how you should make your payments. Your employer might provide only a traditional plan that lets you fund your account on a pretax basis, or it can include a Roth feature that allows after-tax payments. In either case, your payments are deducted straight from your paychecks.

Taxes On Employer Contributions To Your 401

In addition to your contributions, an employer may also put money into your 401. Once that money is in your account, the IRS treats it the same as your contributions. You wont pay any taxes while the money is in your account, but you will pay income taxes when you withdraw it. Unlike your own contributions, you dont pay any payroll taxes when your employer contributes to your account. Its truly free money. It doesnt even count toward the $19,500 contribution limit for 2021.

Also Check: Can An Individual Open A 401k Account

Flexible Spending Accounts And Health Savings Accounts

Health savings accounts and flexible spending accounts are programs designed to allow people with health insurance to put money aside for qualified medical expenses. HSAs are designed for those who have a high-deductible health plan . The money you put into an HSA or FSA can be used tax-free to pay for certain out-of-pocket healthcare costs as they arise. If you are enrolled in one of these programs, your contributions to your account will also show up on your paycheck.

Flexible spending accounts can also be set up as dependent care FSAs to allow for tax-free withdrawals for eligible childcare expenses. Your pay stub may reflect these deductions from your pay.

What Are Examples Of Payroll Deductions

Payroll deductions fall into four different categories pretax, post-tax, voluntary and mandatory with some overlap in between. For instance, health insurance is a voluntary deduction and often offered on a pretax basis. Specific examples of each type of payroll deduction include:

- Pre-tax deductions: Medical and dental benefits, 401 retirement plans and group-term life insurance

- Mandatory deductions: Federal and state income tax, FICA taxes, and wage garnishments

- Post-tax deductions: Garnishments, Roth IRA retirement plans and charitable donations

- Voluntary deductions: Life insurance, job-related expenses and retirement plans

Don’t Miss: How To Transfer 401k Without Penalty

The Difference Between A W

As fall ends and winter begins, employers and HR directors start preparing for the upcoming tax season. One question your employees might ask revolves around the difference between the W-2 vs last pay stub. When employees receive their W-2s each year, they sometimes notice a difference between their last pay stub and whats written on their W-2 form.

Regardless of whether youre new to payroll taxes or youre a seasoned payroll veteran, this topic can be confusing to navigate. But, if youre going to help your employees this tax season, you must comprehend gross pay vs W-2 wages. Weve created this article to help you understand the difference between a pay stub and a W-2, so you can help your employees navigate tax forms successfully.

Tax Rules: Withdrawals Deductions & More

If youre building your retirement saving, 401 plans are a great option. These employer-sponsored plans allow you to contribute up to $19,500 in pre-tax money in 2021. Some employers will also match some of your contributions, which means free money for you. Come retirement, though, your withdrawals are subject to income taxes and other rules. Heres what you need to know about how 401 contributions and withdrawals are taxed. For help with all retirement issues, consider working with a financial advisor.

Recommended Reading: What Is The Tax Rate On 401k After 65

Safe Harbor 401 Plans

A safe harbor 401 plan is similar to a traditional 401 plan, but, among other things, it must provide for employer contributions that are fully vested when made. These contributions may be employer matching contributions, limited to employees who defer, or employer contributions made on behalf of all eligible employees, regardless of whether they make elective deferrals. The safe harbor 401 plan is not subject to the complex annual nondiscrimination tests that apply to traditional 401 plans.

Safe harbor 401 plans that do not provide any additional contributions in a year are exempted from the top-heavy rules of section 416 of the Internal Revenue Code.

Employers sponsoring safe harbor 401 plans must satisfy certain notice requirements. The notice requirements are satisfied if each eligible employee for the plan year is given written notice of the employee’s rights and obligations under the plan and the notice satisfies the content and timing requirements.

In order to satisfy the content requirement, the notice must describe the safe harbor method in use, how eligible employees make elections, any other plans involved, etc. Income Tax Regulations section 1.401-3 , contains information on satisfying the content requirement using electronic media and referencing the plan’s Summary Plan Description.

Both the traditional and safe harbor plans are for employers of any size and can be combined with other retirement plans.

Special Considerations: Social Security Tax Deferral

You might have noticed an increase in take-home pay starting September 1, 2020, through December 31, 2020. It was due to an order issued by then-President Donald Trump authorizing employers to defer Social Security withholding during that period if your biweekly gross earnings were less than $4,000.

According to Trumps original order, the deferred amount had to be repaid by April 30, 2021. However, due to the Consolidated Appropriations Act , 2021, the due date for repaying the deferred Social Security taxes is December 31, 2021.

If you are unsure whether your employer deferred payment on your behalf, check with your human resources department and, if you are subject to pay back, make sure that proper deductions are being made and reflected on your pay stub.

According to the Social Security Administration, beneficiaries of Social Security and Supplemental Security Income will receive a 5.9% cost-of-living adjustment in 2022.

Your specific monthly payment will depend on your situation, including whether youre a retired couple, a widow, or have children. However, on average, a retired worker that got paid $1,565 per month before the COLA will get paid $1,657 monthly in 2022 after the COLA.

Read Also: How To Make A Loan From 401k

Retroactive Paycheck Deductions Of Workers Compensation Premiums

Generally, employers may deduct from an employees paycheck one-half the Medical Aid Fund portion of the workers compensation premium. If an employer regularly fails to deduct the employees portion of the premium, the employer may not retroactively deduct this amount from the employees paycheck. If the error was infrequent and inadvertent, the employer may assess if the overpayment regulation would apply.

Break Down Your Pay Stub And Learn The Importance Of Pre

We always talk about how much we make in terms of gross income. However, no matter how much we get paid, the amount that we actually take home always feels too small. To add insult to injury, payroll companies give us pay stubs that are impossible to decipher, and good luck trying to ask your payroll department for an explanationUnderstanding the breakdown of your pay stub will help you better understand your tax withholding and optimize your savings. So here is a breakdown of the major items in your paystub, from your gross pay to your take home income. Everyone is different, so little differences may apply to you.

Don’t Miss: What Percentage Of 401k Is Required Minimum Distribution

Health Savings Account Contributions

If you have a high deductible health plan with an HSA account, the first item subtracted from your gross pay is your HSA contribution. If you have an HSA and plan to do any long term savings, you should probably contribute to an HSA as the HSA is the most efficient way to save for future health or other expenses. HSA contributions are subtracted first because they do count as Social Security or Medicare income, and so no taxes are assessed when the contribution is made. You may never owe taxes on that amount if you use it later for health-care-related expenses.

What Is A Good 401k Match

401k matching policies amongst different employers can be very inconsistent.

According to the BLS, only 56% of employers even offer 401 plans, and among those 49% match 0%, 41% will offer a match equivalent to 0-6% of the employees salary, and 10% will offer a match of 6% or more.

So if you have a employer that matches 6% or more of your 401 contribution, that is extremely good! You should make sure to take advantage of this opportunity to pad your retirement savings.

Read Also: Should I Pay Someone To Manage My 401k

Compulsory: Over The Fica Wage Base

If you are a compulsory participant in the Basic Retirement Savings Plan and your earnings are over FICA:

- You contribute 5 percent on earnings over FICA.

- No current contributions on earnings below FICA. Earnings for the year exceeded FICA by the time this example paycheck was cut. The year-to-date total is the total 403 amount that has been deducted up to FICA . For 2021, FICA is $142,800 .

- University contributes 10 percent 401 on earnings over FICA:

- 5 percent match

A Note On Individual Retirement Accounts

If your employer doesnt offer a 401 and you decide to contribute to a traditional IRA instead, your taxes will work very similarly. However, your employer doesnt manage your IRA. You are responsible for making contributions, so your employer wont consider any of those contributions when reporting your earnings at the end of the year. Because your employer isnt excluding IRA money from your earnings, you will need to deduct your contributions on your tax return if you want to get the tax benefits. One big difference with 401 plans and IRAs is that IRAs have a much lower contribution limit. You can only deduct $6,000 in IRA contributions for the 2021 tax year. There are also income limits above which you cant contribute this full amount.

Don’t Miss: Should You Move Your 401k To An Ira

Pooled Employer Plan: The 401 Plan Designed For Small To Medium

The Paychex Pooled Employer Plan makes it easier for businesses of any size to offer one of the most popular retirement plans for employees. While you reap the benefits of offering a retirement plan, we oversee plan set-up, implementation, monitoring, enrollment, and other duties. Learn why a PEP could be a retirement game-changer for your business.

How Matching Works

Assume your employer offers a 100% match on all your contributions each year, up to a maximum of 3% of your annual income. If you earn $60,000, the maximum amount your employer would contribute each year is $1,800. To maximize this benefit, you must also contribute $1,800. If you contribute more than 3% of your salary, the additional contributions are unmatched.

A partial matching scheme with an upper limit is more common. Assume that your employer matches 50% of your contributions, equal to up to 6% of your annual salary. If you earn $60,000, your contributions equal to 6% of your salary are eligible for matching. However, your employer only matches 50%, meaning the total matching benefit is still capped at $1,800. Under this formula, you must contribute twice as much to your retirement to reap the full benefit of employer matching.

If your employer matches a certain dollar amount, as in the first example, you must contribute that amount to maximize benefits, regardless of what percentage of your annual income it may represent.

You May Like: How To Check My Walmart 401k

How Does It Work

A 401 plan helps you save pre-tax dollars, which can grow without being taxed until you start withdrawing amounts from the plan. This feature is especially beneficial if, like most people, you will retire in a lower tax bracket. Your 401 also has the ability to grow faster than similar investments made to ordinary taxable accounts, because the interest you earn on your investment grows tax-free.

How A 401k Contribution Affects Your Paycheck

So, you now are ready to begin making contributions to your available 401k plan. The company will match your contributions as follows:

100% of the first 2% of contributions

50% of the next 2% of contributions

25% of the next 2% of contributions

If you make a total of 6% in contributions to your 401k, the company will match that with 3.5% contributed to your account. Your 6% of $30,000 will amount to $1,800 per year, and the company match will be an additional $1,050, for a total contribution of $2,850.

For each paycheck, you are making a contribution of 6%, which is $69.23, and the companys match is an additional $40.38 added to your account. The result in change to your paycheck will work out as follows:

| Total economic increase |

$961.22 |

As you can see, the end result is that you actually have increased your overall money on your balance sheet assets by $52.16, which is a 5.73% increase. Plus, youre paying less income tax to boot! Granted, your 401k account and the company match are restricted in access, but your overall situation is a significant increase.

Read Also: Where Do I Go To Withdraw My 401k

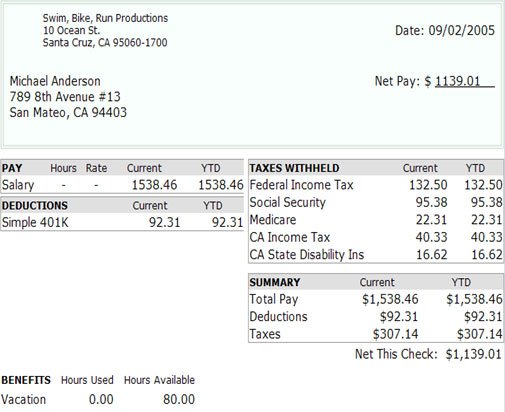

What Is Included On A Pay Stub

Pay stubs include the details of each pay period’s wages including the following, depending on your personal circumstances:

The pay stub may also include year-to-date totals of gross and net earnings and deductions.

If you have questions about any of the items on your pay slip, check with your manager or companys Human Resources department for clarification. They can advise you on your current deductions and on how to make changes to what is withheld from your gross pay.

Taxes On Rolling Over A 401 Account

There are a few instances where you may want to transfer funds from an employers 401 into another account. The most common situation is when you leave an employer and want to transfer funds from your previous employer into your new employers 401, or into your own individual retirement account .

Whenever you withdraw money from a 401, you have 60 days to put the money into another tax-deferred retirement plan. If you transfer the money within 60 days, you will not have to pay any taxes or penalties on your withdrawals. You will need to say on your tax return that you made a transfer, but you wont pay anything. If you dont make the transfer within 60 days, the money you withdrew will add to your gross income and you will have to pay income tax on it. You will also pay any applicable penalties if you withdraw before age 59.5.

If you dont want to worry about missing the 60-day deadline, you can make a direct 401 rollover. This means the money goes directly from one custodian provider) to another without ever being in your hands.

Finally, note that if youre rolling over a 401 into a Roth IRA, youll need to pay the full income tax on the rolled-over amount. However, theres no 10% penalty for doing this before age 59.5.

Recommended Reading: How Old Do You Have To Be To Get 401k