Asset Allocation Strategies That Work

Thomas J Catalano is a CFP and Registered Investment Adviser with the state of South Carolina, where he launched his own financial advisory firm in 2018. Thomas’ experience gives him expertise in a variety of areas including investments, retirement, insurance, and financial planning.

Asset allocation is a very important part of creating and balancing your investment portfolio. After all, it is one of the main factors that leads to your overall returnseven more than choosing individual stocks. Establishing an appropriate asset mix of stocks, bonds, cash, and real estate in your portfolio is a dynamic process. As such, the asset mix should reflect your goals at any point in time.

Below, we’ve outlined several different strategies for establishing asset allocations, with a look at their basic management approaches.

Balancing Assets Based On Age And Time

Investing requires time for assets to grow. Knowing how much time you have can help define how you invest.

If youre investing for retirement in your 20s, you may have 30 or 40 years to reach your goal. If youre 60, you may have less than a decade before you need that money.

Because equities can be volatile, they could swing from one extreme to another. Maybe they go up 20% one year and down 10% another. If you dont need your money for quite a while, the risk of losing some of your value in one or two years could be a risk worth taking, since you may have time for the market to bounce back.

Typically, if you have more time, you might hold higher proportions of equities to capture that potential growth. As you get closer to retirement age , its typically common to allocate more to fixed income to minimize the risk of losing the growth youve had over the earlier years.

Asset Allocation And Risk Tolerance

Investor behavior plays a big part in asset allocation in the form of risk tolerance. A successful asset allocation strategy requires that the investor is able to stick to it. Modern Portfolio Theory assumes all investors behave rationally and unemotionally. We know this isnt the case.

The investor is usually the cause of the failure of their investment plan, not the financial markets. As you might imagine, plans are typically abandoned during crashes or extreme bull markets. One of the mistakes most often made is the overestimation of ones tolerance for risk. Risk tolerance can be defined as the point at which price volatility or drawdown causes you to change your behavior. Obviously, for a young investor with no experience, this point can be hard to assess.

Stocks are more risky than bonds. Buying stocks is a bet on the future earnings of companies. Bonds are a contractual obligation for a set payment to the bond holder. Because future corporate earnings and what the company does with those earnings are outside the control of the investor, stocks inherently possess greater risk and thus greater potential reward than bonds.

William Bernstein suggested that an investor can evaluate their risk tolerance based on how they reacted to the Global Financial Crisis of 2008:

- Sold: low risk tolerance

- Held steady: moderate risk tolerance

- Bought more: high risk tolerance

- Bought more and hoped for further declines: very high risk tolerance

Recommended Reading: Can I Start A 401k

In A Hurry Here Are The Highlights:

- Asset allocation refers to the ratio of different asset classes in an investment portfolio, and is determined by ones investing objectives, time horizon, and risk tolerance.

- Asset allocation is extremely important, more so than security selection, and explains most of a portfolios returns and volatility.

- Stocks tend to be riskier than bonds. Holding two uncorrelated assets like stocks and bonds together reduces overall portfolio volatility and risk compared to holding either asset in isolation.

- There are a few simple formulas to calculate asset allocation by age, suitable for young beginners all the way to retirees, and appropriate for multiple risk tolerance levels.

- There is no best asset allocation. What is appropriate for you may not be appropriate for someone else. The optimal portfolio can only be known in hindsight.

- M1 Finance makes it extremely easy to set, maintain, and rebalance a target asset allocation.

Contents

Use Target Date Funds To Retire On Your Terms

Target date funds are geared toward people who plan to retire at a certain timethe term “target date” means your targeted retirement year. These funds help you maintain diversification in your portfolio by spreading your 401 money across multiple asset classes, including large-company stocks, small-company stocks, emerging-markets stocks, real estate stocks, and bonds.

Youll know your 401 provider offers a target-date fund if you see a calendar year in the name of the fund, such as T. Rowe Price’s Retirement 2030 Fund.

Target date funds make long-term investing easy. Decide the approximate year you expect to retire, then pick the fund with the date closest to your target retirement date. For example, if you plan to retire at about age 60, and that will be around the year 2030, pick a target-date fund with the year “2030” in its name. Once you pick your target-date fund, it runs on auto-pilot, so there is nothing else you need to do but keep contributing to your 401.

Don’t Miss: How To Avoid Taxes On 401k

What Is A Conservative 401 Investment

When retirement experts talk about a 401 portfolio being too conservative, they mean how much is invested in bond funds or cash-like alternatives versus stocks whats called asset allocation. If all or almost all of your retirement account is in bonds or CDs, its conservative. The returns on bond or cash-like investments are typically safe but not high, and they may not even outpace inflation, which the Federal Reserve wants at about 2 percent annually.

If youre not earning around that much annually, you may actually lose purchasing power over time. Thats a serious problem if you want to use your 401 to make your golden years into something truly golden. Thats really the key issue with having a 401 thats too conservative.

One way to achieve higher growth and become more aggressive is to add stock funds, or a higher allocation to stock funds, to your 401. Stock funds will fluctuate more in the short term than bond funds, but theyre more likely to deliver higher returns over time. The average annual return on the S& P 500, a collection of hundreds of companies, has been about 10 percent over long periods.

While it can make sense to become more conservative as youre nearing retirement and need to access the money, you can probably afford to add a little more risk to your portfolio in exchange for a potentially higher return, if you have at least five years. If you have a decade or more, you can allow the short-term fluctuations of stock funds to work themselves out.

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

Don’t Miss: Can I Pull Out My 401k

Strategic Asset Allocation Overview

Diversified buy-and-hold passive investing is an easy approach to building wealth for many people.

For this strategy, you build a diversified portfolio of index funds or ETFs, and re-balance from time to time. In other words, when one asset class goes up and another goes down, you sell some of the higher asset class and buy the dip in the underperforming asset class, to maintain the same weighting over time.

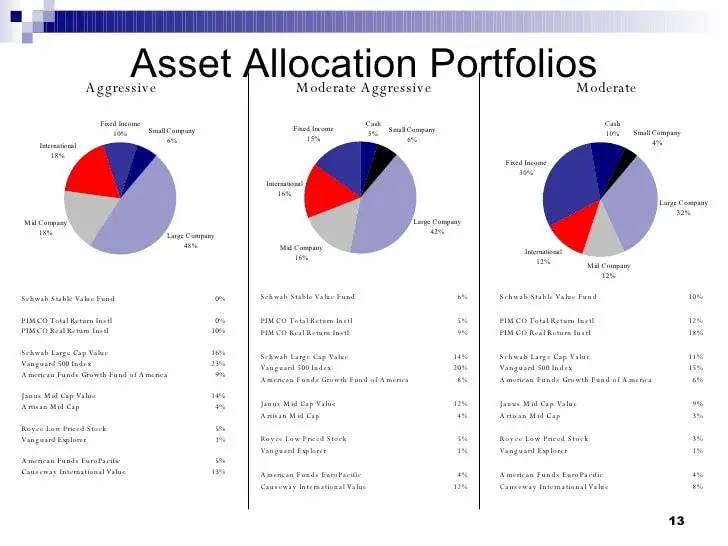

Heres an example image:

The only thing that changes over time for portfolios that follow a strategic asset allocation approach is that they might get more conservative over time. Young investors are typically told to start out with high stock allocations, and then gradually over time the stock allocation within their portfolio decreases and the bond allocation increases.

If youre looking to get started, there are several options.

- Arguably the simplest approach for retirement accounts is to invest in one of the Vanguard LifeStrategy Funds. They let you automatically invest in a diversified portfolio with domestic stocks, foreign stocks, and bonds, that automatically rebalance themselves.

The Connection Between Asset Allocation And Diversification

Diversification is a strategy that can be neatly summed up by the timeless adage, dont put all your eggs in one basket. The strategy involves spreading your money among various investments in the hope that if one investment loses money, the other investments will more than make up for those losses.

Many investors use asset allocation as a way to diversify their investments among asset categories. But other investors deliberately do not. For example, investing entirely in stock, in the case of a twenty-five year-old investing for retirement, or investing entirely in cash equivalents, in the case of a family saving for the down payment on a house, might be reasonable asset allocation strategies under certain circumstances. But neither strategy attempts to reduce risk by holding different types of asset categories. So choosing an asset allocation model wont necessarily diversify your portfolio. Whether your portfolio is diversified will depend on how you spread the money in your portfolio among different types of investments.

Recommended Reading: What Happens To My 401k After I Quit

Use Balanced Funds For A Middle

A balanced fund allocates your 401 contributions across both stocks and bonds, usually in a proportion of about 60% stocks and 40% bonds. The fund is said to be “balanced” because the more conservative bonds minimize the risk of the stocks. This means that when the stock market is quickly rising, a balanced fund usually will not rise as quickly as a fund with a higher portion of stock. When the stock market is falling, expect that a balanced fund will not fall as far as funds with a higher portion of bonds.

If you dont know when you might retire, and you want a solid approach that is not too conservative and not too aggressive, choosing a fund with balanced in its name is a good choice . This type of fund, like a target-date fund, does the work for you. You can put your entire 401 plan in a balanced fund, as it automatically maintains diversification and rebalances your money over time to maintain the original stock-bond mix).

Asset Allocation In Retirement

If you think youre confused about how best to de-accumulate assets to cover retirement expenses, youre not alone. Ive read countless articles about how to preserve capital while creating some sort of income stream to cover expenses in the golden years but no two articles are alike. Unlike your asset accumulation years where there is some consensus related to maxing out your Tax Free Savings Accounts and Registered Retirement Savings Plans for decades on end , no such consensus exists for retirement withdrawal strategies.

Academic research seems to show thanks to William Bengen, a financial planner with a background in aeronautical engineering, that withdrawing 4% of your portfolio every year, and increasing your withdrawals with the rate of inflation, will ensure you not only have enough income to cover expenses but you likely wont outlive your money over a 30-year retirement span.

My personal thesis is that this 4% safe withdrawal rate will be presented with some strong headwinds in the coming decade, thanks to major demographic shifts causing rising healthcare costs, lower government revenues and consequently cuts to various government programs.

What is the appropriate asset allocation for retirement? Is there a way to structure a portfolio to mitigate equity risks?

The Keeping It Safe Structure #1

The I Can Handle Some Risk Structure #2

The Income Focused Structure #3

You May Like: What Happens To Your 401k When You Leave A Company

Achieving Asset Allocation Through Life

Asset-allocation mutual funds, also known as life-cycle, or target-date, funds, are an attempt to provide investors with portfolio structures that address an investor’s age, risk appetite, and investment objectives with an appropriate apportionment of asset classes. However, critics of this approach point out that arriving at a standardized solution for allocating portfolio assets is problematic because individual investors require individual solutions.

The Vanguard Target Retirement 2030 Fund would be an example of a target-date fund. As of 2018, the fund has a 12-year time horizon until the shareholder expects to reach retirement. As of January 31, 2018, the fund has an allocation of 71% stocks and 29% bonds. Up until 2030, the fund will gradually shift to a more conservative 50/50 mix, reflecting the individual’s need for more capital preservation and less risk. In following years, the fund moves to 67% bonds and 33% stocks.

Extra Benefits For Lower

The federal government offers another benefit to lower-income people. Called the Saver’s Tax Credit, it can raise your refund or reduce the taxes owed by offsetting a percentage of the first $2,000 that you contribute to your 401, IRA, or similar tax-advantaged retirement plan.

This offset is in addition to the usual tax benefits of these plans. The size of the percentage depends on the taxpayer’s adjusted gross income for the year and tax-filing status. The income limits to qualify for the minimum percentage offset under the Saver’s Tax Credit are as follows:

- For single taxpayers , the income limit is $33,000 in 2021 and $34,000 in 2022.

- For married couples filing jointly, it’s $66,000 in 2021 and $68,000 in 2022.

- For heads of household, it maxes out at $49,500 in 2021 and $51,000 in 2022.

Read Also: How To Make A 401k Account

Adjust Your Asset Allocation According To Your Age

When your investment timeline is short, are especially problematic — both emotionally and financially. Emotionally, your stress level spikes because you had plans to use that money soon, and now some of it is gone. You might even get spooked and sell. And financially, selling your stocks at the bottom of the market locks in your losses and puts you at risk of missing the stocks’ potential recovery.

Adjusting your allocation according to your age helps you to bypass those problems. For example:

- You can consider investing heavily in stocks if you’re younger than 50 and saving for retirement. You have plenty of years until you retire and can ride out any current market turbulence.

- As you reach your 50s, consider allocating 60% of your portfolio to stocks and 40% to bonds. Adjust those numbers according to your risk tolerance. If risk makes you nervous, decrease the stock percentage and increase the bond percentage.

- Once you’re retired, you may prefer a more conservative allocation of 50% in stocks and 50% in bonds. Again, adjust this ratio based on your risk tolerance.

- Hold any money you’ll need within the next five years in cash or investment-grade bonds with varying maturity dates.

- Keep your emergency fund entirely in cash. As is the nature of emergencies, you may need access to this money with just a moment’s notice.

Why Proper Allocation Is Important

Allocating assets based on an individual investment strategy is what almost every investor would consider good practice. Even billionaires and institutional investors lose money on certain bets, but since they are properly hedged, it ensures that they will not be significantly harmed by a single bad investment.

A balance among equities, fixed income, and cash instruments is also important, because it is a strategy that allows for macroeconomic movements beyond an investor’s horizon. Allocating properly allows for fluctuations in currencies and larger geopolitical moves, giving the investor a safety net against large-scale declines.

Recommended Reading: How To Cash Out Nationwide 401k

Target Date Funds Vs Target Risk Funds

Not everyone has time to do investment research and pick a bunch of individual stocks and bonds. Thats why investment products like mutual funds and exchange-traded funds exist. These types of investments have a professional manager who researches, selects, and combines the ingredients for investors in the product.

Some investment options even take care of the asset allocation. Two types are target date and target risk.

With a target date fund, you can pick one that has a year close to when youll retire or need the assets. The portfolio manager selects all the investments, and, over time, adjusts the asset allocation to typically be more conservative as that date approaches.

With a target risk fund, you pick the investment that best matches your risk tolerance, from conservative to aggressive. The portfolio manager then selects investments that match that level of risk and builds the asset allocation to suit it.

Alternatively, you may consider managed accounts or robo-advisors for an even deeper level of personalization.

What About Investing For Retirementincome

Index fund allocations provide a good means of investing. This is especiallytrue before you retire, and your main concern is building up your nest egg.

Once you start to transition into retirement index fund allocations are still good, but you do need to think specifically about how your retirement withdrawal strategy affects your investment strategy.

The risks you face before retirement are not the same as the risks you face in retirement. Before retirement you are contributing to a portfolio. During retirement, you take withdrawals from the portfolio. Even this simple reversal changes your risk.

Depending on your withdrawal strategy you may need to adjust your portfolio. For example, if you use an income floor strategy.

However, index fund allocations can still provide the basis of yourportfolio.

Read Also: Is 401k Rollover To Ira Taxable

Tips On Retirement Planning

- A financial advisor can help you plan for retirement or determine your asset allocation. Finding a qualified financial advisor doesnt have to be hard. SmartAssets free tool matches you with up to three financial advisors in your area, and you can interview your advisor matches at no cost to decide which one is right for you. If youre ready to find an advisor who can help you achieve your financial goals, get started now.

- No matter what your age, its never too late to start saving. If youre fortunate enough to have one, you should invest as much as you can in an employer-sponsored 401. But if you dont, you can always open a traditional individual retirement account or a Roth IRA.

- If you dont know how much you should be saving, you can use our retirement calculator to figure out how much you should be socking away to fund a comfortable retirement. In addition, we made a 401 calculator and a Social Security Calculator.