Be Smart With Your 401

Opening a 401 is a smart step on the road to a comfortable retirement, but it’s not quite as simple as signing some papers and setting aside a percentage of your paycheck. You have to understand the rules, choose your investments wisely, and continue to maintain your plan for as long as you own it. If you do that, you can feel confident that you’re giving yourself the best shot at a secure retirement.

How Do You Open A 401

Do the following to open your 401:

Should You Do A Roth Solo 401k

One of the options that’s become important is allowing for a Roth solo 401k. Surprisingly, many brokerage firms currently don’t allow a Roth solo 401k, but it can be a valuable option.

When it comes to your solo 401k, it’s important to remember that you have two aspects of contributions to your plan:

Where a Roth option comes in handy is if you’re looking for tax diversification. With Roth contributions, you are using post-tax money. So, you will pay more in taxes today, but you will pay less in the future. However, if you’re putting in large profit sharing contributions into your solo 401k, then it might make sense to make Roth contributions.

The reason? It will give you tax diversification in retirement. You can choose whether you use taxable or tax free money in the future – and options are always great.

The important thing to remember here is options. You just want the options to be able to invest how you choose.

Also Check: Where Should I Put My 401k Money

Roll Your 401 Into An Ira

The IRS has relatively strict rules on rollovers and how they need to be accomplished, and running afoul of them is costly. Typically, the financial institution that is in line to receive the money will be more than happy to help with the process and avoid any missteps.

Funds withdrawn from your 401 must be rolled over to another retirement account within 60 days to avoid taxes and penalties.

Why Employers May Not Offer A 401

Facilitating a 401 plan can be expensive for a company. The IRS requires testing and reporting to ensure retirement plans keep up with regulations. As a result, many small businesses simply can’t afford to administer a 401 plan.

If a company is brand new and trying to get off of the ground, they may not have the time to organize a retirement plan for their employees. Since bringing in an outside firm costs even more money, usually, small businesses don’t have a 401 plan in place.

And because nearly a half of Americans work for small businesses, the amount of people left to their own means to save for retirement is significant.

Don’t Miss: What Happens To 401k When Switching Jobs

Review The Investment Choices

The 401 is simply a basket to hold your retirement savings. What you put into that basket is up to you, within the limits of your plan. Most plans offer 10 to 20 mutual fund choices, each of which holds a diverse range of hundreds of investments that are chosen based on how closely they hew to a particular strategy or market index .

Here again, your company may choose a default investment option to get your money working for you right away. Most likely it will be a target-date mutual fund that contains a mix of investments that automatically rebalances, reducing risk the closer you get to retirement age. Thats a fine hands-off choice as long as youre not overpaying for the convenience, which leads us to perhaps the most important task on your 401 to-do list …

Request A Direct Rollover Of Your 401

When transferring funds, request a direct rollover of your 401 account so that funds are transferred directly to your new account provider. An indirect rollover takes place when funds are first sent to you and then sent onwards by you to your new account provider. An indirect rollover would require you to come up with 20% of the account balance yourself and trigger a 60 day timeline to transfer funds to your account provider, or risk penalty charges.

When initiating a rollover of your 401 account, the most important thing to do is to request a direct rollover. Ask your 401 plan administrator to send your full account balance to your new account provider. A direct rollover means the funds never get sent directly to you if they were sent to you, it would be treated as an indirect rollover, trigger a 60 day timeline to transfer funds to your new account, and require you to contribute 20% of your account balance out of pocket, or incur penalties.

When an indirect rollover is selected, your employer will send you 80% of your 401 balance and withhold 20% for the IRS. It is your obligation to contribute to your new account the 20% withheld. Failure to come up with the funds within 60 days triggers an early distribution penalty of 10% plus taxes.

Free Guide: 5 Ways To Automate Your Retirement

You May Like: How Do I Open A 401k

Keep Your Money Where It Is

Keep your savings invested in your former employer’s retirement plan.

- Your savings stay invested, with the same tax advantages

- You continue with the plan’s investment options

- You can’t make additional contributions

- Your past employer may decide to make changes to the plan that impact your account

- Loans aren’t allowed, but you may be able to withdraw money before you retire under certain circumstances

Withdrawing After Age 595

Recommended Reading: What Do I Do With 401k When I Retire

Avoid Cashing Out Early

Whenever you switch jobs , youll have the opportunity to withdraw money from your 401 account and enjoy a sizable check.

While this is a tempting proposition, it can result in early withdrawal penalties and hundreds, if not thousands, of dollars in lost interest. Your best bet when switching jobs is to transfer your 401 by rolling it over to an IRA or the new employers 401 plan.

Option : Transfer The Money From Your Old 401 Plan Into Your New Employers Plan

Moving your old 401 into your new employers qualified retirement plan is also an option when you change jobs. The new plan may have lower fees or investment options that better support your financial goals. Rolling over your old 401 into your new companys plan can also make it easier to track your retirement savings, since youll have everything in one place. Its worthwhile to talk with an Ameriprise advisor who will compare the investments and features of both plans.

Some things to think about if youre considering rolling over a 401 into a new employers plan:

You May Like: How Much To Withdraw From 401k

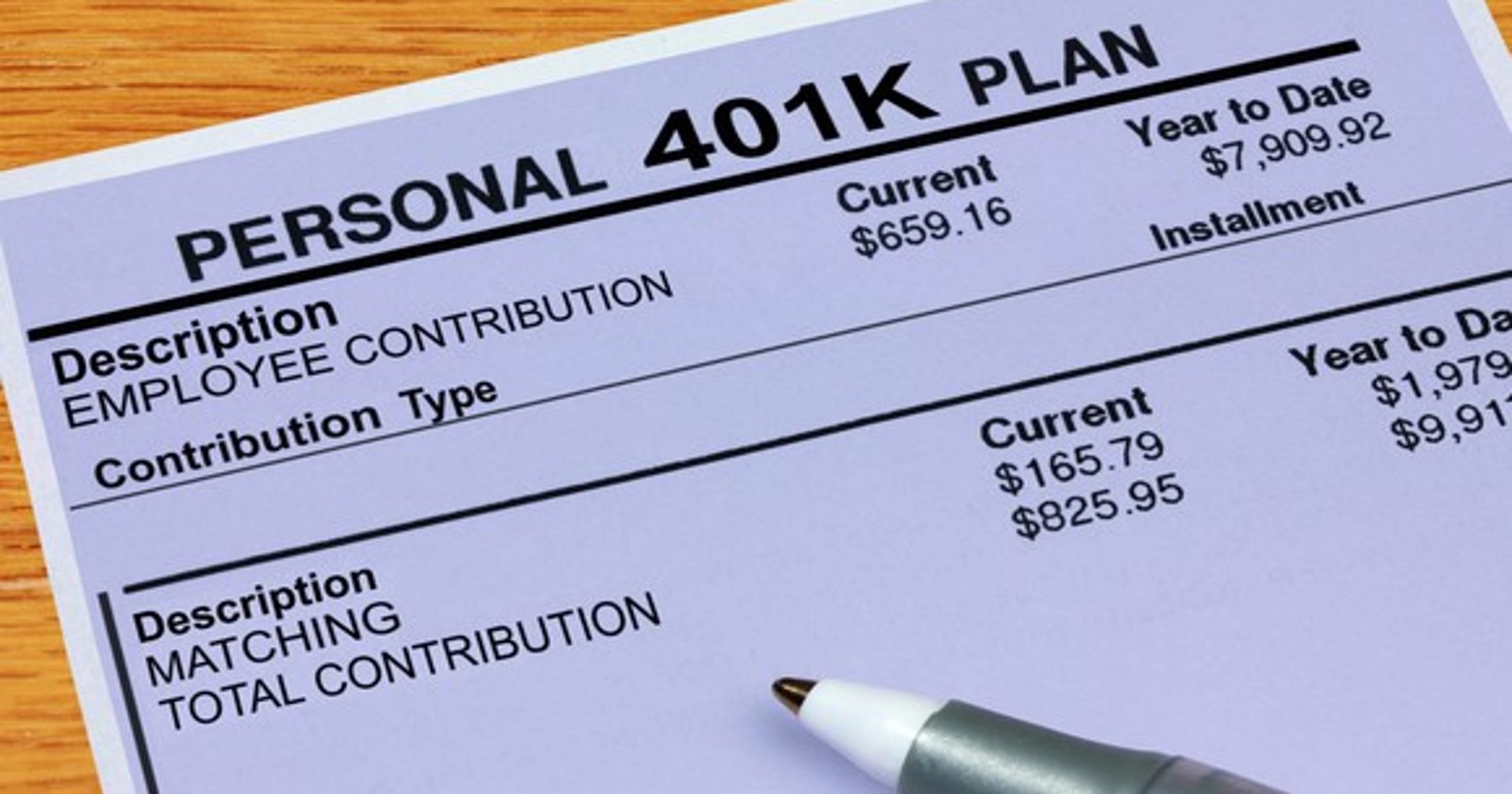

When Is The Money Yours

Some types of matching employer contributions are subject to a vesting schedule. The money is there in your account, but you’ll only get to keep a portion of what the company put in for you if you leave your job before you’re 100% vested. You always get to keep any of the money that you personally put into the plan.

Gift Solo 401k Question:

- Neither the IRA nor the solo 401 regulations allow for gifting retirement money.

- The rules do not allow for transferring, assigning or gifting of solo 401k funds during the account owners lifetime.

- The only exception to the no transfers during life rule is for transfers due to divorce where the solo 401k funds are transferred to the ex-spouse to satisfy a QDRO.

Recommended Reading: How To Rollover Fidelity 401k To Vanguard

Option : Keep Your Savings With Your Previous Employers Plan

If your previous employers 401 allows you to maintain your account and you are happy with the plans investment options, you can leave it. This might be the most convenient choice, but you should still evaluate your options. Each year, American workers manage to lose track of billions of dollars in old retirement savings accounts, so you should make sure to track your account regularly, review your investments as part of your overall portfolio and keep the beneficiaries up to date.

Some things to think about if youre considering keeping your money in your previous employers plan:

Is A 401 Worth It

You don’t have to master investing to allocate money in your 401 account in a way that meets your long-term goals. Here are three low-effort 401 allocation approaches and two additional strategies that might work if the first three options aren’t available or right for you.

Don’t Miss: How Can You Pull Money From Your 401k

Calculate How Much You Need

One way to calculate how much youll need to have saved for retirement is to create a detailed budget of your expected monthly expenses and subtract off the Social Security payments youll get each month. Your expected monthly Social Security benefit information is available through the Social Security Administration website. Then, with the estimated Social Security benefits in hand, add the numbers of years you may live, based on your life expectancy. If you dont want to do all those calculations, Motley Fool recommends creating a simplified retirement plan where you save a percentage of your income each month.

How Much Should I Contribute To My 401

The general rule of thumb is to aim to invest 15% of your gross income into your 401, including your employer match. But the exact target for you depends on your life stage, investing goals, and the aggressiveness of your portfolio. You also may want to combine a 401 with other retirement investment accounts such as a Roth 401 for tax strategy. Talk to an advisor to discuss the right investment plan for you.

Don’t Miss: How Much Tax On 401k Withdrawal

What Is A 401k

A 401k is an employer-sponsored retirement account. It allows an employee to dedicate a percentage of their pre-tax salary to a retirement account. These funds are invested in a range of vehicles like stocks, bonds, mutual funds, and cash. Oh, and if you’re curious where the name 401k comes from? It comes directly from the section of the tax code that established this type of plan specifically subsection 401k.

When Changing Jobs Is This Your Best Option

When an employee leaves a job due to retirement or termination, the question about whether to roll over a 401 or other employer-sponsored plan quickly follows. A 401 plan can be left with the original plan sponsor, rolled over into a traditional or Roth IRA, distributed as a lump-sum cash payment, or transferred to the new employers 401 plan.

Each option for an old 401 has advantages and disadvantages, and there is not a single selection that works best for all employees. However, if an employee is considering the option of transferring an old 401 plan into a new employer’s 401, certain steps are necessary.

Don’t Miss: How Much Should I Put In 401k

How To Maintain Your 401

You can’t just forget about your 401 after you’ve set it up. You must regularly revisit it to determine if you need to make any changes to your contribution amount or to your asset allocation. Check on your plan at least once or twice per year or following any major life event that could affect your finances or retirement plans.

First, look at how your investments are performing. Small losses here and there are to be expected, especially if you have a lot of your money invested in stocks. However, if you’re routinely losing money, that’s a sign something needs to change. You may also want to consider moving some of your money around if it’s underperforming major market benchmark indexes, like the Dow Jones Industrial Average and the S& P 500. In this case, switching to an affordable index fund that tracks these benchmarks may provide better, more predictable returns.

You should also evaluate how much money you’re contributing to your 401. Income usually rises over the course of one’s career, so you may feel more comfortable contributing more of each paycheck as your income grows. Some people choose to start small and increase their contributions by 1% of their salary every year until they reach their goal amount.

What Is An Ira

While there are a number of benefits to 401ks, they’re not the only retirement plan in the game. An IRA is an individual retirement account. Where a 401k can only be offered through an employer, an IRA account can be opened up by an individual whether they’re associated with an employer or not. That means they’re the best option for independent contractors without an employer or anyone who wants to do some extra retirement planning on top of their 401k.

Read Also: How To Start My 401k

How And Why To Transfer Your 401 To An Ira

posted on

By Justin Pritchard, CFP® in Montrose, CO

When you change jobs or retire, you have several options for the money in your 401. You can typically transfer that money to an IRA, leave it in the plan, move it to your new jobs retirement plan, or cash out. In many cases, its smart to move your savings into an IRA. Well cover the pros and cons here so you can decide whats best.

The process can be confusing and intimidating, so its easy to do nothing. But that might result in leaving your savings with an employer that you no longer have any connection to, and one you might even dislike or distrust.

Key takeaway:Read more below, or listen to the explanation .

Come To Terms With Risk

Some people think investing is too risky, but the risk is actually in holding cash. Thats right: Youll lose money if you dont invest your retirement savings.

Lets say you have $10,000. Uninvested, it could be worth less than half that in 30 years, factoring in inflation. But invest 401 money at a 7% return, and youll have over $75,000 by the time you retire and thats with no further contributions. calculator to do the math.)

Clearly youre better off putting your cash to work. But how?

The answer is a careful asset allocation, the process of deciding where your money will be invested. Asset allocation spreads out risk. Stocks often called equities are the riskiest way to invest bonds and other fixed-income investments are the least risky. Just as you wouldnt park your life savings in cash, you wouldnt bet it all on a spectacular return from a startup IPO.

Instead, you want a road map that allows for the appropriate amount of risk and keeps you pointed in the right long-term direction.

You May Like: How To Move 401k To Another Company

Compare Retirement Plan Options

If youre lucky enough to work for a company that offers some form of retirement plan, you may only be offered one or two retirement plan options. If youre self employed or charged with the responsibility to set up a retirement plan for your workers, then some plans to consider are a 401K or an IRA. IRAs are typically simpler to set up and have higher annual contribution limits, while a 401K tends to have more paperwork to manage.

Other Benefits Of A 401

Even for employers who do not offer any matching program, every employer with a 401 plan is responsible for administering the plan. That may seem like its no big deal, but it actually saves quite a bit of trouble for the employees. As an employee in a 401 plan, you dont have to worry about the complicated rules and regulations that need to be followed, or about making arrangements with the funds in which you invest your moneyyour employer takes care of all of that for you. Thats quite a bit of saved paperwork.

At the same time, employees who participate in a 401 maintain control over their money. While employers provide a list of possible investment choices, most commonly different sorts of mutual funds, employees have quite a bit of freedom to decide their own strategy. Whether you are willing to take on a little more risk with your investments, or if you would rather play it safe, theres probably an option for you.

Read Also: Is There A Fee To Rollover 401k To Ira