How Much Should I Invest In A Roth 401

We recommend investing 15% of your income into retirement savings. If you have a Roth 401 at work with good mutual fund options, you can invest your entire 15% there. Lets say you make $60,000 a year. That means you would invest $750 a month in your Roth account. See? Investing for the future is easier than you thought!

Can I Do A Roth Conversion If I Am Retired

Yes, you can do a roth conversion at any time. Just keep in mind a roth conversion always comes with a tax bill. When you move the funds from your 401k or IRA, you will also be missing out on tax-free growth.

If you retire at 59 ½ then it might not make sense to do a roth conversion ladder as your funds for a 401k/IRA will then be accessible penalty-free.

How Do I Protect My Ira From The Market Crash

How to protect your 401 from a stock market crash To see also : Ask the Hammer: How Much of My Traditional IRA Should I Convert Into My Roth IRA?.

- Protect your 401 from a stock market crash.

- Diversification and asset allocation.

- Try to have cash on hand.

- Keep contributing to your 401 and other retirement accounts.

- Dont panic and withdraw your money early.

- Bottom line.

Can I freeze my IRA account?

401 retirement plans can be frozen by management, which temporarily suspends new contributions and withdrawals. you may have the option to transfer the funds in your frozen 401 to an eligible IRA.

Can you lose your IRA if the stock market crashes?

These investment institutions like Fidelity have seemingly endless investment options to choose from within their IRAs. By moving your investments to less risky bond funds, your 401 will not lose all of your hard-earned savings when the stock market crashes.

Where should I put my money before the market crashes?

Put your money in savings accounts and certificates of deposit if you fear a crash. They are the safest vehicles for your money.

You May Like: Can I Use My 401k To Buy Investment Property

Freedom To Invest Your Money Where You Like

With a 401, your employer and plan provider present you with your investment choices. These choices typically include the company’s stock , funds put together based on , and target-date funds — which you select based on your projected retirement year.

On the other hand, Roth IRAs function like brokerage companies in that you can choose which investments you want, whether that’s single companies or funds. Having this freedom gives you more control over your investment decisions.

Can I Contribute To A Traditional Ira If I Have A Roth 401k

Short answer: Yes, you can contribute to both 401 and IRA, but if your income exceeds IRS limits, you may lose one of the IRA tax rates. Note: You can always donate to both Roth IRA and 401 , as long as your money makes you eligible for Roth right.

How much can I contribute to an IRA if I also have a 401k?

If you participate in an employee retirement plan, such as 401 , and your adjusted amount is equal to or lower than the number in the first column of your tax status, you can make and withdraw. an old IRA contribution of up to six dollars, or $ 7,000 if you are 50 years old or older, in

Do Roth and traditional contributions count towards 401k limit?

This is a post-tax contribution, which means you will not be able to deduct contributions from your tax deductible amount. Keep in mind that the maximum contribution is the average limit for all your 401 plans You cannot save $ 19,500 in custom 401 and another $ 19,500 in Roth 401 .

Recommended Reading: Can I Open A Roth 401k On My Own

Roth Iras’hidden Tax Benefits

But there is a great tax benefit to a Roth IRA. These accounts give you a pot of tax-free income to draw upon that may allow you to lower your tax bill.

Roth money doesn’t count in the calculation for taxing Social Security benefits, for example, or in the calculation for the tax on investment income.

Flexibility As You Save

Another big benefit of Roths is you can withdraw your contributions anytime, without taxes or penalties. If you pull out investment earnings early, however, youll owe taxes and penalties on that money.

The first and foremost reason is the flexibility of distributions, says Michael Bucci, senior manager of investment strategy for retirement plan services at Schneider Downs Wealth Management Advisors in Pittsburgh.

In fact, a Roth IRA can act as a backup emergency fund. For immediate emergencies, you want money in a savings account, not the stock market. But in the event of a long-term job loss, for example, having a Roth can be a blessing.

Also Check: Can Roth 401k Be Converted To Roth Ira

Direct And Indirect 401 Rollovers

Before you roll over your 401, youll need to open an IRA account. You can do this at virtually any major brokerage firm, mutual fund company or robo-advisor. Do some research, then head to your financial institutions website to open your account. At some point, youll want to talk to a customer representative to find out whether the rollover and conversion can be done at once or if they are done sequentially. If its the former case, youll just have to pick your investments once. If its the latter, youll want to keep the money liquid in the IRA before converting to a Roth.

Once youve opened the IRA, you can contact the company managing your 401 account to begin the rollover process. You can do this online or over the phone. Your 401 plan administrator will then transfer your funds into your new IRA account. This is called a trustee-to-trustee or direct rollover, and its the easiest way to do it.

Another path is an indirect rollover. In this case, the balance of the account is distributed directly to you, typically as a check. Youll have 60 days from the date you receive the funds to transfer the money to your custodian or IRA company. If you dont deposit the funds within the 60 days, the IRS will treat it as a taxable withdrawal, and youll face a 10% penalty if youre younger than 59.5. This risk is why most people choose the direct option.

How Does A 401 Work

While both accounts are tax-advantaged and intended to help individuals save for retirement, there are some big differences between them.

A 401 is employer-sponsored, which means you can only open an account if it’s offered by the company you work for. You typically can’t sign up for one independently. Any contributions to a 401 account are made using pretax dollars that come straight out of your paycheck.

With a 401, or other employer-sponsored account like a 403, you don’t pay taxes on the money until you begin taking out distributions for retirement. How much that money gets taxed depends on the tax bracket you’re in at the time of the withdrawal, and pulling from your 401 prior to the age of 59½ could result in a penalty.

A major perk with 401 plans is that employers often offer a “contribution match.” This is also sometimes referred to as an “employer match” or “company match,” but typically it means your company contributes the same amount to your 401 as you do, up to a certain percent.

For example, if you earn $55,000 a year plus a 4% match, you’ll need to contribute 4% in order to get the full employer match of $2,200. If you only put in $1,000, your employer will as well, which means you’re missing out on $1,200 of essentially free money that could be growing in the market.

In the U.S., the average company 401 match is 4.7%, according to retirement plan provider Fidelity.

You May Like: How Can I Use 401k To Buy A House

Put Your Child’s Earnings To Work

A contribution to a Roth IRA for Kids can be made if a minor has earned income during the year. Eligible income can include formal employment income or self-employment income. Activities like babysitting or mowing lawns can qualify a minor for Roth IRA contributions. Note that in some cases self-employment taxes can apply so it’s advisable to consult with a tax professional. The current maximum annual contribution is $6,000, or the total of a childs earned income for the yearwhichever is less. For example, if your daughter earned $2,000 during a summer job, you could contribute up to $2,000 to a Roth IRA in her name. If your child is not filing a tax form that covers his or her earned income, consider maintaining a written log of their earnings in case the IRS asks questions. Unlike traditional IRAs, contributions to Roth IRAs are made with after-tax dollars. This means the account owner cannot claim a tax deduction for his or her contributions. However, since most kids have low annual earnings, their income tax rate is already quite low or even zero. Therefore, tax deductions may not be an important factor at this stage of their lives. Moreover, when it comes time to tap their savings at retirement age, distributions from a Roth IRA will be tax-free, unlike distributions from a traditional IRA.

Talk With An Investment Pro About Your Roth 401

If you want to learn more about your Roth 401 or other investing options, find an investing pro in your area. A financial advisor can help you understand your investments and make confident decisions.

A do-it-yourself approach to investing is never a good idea. Even the pros work with a financial advisor! Your familys future is way too important to wing it.

Looking for a qualified investing pro? Try the SmartVestor program! Its a free way to find top-rated financial advisors near you. Start building a relationship with an investing pro who understands the financial journey youre on.

Recommended Reading: What Are The Best 401k Funds To Invest In

The Best Choice: Work With A Pro

Heres the deal: Investing is worth the hard work. If you dont save and invest now, you wont have anything to live on in retirement. It can be intimidating and complex, but you dont have to do this alone.

Talk with an investment professional like our SmartVestor Pros. Get someone on your team who will help you stay focused and chasing your dreams. They can walk you through your 401 and Roth IRA contribution options and create a plan for your situation.

About the author

Ramsey Solutions

Ramsey Solutions has been committed to helping people regain control of their money, build wealth, grow their leadership skills, and enhance their lives through personal development since 1992. Millions of people have used our financial advice through 22 books published by Ramsey Press, as well as two syndicated radio shows and 10 podcasts, which have over 17 million weekly listeners.

Benefits Of Having Both A 401 And A Roth Ira

Using both a 401 and a Roth IRA to save can be a great option for someone looking to put as much money as possible into tax-advantaged retirement accounts.

If you’re a higher-income earner on the edge of qualifying for a Roth IRA contribution, making a 401 contribution could push you under the income limitations, since those contributions don’t count toward your AGI. That would open the door for more flexibility with short-term savings in a Roth IRA.

Ultimately, an employer-sponsored 401 shouldn’t prevent you from getting money into a Roth IRA. While you should consider any other options at your disposal, maximizing the amount of money in your tax-advantaged savings accounts is usually a good strategy for a healthy retirement.

You May Like: Can I Start My Own 401k Plan

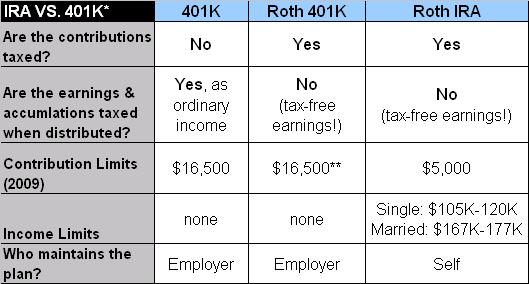

Roth Ira Vs : What Are The Major Differences

The main difference between a Roth IRA and 401 is how the two accounts are taxed. With a 401, you invest pretax dollars, lowering your taxable income for that year. But with a Roth IRA, you invest after-tax dollars, which means your investments will grow tax-free.

Okay, folks, does anybody else feel like theyve been drinking water from a firehose? That was a lot of information! Lets review the main differences between the Roth IRA and the 401 so you can easily compare their features:

|

Feature |

|

|

Penalties for withdrawals before 59 1/2. |

Penalties for withdrawals before 59 1/2. |

What Kinds Of Mutual Funds Should I Choose For My Roth 401

Diversifying your portfolio is key to maintaining a healthy amount of risk in your retirement savings. Thats why it’s important to balance your investment among four types of mutual funds: growth and income, growth, aggressive growth, and international funds.

If one type of fund isnt performing as well, the other ones can help your portfolio stay balanced. Not sure which funds to select based on your Roth 401 options? Sit down with an investment professional who can help you understand the different types of funds, so you can choose the right mix.

You May Like: How To Figure Out Your 401k Contribution

Roth Ira Vs Roth 401 Choose The Best Plan For You

Jeff Rose, CFP® | September 03, 2021

The Roth IRA vs. the Roth 401 they have so much in common, yet theyre also so different! How can that be, since are both Roth plans? Mostly, its because one is an employer-sponsored plan, and the other is a self-directed account.

But the IRS allows certain specific benefits for each plan type. The Roth IRA versus the Roth 401 how are they similar, and how are they different?

Where Should My 401k Be By Age

This is how many Fidelity experts recommend that you save for retirement at any age:

- Up to 30 years, you should have saved the equivalent of your salary.

- Up to 40 years, you should have saved three times your salary.

- Up to 60, you should have saved eight times your salary.

How much should I have in my 401k at 40?

If your household income is closer to $ 50,000, you should still see a nice 30% boost to your retirement savings if you consistently save 20% of your after-tax income. At age 40, you should really be closer to $ 500,000 or more in your 401k.

How much should I have in my 401k at 60 years old?

Fidelity says up to 60 years you should have saved eight times your current salary. So, if you earn $ 100,000 by then, your 401 balance should be $ 800,000. How much money do you need to pay your bills each month?

At what age should you be a 401k Millionaire?

Recommended 401k Amount By Age Middle-aged savers should be able to become 401k millionaires around 50 years of age if they have reached their 401k maximum and invested properly since the age of 23.

Don’t Miss: How Do I Open A 401k Account

What’s The Difference Between A Roth Ira And A 401

An IRA and 401 are both retirement savings vehicles. An IRA is an account opened by an individual, and a Roth IRA allows you to save after-tax funds to withdraw tax-free in retirement. Whether you can contribute to a Roth IRA depends on your income. A 401 is sponsored by an employer. You contribute pre-tax funds to a 401, and an employer may contribute as well. Those contributions lower your income taxes.

Disadvantages Of A Roth Ira

Just like a 401, a Roth IRA has its downsides:

- Contribution limit. You can only invest up to $6,000 in a Roth IRA each year or $7,000 if youre age 50 or older.3 Thats a lot less than the 401 contribution limit.

- Income limits. If youre single or the head of a household, your modified adjusted gross income has to be less than $125,000 to contribute the full amount to a Roth IRA. If youre married and file your taxes jointly with your spouse, your MAGI must be less than $198,000. If your income is above these limits, the amount you can invest is reduced. And if you make $140,000 or more as a single individual or $208,000 or more as a married couple filing jointly, youre not eligible for a Roth IRA.4 However, the traditional IRA would still be an option.

You May Like: How Can I Use My 401k To Buy A House

Converting Roth 401 To Roth Ira

Rolling over your Roth 401 into a Roth IRA can be beneficial because of greater investment flexibility with an IRA. Typically, individual IRA accounts have wider investment options than Roth 401. Sometimes your options in a 401 are limited to mutual funds or a few different index funds.

The 5-Year Rule

One thing to keep in mind is the 5-year rule. If you roll a Roth 401 to a Roth IRA, its the time clock on the Roth IRA that counts. For example, imagine youve had a Roth 401 for 10 years and a Roth IRA for five years. If you roll your Roth 401 to that Roth IRA the clock is reset to the time youve had the Roth IRA. In this case, its five years, so youre good. If that Roth IRA was only active for three years, then youd need to wait two more years before you could withdraw earnings tax-free.

What Does Roth Mean Where Did The Term Come From Why Is It Called Roth Is Roth An Acronym

Lets start with the word Roth. The word Roth originates from Senator William Roth of Delaware. In 1989 Senator Roth teamed up with Senator Bob Packwood of Oregon. They proposed the IRA Plus Plan which allowed individuals to invest up to $2,000 with no tax deductions. The earnings could be later withdrawn tax-free at retirement.

The Roth IRA was eventually established by the Taxpayer Relief Act of 1997 and named after Senator Roth. In 2000, 46.3 million taxpayers held IRA accounts amounting to $2.6 trillion. Only about $77 billion was held in Roth IRAs. Seven years later the number of IRA owners jumped to 50 million with $3.3 trillion invested.

Recommended Reading: Does A 401k Rollover Count As A Contribution