Receiving Your Funds By Check

Many 401 plans let you manage your account online, and this includes withdrawals and monitoring your 401 check status. You can submit an online withdrawal request, and depending on your plan, it could take five to seven business days for your withdrawal application to be processed. Once it’s processed, you can expect to receive your check in the mail shortly thereafter. Keep in mind, receiving your funds by paper check will take longer than opting for direct deposit.

Can I Use My 401 To Buy A House

For many would-be homeowners, the down payment is the biggest entry barrier to buying a house. While down payments can be as low as 3.5%, 20% is ideal if you want to secure a mortgage without monthly mortgage insurance fees.

If youre having trouble gathering funds for a down payment, you might find yourself considering using your 401 retirement fund as a convenient source of cash. While this is technically allowed, and could help you cover your down payment, there are some factors and drawbacks that you might want to consider.

Well break down the pros and cons of making a 401 withdrawal for a home purchase, as well as some alternatives.

When Can You Withdraw From A Roth Ira

You can withdraw the contributions you’ve made to a Roth IRA at any time. If you withdraw earnings before age 59 1/2, they’re subject to income taxes and a 10% tax penalty. You can withdraw earnings without a penalty under certain circumstances, including using it for a first-time home purchase and for qualified educational expenses.

Don’t Miss: Where Can I Find My 401k Balance

Try To Have Cash On Hand

Some financial professionals recommend retirees have enough cash or cash equivalents to cover three to five years worth of living expenses. Having cash reserves can help pay for unexpected expenditures that a fixed income may not otherwise be able to cover.

Cash on hand can also mitigate whats called sequence of returns risk. Thats the potential danger of withdrawing money early in retirement during market downturns and, thus, permanently diminishing the longevity of a retirement portfolio. By selling low, the longevity of the investors portfolio is jeopardized. However, with cash reserves retirees can withdraw less money from their 401 during a market decline and use the cash to cover living expenses.

What Is A 401k

A 401k allows you to dedicate a percentage of your pre-tax salary to a retirement account.

Employers can also choose to match some or all of the contributions, but this isn’t required so it’s not guaranteed.

There are two basic types of 401ks – traditional and Roth – with the main difference being how they’re taxed.

In a traditional 401k, employee contributions reduce their income taxes for the year they are made, but they’ll pay tax when they withdraw cash.

Don’t Miss: Where Can I Find My 401k

Find Out About Your Options

- You can review full details of your distribution options and the steps you need to take to receive payments in the Distribution Options Brochure below.

- Obtain a printed copy of the brochure by calling a Fidelity Investments Retirement Services Specialist toll-free at MIT-SAVE or 648-7283.

- Access information about your account through Fidelity NetBenefits.

What Type Of Situation Qualifies As A Hardship

The following limited number of situations rise to the level of hardship, as defined by Congress:

- Unreimbursed medical expenses for you, your spouse or dependents

- Payments necessary to prevent eviction from your home or foreclosure on a mortgage of principal residence.

- Funeral or burial expenses for a parent, spouse, child or other dependent

- Purchase of a principal residence or to pay for certain expenses for the repair of damage to a principal residence

- Payment of college tuition and related educational costs for the next 12 months for you, your spouse, dependents or non-dependent children

Your plan may or may not limit withdrawals to the employee contributions only. Some plans exclude income earned and or employer matching contributions from being part of a hardship withdrawal.

In addition, IRS rules state that you can only withdraw what you need to cover your hardship situation, though the total amount requested may include any amounts necessary to pay federal, state or local income taxes or penalties reasonably anticipated to result from the distribution.

A 401 plan even if it allows for hardship withdrawals can require that the employee exhaust all other financial resources, including the availability of 401 loans, before permitting a hardship withdrawal, says Paul Porretta, a compensation and benefits attorney at Troutman Pepper in New York.

Don’t Miss: Does 401k Roll Over From Job To Job

Caveats To The 4% Rule

Several variables can make this rule of thumb either too conservative or too risky, and you might not be able to live on 4%-ish a year unless your account has a significantly large balance.

The first caveat you should consider when thinking about applying the 4% rule to your personal situation is that it calls for putting 50% each in stocks and bonds. You may not be comfortable putting that much of your retirement assets in equities, and you may want to keep at least a portion of your nest egg in cash or a money market fund.

You also might not expect to live for 30 years after retirement, either because you retired later than most people do or for some health-related reason. And you may not feel you need the almost 100% confidence level Bengen was seeking in his rule a confidence level of 75% to 90% that you won’t run out of money might be acceptable to you and may afford a more flexible withdrawal rate.

Should You Take A Distribution From Your 401 Or Ira

Like the CARES Act, the Consolidated Appropriations Act allows you to withdraw funds from both a 401 and an IRA, as long as the amount is up to $100,000 across all accounts. If you are deciding whether to take a distribution from either your IRA or a 401, think about factors such as each of the account’s typical rules around penalties and taxes. F

Recommended Reading: How To Transfer 401k To Bank Account

When You Don’t Take An Rmd

If you are subject to RMDs, it is extremely important to withdraw this money by the deadlines.

If you dont take an RMD:

Youll be subject to a penalty of 50 percent of the value of the RMD, which is basically giving money away.

You dont have to spend the money, but you do have to remove it from the retirement plan it is in according to the rules.

You can learn more about RMDs, how theyre calculated in regards to life expectancy and everything else you need to know at the IRSs RMD resource page.

After you take your RMD, you have a few other places you can withdraw money from, as well.

Accessing Money Before Traditional Retirement Age

But what happens if you retire before age 59 ½? Can you access your money early without penalties?

You could use the 401 option discussed above.

Unfortunately:

You must retire from the company with the 401 in the calendar year you turn 55 for this to work.

If the 401 option doesnt work for you, there is another option called Rule 72. This rule requires you to follow strict guidelines. That said, it allows you to take penalty-free withdrawals from traditional retirement accounts.

To do so, you must take substantially equal periodic payments.

Read Also: How Much Should I Put In 401k

Substantially Equal Periodic Payments

Substantially equal periodic payments are another option for withdrawing funds without paying the early distribution penalty if the funds are in an Individual Retirement Account rather than a company-sponsored 401 account.

SEPP withdrawals are not permitted under a qualified retirement plan if you are still working for your employer. However, if the funds are coming from an IRA, you may start SEPP withdrawals at any time.

There is an exception to this rule for taxpayers who die or become permanently disabled.

SEPP must be calculated using one of three methods approved by the Internal Revenue Service : fixed amortization, fixed annuitization, or required minimum distribution . Each method will calculate different withdrawal amounts, so choose the one that is best for your financial needs.

Changing Or Leaving A Job Can Be An Emotional Time

How to cash out 401k from old job fidelity. If your retirement plan is with fidelity, log in to netbenefits ®. Find out your 401 rules, compare fees and expenses, and consider any potential tax impact. This video will help you learn how to evaluate your situation and assist you in making the most.

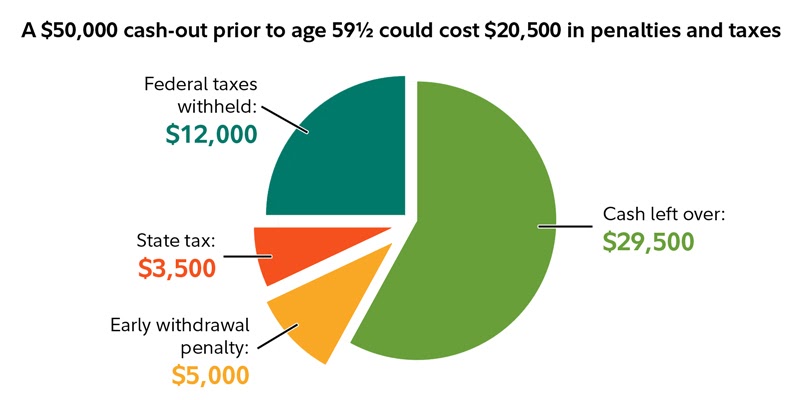

Otherwise, you can roll over the money from the previous 401k into the new version with your new employer or roll it into an individual retirement account . Say you have a $50,000 balance in your 401 account and you decide to cash it out. You will be subject to 10% early withdrawal penalty and the money will be taxed as regular income.

If you’ve explored all the alternatives and decided that taking money from your retirement savings is the best option, you’ll need to submit a request for a 401 loan or withdrawal. Thinking of cashing out my 401k from my previous employer. Generally speaking, you can cash out your 401 k retirement account if it contains less than $1000 in funds.

Once you log into netbenefits, choose the account from which you want to withdraw. Theyll close your account and mail you a check. Cash out if you withdraw the money from your 401 plan, your cash distribution will be subject to state and federal taxes and, before age 59½, a 10% withdrawal penalty may apply.

With a 401 loan, you borrow money from your retirement savings account. You can either cash it out, or you may roll it over through an ira. You can leave the account where you worked before.

Read Also: Can You Roll Over 403b To 401k

How Much Tax Do I Pay On An Early 401 Withdrawal

The money will be taxed as regular income. That’s between 10% and 37% depending on your total taxable income.

In most cases, that money will be due for the tax year in which you take the distribution.

The exception is for withdrawals taken for expenses related to the coronavirus pandemic. In response to the coronavirus pandemic, account owners have been given three years to pay the taxes they owe on distributions taken for economic hardships related to COVID-19.

If You Are 59 1/2 Or Older

Once you are six months away from your 60th birthday, you can begin making withdrawals from your Fidelity 401k without having to worry about any additional tax penalties. Your 401k is now money thats there for you to start preparing for the next stage of your life as you put the finishing touches on your career and prepare to start drawing Social Security benefits.

However, that doesnt mean you dont have to worry at all about taxes. Money withdrawn from your 401k is taxable income, so you should be careful to consider just how much you need to withdraw in any given tax year to ensure youre not hitting a higher tax bracket and seeing more of your hard-earned money lost to taxes. If you have a Roth IRA or Roth 401k, though, you can make tax-free withdrawals from those, so you can balance withdrawals to minimize the tax impact.

Your Fidelity 401k comes with the option to schedule regular withdrawals so that you can do the paperwork for your withdrawal once and then set up a recurring payment. With structured, regular withdrawals, you can set up a budget that will limit your withdrawals to what you need, and youll be able to have checks showing up on a set schedule.

Learn: The Best 401k Companies

Recommended Reading: How Does 401k Work When You Quit

Opting For Direct Deposit

Choosing direct deposit doesn’t change the way you initiate your 401 withdrawal, nor does it speed up the application processing time you would have to follow the same procedure as you would for receiving your funds by check in the mail. However, in case you need your funds a little faster, then you should select direct deposit if that option is available to you.

You will still need to wait for your withdrawal application to process which takes five to seven days on average before the funds are released into your account. Once the money is released, it could post as early as the same day, or within 48 hours, depending upon your banking institution.

Build An Emergency Fund

This should be the foundation of your financial plan and experts recommend having about six months worth of expenses saved. You can park this money in a high-yield savings account to earn more interest than you would in a traditional checking account. An emergency fund should help you manage most of lifes curveballs.

Read Also: How To Select 401k Investments

Loan Or 401 Withdrawal

While similar, a 401 loan and 401 withdrawal aren’t interchangeable and have a few key differences. While you can use either to access up to $100,000 of your retirement funds penalty- and tax-free as part of the Consolidated Appropriations Act, they each have their own rules.

As part of a 401 withdrawal:

- Repayment isn’t required.

- There’s no withdrawal penalty.

- Distribution will be taxed as income, but you can pay it back within three years and claim a refund.

As part of a 401 loan:

- You must repay the loan within a specified time frame .

- The loan amount isn’t taxed initially, and there’s no penalty. If you can’t pay it back within the specified time frame, the outstanding balance is taxed and you’ll also be assessed a 10 percent early withdrawal penalty, if you are under age 59 1/2.

- If you leave your job, you have until mid-October of the following year to offset the outstanding loan amount. Otherwise, you could owe 401 early withdrawal taxes and penalties.

Work with your plan sponsor to learn more about the pros and cons of a 401 withdrawal vs. 401 loan.

Periodic Distributions From 401

Instead of cashing out the entire 401, you may choose to receive regular distributions of income from your 401. Usually, you can choose to receive monthly or quarterly distributions, especially if inflation increases your living expenses. If the 401 is your main source of income, you should budget properly so that the distributions are enough to meet your expenses.

For example, if you have accumulated $1 million in retirement savings, you can choose to receive $3,330 every month, which amounts to approximately $40,000 annually. You can adjust the amount once a year or every few months if your 401 plan allows it. This option allows the remaining savings to continue growing over time as you take periodic distributions.

Also Check: How Can I Take Out My 401k

How Much Money Can I Put Into My 401 Account

The maximum pre-tax contribution dollar amount is set by law and adjusted for inflation annually. The current pre-tax contribution limit is $18,000. If you are age 50 or older you may also make an additional catch-up contribution of $6,000 per year. In addition, there are special non-discrimination rules that apply to the plan. If you earn more than $120,000 a year, or own more than 5 percent of the company, contribution caps may apply for you.

Dividing Your 401 Assets

If you divorce, your former spouse may be entitled to some of the assets in your 401 account or to a portion of the actual account. That depends on where you live, as the laws governing marital property differ from state to state.

In community property states, you and your former spouse generally divide the value of your accounts equally. In the other states, assets are typically divided equitably rather than equally. That means that the division of your assets might not necessarily be a 50/50 split. In some cases, the partner who has the larger income will receive a larger share.

For your former spouse to get a share of your 401, his or her attorney will ask the court to issue a Qualified Domestic Relations Order . It instructs your plan administrator to create two subaccounts, one that you control and the other that your former spouse controls. In effect, that makes you both participants in the plan. Though your spouse cant make additional contributions, he or she may be able to change the way the assets are allocated.

Your plan administrator has 18 months to rule on the validity of the QDRO, and your spouses attorney may ask that you not be allowed to borrow from your plan, withdraw the assets or roll them into an IRA before that ruling is final. Once the division is final, your former spouse may choose to take the money in cash, roll it into an IRA or leave the assets in the plan.

Don’t Miss: How Do I Set Up A 401k For My Employees

Alternatives To Tapping Your 401

If you must tap into retirement savings, it’s better to look at your other accounts firstspecifically IRAsespecially if you’re buying a first home .

Unlike 401s, IRAs have special provisions for first-time homebuyerspeople who haven’t owned a primary residence in the last two years, according to the IRS.

First, look to take a distribution from your IRAif you have one. You may be able to withdraw IRA contributions without penalty due to a qualified financial hardship. You can also withdraw up to $10,000 of earnings tax-free if the money is used for a first-time home purchase. As a first-time homebuyer, you can take a $10,000 distribution without owing the 10% tax penalty, although that $10,000 would be added to your federal and state income taxes. If you take a distribution larger than $10,000, a 10% penalty would be applied to the additional distribution amount. It also would be added to your income taxes.