How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

Rules For Roth Ira Conversions And Other Considerations

Once you start evaluating how a Roth IRA might work for your retirement goals, taxes start to become a significant consideration. Working with your tax professional will help you determine:

- The best times and ways to move money between retirement accounts including between different companies, especially if you are consolidating accounts

- When and how to pay taxes on the money in your retirement accounts

- Which IRS rules may impact your strategy

It may be a good idea to talk with your financial professional or tax professional about if participating in a Roth IRA, no matter how you do it, makes sense for you todayor in the future years.

Is It Better To Move Money From A 401 To A Roth Ira

Because of the five-year rule limiting qualifying withdrawals, it’s advisable to transfer the funds to an existing Roth IRA account, if you have one. If you intend to withdraw the transferred money soon, transferring them to another Roth 401 may give better tax treatment. Otherwise, the rules would require us to start taking required minimum distributions later than we’d like.

Transfers between retirement accounts are not tax-free. So even if you owe no taxes now, you might owe some in the future. You should also know that once you transfer funds out of one retirement account and into another, those original funds are gone forever. They can’t be brought back.

The only way to avoid any tax on the transaction is if you’re in a zero percent tax bracket right now. In that case, there would be no tax due because all of your income would be below the filing threshold. But since this is not guaranteed at the time of writing, we can say that moving funds between retirement accounts can be a good way to keep more of your hard-earned money.

It’s important to understand that while Roth IRAs are great options for people who want to use their retirement savings as tax-free money, they are not free from charge-offs or losses. If investments in your Roth IRA account perform poorly, you could end up with a negative balance.

Don’t Miss: What To Do With 401k When You Quit Your Job

Can You Withdraw Contributions From A Backdoor Roth Ira

And you can withdraw both your contributions and earnings from a Roth IRA with no taxes or penalties after you turn 59 and a half, as long as the account is at least five years old. Otherwise, you will be subject to the 10% tax penalty unless an exception applies .

How do you remove a backdoor from a Roth IRA?

To reverse a conversion by returning an account to traditional IRA status, you must submit the required form to the Roth IRA trustee or custodian by October 15 of the year following the conversion.

Can I withdraw my contributions from a Roth IRA conversion without a penalty?

As a general rule, you can withdraw your contributions from a Roth IRA at any time without paying any taxes or penalties. If you withdraw money from a conversion too soon after that event and before the age of 59 and a half, you could incur a penalty.

A Conversion May Affect Government Programs

If you participated in government healthcare programs or others that depend on your income, its vital to note that a conversion could affect your eligibility in those programs or their cost.

The Roth conversion is viewed as taxable income in the year it occurs, says Keihn. This means that it could affect your eligibility for Obamacare or financial aid or your childrens financial aid. If you are on Obamacare or completing a FAFSA application, it is important to factor that into the decision of how much to convert, if any.

People who are two years from receiving or are receiving Medicare benefits need to know that their Medicare premium most likely will go up two years after they convert to a Roth IRA, says Gilbert. Medicare has a two-year look-back to determine premiums and in the year you convert, your income will be higher than other years. But this is a one-year spike that will then decrease the following year.

Read Also: How Can You Take Out Your 401k

Should You Make A Roth Conversion Or Not

If you have a traditional individual retirement account or IRA, you may have considered converting to a Roth IRA. With a conversion, investors are able to move money out of a traditional IRA, pay taxes on the funds at ordinary federal and state rates, and move it into the Roth, where it will grow tax-free. You can make future withdrawals from a Roth IRA tax-free as long as you meet certain qualifications.

In order for Roth IRA distributions to be made on a tax-free basis, they must be made after a five-taxable-year period of participation and must occur when or after you reach age 59 1/2. In the case of a conversion, five years must have passed since the conversion.

A Roth IRA conversion can make a lot of sense for some. On the other hand, there are certain cases when it makes no sense at all. Before you convert to a Roth, ask yourself these questions:

Disadvantages Of A Roth Ira

- There is a contribution cap. A Roth IRA allows you to invest up to $6,000 per year, or $7,000 if youre 50 or older. 3 Thats far less than the 401 contribution cap.

- Income restrictions apply. To contribute the full amount to a Roth IRA, your modified adjusted gross income must be less than $125,000 if youre single or the head of a family. Your MAGI must be less than $198,000. If youre married and file jointly with your spouse, your MAGI must be less than $198,000. The amount you can invest is lowered if your income exceeds specified limits. You cant contribute to a Roth IRA if you earn $140,000 or more as a single person or $208,000 as a married couple filing jointly. 4 Traditional IRAs, on the other hand, would still be an option.

Don’t Miss: How To Check If You Have A 401k

Drawbacks Of Keeping Your 401 With A Former Employer

There are potential drawbacks to this strategy, which may lead you to roll over your account into a new plan.

Multiple accounts to manage: Keeping your 401 with your former company means youll have more than one retirement account to track. For some investors, that may be one too many accounts to juggle.

Contributions end: While the money in your old 401 will continue to grow tax-deferred, you will no longer be able to contribute to the account.

Communication: You may be out of the loop about important updates concerning your account if information about your former employers plan is distributed via company email.

Higher fees: Its possible that fees and expenses attached to your former employers plan are higher than what is offered by your new company. Remember to check the fee disclosure notice of any plan that youre in or thinking of joining.

Is The Roth 401 A Good Deal

As for the Roth 401, one thing should be noted: only your contributions are not taxable. If your company offers correspondence, you must pay the retirement income tax on the correspondence page of your personal account. That said, the Roth 401 is an incredible deal. You can literally save hundreds of thousands of dollars in retirement.

Read Also: Can I Invest In 401k And Roth Ira

How Does The Nerdwallet 401k Calculator Work

401 Calculator 401 Calculator NerdWallet calculates your 401 balance in retirement, considering your contributions, applicable employer dollar amounts, expected retirement age, and investment growth. New to 401s? Learn the basics from your 401 guide.

Traditional ira vs roth iraWhat are the advantages and disadvantages of a Roth IRA? Here are the main advantages and disadvantages of accounts and how they differ from traditional IRAs. Withdrawals from a Roth IRA are tax-free if the account has been open for at least five years and you are 59½ or older. In contrast, withdrawals from a traditional IRA are tax-deductible.How do you calculate a Roth IRA?Divide the bâ¦

Reasons To Convert From 401 To Roth Ira

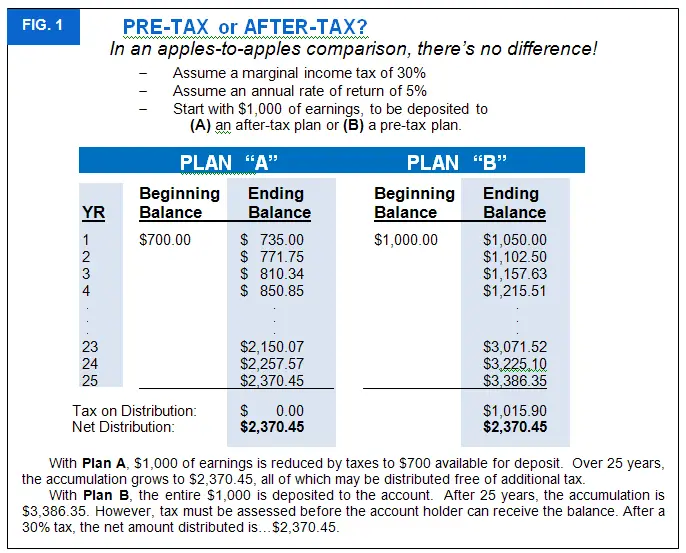

Remember that the biggest difference between a 401 and a Roth IRA is when the income is taxed. With a 401, taxes are deferred until after retirement. With a Roth IRA, you pay taxes now, but can take the money out tax-free when you are retired. For that reason, the decision to convert from a 401 to a Roth IRA depends your current income tax rate and the rate you expect to pay when you retire.

The rule of thumb is this: If you expect to be in a higher tax bracket when you retire, convert to a Roth IRA. Heres why. If you currently pay a 25 percent tax on your income, its better to pay now and reserve your tax-free Roth IRA distributions for retirement, when you are in the 35 percent tax bracket.

But why would anyone be in a higher tax bracket after they retire? Lets use Joe as an example. Joe makes a nice salary, but for most of his working years, he had the benefit of several large deductions and tax breaks that lowered his taxable income. Joe is married, has four kids, and owns his home, so he always filed jointly, took deductions for each dependent, and deductions for mortgage payments. He also maxed out his 401 contributions every year , further lowering his taxable income.

Now lets look at why Samantha, Joes daughter, might want to stick with a 401.

Don’t Miss: How Do You Take A Loan Out Of Your 401k

A Roth Conversion Could Trigger Other Taxes

Look at the big picture if you plan a conversion. The added taxable income could boost you into a higher tax bracket, at least temporarily. A big jump in income could trigger one-time taxes, too, such as the 3.8% net investment income tax, or also called the Medicare surtax.

A series of small conversions over several years could keep the tax bill in check. For instance, you may want to convert just enough to take you to the top of your current tax bracket.

Your Income Is Low This Year

It could even make sense to do a conversion during a year when your income is unusually low.

This year we have seen millions of people quit their jobs to take time to consider new career moves, says Keihn. If you have opted to take a few months off before starting a new career, a Roth conversion could be a great option for you this year due to temporarily lower income.

Recommended Reading: Where Is My 401k Money Invested

Should You Convert Your Traditional 401 Into A Roth 401

7 Minute Read | December 14, 2021

Over the past few years, you might have received an email from your companys human resources department introducing a new retirement savings plan option: the Roth 401.

More and more companiesespecially large onesare adding Roth options to their 401 plans. In fact, seven out of 10 employers now offer this option to their employees.1 If the Roth 401 is on the table at your workplace, thats great news for you!

But if you now have a Roth 401 option, youre probably wondering what to do with your existing 401. Is converting an existing 401 to a Roth the way to go? Or should you just leave it alone?

There are some things to keep in mind before you make this decision, so lets dive in.

How Does The 55 Rule Work

If you are between the ages of 55 and 59 1/2 and are fired or laid off or quit your job, the IRS rule of 55 allows you to withdraw money from your 401 or 403 plan without penalty. Once done, you can leave your current job before age 59 and a half and withdraw the money using the Rule of 55.

How do you use the Rule of 55?

The rule of 55 applies to you if: You leave your job in the calendar year that you turn 55 or later . You can leave for any reason, including because you got fired, fired, or quit.

How much can I take out of my 401k at 55?

What is the rule of 55? Under the terms of this rule, you can withdraw funds from your current jobs 401 or 403 plan without any 10% tax penalty if you leave that job within or after the year you turn 55.

Also Check: When Do You Have To Take 401k Distributions

Does The Conversion Have To Be Done All At Once

Many people cant afford to pay the taxes that will come due on a Roth IRA conversion, even if they believe that conversion is their best long-term financial strategy. So you can convert only the amount of your account on which you know you can comfortably afford to pay the tax.

You can continue to do a partial conversion year after year, never having to make that giant tax payment, while gradually shifting your retirement accounts to tax-free status over time.

How Are Roth Conversions Taxed

When you convert money from a tax-deferred retirement account to a Roth IRA you are taxed on the AMOUNT that you convert. Suppose you have $500,000 in a tax-deferred 401k or 403b. If you convert that full amount youll have to include $500,000 in your taxable income.

Suppose instead you convert only a portion of your account, or $25,000. In that case you would include the $25,000 dollars in your taxable income.

The point here is to understand that the taxable value is the amount that you convert.

Also Check: How Does A Solo 401k Plan Work

Should You Invest In A 401k Or A Roth

Many new investors wonder if they should invest in a 401k or Roth IRA. Both are tax-advantaged retirement accounts, but there are differences between the two. Ideally, you should be getting the most out of your 401k and Roth IRA. This is what they do. But if you’re just starting out, this is a lot of money. Some people can’t add that much.

Cares act 401k withdrawal deadline 2021

Use A Roth Ira Before Retirement For Other Purposes

The ability to tap money in a Roth IRA without penalty before age 59 1/2 allows for flexibility to use the Roth IRA for other purposes. In essence, this account can act as an emergency fund and could be used to pay off significant unexpected medical bills or cover the cost of a child’s education.

But it’s best to only tap into these funds if it’s absolutely necessary. And if you must withdraw any money from a Roth IRA before retirement, you should limit it to contributions and avoid taking out any earnings. If you withdraw the earnings, then you could face taxes and penalties.

Don’t Miss: What Is 401a Vs 401k

Leaving Money To Others

If you’re planning to leave retirement savings to heirs, consider how it may affect their taxes. Because of their RMDs, inherited traditional IRAs generate taxable income for heirs, often during their peak earning years. These distributions could incur taxes when they’d rather avoid them, or unintentionally push them into a higher tax bracket. Inheriting Roth IRA assets, which generally don’t incur any income taxes, can be a benefit to your heirs. In addition, the income taxes paid on a Roth IRA conversion may also help reduce the size of a taxable estate.

But there are many details to consider. For example, if your heirs are likely to be in a much lower tax bracket than you are, it may be advantageous to leave them a traditional IRA. That’s because it may be better for them to pay lower taxes in the future than for you to pay higher taxes now.

Also, Roth IRA conversions may be disadvantageous to those who intend to leave at least some of their assets to charitable institutions. Traditional IRAs can typically be left to charity without any tax bill at all for either party. So, in that case, conversion will mean that the tax was paid needlessly.6

If leaving money to others is part of your plan, no matter what your goals are, be sure to consult an estate planning attorney and think carefully before taking any action.

Read Viewpoints on Fidelity.com: An all-in-one wealth transfer checklist