Is It A Good Idea To Use The Rule Of 55

Just because you can take distributions from your 401 or 403 early doesn’t mean you should. Depending on your financial situation, it might be better to let your money continue to grow. Holding off withdrawals could help you better position yourself for a financially sound future. If you’re tempted to withdraw retirement funds before you’re eligible, instead consider finding another job, drawing from your savings or using other sources of income until you need to tap into your retirement savings.

If you decide to begin withdrawing funds from your 401 early, the long-term value of your portfolio will likely decrease. It’s essential that you time your withdrawals carefully and take into account how much they would cost you in taxes. To create a strategy that makes sense in your situation, consider working with a financial advisor or a retirement planner.

Retirement Plan And Ira Required Minimum Distributions Faqs

Information on this page may be affected by coronavirus relief for retirement plans and IRAs.

The Setting Every Community Up for Retirement Enhancement Act of 2019 became law on December 20, 2019. The Secure Act made major changes to the RMD rules. If you reached the age of 70½ in 2019 the prior rule applies, and you must take your first RMD by April 1, 2020. If you reach age 70 ½ in 2020 or later you must take your first RMD by April 1 of the year after you reach 72.

For defined contribution plan participants, or Individual Retirement Account owners, who die after December 31, 2019, , the SECURE Act requires the entire balance of the participant’s account be distributed within ten years. There is an exception for a surviving spouse, a child who has not reached the age of majority, a disabled or chronically ill person or a person not more than ten years younger than the employee or IRA account owner. The new 10-year rule applies regardless of whether the participant dies before, on, or after, the required beginning date, now age 72.

Your required minimum distribution is the minimum amount you must withdraw from your account each year. You generally have to start taking withdrawals from your IRA, SEP IRA, SIMPLE IRA, or retirement plan account when you reach age 72 . Roth IRAs do not require withdrawals until after the death of the owner.

For more information on IRAs, including required withdrawals, see:

How Fidelity Can Help You Plan

If you are taking RMDs, we can help you:

- Use our Planning & Guidance Center to get a holistic view of your retirement income plan and see how long your money may last.

- Adjust your portfolio as your life changes. Schedule an appointment with one of our experienced advisors to create a customized path forward.

Don’t Miss: Is It Good To Convert 401k To Roth Ira

If You’re Required Minimum Distribution Age* Take Your Distributions

*The age at which you must begin taking RMDs differs depending when you were born:

- If you were age 70½ before January 1, 2020 , you were required to begin taking RMDs for each year beginning with the year you turned age 70½.

- If you were not age 70½ before January 1, 2020 , you must begin taking RMDs for each year beginning with the year you reach age 72.

If you haven’t reached RMD age, you can skip this step. But if you have, you’re now required to withdraw a certain amount from many types of retirement accounts so that you can start paying the taxes you’ve been deferring all these years.

Consider moving your yearly RMD amount into your money market fundunless you don’t need it to cover your expenses. If that’s the case, you can move the money into any taxable account.

Just don’t leave it in your retirement account. There are steep IRS penalties if you don’t take your RMDs.

Taxes On 401 Contributions

Contributions to a traditional 401 plan come out of your paycheck before the IRS takes its cut. Youll sometimes hear this referred to as pre-tax income, and it means two things: 1) you wont pay income tax on those contributions, and 2) they can reduce your adjusted gross income.

An example of how this works: If you earn $50,000 before taxes and you contribute $2,000 of it to your 401, that’s $2,000 less you’ll be taxed on. When you file your tax return, youd report $48,000 rather than $50,000.

A few other notable facts about 401 contributions:

-

In 2021, you can contribute up to $19,500 a year to a 401 plan. If youre 50 or older, you can contribute $26,000.

-

In 2022, the contribution limit increases to $20,500 a year. If you’re 50 or older, you can contribute $27,000.

-

The annual contribution limit is per person, and it applies to all of your 401 account contributions in total.

-

You still have to pay some FICA taxes on your payroll contributions to a 401.

-

Your employer will send you a W-2 in January that shows how much it paid you during the previous calendar year, as well as how much you contributed to your 401 and how much withholding tax you paid.

See more ways to save and invest for the future

-

Our retirement calculator will show whether you’re on track for the retirement you want.

-

Stocks are a good long-term investment even during periods of market volatility. Here’s what to know.

Don’t Miss: What Is A Simple 401k

What Is A Required Minimum Distribution

The government imposes penalties for making early withdrawals from retirement accounts. After a certain age, however, youre required to take some money out every year. A mandatory 401k withdrawal is called a required minimum distribution.

In general, 401k withdrawal rules from the IRS require you to start withdrawing money from your 401k by April 1 of the year following the year that you turn 70.5, and your age and account value determine the amount you must withdraw. If youre 70.5 or older and still working, you might be able to delay taking RMDs if your plan is sponsored by the company for which youre still working. Known as the still working exception, you can apply if you:

Related: How to Master Your 401k in Your 60s

How Much Tax Do I Pay On A 401 Withdrawal

Your withdrawal is taxed as ordinary income and depends on what tax bracket you fall into for the year. You can withdraw up to $5,000 tax-free to cover costs associated with a birth or adoption. Under the CARES Act, account owners could withdraw up to $100,000 without penalty and also had three years to pay the tax owed. The early withdrawal penalty is back in 2021, and income on withdrawals will count as income for the 2021 tax year.

You May Like: How Can I Take Money Out Of My 401k

Is It Possible For A Plan To Allow In

Indeed. The plan can specify that participants are limited to a maximum number of in-service distributions per year or that there is a minimum amount that can be taken . However, since imposing those sorts of restrictions requires that they be monitored, we dont see them in very many plans.

Another restriction we see a little more frequently is that in-service distributions can only be taken from accounts in which the participant is 100% vested.

If any of these restrictions are to be imposed, they must be written into the plan document and applied consistently across the board to all participants.

When You Stop Rmds Start

What happens when you stop working? RMDs start that year, even if you quit working on Dec. 31 of that year. As IRS Publication 575 notes, Unless the rule for 5% owners applies, you must generally begin to receive distributions from your qualified retirement plan by April 1 of the year that follows the later of: The calendar year in which you reach age 72, or the calendar year in which you retire from employment with the employer maintaining the plan.

You May Like: When Can You Take Out 401k

Can An Account Owner Just Take A Rmd From One Account Instead Of Separately From Each Account

An IRA owner must calculate the RMD separately for each IRA that he or she owns, but can withdraw the total amount from one or more of the IRAs. Similarly, a 403 contract owner must calculate the RMD separately for each 403 contract that he or she owns, but can take the total amount from one or more of the 403 contracts.

However, RMDs required from other types of retirement plans, such as 401 and 457 plans have to be taken separately from each of those plan accounts.

Why Do Rmds Exist

You may find yourself wondering why there is a required minimum distribution for your IRA. After all, its your money, so why cant you take it out of your account at your own pace? The answer to this question is the same as the answer to many questions when it comes to financial matters: taxes.

You dont pay taxes on the money in your IRA when you put it in. Instead, you pay taxes when you withdraw the funds in retirement. The money will be taxed according to your current tax bracket. This is beneficial if you are in a lower tax bracket in retirement than you were when you first earned the money and were probably earning a much higher total income.

If you were to leave all of your money in your IRA, it would eventually become eligible to be passed on as inheritance and perhaps end up un-taxed. The required minimum distribution forces you to take out some money while it can still be taxed.

Read Also: How To Pull From Your 401k

Set Up A Money Market Account

You’ll still have bills to pay in retirement, but you probably don’t want to move money directly from your investments to your bank account every time you need to pay one.

For one thing, frequent transactions mean market swings could have a bigger impact on youif you’re forced to sell shares whenever you need cash, even if the value of your investments has dropped.

Instead, think about opening an account in a money market fund. You can move a year’s worth of withdrawals to your money market account at one time, to lessen the impact of market swings.

You can also direct any other income streams into your money market fund. Then transfer one month’s worth of expenses at a time to your bank account, and pay your bills from there.

Rmd Deadlines And Exceptions

The first year you are required to take an RMD, you can delay making the withdrawal until April 1 of the following year. But youll need to take another RMD by December 31 of that year. So you may not want to take two RMDs in one year, since they count as taxable income and may together put you in a higher tax bracket. A tax professional can help you with this decision while a financial advisor with tax expertise can also help you figure out where and in what order to draw down your accounts.

Another way you can delay taking your RMD is if you still work at the company that sponsors your 401 plan or other employer-sponsored account. As long as you dont own 5% or more of that company, you can delay making your first RMD until after you retire. But if you leave that company after you turn 72, you must start taking RMDs.

To calculate your 401 RMD, you would use the same tables and take the same steps as you would for calculating your traditional IRA RMDs.

So far, weve covered how RMDs apply to accounts in your name. But RMD rules apply differently to beneficiaries who inherit the assets in your retirement account. Dont worry. Well explain these in plain English.

Also Check: Do Part Time Employees Get 401k

How Do I Terminate My Simple Ira Plan

Step 1: Notify your employees within a reasonable time before November 2 that you’ll discontinue the SIMPLE IRA plan effective the following January 1.

Step 2: Notify your SIMPLE IRA plan’s financial institution and payroll provider that you won’t be making SIMPLE IRA contributions for the next calendar year and that you want to terminate your contributions.

Step 3: You should keep records of your actions, but you don’t need to notify the IRS that you have terminated the SIMPLE IRA plan.

Example: Acme Company decided on November 18, 2014, to terminate its SIMPLE IRA plan as soon as possible. The earliest effective date for the termination is January 1, 2016. Acme must notify its employees before November 2, 2015, that it won’t sponsor a SIMPLE IRA plan for 2016.

If You Withdraw The Money Early

For traditional 401s, there are three big consequences of an early withdrawal or cashing out before age 59½:

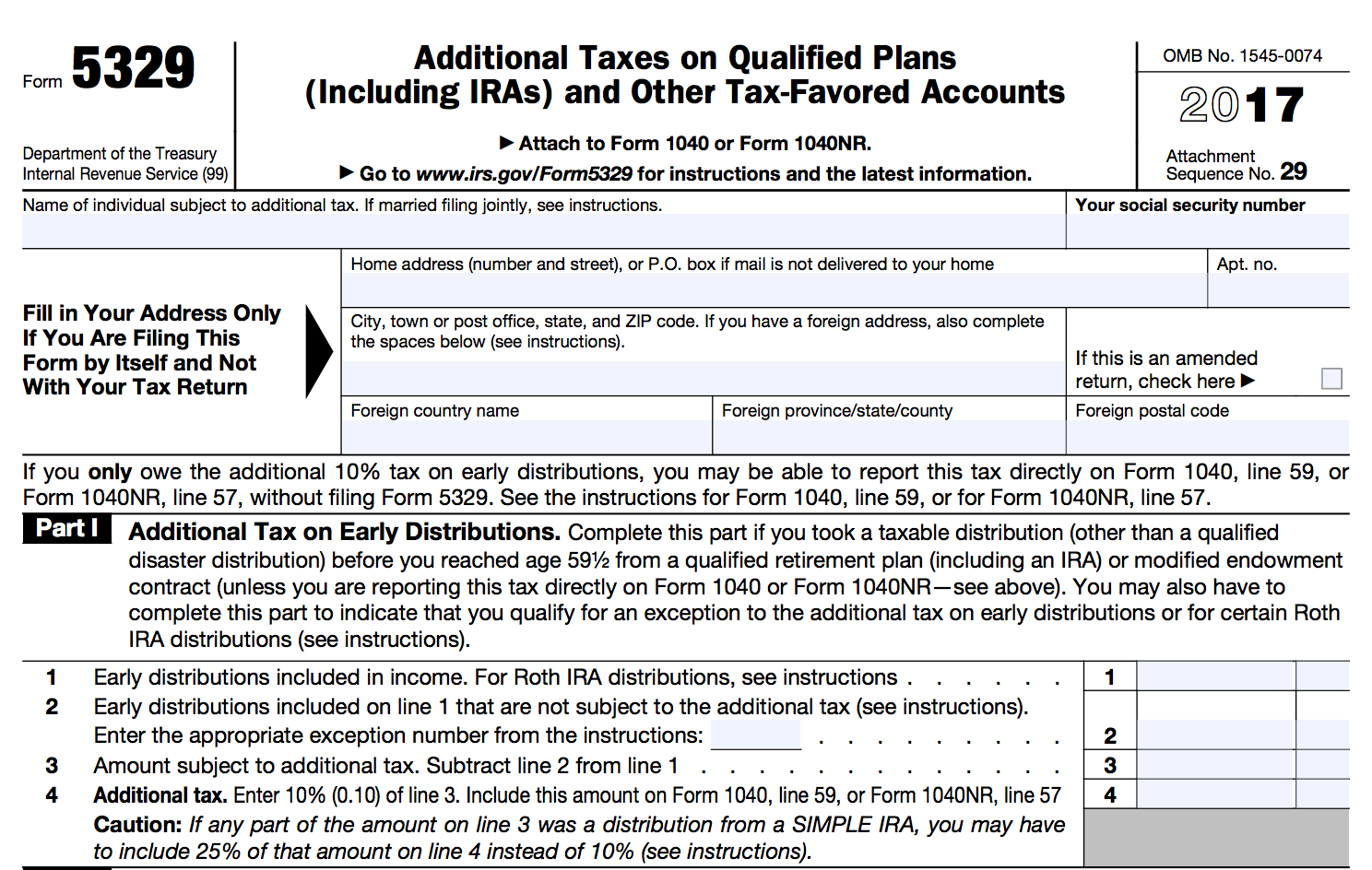

Taxes will be withheld. The IRS generally requires automatic withholding of 20% of a 401 early withdrawal for taxes. So if you withdraw the $10,000 in your 401 at age 40, you may get only about $8,000.

The IRS will penalize you. If you withdraw money from your 401 before youre 59½, the IRS usually assesses a 10% penalty when you file your tax return. That could mean giving the government another $1,000 of that $10,000 withdrawal.

You will have less money for later, especially if the market is down when you start making withdrawals. That could have long-term consequences.

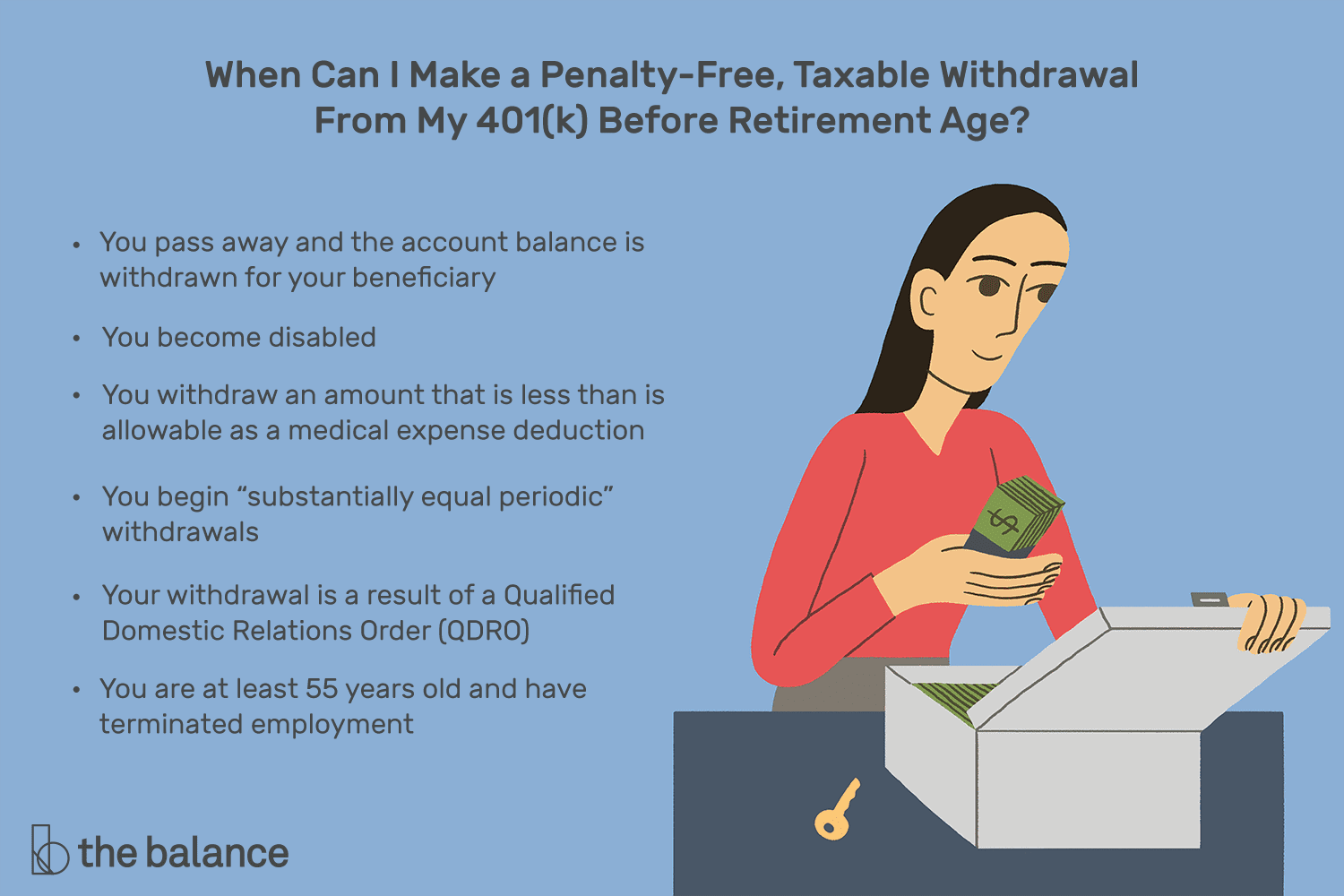

There are a lot of exceptions. This article has more details, but in a nutshell, you might be able to escape the IRSs 10% penalty for early withdrawals from a traditional 401 if you:

-

Receive the payout over time.

-

Qualify for a hardship distribution with the plan administrator.

-

Leave your job and are over a certain age.

-

Are getting divorced.

-

Die.

Recommended Reading: Is A 401k Considered An Annuity

How To Take Solo 401k Distributions When You Turn 59 1/2

September 28, 2021 by Madeline DeFrank

Do you daydream about giving up the grind and trading it for an active retirement? Once you reach age 59 ½, you can start taking distributions from your Solo 401k with NO early withdrawal penalties. If that is your daydream, here are some key dates to keep in mind:

A Note On Individual Retirement Accounts

If your employer doesnt offer a 401 and you decide to contribute to a traditional IRA instead, your taxes will work very similarly. However, your employer doesnt manage your IRA. You are responsible for making contributions, so your employer wont consider any of those contributions when reporting your earnings at the end of the year. Because your employer isnt excluding IRA money from your earnings, you will need to deduct your contributions on your tax return if you want to get the tax benefits. One big difference with 401 plans and IRAs is that IRAs have a much lower contribution limit. You can only deduct $6,000 in IRA contributions for the 2021 tax year. There are also income limits above which you cant contribute this full amount.

Read Also: What Is An Ira Account Vs 401k

When Do I Have To Start Taking Rmds

Before the 2019 SECURE Act, RMDs applied to employees who turned 70 ½. However, this legislation increased the RMD age to 72 starting in 2020.

You may remember that the CARES Act, passed in March 2020 in response to the COVID-19 crisis, temporarily waived RMDs for 2020. RMDs resumed for the 2021 plan year with the newly increased age limit of 72.

How much do I have to withdraw?

RMDs are calculated based on your age and your account balance as of the end of the previous year. To determine the required distribution amount, Betterment divides your previous years ending account balance by your life expectancy factor from the uniform lifetime table . As a note, if you had no balance at the end of the previous year, then your first RMD will not occur until the following year.

Uniform Lifetime TableAge of Plan ParticipantLife Expectancy 7027.47126.57225.67324.77423.87522.97622.07721.27820.37919.58018.78117.98217.18316.38415.58514.88614.18713.48812.78912.09011.49110.89210.2939.6949.1958.6968.1977.6987.1996.71006.31015.91025.51035.21044.91054.51064.21073.91083.71093.41103.11112.91122.61132.41142.1115 and older1.9

Additionally, if you have taken a cash distribution from your 401 account in any given year you are subject to an RMD, and that distribution amount is equal to or greater than the RMD amount, that distribution will qualify as the required amount and no additional distribution is required.

May I Impose Less Restrictive Eligibility Requirements

You may eliminate or reduce the prior year compensation requirement, the current year compensation requirement, or both. For example, you could allow participation for employees who received $3,000 in compensation during any preceding calendar year. However, you cannot impose any other conditions on participation.

Don’t Miss: How Do I Start My Own 401k

Taxes On Rolling Over A 401 Account

There are a few instances where you may want to transfer funds from an employers 401 into another account. The most common situation is when you leave an employer and want to transfer funds from your previous employer into your new employers 401, or into your own individual retirement account .

Whenever you withdraw money from a 401, you have 60 days to put the money into another tax-deferred retirement plan. If you transfer the money within 60 days, you will not have to pay any taxes or penalties on your withdrawals. You will need to say on your tax return that you made a transfer, but you wont pay anything. If you dont make the transfer within 60 days, the money you withdrew will add to your gross income and you will have to pay income tax on it. You will also pay any applicable penalties if you withdraw before age 59.5.

If you dont want to worry about missing the 60-day deadline, you can make a direct 401 rollover. This means the money goes directly from one custodian provider) to another without ever being in your hands.

Finally, note that if youre rolling over a 401 into a Roth IRA, youll need to pay the full income tax on the rolled-over amount. However, theres no 10% penalty for doing this before age 59.5.