Review Employer Matching Rules

An employer match occurs when a company contributes to your 401 after you put your own money into your account. Companies may match 100% of your contributions up to 4% or your salary or use another system, such as contributing 50% of up to 6% of your salary. Vanguard data, however, shows the median 401 match is 4% of a worker’s salary.

Because requirements can differ, you need to know your individual company’s rules for matching contributions. If you don’t already know how this process works, find out as soon as you can in 2022. That way, you’ll have all year to claim as much of the free money available to you from your employer as possible and you’ll know exactly what you need to do in order to do that.

How Do I Grow My Assets While Still Taking Income And How Can I Protect What Ive Earned

These are questions you may be thinking about when youre nearing or entering retirement. But, of course, when youre ready to retire, youll need a source of income that allows you to embrace your new lifestyle fully.

Whatever your ideal retirement looks like, youll need to examine how you may be able to grow and protect your assets. Some of these approaches youve likely heard of, and others may be completely new.

Certificate of Deposit

A CD is a traditional savings account that earns interest over time. Theyre usually kept for a finite period and may have penalties for early withdrawal. When CD rates are low, this type of solution protects your money but may not allow for enough growth.

Stocks and Bonds

You can also invest in traditional stocks and bonds. Putting your money in the market may come with risks and less protection than CDs but can provide the potential for greater growth.

Annuity

Annuities are insurance contracts that let your money grow, or you take income from it. Some annuities even allow you to let your money grow while also receiving that guaranteed lifetime income you need in retirement.

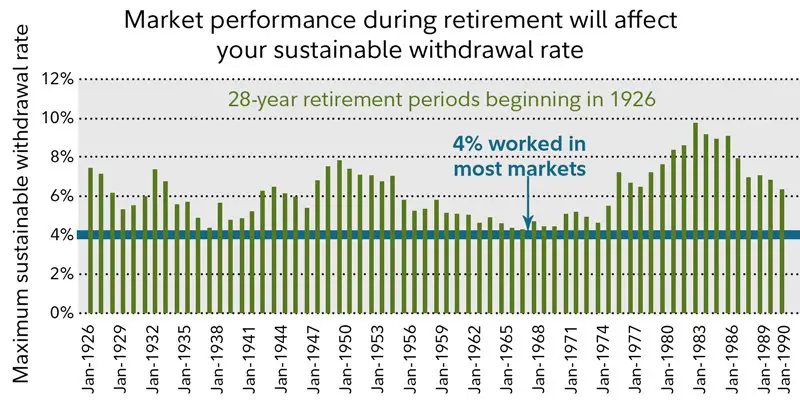

What Is The 4 Percent Rule

One way to help determine how long your savings might last throughout your retirement is to use the 4 percent rule. Financial advisor William Bengen developed the 4 percent rule in the 1990s as an ideal withdrawal rate after analyzing historical data on stock and bond returns between 1926 and 1976. Here’s how it works: If you begin your first year of retirement by withdrawing 4 percent of your savings and making subsequent annual adjustments for inflation , your money should last approximately 30 years. You can use the 4 percent rule as a rough estimate to determine how much money you may need when you retire. The 4 percent rule, however, has been challenged by many retirement planning experts because recent interest rates have been significantly lower than historical averages. Rates of return on portfolios heavily invested in bonds also have been lower, leading to a slower portfolio growth, which will lessen a portfolios value over time. Consequently, retirement funds may run out sooner than 30 years when applying the 4 percent rule when taking into consideration recent market trends. Given fluctuations in market returns, your retirement expenses and inflation over time, it may be helpful to consider dynamic withdrawals.

Read Also: Should You Roll Your 401k Into An Ira

How Long Will My Money Last With Systematic Withdrawals

You have worked hard to accumulate your savings. Use this calculator to determine how long those funds will last given regular withdrawals.

This information may help you analyze your financial planning needs. It is based on information and assumptions provided by you regarding your goals, expectations and financial situation. This service shall not infer that company assumes any fiduciary duties. In addition, such service should not be relied upon as the only source of information. This information is supplied from sources we believe to be reliable but we cannot guarantee its accuracy. Hypothetical illustrations may provide historical or current performance information. Past performance does not guarantee nor indicate future results.

Pensions 401s Individual Retirement Accounts And Other Savings Plans

NISHIOHMIYA …” alt=”How long will my 401k last when i retire > NISHIOHMIYA …”>

NISHIOHMIYA …” alt=”How long will my 401k last when i retire > NISHIOHMIYA …”> 401, 403, 457 Plan

In the U.S., two of the most popular ways to save for retirement include Employer Matching Programs such as the 401 and their offshoot, the 403 . 401s vary from company to company, but many employers offer a matching contribution up to a certain percentage of the gross income of the employee. For example, an employer may match up to 3% of an employee’s contribution to their 401 if this employee earned $60,000, the employer would contribute a maximum of $1,800 to the employee’s 401 that year. Only 6% of companies that offer 401s don’t make some sort of employer contribution. It is generally recommended to at least contribute the maximum amount that an employer will match.

Employer matching program contributions are made using pre-tax dollars. Funds are essentially allowed to grow tax-free until distributed. Only distributions are taxed as ordinary income in retirement, during which retirees most likely fall within a lower tax bracket. Please visit our 401K Calculator for more information about 401s.

IRA and Roth IRA

Pension Plans

In the U.S., pension plans were a popular form of saving for retirement in the past, but they have since fallen out of favor, largely due to increasing longevity there are fewer workers for each retired person. However, they can still be found in the public sector or traditional corporations.

For more information about or to do calculations involving pensions, please visit the Pension Calculator.

Investments and CDs

Don’t Miss: What Happens With 401k When You Quit

What Is The Bucket Approach

One final strategy to think about is the bucket approach, which separates your savings into three different buckets to help cover your immediate, short-term and long-term expenses. For example, your first bucket might contain six months of living expenses in an emergency savings account. Your second bucket could set aside three or four years’ worth of living expenses, possibly split between a savings account and a bank certificate of deposit . Your third bucket could contain longer-term investments. Over time you periodically move money from your long-term bucket into your short-term bucket. The goal of the bucket strategy is to help reduce your exposure to investment risk by giving you time to ride out fluctuations in the market over a few years. You may not have to cash in your investments when the market is down with access to the reserves you have in your short-term bucket.

Best Places For Employee Benefits

SmartAssets interactive map highlights the counties across the country that are best for employee benefits. Zoom between states and the national map to see data points for each region, or look specifically at one of four factors driving our analysis: unemployment rate, percentage of residents contributing to retirement accounts, cost of living and percentage of the population with health insurance.

Also Check: How To Invest Money From 401k

How Long Will Your Money Last In Retirement

Once you are retired, you can spend three decades or more in retirement. Your retirement and its duration will depend on your circumstances, such as when you leave your career and how long you live. Retirement income can come from a few sources, including a state pension, other pensions that accrued during your career, and investments and savings. Before you retire, you need to make sure you have enough money from your various sources to live a comfortable life.

How Long Will My Money Last Using The 4% Rule

The 4% rule shows you how to withdraw your retirement savings at a safe, sustainable rate.

Here’s how it works:

- Invest at least 50% of your money in stocks and the rest in bonds

- Figure out how much you need for basic expenses, like housing and food

- Make sure you can cover these expenses with guaranteed income, such as Social Security, bond ladders or an annuity

- During retirement, withdraw 4% out of your savings the first year

- With each successive year, take out that same dollar amount plus an inflation adjustment

The 4% rule remains a safe withdrawal rate even during the worst market downturns. This strategy was based on research by William Bergen. He tested his theory across different recessions, even the Great Depression, and discovered 4% was a safe withdrawal rate.

The 4% rule can help your money last even longer than 30 years of retirement. Since you don’t have to sell stocks during markets, your savings can last for the long haul.

What about inflation?

You May Like: How Much Tax On 401k Withdrawal

Why You Can Trust The Annuity Expert

At The Annuity Expert, we strive to help you make confident financial decisions regarding annuities. Content provided is created by an independent licensed financial professional.

The Annuity Expert is an online insurance agency that provides the widest variety of annuities in the United States. When you buy an annuity directly from us, we receive a predetermined commission from the insurance company . While your annuity is active, clients are not charged any servicing or management fees. Learn more.

What Is A 401k

A 401k allows you to dedicate a percentage of your pre-tax salary to a retirement account.

Employers can also choose to match some or all of the contributions, but this isn’t required so it’s not guaranteed.

There are two basic types of 401ks – traditional and Roth – with the main difference being how they’re taxed.

In a traditional 401k, employee contributions reduce their income taxes for the year they are made, but they’ll pay tax when they withdraw cash.

You May Like: Can I Manage My Own 401k

Things To Consider When Retiring

- If you cant afford to lose money, invest your savings without the risk.

- Inflation is rising whether you like it or not. Plan accordingly or decrease your lifestyle in the future.

- Per the U.S. Department of Health and Human Services, you have a 70% chance of going into a Nursing Home, Assisted Living Facility, or Home Health Care. Buy long-term care insurance now.

- There is a 100% chance you will die, buy cheap life insurance, or at the minimum, burial insurance for funeral expenses.

The Four Percent Rule For Retirement Savings

Basically, the four percent rule states that you take out four percent of your savings each year and use that for your living expenses. According to the rule, you can enjoy a steady income through retirement for up to thirty years.

Why four percent? It was believed that withdrawing more could leave you more vulnerable to market crashes and eat at your money much quicker. This means that you could possibly outlive your savings. Of course, the four percent rule doesn’t automatically guarantee you’ll always have enough for your retirement it just highly increases the likelihood that you won’t run out of money. That’s a scary thought, which is why it’s important to tailor your retirement strategy to your specific lifestyle and capital.

The four percent figure was created by financial planner William Bengen and dates back to the early 1990s. He studied historical data from stock and bond returns dating back to 1926, including the big market crashes of 1929 and the 70s. Bengen concluded that a four percent withdrawal rate was a stable bet that accounted for the possibility of a volatile market.

While the 4% rule does not guarantee that youll have money through retirement, it does aim to provide a consistent income for 25-30 years. The term rule is a little misleading since this should be considered more of a guideline .

Recommended Reading: How To Transfer 401k When Changing Jobs

Other Benefits Of A 401

Even for employers who do not offer any matching program, every employer with a 401 plan is responsible for administering the plan. That may seem like its no big deal, but it actually saves quite a bit of trouble for the employees. As an employee in a 401 plan, you dont have to worry about the complicated rules and regulations that need to be followed, or about making arrangements with the funds in which you invest your moneyyour employer takes care of all of that for you. Thats quite a bit of saved paperwork.

At the same time, employees who participate in a 401 maintain control over their money. While employers provide a list of possible investment choices, most commonly different sorts of mutual funds, employees have quite a bit of freedom to decide their own strategy. Whether you are willing to take on a little more risk with your investments, or if you would rather play it safe, theres probably an option for you.

Keeping Up With Inflation

Some annuities offer a guaranteed lifetime income with the ability to increase your income regularly to keep up with inflation. Once the income increases, the payment amount is locked in and can never go backward from that point forward.

Example

A 40-year-old purchases a $1,000,000 annuity with a lifetime income rider to retire at age 60. At age 60, the lifetime income amount may be guaranteed $105,380 initially but hypothetically increases to $288,439 by age 67. Once the income has increased to $288,439 annually, this payment is locked in and can never go below $288,439 in the future.

On the other hand, a performance-based annuity may hypothetically generate an income of $381,349 a year for life starting at age 60, increasing to $636,610 a year by age 70. Once the income has increased to $636,610 annually, this payment is locked in and can never go below $636,610 in the future.

You May Like: How To Transfer 401k Without Penalty

Are You Saving Enough For Retirement

It’s never too soon to start saving for retirement. When you have a spouse, children, a mortgage and college tuition to think about, competing financial priorities can make it more challenging to save for your retirement years. However, each year you delay saving for your retirement means facing the financial burden of catching up with your savings down the road if you want to achieve your retirement objectives. Are you curious about whether your retirement savings are on track for your age? Here are some average retirement savings by age to help you gauge your progress. By using our Retirement Savings Calculator, you can figure out how long your current savings might last you in retirement and what additional annual savings may be necessary to meet your goals.

Understanding How Long Your Account Will Last

Use our calculator to find out how long your account will last when you use systemic withdrawals to generate income. If you save money for retirement or choose to take out money through systemic withdrawals to enjoy more income now, understanding how long your investments will last this way is important for a few reasons:

- It helps you understand whether you need to be concerned about retirement. Have you saved enough for retirement? Will your savings last longer than you do? Making sure you have enough for your senior years is an important part of planning for the future. Understanding how long systemic withdrawals will allow you to keep earning income is important for long-term financial planning and for your retirement plan.

- It helps you understand whether systemic withdrawals are right for you. When you find out how long your investments will last, you can determine whether systemic withdrawals are right for you or whether you should switch to annuities or withdraw once a year and place your money in a money market account. If you find that your systemic withdrawals would not allow your investments to last long enough, you may also take other steps with a financial planner to ensure your money meets your needs.

Sign up for our newsletter and get the latest news and updates

Money Help Center

Read Also: Should I Roll My 401k Into An Ira

Other Sources Of Retirement Income

Home Equity and Real Estate

For some people in certain scenarios, preexisting mortgages and ownership of real estate can be liquidated for disposable income during retirement through a reverse mortgage. A reverse mortgage is just as it is aptly named â a reversing of a mortgage where at the end , ownership of the house is transferred to whoever bought the reverse mortgage. In other words, retirees are paid to live in their homes until a fixed point in the future, where ownership of the home is finally transferred.

Annuities

A common way to receive income in retirement is through the use of an annuity, which is a fixed sum of periodic cash flows typically distributed for the rest of an annuitant’s life. There are two types of annuities: immediate and deferred. Immediate annuities are upfront premiums paid which release payments from the principal starting as early as the next month. Deferred annuities are annuities with two phases. The first phase is the accumulation or deferral phase, during which a person contributes money to the account . The second phase is the distribution, or annuitization phase, during which a person will receive periodic payments until death. For more information, it may be worth checking out our Annuity Calculator or Annuity Payout Calculator to determine whether annuities could be a viable option for your retirement.

Passive Income

Inheritance

Amount You Want To Spend Annually In Retirement

How much money you want to spend annually in retirement including payment of taxes. Use today’s dollars. Subtract from this number annual Social Security, pension, or other lifetime income sources. Be careful not to underestimate living expenses and taxes. Doing so could cause serious cash-flow shortages later on.

You May Like: How To Find Out If You Have An Old 401k