Get Used To Saving For Retirement

Probably the best reason to start investing in your retirement at a young age is that you get used to saving and having a portion of your income go towards a retirement fund. When of the best pieces of advice for someone just out of college is to start having automatic deposits into their retirement fund. I started from day one at my job and I have never missed not having that portion of my paycheck because it is taken out automatically. Its much easier to have this setup from day one versus see a drop in your take-home pay later on.

I realize that many do not have retirement benefits through work. This is just another reason to take a proactive approach at a young age. Many young adults will likely change careers and go in and out of part-time/freelance work at some point or another, so taking retirement savings into your own hands is of vital importance.

Average 401k Balance At Age 45

When you hit your 50s, you become eligible to make larger contributions towards retirement accounts. These are called catch-up contributions. Make sure that you take advantage of them! Catch-up contributions are $6,500 in 2021. So if you contribute the annual limit of $19,500 plus your catch-up contribution of $6,500, thats a total of $26,000 tax-deferred dollars you could be saving towards your retirement.

Starting Late Turn Up The Dial On Your Contributions

Making the most of the early years of your career is one way to hit your retirement savings goaland probably the easiestbut it’s not the only way. If you have less time to save for retirement, you’ll simply need to save more each year.

For example, as we saw above, if your goal is to have $1 million at age 65 and you save just under $4,500 each year starting at age 20, there’s a good chance you’d meet your goal.

If you start at age 30 instead, you’ll have to save about $9,000 each year for the same chance at reaching your goal.

Beginning at age 40? You’ll need to save about $18,000 a year. And if you wait until age 50, you’ll need to put away over $40,000 a year to give yourself a good shot at reaching your goal.*

In other words, no matter what your current age, you’ll always be better off starting now rather than waiting until later.

Also Check: Why Cant I Take Money Out Of My 401k

Start Investing As Young As You Can

I wish I knew more about the stock market when I was in high school or college. That way I could have had 5 or 6 additional years of experience under my belt. I think everyone should learn to invest young and figure out how the stock market works.

Of course, many young folks dont have any money to invest. These days, new graduates have a ton of student loans to deal with, too. I still think it is very important to start investing even if you have debt. The easiest thing to do when starting out is to contribute to your 401 at least enough to get all the company matching. Thats a 100% gain. You dont want to leave it on the table.

Anyway, Im trying to teach my son about investing while hes young. He has an investment account and it did very well in 2020. It dropped in March but came back to hit a new high recently. He can see his money growing passively and he loves that. I think it is a great lesson. He can learn more about index investing as he grows up. For now, hes happy that his account is growing. Thats a seed, right?

When did you start investing in the stock market? Do you think you could have done better if you started earlier?

Making The Case To The Children In Your Life

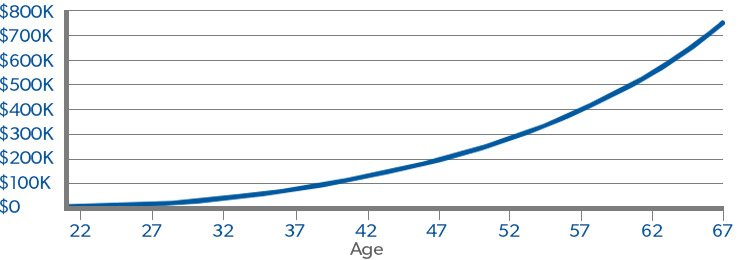

Helping the children in your life get started with a Roth IRA can teach them about the importance of saving for retirement. With a long time horizon, even modest contributions to a Roth IRA can become a sizeable nest egg over time, thanks to the power of tax-free compound growth. The chart below illustrates how annual Roth IRA contribution amounts may potentially grow into impressive sums over many years.

Read Also: How Do I Cash Out My 401k Early

Why Employers May Not Offer A 401

Facilitating a 401 plan can be expensive for a company. The IRS requires testing and reporting to ensure retirement plans keep up with regulations. As a result, many small businesses simply can’t afford to administer a 401 plan.

If a company is brand new and trying to get off of the ground, they may not have the time to organize a retirement plan for their employees. Since bringing in an outside firm costs even more money, usually, small businesses don’t have a 401 plan in place.

And because nearly a half of Americans work for small businesses, the amount of people left to their own means to save for retirement is significant.

Contributions And Allocations Are Limited

Contributions to a 401 plan must not exceed certain limits described in the Internal Revenue Code. The limits apply to the total amount of employer contributions, employee elective deferrals and forfeitures credited to the participant’s account during the year. See 401 and Profit-Sharing Plan Contribution Limits.

Read Also: How To Find 401k Account Number

Here’s How To Open A Roth Ira For Your Kids

Your childs income is what makes him eligible for the Roth IRA, but a parent or other adult will have to help open the account. Roth IRA providers typically require an adult to open and manage a custodial Roth IRA on behalf of a minor.

The process is simple and should only take about 15 minutes you’ll need to provide Social Security numbers for you and your child, birthdates and other personal information.

Employee Participation Standards Must Be Met

In general, an employee must be allowed to participate in a qualified retirement plan if he or she meets both of the following requirements:

- Has reached age 21

- Has at least 1 year of service

- plan may require 2 years of service for eligibility to receive an employer contribution if the plan provides that after not more than 2 years of service the participant is 100% vested in all plan account balances. However, the plan must allow the employee to participate by making elective deferral contributions after no more than 1 year of service.)

A plan cannot exclude an employee because he or she has reached a specified age.

Leased employee. A leased employee is treated as an employee of the employer for whom the leased employee is providing services for certain plan qualification rules. These rules apply to:

- Nondiscrimination requirements related to plan coverage, contributions, and benefits.

- Minimum age and service requirements.

- Vesting requirements.

- Limits on contributions and benefits.

- Top-heavy plan requirements.

Certain contributions or benefits provided by the leasing organization for services performed for the employer are treated as provided by the employer.

You May Like: Can I Transfer Money From 401k To Ira

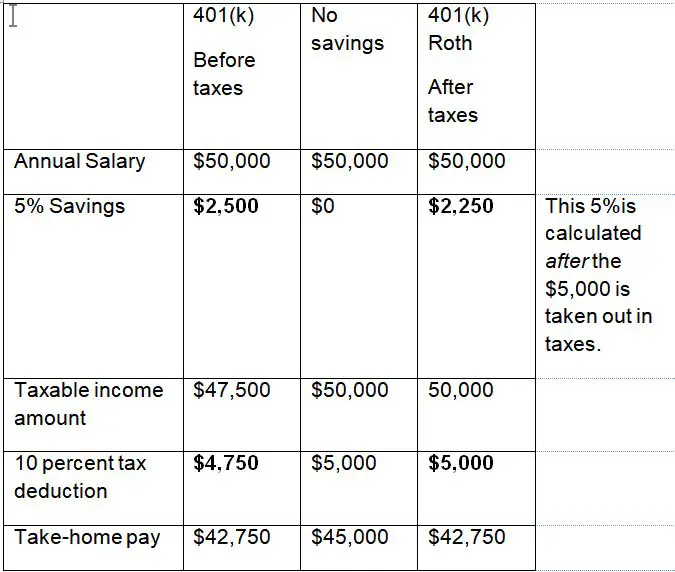

How Old Do You Have To Be To Invest In A 401

A 401 is a qualified retirement plan that allows working individuals to save for retirement in a tax-deferred manner. Employers manage their employees’ 401 accounts. Due to the preferential treatment that the IRS gives to 401 accounts, you must meet a number of prerequisites in order to have one, one such prerequisite being a minimum age requirement.

You Can Be An Everyday Millionaire

When you think of the word millionaire, you probably think of an older gentleman sporting a fancy suitpocket square included. Or you might think of people like Jay-Z and Beyoncé with their cool clothes and private jet.

No matter what you see, its probably safe to assume that more millionaires are older rather than younger. But dont assume that just because youre young that you cant start working toward that goal. In fact, the National Study of Millionaires found that if members of younger generations are diligent over time, they can become net-worth millionaires in their own right.

Millionaires view investing as the primary tool for building wealth and securing financial peace. In fact, 80% of net-worth millionaires in the study said that investing in their employer-sponsored retirement plan was the main way they reached millionaire status.1 Meanwhile, 74% mentioned investing outside the company plan, and 73% mentioned the habit of saving money regularly.2

What can you do? Start early. Start now. And if youre not in your 20sthats okay. Its never too late to starteven right now.

You May Like: How To Get My 401k Money From Walmart

Open A Brokerage Account

Maurie Backman: The tricky thing about retirement planning for newborns is that you can’t just open an IRA on their behalf. You need earned income for one of those plans, and, well, most newborns clearly aren’t there yet.

But one thing you can do is start investing on your baby’s behalf in a brokerage account. If you start buying quality stocks when your child is first born, you’ll give that money a lot of time to grow. Then, as your child gets older, you can add stocks to that account together so that your child learns to pick stocks and why it’s important to stay invested in them for the long haul.

Eventually, you can transfer that brokerage account into your child’s name once they turn 18 . And from there, your child can add to that account and/or hold those stocks so they serve as a retirement nest egg.

Of course, having that financial start could put your child at a huge advantage when it comes to retirement savings. Many people don’t accrue so much as a dime for retirement purposes until they go out and start earning wages in their late teens or 20s.

But what may be equally instrumental to your child’s success on the retirement savings front is having the knowledge to research and evaluate stocks. And while your baby’s first words don’t have to be “P/E ratio,” the sooner you get your child on the right path, the better.

S For Young Adults To Open And Maintain A 401

In your 20s and even in your 30s, retirement seems like a long time away, but the fact is, someday you may want to stop working as hard as you do and relax and enjoy your life in your 60s, 70s, and beyond. And for young adults who take great care of themselves, living a long and healthy life is not only a possibility but quite likely.

You don’t want to run out of money before you run out of time. Saving for the future should start the day you begin working at a full-time job. A 401, if offered by your employer, is the best way to get started with planning for the future.

Also Check: How Do I Transfer My 401k To A Roth Ira

Read The Roth Ira Fine Print

Another perk of Roths: You can think of it as a back-up emergency account. If you need to, you can withdraw your contributions at any time, tax- and penalty-free . On the other hand, tapping into a 401 or a traditional IRA in an emergency means paying a 10% early withdrawal penalty, plus whatever taxes you owe .

That said, most financial planners advise against withdrawing from your Roth or any other retirement account early so you give your contributions more time to accrue compound interest.

But keep in mind that Roth IRAs have certain income limits. Individuals must have a modified adjusted gross income under $140,000 for the tax year 2021, and married couples must have a MAGI under $208,000 to contribute to a Roth.

Finally, you also must meet withdrawal requirements or you’ll be hit with penalties. Typically, you can make withdrawals of both your contributions and interest earned after age 59½ if the first contribution to the account was made at least five years prior.

Exceptions to this include first-time home purchases, qualified college expenses, some birth or adoption expenses and qualified medical expenses, which can often be withdrawn earlier.

Individuals who meet the income limits can contribute up to $6,000 in 2021 if they are under age 50, and $7,000 if they are 50 or older.

Next Steps To Consider

Fidelity does not provide legal or tax advice. The information herein is general and educational in nature and should not be considered legal or tax advice. Tax laws and regulations are complex and subject to change, which can materially impact investment results. Fidelity cannot guarantee that the information herein is accurate, complete, or timely. Fidelity makes no warranties with regard to such information or results obtained by its use, and disclaims any liability arising out of your use of, or any tax position taken in reliance on, such information. Consult an attorney or tax professional regarding your specific situation.

A qualified distribution from a Roth IRA is tax-free and penalty-free, provided the 5-year aging requirement has been satisfied and one of the following conditions is met: age 59½ or older, disability, qualified first-time home purchase, or death.

Fidelity Brokerage Services LLC, Member NYSE, SIPC, 900 Salem Street, Smithfield, RI 02917

Don’t Miss: Can Bankruptcy Take Your 401k

Supplement Your 401 With A Roth Ira

Some employer 401s suffer from a lack of investment options. This is where an individual retirement account comes in handy.

And if your employer doesnt match contributions, you might choose to forgo your 401 altogether, says Ned Gandevani, program coordinator and professor in the masters of science in finance program at the New England College of Business. When theres no contribution from your employer towards your plan, theres no need to invest in it. By investing in a restricted plan, you end up paying too much with no benefits from your employer.

Always Maximize Your Employer Match

In theory, no one would turn down free money. But thats exactly what many Americans do when they drop the ball on matching retirement funds when an employer offers them.

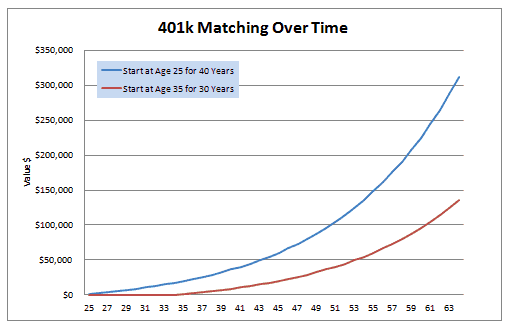

Many employers will match 50% of money that you, the employee, puts into your 401, up to a specified maximum percentage of your salary.

Ignoring this benefit by either not opting into your 401 or failing to contribute the maximum your employer will match is literally leaving a portion of your salary on the table.

Read Also: Can You Contribute To 401k And Roth Ira

Why You Need To Start Investing When Youre Young

One of the key components to wealth building is to start investing as early as possible. At this point, most personal finance blogs would tell you all about compound interest and how starting early will give your portfolio more time to grow. Thats 100% true, but there is something else thats even better. What can be better than compound interest? Its the experience you gain from making mistakes. Read on!

Why Open An Ira For Your Child

IRAs for kids are not a widely understood concept, but they can be a great strategy to encourage investing in a tax-advantaged account at a young age. Contributions can add up quickly, and earnings potential rises exponentially the earlier you start as an investor in a tax-sheltered account.

Plus, with an early IRA or Roth IRA, you are setting your kids up with a financial life that they can build upon and learn from a few years earlier than their peers. That kind of experience can be invaluable in helping your child make wise financial decisions.

Read Also: Should I Roll My Old 401k Into My New 401k

Leave Your Investments Alone

Investing is a long-term process, so if you choose to invest, make sure youre willing to leave your investments alone for at least 5 years. Its best to aim for 10 years or more.

As tempting as it might be, get-rich-quick schemes rarely ever work. Statistics show that the odds arent in your favor, even for professional investors.

Instead, focus on consistently investing every monthly paycheck for the long haul. doesnt really gain steam for at least 10 years, so make sure youre willing to let the investments grow.

Time Is On Your Side Small Steady Contributions Will Grow Into A Sizable Stash

At this stage of your life, your most valuable asset isn’t youthful vigor or a full head of hair. It’s time. Because you’re decades from retirement, contributions to a 401 or other retirement plan will have years to compound and grow. Even a modest contribution now will pack a much greater wallop than a significantly larger contribution when you’re in your forties and fifties.

If you start socking away $200 a month in a retirement account from the moment you land your first full-time job at age 22, within ten years you’ll have a stash of more than $37,000, assuming your investments grow 8% a year. In 20 years, you’ll have more than $122,000, and by the time you reach age 67, your nest egg will be worth $1.2 million.

Stuart Ritter, a certified financial planner for T. Rowe Price, recommends investing 15% of your salary toward retirement. That may seem like an unreachable goal for young people with other demands on their paycheck. If you’re pulling in $30,000 a year, for example, that’s $375 a month. But with tax breaks associated with employer-sponsored retirement plans, plus a possible employer match, you can reduce your actual out-of-pocket contribution. Even a smaller contribution will give you a serious head start on saving, so you’ll have a bigger stash that can grow for decades — plus more wiggle room to deal with the competing demands on your paycheck later on.

Recommended Reading: What Happens To Your 401k When You Die