Start With Your Old 401k

When you want to do a 401K rollover, start with your old employer and the company that managed your 401K with your old employer . We start here as each 401K plan has its own rules and processes. Some have an online process, some require you to send an email to the plan provider, and some require signed forms from different parties in the process.

If you have an online portal that you used to see your 401K account information, find the contact information for somebody at the provider to reach out to and tell them you want to begin a rollover. Even emailing the general email inbox at the custodian typically works as these companies are very familiar and comfortable with their clients performing a rollover. If you are unsure about an online portal or dont have your account information, reach out to an HR representative at your old employer and tell them you want to do a 401K rollover and they will help you get started.

At this point, you are mostly in information-gathering mode. When you talk to an HR representative or 401K custodian, tell them you want to do a rollover and ask the following:

-

What is their process for completing a rollover?

-

What forms and signatures do they require?

-

What will you need from your old employer and from your current employer?

-

How quickly can they complete the rollover?

In some cases, you will be required to fill out a paper form and fax it to your old employer for signatures.

Dont Miss: How To Find Old 401k Money

Provide Them With Your Account Number And Customer Information

How to close fidelity 401k account. Close a fidelity account by phone in any case, you will need to contact the broker to submit your closure request, and there are a variety of avenues at fidelity to do this. If all you want to do is close your 401k account, thats easy. You will receive a confirmation letter or email.

These numbers represent the employee deferral and a profit sharing of up to 25% of your w2 . Ask to speak with a representative. If you dont have any statements, contact your former employers human resources department.

Which accounts can i close online through the virtual assistant? There are a few different ways to close your account. 3 fidelity workplace investing corporate dc assets including tem.

A nazarene 403 retirement savings plan account has been established for most qualified nazarene ministers with fidelity investments. You can speak to a representative that will guide you through the process of closing your account. Although you have to contact the brokerage house to get the appropriate fax number.

4 fidelity workplace investing as of december 31, 2020. The fifth method to close an account is to snail mail a written request to the companys physical address: Do a small $50 transfer when you setup the account, do not invest the money.

There is no penalty for doing so. If you think youve lost track of a savings plan, search your files for old retirement account statements. To close your fidelity investments account:

Pin On Stocks

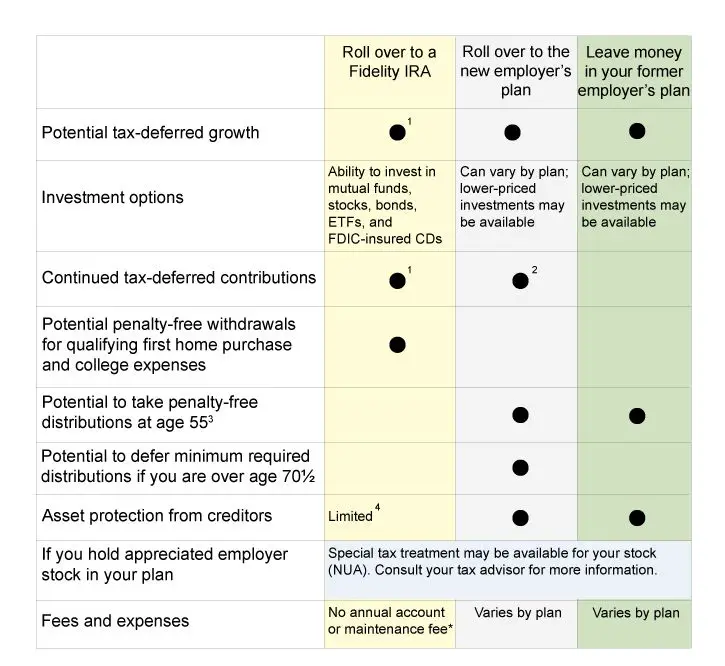

Roll The Assets Into New Employers 401 Plan

This is an option I am strongly considering, but it will depend on several factors notably my new 401 plans investment options. The other factor that I like is simplifying the number of investment accounts I need to keep track of, maintain, and balance.

Possible Advantages: Your investment maintains its tax advantages and there are no penalties to transfer or rollover your money. You will be able to borrow against your 401 holdings if you wish to do so, and you will minimize the number of retirement accounts you have.

Possible Disadvantages: You are limited to your new plans investment options. This is a biggie if your plan has limited options or higher than average expense ratios, which eat away at your returns. There may also be a waiting period before you can sign up for your new companys 401 plan, which means you would have to wait to roll it over.

Verdict: Consider this option if your new plan has strong investment options and/or you want to maintain simplicity in your retirement holdings.

Also Check: Why Cant I Take Money Out Of My 401k

Its Your Money And Your Choice

When it comes to what to do, there are advantages and disadvantages to all options so theres no one right answer for all. You need to review your options and choose whats best for you and your retirement. Retirement savings is one of the most important and long-lasting investment decisions youll ever make. If youre not sure what to do, you always have the option of talking to an advisor. Whether you need a bit of advice or a comprehensive financial plan, a Certified Financial Planner can help guide you in the right direction.

When Switching Makes Sense

Offering a competitive retirement offering is critical to attracting and retaining employees. To ensure that it stays competitive, youll need to continually reassess your 401 plan and provider. Every year, grade your 401 provider on measurable criteria such as:

- Cost

- Fiduciary and compliance support

- Employee and administration services

Cost is often a major factor in the decision to move on, and for good reason. Many 401 providers charge employers and plan participants hidden fees. Investment, administrative, and service fees can quickly add up as can those pesky 12b-1 and other fund fees that are only reflected in your investment returns. Not sure what those are? Neither do most of the employees that pay them. Guideline offers transparent pricing that doesnt come with hidden costs.

Participant engagement should be something you think about. Is your provider getting people to enroll in your plan? After all, the goal of a retirement plan is to get individuals prepared for retirement. If very few people are contributing, maybe your dollars would be better spent on other benefits. Auto-enrollment is a way to ensure your employees are engaged and getting most out of the retirement plan you offer.

Don’t Miss: How To Find Out If I Have An Old 401k

You Might Be Missing Out On Better Investments

401 accounts grow at different rates depending on which assets you invest in. If the retirement savings plan at your new companyor an individual retirement plan offers a selection of stocks and bonds that better aligns with your financial goals, it might be time to initiate a rollover.

The money thats sitting in your old 401 could potentially grow at a faster rate if you roll it over into a new plan or into an IRAits certainly worth investigating the growth rates of each. Keep in mind that investors can lose money when investing, too, so it always makes sense to consider your personal risk tolerance when deciding how to invest your retirement accounts.

Freeze Retirement Account Changes

Under normal circumstances, participants can update their contributions, make withdrawals, or request loans at any time. But when youre in the middle of switching 401 providers, that kind of activity can complicate the behind-the-scenes work needed to make the handoff a success. Thats why switching requires you to go through a blackout period where employees cant touch their retirement accounts.

Because blackout periods can last as long as two months, companies are required to give plan participants written notice at least 30 days beforehand, per IRS rules.

You May Like: How To Find Out If You Have 401k Money

Option : Leave Your Money Where It Is

Usually, if your 401 has more than $5,000 in it, most employers will allow you to leave your money where it is. If youve been happy with your investment options and the plan has low fees, this might be a tempting offer. Before you decide, compare your old plan with any retirement plans offered at your new job or with an IRA of your own.

Your new employer-sponsored plan might have more limitations on it than your previous plan or other available options. Maybe there are fewer investment choices/options. Maybe it doesnt have an employer match or higher management fees. So youll want to look closely.

Also consider how often you tend to stay at jobs. If you change jobs every few years, you could end up with a trail of 401 plans at all the different places youve worked. Consolidating might be easier in the long run.

How To Transfer 401 To A New Job

If you recently changed jobs, learn how to transfer 401 to the new job, and the pros and cons of moving old 401s to a new retirement plan.

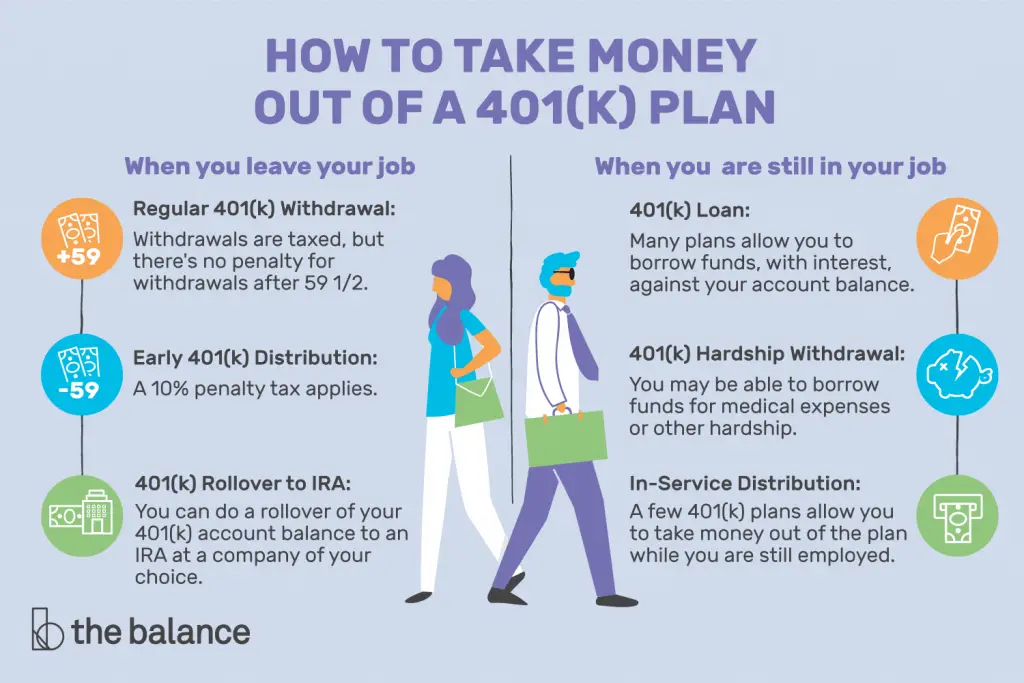

Changing jobs after years of working for your employer can be an emotional time, and you may likely forget about your old 401 account. Unless you let the former employer continue managing your retirement savings, you must decide where to move your 401 within 60 days. Usually, you can let your former employer continue managing your 401 account if you have at least $5,000.

If you decide to transfer 401 to your new employerâs 401, you must first contact the new plan sponsor to discuss the transfer. If the new employer accepts 401 rollovers from other employers, you will be required to fill forms for the transfer, detailing your personal information and the old 401 plan details. Once approved, you should provide the new 401 account details to the old plan sponsor to initiate the transfer. You can opt to have the former employer transfer the funds directly to the new employerâs 401 or choose to receive a check, which you must deposit to the new 401 plan in 60 days.

You May Like: Should I Invest My 401k

What Are The Advantages Of Rolling Over A 401 To An Ira

Doing a 401 rollover to an IRA offers perks that can include more diverse investment selections than a typical 401 plan, perhaps cheaper investments and lower account fees. It’s also a way to keep your retirement funds organized and ensure you have easy access to them. And while some 401 plans pass account management fees along to the employees, many IRAs charge no account fees.

In summary, it’s a good way to save money, stay organized and make your money work harder.

Choose Which Type Of Ira Account To Open

An IRA may give you more investment options and lower fees than your old 401 had.

-

If you do a rollover to a Roth IRA, youll owe taxes on the rolled amount.

-

If you do a rollover to a traditional IRA, the taxes are deferred.

-

If you do a rollover from a Roth 401, you wont incur taxes if you roll to a Roth IRA.

Don’t Miss: Can I Rollover My 401k To A Mutual Fund

Move The 401 To Your New Employers 401

If you change companies, its typically no problem to rollover your old retirement plan into your new employers 401. With a little bit of paperwork, the old plan administrator can simply shift the contents of your account directly into the new plan account with a direct transfer. This custodian-to-custodian transaction is not considered taxable.

Another option is to elect to have your balance distributed to you in check format, which you can then deposit into your new 401 account within 60 days, without paying the income tax. If you are a sole proprietor, freelancer, or entrepreneur, you may also consider setting up your own Solo 401 for yourself at this point. If you are in the middle of a lawsuit or worry about future claims against your assets, leaving your money in a 401 is going to offer better protection against liquidation.

Also Check: How Do I Use My 401k To Start A Business

You Could Lose Track Of The Account

Its not your fault, its just logistics. Its harder and more time-consuming to juggle multiple retirement accounts than it is to juggle one. Until you retire, youll be managing two websites, two usernames and passwords, two investment portfolios, and two growth rates for decades.

And if you leave this next job to go to a third , the 401 plans could pile up, creating even more tracking work for you. Plus, when youre no longer with an employer, you might miss alerts about changes that may occur with an old retirement plan.

Read Also: What Is The Penalty For Taking Money Out Of 401k

The Right Decision Depends On Your Situation

In the flurry of starting a new job, it’s easy to forget about your 401, but neglecting this investment account can have lasting effects on your finances. To make the most of your retirement savings, carefully consider the pros and cons of each option for handling your 401. And don’t make a move until you fully understand all the alternatives and how your decision might affect your tax liability and your financial future.

Open Your New Ira Account

You generally have two options for where to get an IRA: an online broker or a robo-advisor. The option you choose depends on whether you’d rather have your investments managed for you, or you’d rather do it yourself.

-

If you’re not interested in picking individual investments, a robo-advisor can do that for you. Robo-advisors build personalized portfolios using low-cost funds based on your preferences, then rebalance those funds over time to help you stay on track, all for a much lower fee than a conventional investment manager.

-

If you want to build and manage your own investment portfolio, an online broker lets you buy and sell investments yourself. Look for a provider that charges no account fees, offers a wide selection of low-cost investments and has a reputation for good customer service.

» Ready to get started? Explore best IRA accounts for 2021

You May Like: How Much Should I Put In My 401k Calculator

Contact Your Current Plan Administrator And New Plan Administrator

The easiest 401 rollover option is to get your old plan administrator to transfer your balance directly to your new account. This is called a direct 401 rollover, and it frees you from having to worry about tax consequences or early withdrawal penalties.

Speak with your new plan provider about getting an account number, then provide the information to your current 401 administrator. Theyll take care of the rest.

Be aware that not every plan administrator will perform a direct 401 rollover. In this case, the plan administrator cuts you a check for the balance, and its up to you to send the funds to your new 401 plan provider. You have just 60 days to redeposit the balance in your new plan. Otherwise its treated as an early withdrawal that incurs a penalty and income tax liabilities.

Guide To 401 And Ira Rollovers

According to the most recent data from the Bureau of Labor Statistics¹, the average time an American worker was with an employer is 4.6 years.

When you switch jobs, one key task is transferring your regular 401, Roth 401 or another tax-advantaged retirement plan. Neglecting this task could leave you with a trail of retirement accounts at different employers, or even nasty tax penalties should your past employer simply send you a check that you did not reinvest properly in time.

“Workers are much more transient today,” says Scott Rain, tax senior at Schneider Downs & Co., in Pittsburgh, Penn. “If you leave your 401 at each job, it gets really tough trying to keep track of all of that. It’s much easier to consolidate into one 401 or into an IRA.”

Also Check: Can You Have A Roth Ira And A 401k

What Is A 401 To 401 Transfer

A 401 to 401 transfer is simply the movement of your old 401 to combine it with your new 401. Once the transfer is complete, youre left with one 401 at your new employer.

An important step to remember is to check with your new 401 provider to ensure that they accept 401 roll-ins. This means that youre able to transfer outside 401 plans into the new one. Most plans do allow this, but its best to check first to make sure.

Options For Your 401 Or 403

When you leave your job, you have four options for what to do with your 401 or 403:

Before going into these options, its important to note that a 401, 403 or an IRA is an account.

Within these accounts, you can choose between a variety of investment options with varying fees, risk profiles, and returns .

You can think of an IRA or a 401 like choosing the restaurant where you want to eat. Once youre there, you have a variety of menu options at different price points, flavor profiles, and nutritional value.

An employer-sponsored plan offers curated investing options. When youre in an employer-sponsored plan, you dont get to choose the restaurant.

If your employer has chosen Chipotle, you can choose a Carnitas burrito or a vegetable burrito bowl. But youre out of luck if youre in the mood for tomato bisque.

In contrast, choosing an IRA gives you the choice of what restaurant to go to. And what menu options to select.

You can choose to go to Whole Foods where you can affordably eat sushi, pizza, or the hot food bar. But you can also choose a fancy restaurant at a higher price point but with more personal attention.

Returning to the four options for your old 401 or 403, cashing it out is the worst option.

You May Like: When Can I Get Money From 401k