Should I Roll Over My Traditional 401 To A Roth 401

There isnt a one-size-fits-all answer when it comes to rolling over your retirement savings to a Roth account. If it makes sense for your situation, a Roth conversion is a great way to take advantage of tax-free growth on your accounts. But keep in mind that rolling over a traditional 401 means paying taxes on it now. And if youre converting a large sum all at once, it could bump you into a higher tax bracket . . . which means a bigger tax bill.

For example, if youre rolling over $100,000 and youre in the 22% tax bracket, that means you have to come up with $22,000 cash to cover the taxes. Dont pull that money out of the investment itself!

If you can pay cash for the taxes without taking money out of your nest egg and youre still several years away from retirement, it may make sense to roll it over. But before you roll over accounts, make sure to sit down with an experienced investment professional. Theyll help you understand the tax impact of rolling over your 401 and how you can be prepared for it.

What Are Roth 401 Contribution Limits

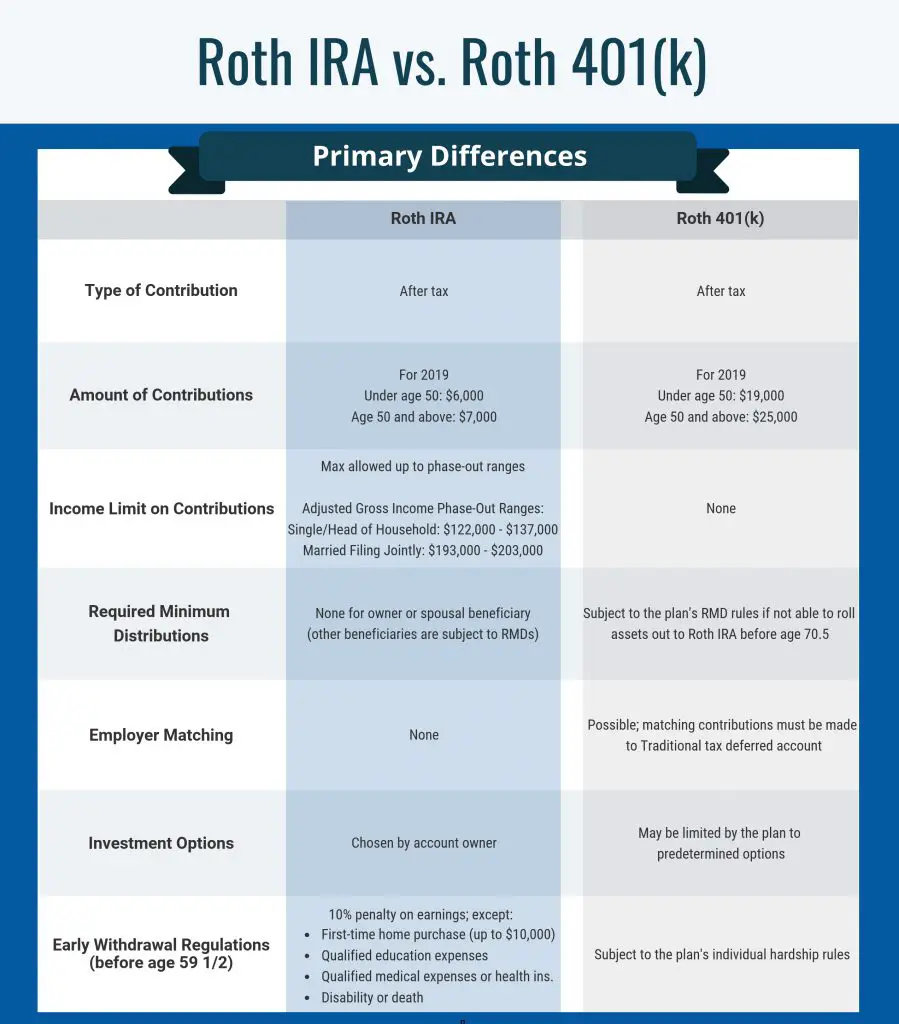

For 2021, the 401 contribution limit is $19,500. This contribution limit applies to your 401 contributions, whether theyre in a Roth or traditional 401. That means if youre contributing to both, the combined total of your contributions cant exceed that amount.6 And in case you were wondering, your employers contributions do not count toward the limit.

If youre 50 or above, the contribution limit increases to $26,000.7

What Are The 2022 Roth 401 Contribution Limits

The contribution limit for a designated Roth 401 increased $1,000 to $20,500 in 2022. Accountholders who are age 50 or older may make additional catch-up contributions of up to $6,500. This means the total contribution can reach as much as $27,000.

Employers can make contributions to a Roth 401 by matching employee contributions up to a certain percentage or dollar amount. They can also make elective contributions that dont depend on employee contributions.

The Internal Revenue Service adjusts contribution limits each year based on inflation. For 2022, the limit on employee and employer contributions is $61,000 or 100% of employee compensation, whichever is lower. Workers who are age 50 and over can add a $6,500 catch-up contribution for a total of $67,500.

You May Like: How To Open 401k For Individuals

Can I Contribute To Both Types Of 401s

-

Yes, you can contribute to both types of 401s if your employer offers both.

-

If you contribute to both, the annual contribution limit is $19,500 in 2020 and 2021, if youre under age 50. $26,000 if youre age 50+.

Generally, traditional 401s are much more common, as Roth 401s are less likely to be offered. If youre unsure which options you have through your current 401 provider, be sure to ask specifically whether you can contribute to a 401 or a Roth 401, or possibly both.

What Is A 401 Plan

So, what is a 401a? A 401a retirement plan is a form of defined contribution plan that allows contributions from both the employee and employer. The specific rules about these plans are laid out in Section 401 of the Internal Revenue Code. Typically, these plans are offered to employees of government agencies and non-profit organizations, much like a 457 plan or 403 plan. Employers have quite a bit of control over both the employee and employer contributions into the plan. The employer decides whether employee contributions are voluntary or mandatory. Employer contributions are always mandatory, although the amount of the contributions can change. Employers may decide to contribute a fixed dollar amount or a matching percentage based on the amount of contributions by the employee. Contributions may be made either pre-tax or after-tax. Employers often have strict rules around eligibility criteria, vesting schedules, and contribution amounts to encourage employees to remain in employment.

Employees may contribute up to a total of $58,000 per year into their 401a as of 2021. This includes both employee and employer contributions. There is no distinction between the two when it comes to the total contribution limits. The investment options available in a 401a are generally limited to very conservative and safe options. Mutual funds and annuities are essentially the only options available for these types of plans.

Don’t Miss: How Soon Can I Get My 401k After I Quit

How Theyre The Same

Income limits

Nada. You can contribute to a traditional or Roth 401 no matter how much you make. Theres one exception: If youre considered a highly compensated employee , your contributions may be capped because of the IRSs non-discrimination requirements. Check with your HR team or 401 plan administrator if you think that might apply to you.

Contribution limits

The annual 401 contribution limit in 2021 is $19,500 . How you split that between a traditional and Roth account is up to you.

Age requirement for withdrawals

You cant take your money out of a 401 until youre 59½ . Otherwise, youll have to pay all the taxes you owe plus a 10% penalty fee. Ouch.

Required minimum distributions

You have to start withdrawing your money in the year you turn 72 . If you dont there are you guessed it more hefty fees.

Taxes while your moneys growing

Good news: You wont pay taxes on any capital gains, dividends, or interest that your contributions earn.

Moving To A Lower Cost State

Every state in the U.S. has different tax rates. To jumpstart your career, you would need to work in job-specific hubs initially. For example, N.Y.C. for finance, Hollywood for acting, or San Francisco as the best place for technology jobs,

In such cases, you are better off taking the tax deduction now when working in expensive locations like California or New York. After taking the tax break, you could move to Florida or Texas later in your career. Or you might decide to move out of state in retirement when you need to withdraw from your 401.

Also Check: Can You Convert A 401k Into A Roth Ira

What Is The Difference Between A Regular 401 Deferral And A Roth 401 Deferral

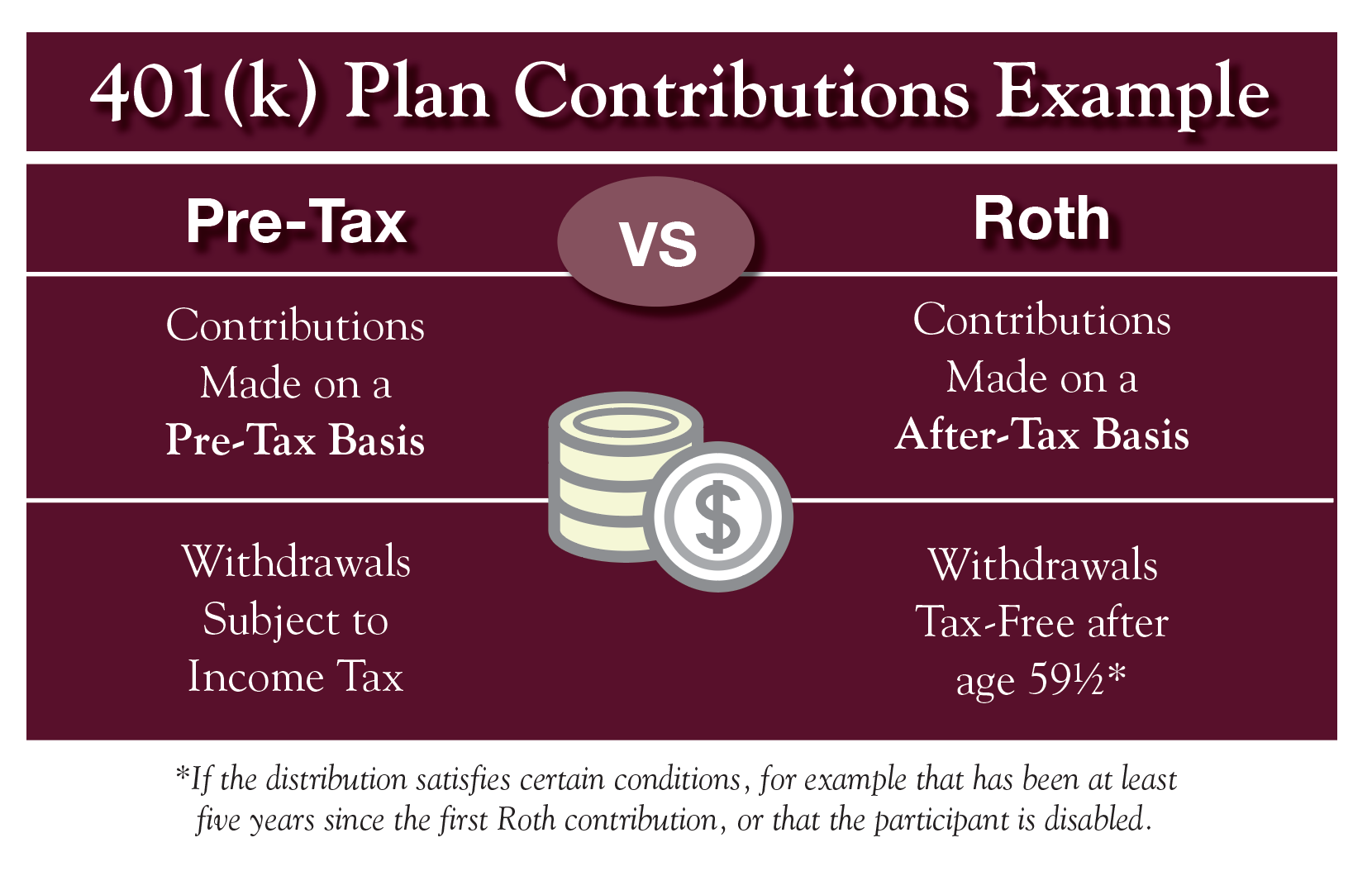

Under either a regular 401 deferral or a Roth 401 deferral, you make a deferral contribution by electing to set aside part of your pay . For a regular 401 deferral, the taxable wages on your W-2 are reduced by the deferral contribution therefore, you pay less current income tax. However, you will eventually pay tax on these contributions and earnings when the plan distributes the regular 401 deferrals and earnings to you. The result is that the tax on the regular 401 deferrals and earnings is only postponed.A Roth 401 deferral is an after-tax contribution, which means you must pay current income tax on the deferral. Since you have already paid tax on the deferral, you wont pay tax on it again when you receive a distribution of your Roth 401 deferral. In addition, if you satisfy certain distribution conditions, you wont have to pay tax on the earnings either. This means that the distribution of the Roth 401 earnings can be tax-free, not just tax-deferred.

Plan Vs 401 Plan // What Is The Difference

When it comes time to choose a retirement plan, the options can often be confusing. Since most retirement plans are employer-sponsored, the plans that are available to you might depend on your work situation. Many employees in the private sector have access to a 401k while those who work for educational institutions, government agencies, or non-profit organizations might have access to a 401a. But what happens when you have access to both? How do you choose the one that is right for you? Keep reading to learn more about 401a and 401k plans and the differences between the two.

You May Like: Can You Take A Loan From 401k For Home Purchase

Roth Vs Traditional 401 Contributions How To Choose

- Retirement Planning

- Roth vs. Traditional 401 Contributions How to Choose

The most expensive thing youll probably buy during your lifetime is retirement. Perhaps youve never thought of buying retirement, but thats exactly what you do when you participate in a 401 plan you are saving now to buy retirement income later. When you consider that income may need to last 10, 20, even 30 years, its easy to understand why retirement is so expensive. However, by following a simple 4-step plan during your working years – save early, contribute regularly, invest appropriately, minimize account fees – you can reduce the out-of-pocket cost of your retirement by a lot!

You may be able to reduce your retirement’s cost even further by contributing Roth deferrals to your 401 account instead of traditional deferrals. While traditional deferrals are contributed pre-tax and then taxed at distribution, Roth deferrals are the opposite – contributed after-tax and then tax-free at distribution. Taking the tax hit on Roth deferrals now could save you a lot in taxes in the long-run.

Not all 401 plans permit Roth deferrals, but if your plan does, making an informed decision about the best deferral option for your 401 account can be well worth your time. Not sure how to choose? Below is a comparison and factors to consider.

When Can Employees Make Distributions From Their Roth 401

There are two conditions that employees need to meet to make qualified distributions from their Roth 401 accounts:

- The investor must be at least 59 ½ years old or have suffered a specific disability.

- They must have owned the account for a minimum of five years.

What is a qualified distribution? A qualified distribution is one that meets the IRS conditions for making distributions or withdrawals from a retirement account.

The beneficiaries of employees who have Roth 401 plans can also make qualified withdrawals under two conditions:

- The owner of the Roth 401 plan has passed away.

- The Roth 401 has been under ownership by the owner for at least five years.

And when they turn 70 ½ years old, the IRS will compel the investor to make required minimum distributions every year.

Recommended Reading: How Do You Get Money From Your 401k

Can You Cash Out A 401a

When you leave your employer, you can cash out your account and rollover the balance into another qualified plan without a penalty. If you decide to cash it out and withdraw the money without rolling over, then you will pay a 10% penalty if you do so before age 59 1/2. Rollovers incur no penalty as long as the full account balance is rolled into another qualified plan.

What Is A 401k Retirement Plan

A 401k is a tax-advantaged, company-sponsored defined contribution plan that most employers provide. Generally, employees can contribute directly to their accounts via automatic payroll withholding, and their employers can match some or all of these contributions. Typically, the investment contributions in a 401k account are not taxed until the moment you decide to withdraw the money after retirement. However, if you have a Roth 401K plan, you can benefit from tax-free withdrawals.

Similar to Roth IRA, a Roth 401k is a combination of the features of Roth IRA and 401k plans, whereby its company-sponsored, and the investment comes from after-taxed dollars rather than your pre-taxed income. One of the most significant advantages of a Roth 401k is there is no income limit, although the contribution limits are similar to a traditional 401k. Similarly, though you can withdraw from a Roth 401k plan tax-free, the distribution rules are the same as those of a standard 401k plan.

Below are additional pros and cons of the various 401k plans to help you decide which is the best option based on your individual saving needs.

Also Check: How Do You Max Out Your 401k

Talk With A Financial Pro About Your 401 Options

The Roth 401 is an attractive option for people in a low tax bracket and who expect to be in a higher one when they retire. It can be tough to calculate just how much of your income you should defer for future taxes and how much you can afford to pay right now.

Still not sure which is right for you? Youre not alone. Many people don’t know when to contribute to a 401 vs a Roth 401. If you contribute to the wrong type, you could end up overpaying in taxes. Wouldnt you rather keep that money in your pocket?

When you choose a financial planner, youll get professional expertise to help determine which type of 401 is best suited for you. Were here to help you make the most of your retirement dollars.

Brandy Branstetter, CFP®

What Are The Advantages Of A 401a Over A 401k

One of the biggest advantages to a 401a vs a 401k lies in the contribution limits. A 401a allows a maximum contribution of $58,000 per year into your account. There is no distinction between employer and employee contributions, so any combination of contributions can be made to arrive at this limit. With a 401k, you are only allowed to put $19,500 into your account each year.

Recommended Reading: Can You Borrow Money Against Your 401k

What Is A Traditional Ira

Traditional IRAs function much like a traditional 401. Contributions are made with pre-tax money, are allowed to grow tax-deferred, and are subject to income tax when they are withdrawn. Withdrawals made before age 59 1/2 are subject to income tax and an additional 10% early withdrawal penalty. For 2020, individuals can contribute up to $6,000 a year, or $7,000 if theyre over age 50. Traditional IRA accounts are subject to RMDs.

The tax deduction for traditional IRAs begins to phase out when you make a certain amount of money. The more money a person makes, the less they are able to deduct. And if an individual makes too much, they wont be able to deduct anything.

What Kinds Of Mutual Funds Should I Choose For My Roth 401

Diversifying your portfolio is key to maintaining a healthy amount of risk in your retirement savings. Thats why it’s important to balance your investment among four types of mutual funds: growth and income, growth, aggressive growth, and international funds.

If one type of fund isnt performing as well, the other ones can help your portfolio stay balanced. Not sure which funds to select based on your Roth 401 options? Sit down with an investment professional who can help you understand the different types of funds, so you can choose the right mix.

You May Like: Can I Use My 401k To Purchase A House

Traditional And Roth 401s

When you participate in a traditional 401 plan, the taxable salary that your employer reports to the IRS is reduced by the amount that you defer to your account. This means income taxes on that money are postponed until you withdraw from your account, usually after you retire.

An increasing number of employers are offering employees a relatively new 401 choicea Roth 401. If you participate in a Roth 401, the amount you defer doesn’t reduce your taxable income or your current income taxes. But when you withdraw after you retire, the amounts you take out are tax-free, provided you’re at least 59½ and your account has been open at least five years.

Both the traditional 401 and Roth 401 offer tax advantages when you defer a portion of your salary into an account in your employers retirement savings plan. Both feature tax-deferred compounding of contributions that are made to the account. Both have no income limits and require minimum distributions after you turn 72 in most cases, and both can be rolled over to an IRA when you retire or leave your job for any reason.

Here is a chart showing the different tax structures for the two 401 options:

Whats more, if your modified adjusted gross income is too large to allow you to qualify for a Roth IRA, a Roth 401 is one way to have access to tax-free withdrawals. There are no income restrictions limiting who can participate. The only requirement is being eligible to participate in your employers plan.

How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

You May Like: Why Roll 401k Into Ira