Should I Convert My Ira To A Roth

Contents

A Roth IRA conversion can be a very powerful tool for your retirement. If your taxes increase due to government increases or because you earn more by putting yourself on a higher tax bracket a Roth IRA conversion can save you considerable money in taxes in the long run.

How much tax will I pay if I convert my IRA to Roth? How much tax do you owe on a Roth IRA conversion? Lets say you are in the 22% tax range and convert $20,000. Your income for the fiscal year will increase by $20,000. Assuming this doesnt push you into a higher tax bracket, you will owe $4,400 in conversion tax.

What Is A 403

A 403 plan is also known as a tax-sheltered annuity, or TSA, plan. These plans tend to be offered by public schools and some nonprofits. For reference, the private company equivalent of a 403 is a 401 plan.

For the most part, 403s still allow you to contribute to a retirement plan and, depending on your employer, they may allow for employer contributions to the account as well. You might be eligible for one if you work for:

- A public school

- A state college or university

- A church

- A school within an Indian tribal government

- Some self-employed ministers may also qualify.

Your contributions and earnings from a 403 are pre-tax, which means any income you defer into the account wont be subject to income tax right now. You also wont have to worry about paying taxes on dividends or capital gains as the invested money grows. In fact, you wont pay taxes until you start making eligible distributions from your 403 plan, which comes when you turn 59.5 years old.

Contribution limits for a 403 plan are similar to a traditional 401 account. For the 2022 tax year , you can contribute up to $20,500. If youre 50 years of age or older, you can make an additional $6,500 in catch-up contributions. That means those 50 or older can contribute up to $26,000 in 2022.

Depending on the plan your employer chooses, a 403 plan can be invested in one of a few different ways:

What Happens If I Take A Distribution From My Designated Roth Account Before The End Of The 5

If you take a distribution from your designated Roth account before the end of the 5-taxable-year period, it is a nonqualified distribution. You must include the earnings portion of the nonqualified distribution in gross income. However, the basis portion of the nonqualified distribution is not included in gross income. The basis portion of the distribution is determined by multiplying the amount of the nonqualified distribution by the ratio of designated Roth contributions to the total designated Roth account balance. For example, if a nonqualified distribution of $5,000 is made from your designated Roth account when the account consists of $9,400 of designated Roth contributions and $600 of earnings, the distribution consists of $4,700 of designated Roth contributions and $300 of earnings .

See Q& As regarding Rollovers of Designated Roth Contributions, for additional rules for rolling over both qualified and nonqualified distributions from designated Roth accounts.

Also Check: How Can I Find All Of My 401k Accounts

Does The Conversion Have To Be Done All At Once

Many people cant afford to pay the taxes that will come due on a Roth IRA conversion, even if they believe that conversion is their best long-term financial strategy. So you can convert only the amount of your account on which you know you can comfortably afford to pay the tax.

You can continue to do a partial conversion year after year, never having to make that giant tax payment, while gradually shifting your retirement accounts to tax-free status over time.

When It Might Make Sense

Here are some of the most common reasons people roll IRAs into 401 accounts.

Avoid required minimum distributions : After you reach age 70 1/2, the IRS may require you to take money out of pre-tax retirement accounts, which helps generate tax revenue. But if you are still working, you might be able to wait until you retire to take RMDs from your 401 . Some owners of the business even partial owners arent allowed to use that strategy, so check with the IRS or a good CPA before you attempt this. Switching from an IRA to your 401 allows you to delay taxes, potentially resulting in more compounding.

Backdoor Roth and conversions: If you plan to convert traditional IRA money to Roth IRA money or make back door Roth contributions you might want to minimize pre-tax money in IRAs. Doing so may neutralize the pro-rata rule, which causes complications and taxes when you have pre-tax money in an IRA. By shifting that pre-tax IRA money to your 401, only post-tax money remains in the IRA, which simplifies things substantially.

Age 55 withdrawals: 401s can be more flexible than IRAs if youre between the ages of 55 and 59 1/2. With an IRA, you have to wait until age 59 1/2 to take withdrawals without penalty taxes . With a 401, you can take withdrawals without penalty if you retire at 55 or older. Its probably not ideal to cash out all of your retirement money when youre that young, but its an option.

You May Like: How To Take Money From 401k Without Penalty

You May Like: How To Find Out If I Have Old 401k

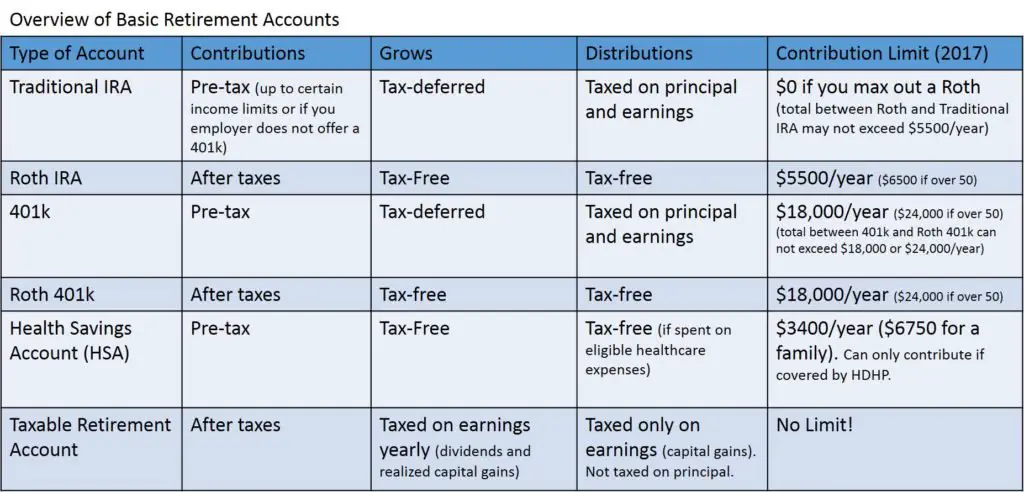

The Difference In Roth 401 And Pre

The Roth contributions, its very important that you understand theyre made with after-tax dollars. So whether its a Roth IRA that you fund on your own out of your own savings or checking account, or its a Roth 401, its made with after-tax dollars. This means that you dont get the tax break up front, but it has a whole lot of other amazing tax advantages that youre going to get later on, which Im going to discuss.

Now the pre-tax contributions, theyre going to be made before your tax is actually paid. So whether its a regular IRA, where youre going to make a contribution and take a deduction on your tax return, so the effect is, its before your taxes are paid. Or, its your pre-tax contributions into your 401 plan, those contributions are going to go in before your tax is paid.

So thats the biggest difference between Roth, which is an after-tax contribution, youve already paid your taxes. And pre-tax, and we also call pre-tax traditional contributions, thats the traditional way that 401 contributions were made. And those are made before your taxes are paid. So thats the real big difference. Theres a lot of other differences, but thats the big one that you need to be focused on today.

Eligibility And Contribution Limits

There are no modified adjusted gross income limits for saving to a 401, so you can make use of this type of account, no matter how much or how little money you earn. You might not be able to save the full amount allowed each year to a Roth IRA, or you may not be able to contribute at all if you earn above certain MAGI limits.

The amount of your contribution also depends on your income tax filing status.

| 2022 Roth IRA Income Limits | ||

|---|---|---|

| If Your Filing Status Is: | And Your MAGI Is: | |

| $10,000 | Zero | |

| Single, head of household, or married filing separately, and you didn’t live with your spouse at any time during the year | < $129,000 | Up to the limit |

| Single, head of household, or married filing separately, and you didn’t live with your spouse at any time during the year | $129,000 but < $144,000 | A reduced amount |

| Single, head of household, or married filing separately, and you didn’t live with your spouse at any time during the year | $144,000 | Zero |

The IRA contribution limit for 2021 is $6,000. It’s $7,000 if you’re 50 or older. These limits will remain the same in 2022. Subtract from your MAGI one of three amounts to figure out the amount of your permitted reduced contribution in 2022:

- $204,000 if you’re married and filing a joint return or are a qualifying widow or widower

- $0 if you’re married and filing a separate return, and you lived with your spouse at any time during the year

- $129,000 if you have any other filing status

Read Also: Can You Use Money From 401k To Buy A House

How Much Should I Invest In A Roth 401

We recommend investing 15% of your income into retirement savings. If you have a Roth 401 at work with good mutual fund options, you can invest your entire 15% there. Lets say you make $60,000 a year. That means you would invest $750 a month in your Roth account. See? Investing for the future is easier than you thought!

Reasons Not To Convert From 401 To Roth Ira

Unlike her dad, 27-year-old Samantha Morgan doesnt benefit from a lot of tax deductions. Shes single, with no dependents and renting a one-bedroom apartment. After years of struggling as a low-paid medical resident with lots of student loans, she is finally debt-free and earning a doctors salary, which puts her firmly in the 35 percent tax bracket.

One of the big reasons Joe Morgan decided to convert to a Roth IRA was because he expected to be in a higher tax bracket when he retired. Samantha, on the other hand, has good reason to expect to be earning considerably less, and paying less in taxes, after she retires. For that reason, it makes more sense for Samantha to make tax-free contributions to a 401, because she will pay a lower tax rate when she withdraws the 401 funds after retirement.

The other benefit of Samanthas 401 is that her employer, St. Judes Hospital, matches a percentage of Samanthas 401 contributions. Thats free money! The standard arrangement is to match 50 percent of employee 401 contributions every pay period up to the first 6 percent of salary . But if Samantha wants to maximize the match, she needs to pace herself.

The best advice is to talk to your tax professional about whether a 401 to Roth IRA conversion is right for you. For lots more information, check out the related HowStuffWorks links on the next page.

Recommended Reading: Are Part Time Employees Eligible For 401k

Ira Vs : How To Choose

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

The investing information provided on this page is for educational purposes only. NerdWallet does not offer advisory or brokerage services, nor does it recommend or advise investors to buy or sell particular stocks or securities.

Is 401k And Roth Ira The Same

The primary distinction between a Roth IRA and a 401 is how they are taxed. You invest pretax cash in a 401, lowering your taxable income for the year. A Roth IRA, on the other hand, allows you to invest after-tax cash, which means your money will grow tax-free.

Is anyone else feeling like theyve been drinking from a firehose? That was quite a bit of data! Lets go over the key distinctions between a Roth IRA and a 401 so you can compare their benefits:

Employer-sponsored programs are the only way to get it. Before enrolling, there may be a waiting time.

Earned income is required, although restrictions apply after a certain amount of income, depending on your filing status.

$20,500 per year in 2022 . Highly compensated employees may be subject to additional contribution limits .

To avoid fines, you must begin drawing out a specific amount each year at the age of 72.

A third-party administrator manages investment opportunities for the account.

Don’t Miss: Can I Roll My Wife’s 401k Into My Ira

Reasons To Convert From 401 To Roth Ira

Remember that the biggest difference between a 401 and a Roth IRA is when the income is taxed. With a 401, taxes are deferred until after retirement. With a Roth IRA, you pay taxes now, but can take the money out tax-free when you are retired. For that reason, the decision to convert from a 401 to a Roth IRA depends your current income tax rate and the rate you expect to pay when you retire.

The rule of thumb is this: If you expect to be in a higher tax bracket when you retire, convert to a Roth IRA. Heres why. If you currently pay a 25 percent tax on your income, its better to pay now and reserve your tax-free Roth IRA distributions for retirement, when you are in the 35 percent tax bracket.

But why would anyone be in a higher tax bracket after they retire? Lets use Joe as an example. Joe makes a nice salary, but for most of his working years, he had the benefit of several large deductions and tax breaks that lowered his taxable income. Joe is married, has four kids, and owns his home, so he always filed jointly, took deductions for each dependent, and deductions for mortgage payments. He also maxed out his 401 contributions every year , further lowering his taxable income.

Now lets look at why Samantha, Joes daughter, might want to stick with a 401.

Why Iras Are A Bad Idea

That distance is measured in time in the case of the Roth. Youll need time to recover the losses sustained as a result of the taxes you paid. As you get closer to retirement, youll notice that youre running out of time.

Holders are paying a significant present tax penalty in exchange for the possibility to avoid paying taxes on distributions later, explains Patrick B. Healey, Founder & President of Caliber Financial Partners in Jersey City. When youre near to retirement, its not a good idea to convert.

The Roth can ruin your retirement if you dont have enough time before retiring to recuperate those taxes.

When it comes to retirement, theres one thing that most people dont recognize until its too late. Taking too much money out too soon in retirement might be disastrous. It may not occur on a regular basis, but the possibility exists. Its also a possibility that you may simply avoid.

Withdrawing from a traditional IRA comes with its own set of challenges. This type of inherent governor does not exist in a Roth IRA.

Youll have to pay taxes on every dime you withdraw from a regular IRA. Taxes act as a deterrent to withdrawing funds, especially if doing so puts you in a higher tax rate, decreases your Social Security payment, or jeopardizes your Medicare eligibility.

As a result, if you believe you lack willpower, a Roth IRA could jeopardize your retirement.

Read Also: How To Rollover 401k To Ira Fidelity

Option : Keep Your Savings With Your Previous Employers Plan

If your previous employers 401 allows you to maintain your account and you are happy with the plans investment options, you can leave it. This might be the most convenient choice, but you should still evaluate your options. Each year, American workers manage to lose track of billions of dollars in old retirement savings accounts, so you should make sure to track your account regularly, review your investments as part of your overall portfolio and keep the beneficiaries up to date.

Some things to think about if youre considering keeping your money in your previous employers plan:

What Are The Similarities Between A Traditional 401 And A Roth 401

Lets start with what a traditional 401 and a Roth 401 have in common.

First, these are both workplace retirement savings options. With either type of 401 plan, you can enjoy the convenience of having the contribution drafted out of your paycheck.

Second, both can include a company match. About 86% of companies that offer a 401 or similar product provide a match on employee contributions.3 If you work at a place that offers a match, take it. Your employer is giving you free money!

Third, both types of 401s have the same contribution limit. In 2022, the contribution limit is $20,500 per year or $27,000 if youre over 50.4 The opportunity to invest that much every year is a huge perk of either type of 401, especially when compared to the Roth IRAs contribution limit of $6,000 per year.5

The Roth 401 includes some of the best features of a 401convenient contribution methods and the possibility of a company match if your employer offers one. But thats where their similarities end. Lets dig into the distinct differences between these two retirement savings options.

You May Like: What Happens To My 401k When I Leave My Job

Ira Vs : The Quick Answer

Both 401s and IRAs have valuable tax benefits, and you can contribute to both at the same time. The main difference between 401s and IRAs is that employers offer 401s, but individuals open IRAs . IRAs typically offer more investments 401s allow higher annual contributions.

If the IRA vs. 401 comparison is weighing on you, heres the quick answer:

-

If your employer offers a 401 with a company match: Consider putting enough money in your 401 to get the maximum match. That match may offer a 100% return on your money, depending on the 401. For example, some employers promise a 100% match up to 3% of salary. That means, if your salary is $50,000, your employer will put in $1,500, as long as you also contribute at least $1,500. Once you get the match, then consider maxing out an IRA for the year, return to the 401 and resume contributions there.

-

If your employer doesnt offer a company match: Consider skipping the 401 at first and start with an IRA or Roth IRA. You’ll get access to a large selection of investments when you open your IRA at a broker, and you’ll avoid the administrative fees that some 401s charge. After contributing up to the IRA limit, think about funding your 401 for the pre-tax benefit it offers. Here’s how and where to open an IRA.

Here’s more on the pros and cons of the IRA vs. 401 question:

» Want to turn a 401 into an IRA? See our guide to rollover IRAs