Keep Your 401 With Your Previous Employer

In this instance, you wont change a thing. Just make sure that you actively monitor your investments in the plan for performance and remain aware of any significant changes that occur.

If you really like your current investment options and are paying low fees on the investments, this might be the right choice for you.

Keep Tabs On The Old 401

If you decide to leave an account with a former employer, keep up with both the account and the company. People change jobs a lot more than they used to, says Peggy Cabaniss, retired co-founder of HC Financial Advisors in Lafayette, California. So its easy to have this string of accounts out there in never-never land.

Cabaniss recalls one client who left an account behind after a job change. Fifteen years later, the company had gone bankrupt. While the account was protected and the money still intact, getting the required company officials and fund custodians to sign off on moving it was a protracted paperwork nightmare, she says.

When people leave this stuff behind, the biggest problem is that its not consolidated or watched, says Cabaniss.

If you do leave an account with a former employer, keep reading your statements, keep up with the paperwork related to your account, keep an eye on the companys performance and be sure to keep your address current with the 401 plan sponsor.

Keeping on top of how the plan is performing is very important as you may later decide to do something different with your hard-earned money.

Option : Roll The Money Into Your New Employers Plan

Rolling your money over to your new 401 plan has some benefits. It simplifies your life because your investments will be in one place and youll also have higher contribution limits with a 401 than you would with an IRA. But there are lots of rules and restrictions with rolling money over into your new employers plan, so its usually not your best option. Which brings us to . . .

Recommended Reading: How To Take Money From 401k Without Penalty

Option : Roll It Into An Ira

If your new employer doesnt offer a 401 or you dont like their option, you can roll your 401 into an IRA.

Rolling over accounts is easier than it sounds. You may need to open an IRA at a brokerage company and sign a few papers that allow the brokerage to transfer the money into your new account. This option will help keep your balance growing tax deferred and you can continue to make tax-deferred contributions.

Make Sure Your Retirement Plan Follows Your Career Trajectory

Lets face it. Things were a little simpler for your grandad. He probably stayed with the same company, contributing to the same retirement plan for years building a nice nest egg over the course of a career. Things are a little different today and staying with one employer is a luxury we dont often have. Whether youre changing jobs because you want to or you have to, youll need to make a decision about what to do with your employer savings plan.

Also Check: How To Claim 401k Money

What Is A 401

A 401 is a retirement savings plan offered by employers that allows workers to defer a portion of their paycheck into a long-term investment account. Some employers match a portion of contributions, while others just provide the 401 accounts themselves. By investing your money, you let it grow through the power of compound interest. A 401 is just a handful of tax-advantaged retirement savings vehicles available. Other options include an IRA for self-managed retirement savings, a 403 for public school employees and tax-exempt organizations, a 457 for state and local government employees and some non-profit employees, and a TSP for federal government employees.

Make The Best Decision For You

When it comes to deciding what to do with an old 401, there may be factors that could be unique to your situation. That means the best choice will be different for everyone. One thing to remember is that the rules among retirement plans vary so it’s important to find out the rules your former employer has as well as the rules at your new employer.

Do also compare the fees and expenses associated with the accounts you’re considering. If you find it confusing or overwhelming, speak with a financial professional to help with the decision.

Don’t Miss: How To Borrow From 401k

Roll It Over To Your New Employer

If youve switched jobs, see if your new employer offers a 401, when you are eligible to participate, and if it allows rollovers. Many employers require new employees to put in a certain number of days of service before they can enroll in a retirement savings plan. Make sure that your new 401 account is active and ready to receive contributions before you roll over your old account.

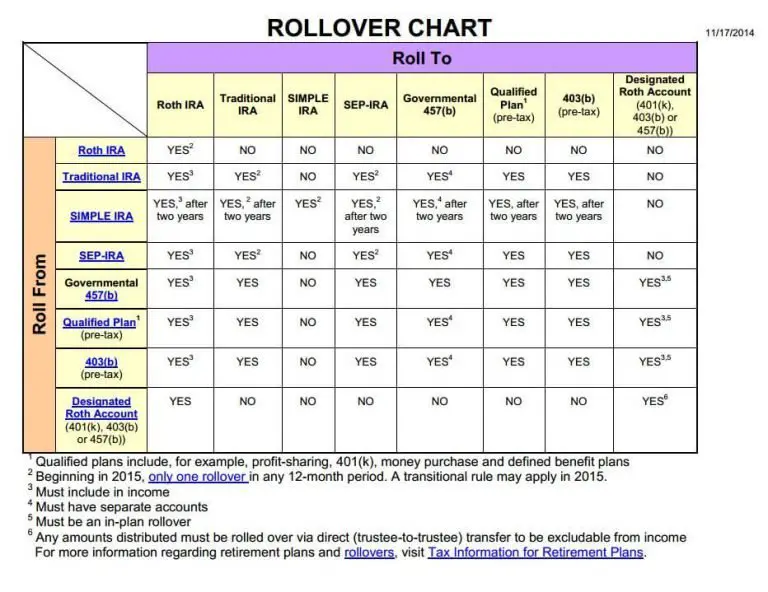

Once you are enrolled in a plan with your new employer, its simple to roll over your old 401. You can elect to have the administrator of the old plan deposit the balance of your account directly into the new plan by simply filling out some paperwork. This is called a direct transfer, made from custodian to custodian, and it saves you any risk of owing taxes or missing a deadline.

Alternatively, you can elect to have the balance of your old account distributed to you in the form of a check, which is called an indirect rollover. You must deposit the funds into your new 401 within 60 days to avoid paying income tax on the entire balance and an additional 10% penalty for early withdrawal if youre younger than age 59½. A major drawback of an indirect rollover is that your old employer is required to withhold 20% of it for federal income tax purposesand possibly state taxes as well.

Move The Money To Your New Plan

You could move the money directly into your new employer’s retirement plan. Many employers will offer the option of a plan-to-plan rollover into their 401 or other qualified retirement plans. There are no tax consequences or penalties with this move, and your employer should offer instructions to walk you through it.

If you choose to withdraw a lump sum from the old plan and then deposit it to the new plan instead of a direct transfer, your employer may withhold 20% of the sum for taxes. Be sure to report this amount on your taxes for the year the distribution was made.

This rollover option can be a very easy option that keeps your savings momentum, as long as you like the investment choices in the new plan. It’s also nice to start a new 401 with an already healthy balance.

Don’t Miss: Can You Pull From 401k To Buy A House

Roll The Assets Into New Employers 401 Plan

This is an option I am strongly considering, but it will depend on several factors notably my new 401 plans investment options. The other factor that I like is simplifying the number of investment accounts I need to keep track of, maintain, and balance.

Possible Advantages: Your investment maintains its tax advantages and there are no penalties to transfer or rollover your money. You will be able to borrow against your 401 holdings if you wish to do so, and you will minimize the number of retirement accounts you have.

Possible Disadvantages: You are limited to your new plans investment options. This is a biggie if your plan has limited options or higher than average expense ratios, which eat away at your returns. There may also be a waiting period before you can sign up for your new companys 401 plan, which means you would have to wait to roll it over.

Verdict: Consider this option if your new plan has strong investment options and/or you want to maintain simplicity in your retirement holdings.

Rolling Into An Ira Stay On Top Of The Move

If you decide to roll over your 401 into an IRA not sponsored by your new employer, your IRA sponsor or advisor will help guide you through the process to ensure the money gets to the proper destination in a timely manner.

Be sure your new broker/advisor has experience with rollovers, especially if you have company stock in your 401. Why? Because company stock is liquidated when its rolled into an IRA, and later, when distributed, may be taxed as ordinary income resulting in a higher tax liability.

As recommended above, stay vigilant until your money is safely in its new home and that you have proof typically verified online through the IRA providers website.

Don’t Miss: How To Move Your 401k To A Roth Ira

Indirect Rollovers Can Be Complicated To Manage

With an indirect rollover, you receive a check for the balance of your account that is made payable to you. That might sound good, but as a result, you are now responsible for getting it to the right place. You have 60 days to complete the rollover process of moving these assets to your new employer’s plan or an IRA.

If you dont complete the rollover within this 60-day window, you will owe income taxes on the amount you failed to roll over. If you’re under 59 1/2, you will also face a 10% penalty tax. Indirect rollovers can be made once a year.

Your old employer is required to withhold 20% from your distribution for federal income tax purposes. To avoid being taxed and penalized on this 20%, you must be able to get enough money from other sources to cover this amount and include it with your rollover contribution.

Then, youll have to wait until the following year, when you can file your income tax return to actually get the withheld amount back.

Suppose the 401 or 403 from your prior employer has a balance of $100,000. If you decide to take a full distribution from that account, your prior employer must withhold 20%. That means they keep $20,000 and send you a check for the remaining $80,000.

Even if you have an extra $20,000 on hand, you still must wait until you file your income tax return to get the withheld $20,000 returnedor a portion of it, depending on what other taxes you owe and any other amounts withheld.

Cash Out Your Old Account

Think long and hard before you do this. Its almost never the best choiceand it triggers a big tax bill!

Advantage

- Its money you can use to pay bills or for another purpose. Also, if you left your job during or after the calendar year in which you turned 55, you wont owe an early-withdrawal penalty.

Disadvantages

- Youll owe income taxes on your money. If you’re in a 30% combined federal and state tax bracket, for example, and cash out a $50,000 account, you’ll have only $35,000 left after taxes.

- You will destroy your retirement nest egg.

The bottom line: For most people, the best option is to move your savings into an IRA, which gives you the most freedom and control over your money.

Also Check: What Is A 401k Vs Roth Ira

What Happens With A 401 Loan When I Move To A Different Company

Most 401 retirement plans allow you to take out loans, which usually must be repaid within five years. If you change employers, however, the clock speeds up and a loan you’ve taken out from your 401 may be due in full very quickly. Even worse, you may face serious tax consequences if you can’t repay it.

I Still Have A 401k From My Last Job What Do I Do About That

As you move ahead from job to job, dont make the mistake of leaving a trail of old savings accounts behind you. Put your hard-earned savings to work for you by looking at all the options. If youve left a job and a 401k, here are the options available to you for those funds.

- Leave your balance

- Rollover to new 401 plan.

- Rollover to an IRA.

- Cash out your 401.

Recommended Reading: How Can I Get My 401k Without Penalty

Decide What To Do With Health Savings Account Funds

If youre enrolling in a high deductible health plan at your new employer, you can often transfer a balance in your HSA. If you dont plan to enroll in a HDHP, you can generally leave remaining funds and use as needed for future eligible healthcare expenses.

Tip: If you use HSA funds for unapproved health care expenses, youll face tax implications.

What Happens If You Cash Out Your 401

If you withdraw 401 money before age 59 ½, you could face a 10% penalty from the IRS on top of paying applicable income taxes. There are some exceptions, such as if you leave your job at age 55 or later or if you make a hardship or other eligible withdrawal, but its a good idea to consult a tax professional before cashing out your 401.

No matter when you cash out your 401, though, you may owe income tax on what you withdraw if its a traditional account or investment earnings in a Roth account that you didnt start contributing to at least five years before.

You May Like: How Much Will I Have When I Retire 401k

Contact Your Current Plan Administrator And New Plan Administrator

The easiest 401 rollover option is to get your old plan administrator to transfer your balance directly to your new account. This is called a direct 401 rollover, and it frees you from having to worry about tax consequences or early withdrawal penalties.

Speak with your new plan provider about getting an account number, then provide the information to your current 401 administrator. Theyll take care of the rest.

Be aware that not every plan administrator will perform a direct 401 rollover. In this case, the plan administrator cuts you a check for the balance, and its up to you to send the funds to your new 401 plan provider. You have just 60 days to redeposit the balance in your new plan. Otherwise its treated as an early withdrawal that incurs a penalty and income tax liabilities.

Youre Our First Priorityevery Time

NerdWallet, Inc. is an independent publisher and comparison service, not an investment advisor. Its articles, interactive tools and other content are provided to you for free, as self-help tools and for informational purposes only. They are not intended to provide investment advice. NerdWallet does not and cannot guarantee the accuracy or applicability of any information in regard to your individual circumstances. Examples are hypothetical, and we encourage you to seek personalized advice from qualified professionals regarding specific investment issues. Our estimates are based on past market performance, and past performance is not a guarantee of future performance.

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Recommended Reading: Can I Rollover My 401k To A Money Market Account

You May Be Paying Hidden Fees

There are all sorts of fees that go into effect when you open a 401, including recordkeeping fees, maintenance fees, and fund fees. Expressed in a percentage, these fees inform the expense ratio of a plan.

Employers may cover those fees until you leave the company. Once youre gone, that cost might shift to you without you even realizing it.

Fees matter: When you pay a fee on your 401, youre not just losing the cost of the fee youre also losing all the compound interest that would grow along with it over time. The sooner you roll your plan over, the more you could potentially save.

Beware 401 Balance Minimums

If your account balance is less than $5,000 and youve left the company, your former employer may require you to move it. In this case, consider rolling it over to your new employers plan or to an IRA.

If your previous 401 has a balance of less than $1,000, your employer has the option to cash out your accounts, according to FINRA.

Always keep track of your hard-earned 401 money and make sure that it is invested or maintained in an account that makes sense for you.

Don’t Miss: What Is The Difference Between A Pension And A 401k

Withdraw Your 401 Savings

If youre under 59 1/2 then a 401 withdrawal is almost never a good idea, unless you have an emergency and really need the cash. Why? Because you pay taxes on the money you withdraw plus a 10% penalty. You also give up the opportunity for your 401 savings to grow tax-free over decades. This is known as leakage and its a big reason why people dont end up saving enough for retirement. There are some limited circumstances in which you can withdraw from your 401 without taxes and penalties some of these are known as hardship withdrawals but avoid cashing out your 401 if you can.

Keep Your Money In Your Former Employer’s 401 Plan

This is your legal right if you have at least $5,000 in your account. Ask how long you have to decide. In most cases, you get 30 to 90 days. If your account holds under $5,000, your employer has the option of cashing you out of the plan.

Advantages

- Youre familiar with the plan. And you may think its an exceptionally good one.

- Its easy you dont have to do anything.

Disadvantages

- Once youre no longer an employee, your access to your money may be limited. You may only be allowed a set number of investment choice changesor even prohibited from taking distributions until you reach retirement age. Ask what the rules are.

- As a former employee, you may be charged extra maintenance fees. A company that subsidizes its 401 plan’s record-keeping expenses for active workers may be less generous with participants who no longer work there.

Recommended Reading: How To Roll An Old 401k Into A New 401k