Is It Better To Borrow Or Withdraw From 401k

Pros: Unlike 401 withdrawals, you dont have to pay taxes and penalties when you take a 401 loan. Youll also lose out on investing the money you borrow in a tax-advantaged account, so youd miss out on potential growth that could amount to more than the interest youd repay yourself.

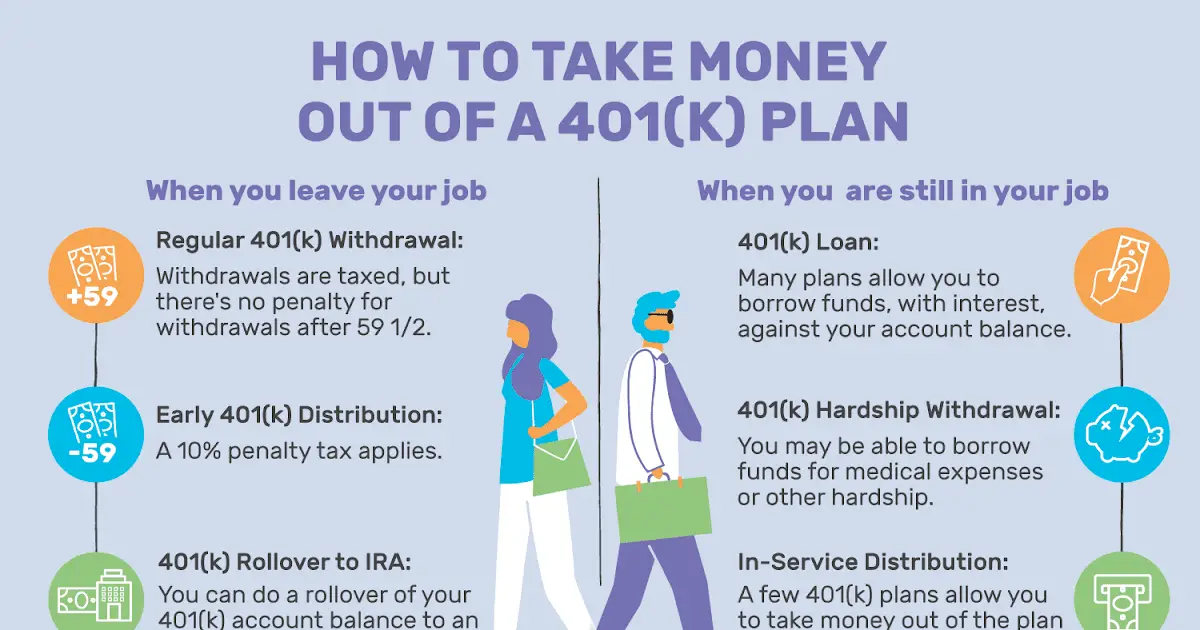

So Whats The Best Way To Take Money Out

To summarize, hardship withdrawals could be an option if theyre offered in your plan. However, youd owe income tax and incur the 10% early withdrawal penalty by doing so. A loan would bypass the early withdrawal penalty, but the tax implications would be.not good.

The best strategy, if its available to you, would be to take an in service withdrawal by rolling your assets into an IRA. Whereas 401k plans dont have an exception to the 10% early withdrawal penalty for qualified educational expenses, IRAs do . Itll still count as taxable income though. And if youre like most parents, your kids will be attending college during your peak earnings years. Which means that taking a withdrawal wont just mean adding to your taxable income. Itll mean adding to your taxable income at the highest rate youll ever pay.

Your Employer May Not Allow 401 Loans Or Withdrawals

The CARES Act permits employers to make more generous loans or allow hardship withdrawals but does not mandate that they do so. Most of these changes really affect the Internal Revenue Code, not labor laws, so you’ll need to check the fine print on your plan. If your employer’s plan does not currently allow for 401 loans or hardship withdrawals, the CARES Act does allow it to grant this relief to its employees and then amend its rules formally within two years. If you and enough employees speak up, your employer may decide to make your life a little easier.

Don’t Miss: Where Can I Cash A 401k Check

How Does A 401k Work

A 401k is an employer-sponsored savings plan that allows workers to set aside a portion of their paycheck for retirement. Many employers offer a matching contribution as a part of your employment benefits package, meaning that theyll match your contribution dollar-for-dollar up to a certain percentage. The plan allows for the employee and the employer to get a tax deduction when they contribute to the employees 401k.

The contribution you make to your 401k will be deducted from your salary on a pre-tax basis, therefore lowering how much you pay on your income taxes.

The purpose of contributing towards a 401k is to save for your retirement throughout your years of employment, so that once you reach retirement age, youll have it as a resource to help finance the rest of your life.

Do You Pay Taxes On 401k Loan

When you take a 401 loan, you could be wondering if you will pay taxes on the amount borrowed. Find out if and when to pay taxes on a 401 loan.

If you need money to cover an unexpected expense, you could consider borrowing from your 401 – if your 401 plan approves it. A 401 loan allows retirement savers to borrow against their retirement savings, with the intent of paying back over a defined period. Although you are essentially borrowing from yourself, you will still pay interest on the loan back to your 401 account. You will have up to five years to repay the loan fully unless you are borrowing to buy your principal residence, where the loan term could be longer than five years.

You donât pay taxes on 401 loans as long as you pay the entire loan on time. However, the interest on the 401 loan is paid with after-tax dollars, but the impact of the income tax will be negligible since the interest component is a modest amount. If you default on your 401 loan obligations, the outstanding amount will be considered a withdrawal for tax purposes, and you will owe income taxes and a potential penalty if you are below 59 ½.

Read Also: When Can You Rollover A 401k Into An Ira

What You Need To Know About Borrowing From Your 401k

Are you considering to borrow against your 401k?

As your 401k account grows, it can be tempting to tap into it, especially if youre in need of extra cash. But, considering that its a means to fund your retirement, its important to understand the pros and cons of borrowing from your 401k.

Below well take a look at what happens when you borrow from your 401k, what alternatives there are and when you should consider tapping into it. Before making any decisions, you may want to consult with a financial advisor to make sure its the best fit for your situation.

Paying Yourself Back May Be The Least Of Your Worries

How much worse will the cash crunch get?

- Print icon

- Resize icon

Congress has just passed the CARES Act, allowing people to borrow more from their retirement portfolio if theyve been hit economically by the crisis.

Its basically doubled, says Robert Neis, tax and benefits lawyer at the law firm Eversheds Sutherland, of the permitted loan limit. Generally, you can only borrow up to 50% of your vested plan balance or $50,000, whichever is less, for a plan participant who has been affected by COVID-19, the limit is increased to the lesser of 100% of the vested account balance or $100,000, he says.

Meanwhile, the new law also waives the 10% early withdrawal penalty for those who take money out for good, although theyll still have to pay income tax.

There are plenty of wrinkles. You have to apply during the next six months, Neis says. And only certain people can benefit from the new rules. They are not available to everybody, he says. You have to be effected by COVID-19. That includes being laid off, furloughed, or working reduced hours for reduced pay, he says. It also includes those who cant work because they cant get child care for their children.

But if you face an emergency cash crunch, should you borrow from you 401? Or is it a disastrous mistake?

Ironically, Congress has made it easier to borrow from your retirement account just as it has become more dangerous.

Even in normal times, there are hidden costs to borrowing from your plan, financial advisers note.

Recommended Reading: How To Close Out Your 401k

Can I Take An Additional Loan From My 401

Most 401 plans allow one loan at a time, and this means you must pay back the first loan fully before you can be allowed to take another loan. However, if your plan allows multiple loans at a time, you can take an additional loan at any time within a rolling 12-month period as long as you have not exceeded the loan limit.

For example, if your 401 vested balance is $120,000, your loan limit is $50,000. If you borrowed $30,000 from your 401, you cannot borrow more than $20,000 as a second loan in a 12-month rolling period even if you paid the first loan early.

What Happens If You Borrow From Your 401k

It may seem less risky to borrow from yourself, but once you look deeper into the drawbacks, you might think twice about borrowing from your 401k. Why?

You lose out on growth potential. You could lose out on the years of growth youd see from when your money is invested in the market. For instance, if you take out $20,000 today, you could be losing out on more than eight times that when you retire depending on the fate of the market once you reach retirement age.

You pay interest. Although the interest goes back into your own account, you pay after-tax dollars to pay for it, meaning that the government takes from it twice the income tax you pay on it and when you use it during retirement.

Youre at risk to the payback timeline. If you leave or are terminated from your job, you have to pay back the loan that you borrowed within 60 days or youll be subject to a possible penalty.

You risk having inadequate funds in retirement. If you pull money out of your 401k, you risk having less saved once you reach retirement age. Consider what your bills might be as a senior will you have enough saved to pay for rent, utilities, debt, medical bills, and more for 30+ years?

Also Check: Can I Use My 401k To Invest In A Business

K Loan Repayment After Leaving A Job

The biggest fear that surrounds borrowing from a 401k is what will happen if you leave the job either voluntarily or involuntarily. Before the Tax Cuts and Jobs Act, loan repayments must have been met within 60 days.

Nowadays you have until your tax returns due date for the year you left your job.

For example, if you left your job in 2020, youd have until April 15, 2021, to repay your loan .

Any outstanding loan balance not repaid on time will be seen as an early withdrawal and subject to an early withdrawal penalty.

This understandably freaks people out. Ideally, you wont borrow against your 401k if you feel that you are in danger of losing your job or you plan to leave shortly. If your job is stable, this fear is mostly unfounded.

Of course, all of us are expendable. What if you do lose your job and have to pay the money back?

Well, we dont have debtors prisoners anymore , so its not like youll be locked up. What will happen is that the IRS will classify the remaining balance as an early withdrawal, hit you with a 10% penalty on that amount, and require you pay taxes on the distribution.

Quick Answer: How Much Money Can I Borrow From My 401k

401 loans: With a 401 loan, you borrow money from your retirement savings account. Depending on what your employers plan allows, you could take out as much as 50% of your savings, up to a maximum of $50,000, within a 12-month period.30-Dec-2020

- If permitted by your specific 401 plan, you can borrow up to the greater of $10,000 or 50 percent of your vested balance, or $50,000, whichever is less. The amount you can borrow from your 401 depends on the vested balance, which is the balance that wont be forfeited due to separation from your job.

Read Also: How Can I Get My 401k Money Without Penalty

How Long Does It Take To Get A 401k Loan

Generally the review takes about 5-7 business days. If your application is approved, you will receive a notification that your promissory note and amortization schedule are available for your review. Once the promissory note terms have been accepted, it takes about 2-3 business days for the check to be mailed out.

Why Would Someone Take A 401 Loan

For some, the only alternative to a 401 loan is running up their credit card balance, and because credit card interest rates can reach the high teens and compound dailymeaning the interest you owe builds quickly401 loans are usually a cheaper option.

Your monthly and total payments on a credit card with 19% interest will be 33% higher than your payments on a five-year 401 loan with 5.75% interest.¹

Other potential advantages to a 401 loan include:

- No preapproval requirementA 401 loan can usually be processed online or over the phone, except in the case of a residential loan with a 10-year repayment, which may require paperwork.

- Interest payments go into your 401You pay interest to yourself.

- Repayment is automaticPrincipal and interest are repaid through payroll.

Read Also: What Happens With 401k When You Quit

Leaving Work With An Unpaid Loan

Suppose you take a plan loan and then lose your job. You will have to repay the loan in full. If you don’t, the full unpaid loan balance will be considered a taxable distribution, and you could also face a 10% federal tax penalty on the unpaid balance if you are under age 59½. While this scenario is an accurate description of tax law, it doesn’t always reflect reality.

At retirement or separation from employment, many people often choose to take part of their 401 money as a taxable distribution, especially if they are cash-strapped. Having an unpaid loan balance has similar tax consequences to making this choice. Most plans do not require plan distributions at retirement or separation from service.

People who want to avoid negative tax consequences can tap other sources to repay their 401 loans before taking a distribution. If they do so, the full plan balance can qualify for a tax-advantaged transfer or rollover. If an unpaid loan balance is included in the participant’s taxable income and the loan is subsequently repaid, the 10% penalty does not apply.

The more serious problem is to take 401 loans while working without having the intent or ability to repay them on schedule. In this case, the unpaid loan balance is treated similarly to a hardship withdrawal, with negative tax consequences and perhaps also an unfavorable impact on plan participation rights.

Next Steps To Consider

This information is intended to be educational and is not tailored to the investment needs of any specific investor.

Fidelity does not provide legal or tax advice. The information herein is general in nature and should not be considered legal or tax advice. Consult an attorney or tax professional regarding your specific situation.

Fidelity Brokerage Services LLC, Member NYSE, SIPC, 900 Salem Street, Smithfield, RI 02917

Recommended Reading: What Happens To My 401k If I Leave My Job

If I Dont Use My 401 To Buy A House When Can I Use My 401

Put simply, 401s are meant to be retirement accounts, meaning that the money is ideally supposed to be used when you reach retirement age. The early withdrawal taxes that 401s and IRAs use are supposed to incentivize you to leave the money untouched until you reach retirement age.

However, hardship withdrawals do exist to allow you to borrow money early under extenuating circumstances.

K Loan Double Taxation Myth

July 30, 2008Keywords: 401k, math, misinformed

I dont know who started it. Suze Orman certainly helped spread it. She says that you shouldnt borrow from your 401k plan because you will be double-taxed. I did a Google search and I found 5 priceless money-saving tips by Suze Orman:

Also, never ever borrow against your 401k plan because you will pay double taxation on the money you borrow. Because you dont pay taxes on the money you put into a 401k, when you pay back the loan , you pay it back with money you have paid taxes on. Then, when you retire and take the money out again, you end up paying taxes on it a second time.

This allegation is all over the place. It is a myth because there is NO double taxation. Its a mind trick similar to that well-known wheres the missing dollar puzzle.

Three men went into a hotel. The manager said the room was $30 so each man paid $10. A while later the manager realized the room was only $25 so he sent the bellboy to the 3 guys room with $5. The bellboy only gave each man $1 back and kept the other $2 for himself. Now 3 men paid $9 each for the room, which is $27. Add the $2 that the bellboy kept, and thats $29. But the 3 men paid $30 originally. Where is the other dollar?

I was able to find a good explanation for this puzzle. The $30 number is irrelevant. The correct math is $27 $2 = $25. It makes no sense to add $2 to the $27 because its already a part of the $27. The $2 should be subtracted from the $27.

Don’t Miss: How Do You Move Your 401k When You Change Jobs

Alternatives To Borrowing From Your 401k

There are a number of alternatives to consider before deciding to borrow from your 401k including:

Home equity lines of credit. Homeowners have the option to take out home equity lines of credit from their property, which allows you to cover an emergency or an expense on your home. If you have good to excellent credit, it might be a better option than borrowing from your 401k.

Taking out a personal loan. If youre in an emergency situation where you need cash, you may want to consider personal loans before tapping into your 401k. Theyre known for high interest rates and the lender may require a high credit score, but they can be worthwhile considering the drawbacks from borrowing from your 401k.

Negotiating a payment plan. If youre unable to meet your debt payments, you may be able to negotiate a new payment plan, but note that it might have a negative impact on your credit score. Go over your income and expenses to figure out what you can afford, and then discuss a realistic payment plan with your lender.

Myths About Borrowing Against A 401k

There is a lot of fear-mongering about borrowing from your 401k and for a good reason. Not everyone who does it would make good use of the money by investing in a home or an education.

If borrowing were not discouraged, too many people would raid their account for silly reasons that will hurt their retirement savings.

But not all of the doom and gloom is entirely true. Borrowing from your 401k is not necessarily damaging to your retirement savings. When you pay the loan back, the payments go back into your investments.

Because youre paying interest, youre paying back a little more than you borrowed, so youre putting additional money into the account.

As long as any interest payments are the same or greater than what you lost during the time that money wasnt invested, your savings arent affected and can increase if the interest is more than any earnings losses.

Read Also: Should I Rollover My 401k From A Previous Employer