See Other Posts By Sharon A

Plan Sponsors Want DC Specialists with Broad Expertise – notable, according to the study, are the significant shifts among concerns such as: 1) ensuring participants are appropriately invested 2)helping participants with financial wellness and 3)changing number/types of investment options. via @ASPPA

A Brief History Of The 401

Why is it called a 401? Despite their popularity today, 401 plans were created almost by accident. It started when Congress passed the Revenue Act of 1978, which included a provision that was added to the Internal Revenue Code â Section 401 â that allowed employees to avoid being taxed on deferred compensation.

In 1980, benefits consultant Ted Benna referred to Section 401 while researching ways to design more tax-friendly retirement programs for a client. He came up with the idea to allow employees to save pre-tax money into a retirement plan while receiving an employer match. His client rejected the idea, so Bennaâs own company, The Johnson Companies, became the first company to provide a 401 plan to its workers.

In 1981, the IRS issued new rules that allowed employees to fund their 401 through payroll deductions, which kickstarted the 401âs popularity. Within two years, nearly half of all big companies were offering 401s or were considering it, according to the Employee Benefits Research Institute.

Drawbacks To The Solo 401

The solo 401 has the same drawbacks of typical 401 plans, plus a couple others that are specific to itself. Like other 401 plans, the solo 401 will hit you with taxes and penalties if you withdraw the money before retirement age, currently set at 59½. Yes, you can take out a loan or may be able to access a hardship withdrawal, if needed, but those are last resorts.

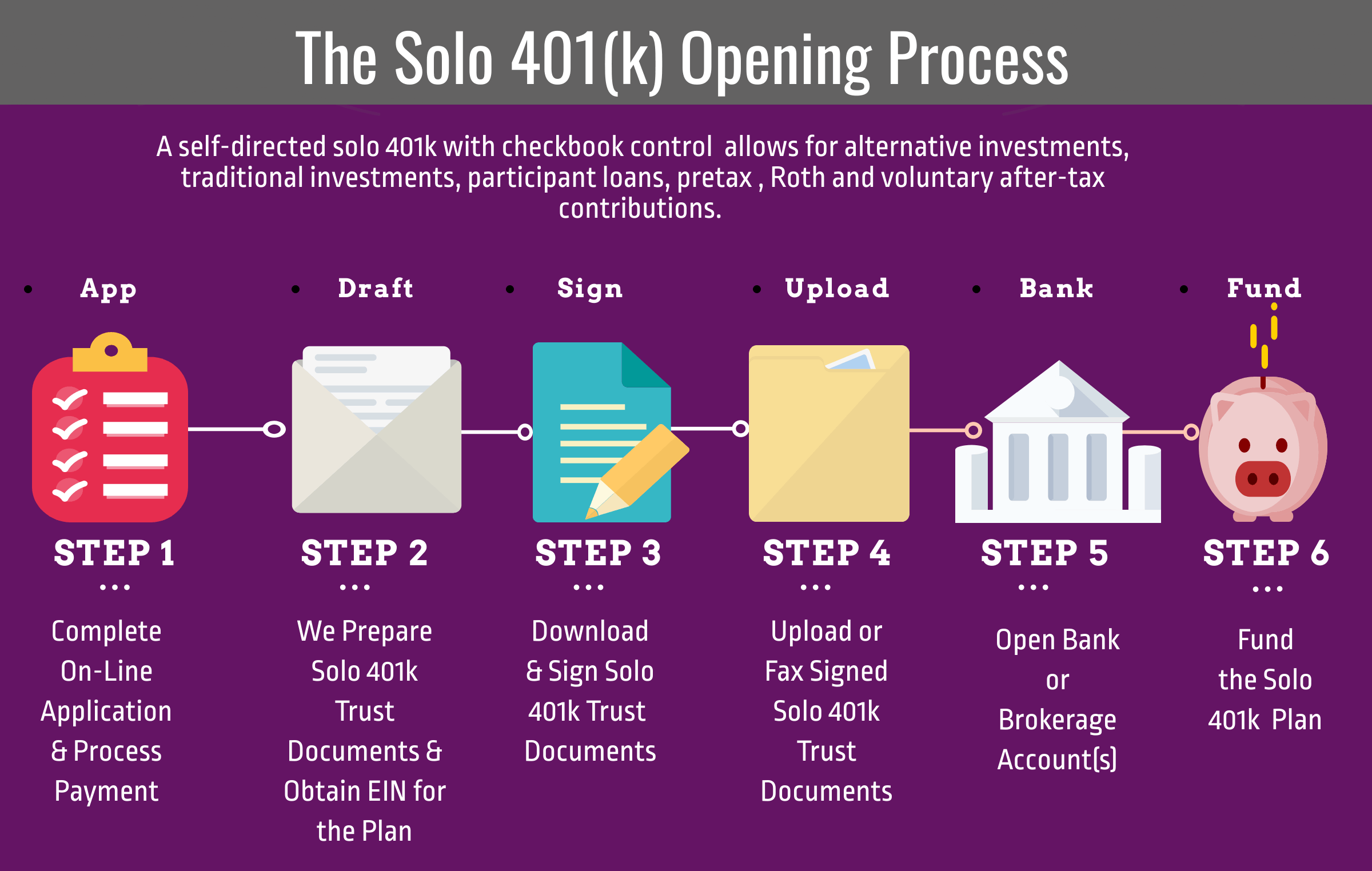

In addition, it can take more paperwork to open a solo 401, but its not especially onerous. You usually wont be able to open the account completely online in 15 minutes, as you would a typical brokerage account. Plus, youll need to get a tax ID from the IRS, which you can do online quickly. On top of this, youll have to manage the plan, choose investments and ensure that you dont exceed annual contribution limits.

Another wrinkle: Once you exceed $250,000 in assets in the plan at the end of the year, youll need to start filing a special form with the IRS each year.

These drawbacks arent especially burdensome, but you should be aware of them.

Don’t Miss: When Do You Need A 401k Audit

Setting Up A Solo 401

Some paperwork is required, but its not too onerous. To establish an individual 401, a business owner has to work with a financial institution, which may impose fees and limits as to what investments are available in the plan. Some plans may limit you to a fixed list of mutual funds, but a little bit of shopping will turn up many reputable and well-known firms that offer low-cost plans with a great deal of flexibility.

Generally, 401s are complex plans, with significant accounting, administration, and filing requirements, says James B. Twining, CFP, founder and wealth manager of Financial Plan. However, a solo 401 is quite simple. Until the assets exceed $250,000, there is no filing required at all. Yet a solo 401 has all the major tax advantages of a multiple-participant 401 plan: The before-tax contribution limits and tax treatment are identical.

How A Health Savings Account Works

HSAs are funded with pretax dollars, and the money within them grows tax-deferred as with an IRA or a 401. While the funds are meant to be withdrawn for out-of-pocket medical costs, they dont have to be, so you can let them accumulate year after year. Once you reach age 65, you can withdraw them for any reason. If its a medical one , its still tax-free. If its a non-medical expense, you are taxed at your current rate.

To open an HSA, you have to be covered by a high-deductible health insurance plan . For 2021 and 2022, the Internal Revenue Service defines a high deductible as $1,400 per individual and $2,800 per family.

Also, the annual out-of-pocket expenses, including deductibles, co-payments, but not premiums, must not exceed $7,000 for self-only coverage or $14,000 for family coverage for 2021, but for 2022, not exceed $7,050 for self-only coverage or $14,100 for family coverage.

The annual contribution limit for 2021 is $3,600 for individuals and $7,200 for families the 2022 contribution limit is $3,650 for individuals and $7,300 for families. People age 55 and older are allowed a $1,000 catch-up contribution.

Recommended Reading: What Happens To 401k When Switching Jobs

How A 401 Works

If your employer offers a 401 and you meet the eligibility requirements, you can enroll in the plan and begin making contributions via payroll. Before you start making contributions, though, youâll need to decide:

- What type of 401 you want: Traditional or Roth

- How much you want to save

- What you want to do with the money you save

401s come in two distinct flavors: Traditional and Roth. Although at their heart they aim to achieve the same purpose â to encourage Americans to save more for retirement by offering tax incentives â they do this in drastically different ways. Here are the main ways they differ.

Have more questions? .

Traditional 401: Your contributions are made before taxes and over the years your money grows tax-deferred. This means the contributions you make help lower your taxable income now, and you donât pay any taxes on either your contributions or investment growth until you begin making withdrawals in retirement. At that point, the money will be taxed as ordinary income.

Roth 401: Your contributions are made after you’ve paid tax on the income, but your money grows tax-free. Because you already paid tax up front, when you withdraw money during retirement, you wonât have to pay taxes.

S To Managing Your 401

Even though 401s are called employer-sponsored retirement plans, employers are pretty hands-off when it comes to the setup process. Each worker is in charge of making the investment decisions in their own account.

Your human resources department will make the introduction and explain the high points of how the plan works. HR will pass the baton to the companys 401 plan administrator an outside financial firm to handle the administrative details, such as enrollment, plan management, account statements and so on.

Next, its your turn. Heres your 401 to-do list:

Don’t Miss: How To Rollover 401k When You Change Jobs

What Is The Best 401k Retirement Plan

Fidelitys self-employed 401 plan is our pick for best overall due to a combination of very low fees, a wide range of investment choices, and the companys emphasis on retirement savings. Fidelity self-employed 401 accounts are a great choice for fee-conscious investors, earning our top overall pick.

What Are The Potential Tax Benefits Of A Solo 401

One of the potential benefits of a Solo 401 is the flexibility to choose when you want to deal with your tax obligation. In a Solo 401 plan all contributions you make as the “employer” will be tax-deductible to your business with any earnings growing tax-deferred until withdrawn. But for contributions you make as an “employee” you have more flexibility. Typically, your employee “deferral” contributions reduce your personal taxable income for the year and can grow tax-deferred, with distributions in retirement taxed as ordinary income. Or you can make some or all of your employee deferral contributions as a Roth Solo 401 plan contribution. These Roth Solo 401 employee contributions do not reduce your current taxable income, but your distributions in retirement are usually tax-free. Generally speaking, there are tax penalties for withdrawals from a Solo 401 before 59 1/2 so be sure to know the specifics of your plan.

Read Also: Can I Borrow Against My 401k

How A Keogh Works

Keogh plans usually can take the form of a defined-contribution plan, in which a fixed sum or percentage is contributed every pay period. In 2021, these plans cap total contributions in a year at $58,000. Another option, though, allows them to be structured as defined-benefit plans. In 2021, the maximum annual benefit was set at $230,000 or 100% of the employees compensation, whichever is lower it rises to $245,000 in 2022.

A business must be unincorporated and set up as a sole proprietorship, limited liability company , or partnership to use a Keogh plan. Although all contributions are made on a pretax basis, there may be a vesting requirement. These plans benefit high earners, especially the defined-benefit version, which allows greater contributions than any other plan.

What Are The Benefits Of A 401k

401 tax benefits are hard to dispute, as they can offer workers a lot of financial security, including:

-

Employer match

In fact, let’s dig into 401k benefits a little deeper.

401k employer match

Do you like free money? Good, now that we’ve got that out of the way, a company-matched 401k is basically that. Many employers offer to match employee contributions, either dollar for dollar or 50 cents to the dollar, up to a set limit. So, for example, say you make $100,000 a year and your employer offers a 401k matching of 50% up to the first 6% you elect to contribute. If you contribute 6% of your annual earnings , your employer would contribute an additional 50% of that amount. So, 3,000 free dollars.

It’s up to your employer to decide what percentage they will match, but many companies do offer a dollar-for-dollar match.

401k tax breaks

The tax benefits of 401ks are like the triple-crown of finances. First, contributions are pre-tax. You dont pay taxes on the money until you withdraw it when you retire.

Second, your 401k contributions are not counted as income, which could put you in a lower tax bracket. The result: your tax bill will be smaller for your having squirreled away money for your later years.

401k shelter from creditors

If your finances take a turn for the worst, you won’t have to worry about creditors coming for your 401k. Your qualified retirement plan is protected by the Employee Retirement Income Security Act of 1974 from claims by judgment creditors.

Read Also: How To Borrow Money From Your 401k Plan

Decide How Much To Contribute

One reason experts like 401 plans so much is because 401s make it easy to start investing. “They take the guesswork out of when to invest because money comes out of your paycheck automatically,” says Christine Benz, director of personal finance at Morningstar. “Turns out, that’s a really great way to invest.”

Still, you need to decide how much money to contribute each pay period. Experts typically advise you aim to put away 10% to 15% of your salary for retirement each year, but even if you’re juggling a lot of other expenses, some is better than none. “Put $50 or $100 in there just so you’re used to saving and seeing a statement that has investments in there,” Reyes recommends.

As you earn more money, aim to increase your contributions. There are contribution limits in place: You can make an annual 401 contribution of up to $19,000 as of 2019.

It’s especially important to contribute to a 401 if your employer offers a match. There are a variety of formulas for matching contributions, but the average reached a record high of 4.7% this year, according to data from Fidelity.

That means if you make $50,000 and contribute at least that amount, your company will contribute $2,350 as well.

Rollovers As Business Start

ROBS is an arrangement in which prospective business owners use their 401 retirement funds to pay for new business start-up costs. ROBS is an acronym from the United States Internal Revenue Service for the IRS ROBS Rollovers as Business Start-Ups Compliance Project.

ROBS plans, while not considered an abusive tax avoidance transaction, are questionable because they may solely benefit one individual â the individual who rolls over his or her existing retirement 401 withdrawal funds to the ROBS plan in a tax-free transaction. The ROBS plan then uses the rollover assets to purchase the stock of the new business. A C corporation must be set up in order to roll the 401 withdrawal.

You May Like: Can You Transfer Your 401k

What Is An Ira

While there are a number of benefits to 401ks, they’re not the only retirement plan in the game. An IRA is an individual retirement account. Where a 401k can only be offered through an employer, an IRA account can be opened up by an individual whether they’re associated with an employer or not. That means they’re the best option for independent contractors without an employer or anyone who wants to do some extra retirement planning on top of their 401k.

Know How Social Security Fits In Your Retirement Plan

Will it be around when you retire? Maybe. Maybe not. Or it could be reduced or replaced by something else. This is what we know about Social Security today:

- The earliest you can draw Social Security is age 62, but the longer you wait to take it, the more money youll generally get.

- If you’re a middle income earner hoping to have 80100% of your pre-retirement income, you can plan to collect about 40% of that income from Social Security.3

- If you take Social Security before your full retirement age , and youre working and receiving benefits, there are limits on how much income you can make.

- Your benefits can be taxed! Up to 85% of your check. Its a complex formula, so learn all about it on the Social Security web site.

Set up a my Social Security account at ssa.gov to get an estimate of your potential future benefits and log the information in the retirement savings checklist .

Another reason to set up an account is to help protect your personal information. Only one account is permitted per Social Security number and address, so claiming your account is one more way to keep your information secure.

Want to learn more?

- Read this Q& A: Will Social Security have you covered?

Read Also: How Many Percent Should I Put In 401k

How To Make Money In Retirement Without Leaving Your Home

by Anela | Dec 22, 2021 | Blog

If you want to make money in retirement, there are many ways to achieve that. With the broad online job market, you can work from the comfort of your home. The other great thing about remote jobs is that you very often can choose your work schedule. Plus, you can opt for part-time positions. These options are flexible and easy to incorporate into a daily routine. So, todays topic will provide you with some handy ways to boost your budget during retirement.

Employer Sponsored Retirement Plans 401 403 457 Thrift Savings Plan

If your employer offers one of these plans you should take advantage and join. You can have your contributions payroll deducted so you wont even know its happening. If your employer provides a contribution match which is typically 50% of the first 6% of pay that you contribute then you should contribute enough to maximize that match. After all, its virtually free money! You can contribute up to $18,000 per year for 2017.

Also Check: How To Find Out If You Have 401k Money

Choose An Account Type

Traditional 401s are standard at workplaces, but more employers are adding the Roth 401 option, too.

As with Roth IRAs versus traditional IRAs, the main difference between the two types of plans is when you get your tax break:

-

The regular 401 offers it upfront since the money is automatically taken out of your paycheck before the IRS takes its cut . Youll pay income taxes down the road when you start making withdrawals in retirement.

-

Contributions to a Roth 401 are made with post-tax dollars , but qualified withdrawals are tax-free

-

Investment earnings within both types of 401s are not taxed

Another upside to the Roth 401 is that, unlike a Roth IRA, there are no income restrictions to limit how much you can contribute.

The IRS allows you to stash savings in both a traditional 401 and Roth 401, which can add tax diversification to your portfolio, as long as you dont exceed the annual maximum contribution limits .

Contribute Enough To Get Any Employer Match

Even the priciest 401 plan can have some redeeming qualities. Free money via an employer match is one of them. Contributing enough money to get the match is the bare minimum level of participation to shoot for. Beyond that, it depends on the quality of the plan.

A standard employer match is 50% or 100% of your contributions, up to a limit, often 3% to 6% of your salary. Note that matching contributions may be subject to a vesting period, which means that leaving the company before matching contributions are vested means leaving that money behind. Any money you contribute to the plan will always be yours to keep.

If your company retirement plan offers a suitable array of low-cost investment choices and has low administrative fees, maxing out contributions in a 401 makes sense. It also ensures you get the most value out of the perks of tax-free investment growth and, depending on the type of account or the Roth version), either upfront or back-end tax savings.

Read Also: How To Take My Money Out Of 401k

Find Out How Much Money You May Need In Retirement

Here’s how you do it: Use our Retirement Wellness Planner, a tool that gives a quick snapshot of how much income you may need in retirement. It also helps identify a surplus or gap.

Just plug in your current annual income, how often youre paid, your pre-tax contribution to your retirement account , current retirement savings, estimated Social Security benefit, current age, and desired retirement age. You can adjust your deferral to see how the numbers change.

This is also when a financial professional can be a big help if you want a customized plan for retirement. To learn more, read how to choose and work with a financial professional.