Youll Be Robbed Of Future Retirement Savings

Cashing out your 401 does give you much more immediate access to funds than other alternatives. So, some do use it as a temporary fix for things like debt. For example, if you lose your job, money from the 401 can help cover living expenses while you job search. After you find one, you can hop back into saving instead.

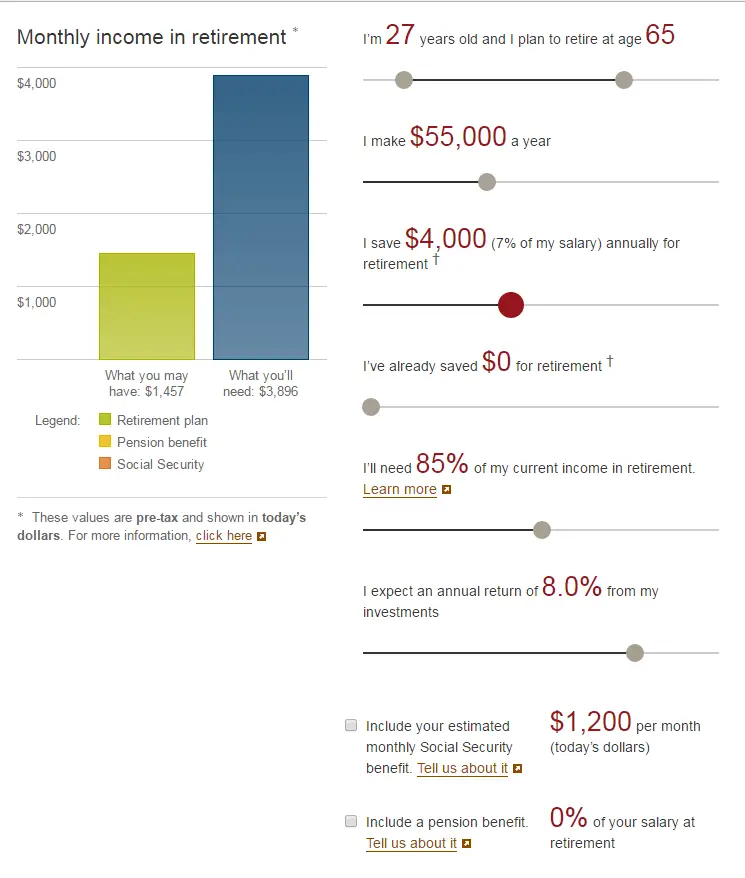

But while it may fix an immediate need, it may harm your financial situation in the future. Cashing out now will cost you earnings and potential interest you would have otherwise earned. For instance, say you have $35,000 put away. Cashing those funds means you lose any future earnings on that amount. Even if you only contribute $5,000 annually and your employer matches that up to 5%, youll have around $499,445 waiting for you by the time youre 66.

Keep in mind that you probably have a certain lifestyle you want to maintain in retirement, too. If you use your 401 now, you wont have sufficient funds to support yourself. That will leave you scrambling to accomplish your retirement goals.

Can I Cash A Check Without An Id

With the exception of endorsing your check to a friend or family member, all of the check cashing places above will require at least one form of ID, sometimes two. If your ID is expired, then technically it is not valid and wont count as a form of identification.

If you do not have an ID, you have three options:

- Endorse the check to someone else

- Cash the check online

- Sign up with a bank and use its online app

Load Funds Onto A Prepaid Debit Card

Consumers who dont have bank accounts sometimes use prepaid cards to deposit checks and access their cash. Prepaid cards are similar to checking account debit cards. Your spending is limited by how much money you have loaded onto the card.

Prepaid cards have different options for check cashing. Some prepaid cards let you set up direct deposit so that checks are automatically loaded onto the card. Other cards come with an app that lets you snap a picture of your check to load it onto your card. Or, you might be able to deposit your check at an ATM to load the money onto the card.

Fees are a big drawback of prepaid cards. The Walmart MoneyCard charges $2.50 to withdraw money at an ATM or a bank teller window, and 50 cents to check your card balance at an ATM. There is a monthly fee of $5.94 unless you direct deposit at least $500 a month onto the card.

Reload fees can be steep. It costs up to $5.95 to add money to a Green Dot Prepaid Visa card. Green Dot also charges $3 for an ATM withdrawal and 50 cents for an ATM balance inquiry. In addition, there is a $7.95 fee for every month there isnt at least $1,000 loaded onto the card.

Don’t Miss: Can You Buy Stocks With Your 401k

A Bank Or Credit Union Loan

With a decent credit score you may be able to snag a favorable interest rate, Poorman says. But favorable is relative: If the loan is unsecured, that could still mean 8%12%. If possible, secure the loan with some type of asset to lock in a lower rate.

Interest is the price of borrowing money. Learn how interest rates work.

Best Places To Cash Checks

Here’s a list of the 11 Best Places to Cash Checks. If you’re looking for the best places to cash a personal check near you then definitely check these out!

I know what youre thinking best places to cash checks!? Cashing a check in this day and age? Isnt that a little old school?

Well, youd be surprised how many side hustles will pay you in checks! And when you see those checks pour through your mailbox , you may want to cash them immediately.

But cashing a check can be a bit complicated. In fact, if youve started a profitable side hustle and are receiving your first checks, you may be confused about how it all works. If you receive checks from various income sources knowing how to cash personal checks conveniently and inexpensively is a must.

Lucky for you, today Ill be telling you how and where to cash your checks fast without paying unnecessarily high fees. Read on to find out all you need to know!

In This Article

Also Check: How To Find Previous 401k

Eligibility For Cashing Out A 401 Plan

No advice you receive on how to cash out 401 accounts will matter if your plan doesnt allow it. Yes, some employers wont let you take the money out. Even if your employer does, there could be restrictions on how the money can be withdrawn. You probably have some type of documentation with your 401 that you can check. If not, ask your HR department to provide your policy documents. You can always take money out of plans youre not participating in anymore e.g. a plan at an old employer.

If youre 59 and ½ years old, though, none of that matters. You can take money from your 401 starting at age 59 and ½ without paying a penalty. If you havent yet celebrated your 59th birthday, you may prefer instead to take a loan against your 401 if your employer allows it. This will help get you through your financial situation while still ensuring the money is there when its time to retire.

Its important to note that the tax man may still come calling, even if you dont pay a penalty. Traditional 401 plans are taxed when you take the money out, while Roth 401 accounts hold funds that youve already paid taxes on. If you have a Traditional 401, youll need to prepare to pay taxes on the money, whether you withdraw it at age 24 or 84. If you have a Roth 401, you can take your contributions out at any time since youve already paid taxes on them, but youll pay taxes on any earnings you withdraw early if youre under 59 and ½.

You May Like: What Is Max 401k Contribution For 2021

What Do You Need To Cash A Check

Regardless of where you plan to cash a check, there are a few things that youll need. Typically, youll have to have some or all of the following:

- The check itself, signed by you and the check writer

- A government-issued photo ID

- Money to pay any check-cashing fees if they arent deducted from the check

If you dont have an appropriate ID, theres one more option for cashing a check: signing it over to someone else. This is called a third-party check, and it allows the person to whom you sign over the check to cash it on your behalf.

Recommended Reading: Is A 401k An Ira

How Long Does It Take To Cash In Your 401

Closing 401 accounts isnt an overnight process, so youll need to get started early. Youll first get in touch with the plan administrator and find out the requirements. If theres a form to be filled out, the time to complete and submit it will factor into how long it takes. Once the administrator has the form, the law allows three business days for processing so that investments can be sold.

You still wont have the money after those three days have passed, though. The processing time varies from one administrator to another.

The best thing you can do when closing out your 401 is to keep it in a retirement account. One way to do this is to roll the funds over to an IRA. IRAs have similar options to 401s if you absolutely must move the money. By keeping your funds in a retirement account, you wont have to pay taxes and youll still have the funds in place when you need them.

If you need emergency funds, you can withdraw the money and pay taxes on it during the year you take that money. By following the regulations under IRS Rule 72, you can withdraw funds out in a way that ensures you wont even pay penalties.

How Can I Cash A Check Online

If you dont have a bank account but have internet access or a smartphone, there are a few options. The two most popular apps that dont require a bank account to be linked are PayPal and Ingo Money.

You can use Ingo money to deposit almost every kind of check, including handwritten personal checks. You simply endorse the check by signing it and taking a picture of the front and back. Once the check is approved, the funds will be sent wherever you designate them.

With Ingo, you have a number of options to access your money:

- Prepaid debit card

- Pick up cash in person at a MoneyGram location

- Amazon gift card

However, the fees for Ingo can add up quickly. Government and payroll checks are $5 each. If the amount is over $250, youll pay a 2% fee. This means for a $1,000 check, youll pay $20. For all other checks, youll pay a 5% fee.

With PayPal, the fees are only slightly better. Youll pay 1% for government and payroll checks and 5% for all others. You can transfer the funds to a prepaid debit card and then withdraw the cash at most ATMs.

With both online apps, you can avoid paying these fees if you are willing to wait a full 10 days to access the funds.

Don’t Miss: Can You Convert Your 401k To A Roth Ira

Can You Withdraw Money From A 401 Early

Yes, if your employer allows it.

However, there are financial consequences for doing so.

You also will owe a 10% tax penalty on the amount you withdraw, except in special cases:

- If it qualifies as a hardship withdrawal under IRS rules

- If it qualifies as an exception to the penalty under IRS rules

- If you need it for COVID-19-related costs

In any case, the person making the early withdrawal will owe regular income taxes year on the money withdrawn. If it’s a traditional IRA, the entire balance is taxable. If it’s a Roth IRA, any money withdrawn early that has not already been taxed will be taxed.

If the money does not qualify for any of these exceptions, the taxpayer will owe an additional 10% penalty on the money withdrawn.

How Much Money Do I Need To Open A Vanguard Ira

At Vanguard, you can open an account with a $0 balance. But there are a few minimums to keep in mind as you begin to invest.

- Vanguard ETFs: You only need enough money to cover the price of 1 share, which can generally range from $50 to a few hundred dollars.

- Vanguard mutual funds: Some Vanguard mutual funds have a $1,000 minimum . Most of our other Vanguard mutual funds have a $3,000 minimum.

Don’t Miss: Can You Withdraw Money From 401k

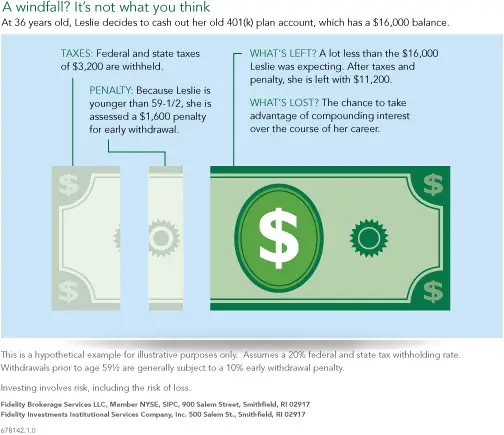

How Much Will I Lose Cashing Out My 401 Early

Consider this concrete example. Lets say your plan allows early distributions, so you decide to take $10,000 out of your 401. Youre taxed at a federal rate of 22% and a state rate of 8%, so youll end up paying $2,500 in federal tax and withholding, plus $800 to the state. That means that you will be paying a hefty $4,300 from your retirement savings to receive $5,700.

Worse yet, assuming the average 8% year-over-year returns, leaving that $10,000 in the account could make you $68,485 over the next 25 years.

Cut through the complexity of choosing and customizing the right 401 for your small business. Get an instant quote.

No More Creditor Protection

Once youve squared away how long it takes to cash out your 401, its time to think about consequences. The first is the loss of protection against creditors. If youre cashing out because creditors may come knocking, this is something you need to consider. Employer-sponsored 401 plans are often protected against creditors, bankruptcy proceedings, and civil lawsuits. Once youve cashed the funds out, theyll be subject to action along with your other assets.

But before you assume this could be a problem, check to make sure your plan isnt vulnerable for other reasons. If youre in the process of divorcing or are already divorced, the other party could be able to snag a portion of the funds under a qualified domestic relations order. Funds in a 401 can also be seized to pay tax debts and federal penalties.

Plan for a better future

Get an affordable, professionally prepared retirement plan today.

Recommended Reading: Can I Refinance My Car Loan With The Same Lender

Don’t Miss: Can I Withdraw Money From 401k

Most People Have Two Options:

Whether youre considering a loan or a withdrawal, a financial advisor can help you make an informed decision that considers the long-term impacts on your financial goals and retirement.

Here are some common questions and concerns about borrowing or withdrawing money from your 401 before retirement.

Compound Interest Only Works If You Leave The Money Alone

We talk a lot at Money Under 30 about compound interest. Its what makes a comfortable retirement possible for most of us. When you cash out your 401 early, youre not just subtracting that balance from your eventual retirement fund. Rather, youre deducting your balance, plus any interest your balance will earn over the next few decades, plus the interest the interest would earn! Taking a few hundred bucks now could cost you thousands down the road. Not to mention that you immediately lose almost 30% of your balance to taxes and fees.

It might feel like a small windfall now, but over the long term, youre taking yourself to the cleaners.

Most retirement funds are set up to allow your money to grow with few interruptions: Hence why the money you put into a 401 isnt taxed, why the interest you earn while your money is in the 401 isnt taxed, and why its relatively hard to remove money from your account until youre close to retirement age.

While we know its tempting to take that small pot of cash, we urge you to resist. And once youve gotten a new job, you should roll your old 401 into your new employers plan. Thatll take away the temptation entirely.

Don’t Miss: What’s The Max You Can Put In 401k Per Year

Consider Converting Your 401 To An Ira

Individual retirement accounts have slightly different withdrawal rules from 401s. So, you might be able to avoid that 10% 401 early withdrawal penalty by converting your 401 to an IRA first. s and IRAs, of course.) For example:

-

Theres no mandatory withholding on IRA withdrawals. That means you might be able to choose to have no income tax withheld and thus get a bigger check now. You still have to pay the tax when you file your return, though. So if youre in a desperate situation, rolling the money into an IRA and then taking the full amount out of the IRA might be a way to get 100% of the distribution. This strategy may be valuable for people in low tax brackets or who know theyre getting refunds.

An Early Withdrawal From Your : Understanding The Consequences

OVERVIEW

Cashing out or taking a loan on your 401 are two viable options if you’re in need of funds. But, before you do so, here’s a few things to know about the possible impacts on your taxes of an early withdrawal from your 401.

For information on the third coronavirus relief package, please visit our American Rescue Plan: What Does it Mean for You and a Third Stimulus Check blog post.

Don’t Miss: How Does A Company Set Up A 401k

Can You Cash A Check At An Atm

Even with a bank account, you technically cant cash a check at an ATM.

You could deposit a check and immediately follow it up by withdrawing cash from your account. However, if you have nothing in your account prior to depositing the check, you will not be able to withdraw the funds for 24 to 48 business hours.

Without an account, though, there is no way to do this.

File Your Taxes With H& R Block

We recommend filing your taxes with H& R Block this tax season because of all of the tax benefits that you will receive.

H& R Block asks you simple questions to fill in the proper form, helps you claim every tax deduction and credit that you qualify for, and you will get the largest refund possible. You never have to know the tax laws or access tax tables during the filing process!

They even have a free tax refund calculator available that allows you to know the amount of money that you will be getting back in your tax refund. Their online filing services have the ability to import your W2 information into your tax return so you can avoid worrying about your forms being delivered via snail mail.

Don’t Miss: Should I Move Money From 401k To Roth Ira

Common 401 Rollover Mistakes And How To Avoid Them

New job, new you. But also … old job, old 401. So what should you do with it?

One option is a 401 rollover, which means transferring your investments from your old account to a new retirement account typically an IRA or your new employers 401. rollover explainer for all the deets.)

But because 401s and IRAs come with tax benefits, they also come with rules and deadlines. And those can really cost you. So if youre thinking about rolling over your account, heres a handy list of common mistakes we see at Ellevest and how to avoid them.