Choose How Much To Contribute

When deciding how much of your gross income to divert into your 401, youll want to consider whether your company offers a matching contribution. Financial advisors will typically recommend taking advantage of the company match and using that percentage as a starting point. For example, if your company offers to match up to 5% of your contributions, you would want to contribute at least 5% to qualify for the match.

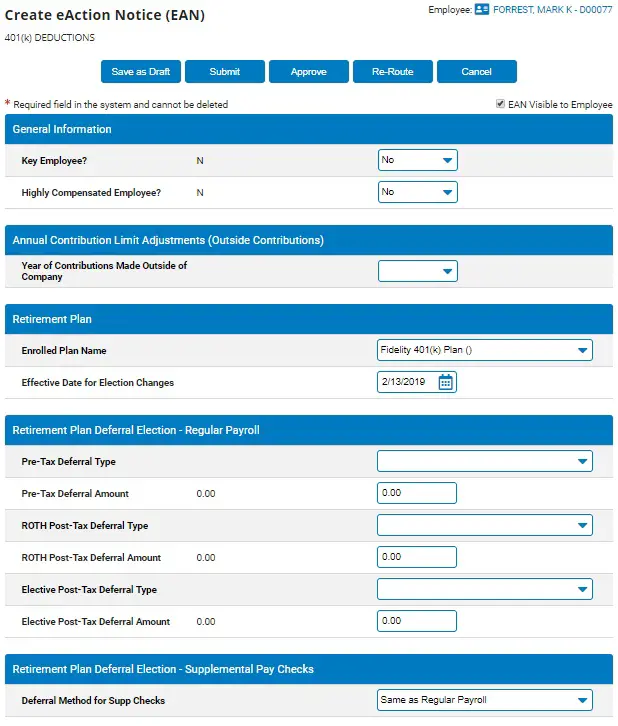

However, there are limits to how much you can set aside each year. An employee can contribute up to $20,500 to their 401 in 2022. Employees who are at least 50 years old can make an additional $6,500 catchup contribution.

What Is The Role Of The Employer In Administering 401k Plans

Under ERISA, plan fiduciaries, including the employer and any third parties who manage the plan and its assets, must act solely in the interest of the plan beneficiaries. Some of their responsibilities include:

- Managing the plan with the exclusive purpose of providing the plans retirement benefits to participants

- Ensuring that the investment menu offers a broad range of diversified investment alternatives

- Choosing and monitoring plan investment alternatives prudently

- Ensuring that the costs of plan administration and investment management are reasonable

- Filing reports, such as Form 5500 Annual Return/Report, with the federal government

These tasks should be taken seriously since fiduciaries can be held personally liable for plan losses or profits from improper use of plan assets that result from their actions.

Who Is Eligible For Individual 401 Plans

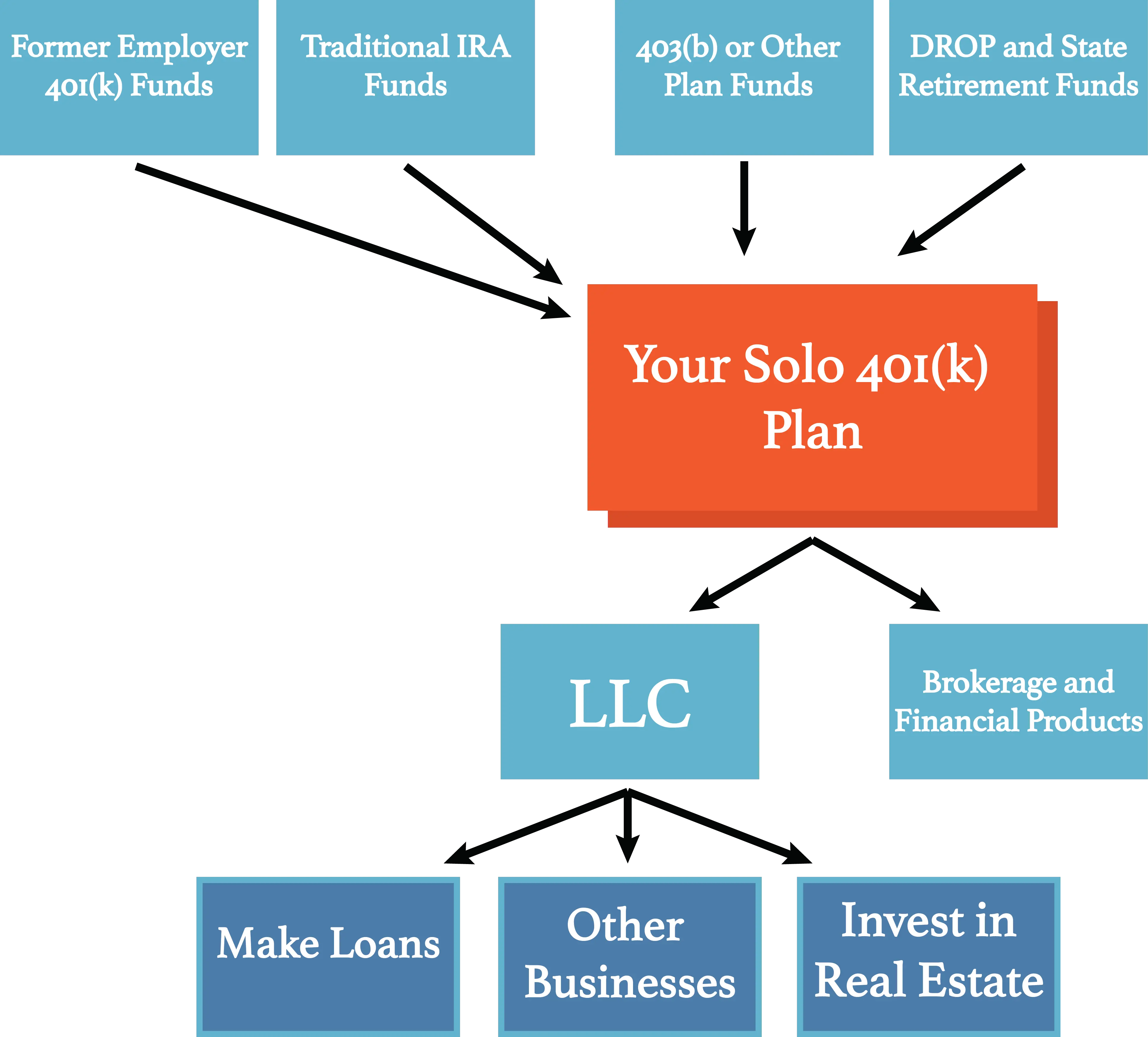

A common misconception about the solo 401 is that it can be used only by sole proprietors. In fact, the solo 401 plan may be used by any small businesses, including corporations, limited liability companies , and partnerships. The only limitation is that the only eligible plan participants are the business owners and their spouses, provided they are employed by the business.

A person who works for one company and participates in its 401 can also establish a solo 401 for a small business they run on the side, funding it with earnings from that venture. However, the aggregate annual contributions to both plans cannot collectively exceed the IRS-established maximums.

Also Check: What Do You Do With 401k When You Retire

Read Also: What Is The Average Management Fee For A 401k

Maintaining 401k Plans For A Business

Most 401k plans are subject to the requirements of the IRC and the Employee Retirement Income Security Act , which provide minimum standards that protect individuals in retirement plans. Administering and maintaining plans that comply with these regulations ranges in difficulty from the moderate to the complex.

Administering A Solo 401 Plan

Once your Solo 401 plan exceeds $250,000 in assets at the end of the year, the IRS requires you file an annual Form 5500 EZ. Or if you ever terminate the plan, you must also file a Form 5500 EZ.

Unlike Traditional 401 plans, there are no compliance testing requirements to ensure Solo 401 plans do not favor highly compensated employees and are non-discriminatory, as long as you have no employees participating in the plan.

These plans can be called Self-Directed 401, Individual 401, Individual Roth 401, Self-Employed 401, Personal 401 or One-Participant 401 depending upon the vendor offering the plan services.

Important Plan Provision Changes: New plan loan provisions are no longer offered in the TD Ameritrade Individual 401 plan. All outstanding plan loans must be paid off by May 31, 2022 to continue to use the TD Ameritrade plan document. Roth 401 deferral contributions in the Individual 401 plan will no longer be accepted as of December 1, 2022.

Read Also: How To Transfer 401k From Fidelity To Vanguard

How To Set Up A 401 Account

Since their inception in 1987, 401s have become the private sectors most common employer-sponsored retirement plan the Investment Company Institute says that there are roughly 60 million active participants in 2020. Participating in your companys 401 is a key component of saving for retirement, allowing you to divert a portion of your pre-tax income into an investment account. A financial advisor in your area can answer questions about retirement planning and help you create a plan for your financial needs. If you recently switched jobs or simply have never before contributed to a retirement plan, here are several easy steps to follow for setting up a 401 account.

Decide Who Is Establishing And Maintaining The Plan

Have your heart set on a 401 plan? If so, your next step is to decide who will establish and maintain said plan. Sure, setting up the plan and maintaining it yourself could be more cost-efficient, but it is also more time-consuming and error-prone.

To save time and help prevent 401-related mistakes, turn to a professional or financial institution .

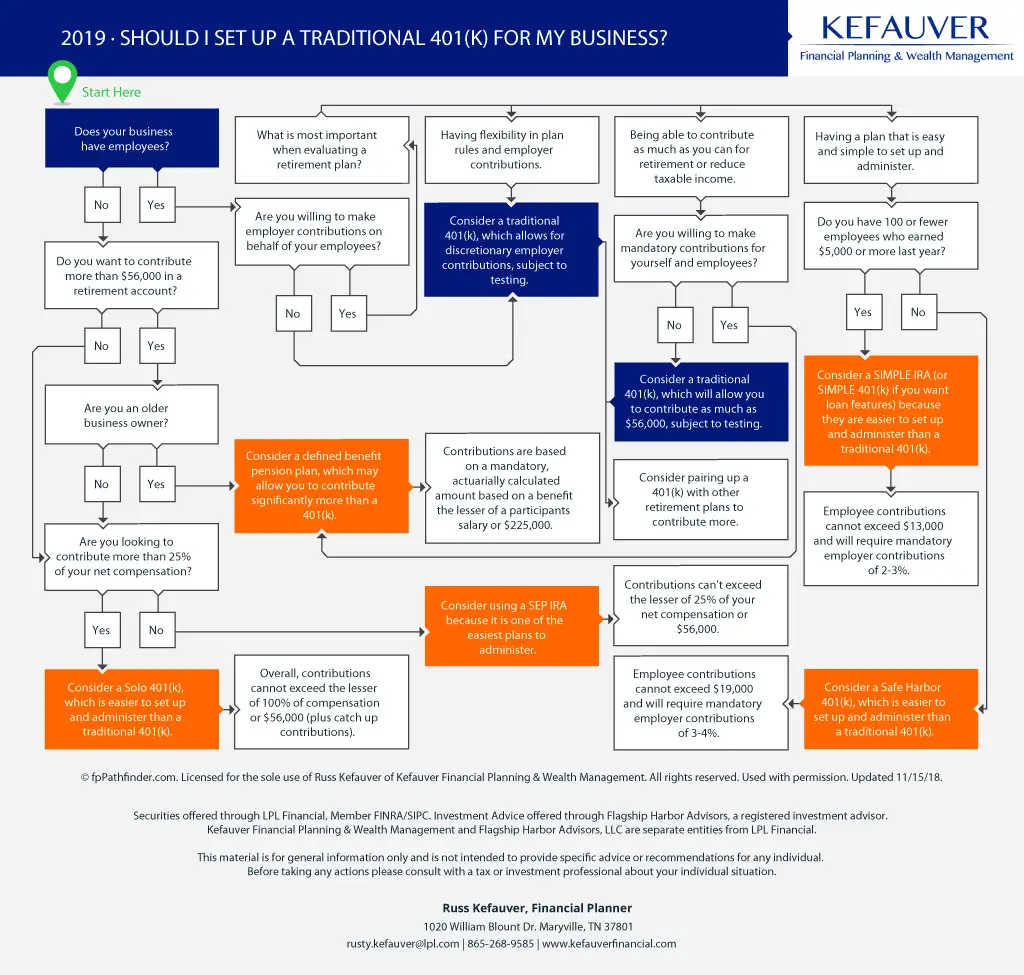

Pro tip: Cant decide which type of 401 plan is best for your business? Consult potential retirement program administrators for advice.

| Looking to start a new 401 plan? It just got easier. Patriot has partnered with Vestwell, a retirement platform trusted by small businesses across all 50 states, to offer payroll with seamless 401 integration. Learn more about the upcoming integration by signing up here. |

Don’t Miss: Is A 401k Worth It Anymore

For Small Business Costs

Small business owners must pay a 401 plan administrator to set up and manage a 401 plan. This comes with an array of costs:

- Start-up costs: These can vary depending on the provider and plan a business chooses. The business can expect to pay the administrator a one-time fee for the initial costs of setting up the plan and providing information to the employees regarding the plan. The typical range for these services is $500 to $2,000.

- Administrative fees and expense: Small business owners may have to pay fees for recordkeeping, accounting, and customer service provided by the 401 planâs administrator. There may also be expenses associated with optional services such as offering employees loans from the 401 plan.

- Optional matching contributions: An employer has the option of offering its employees a 401 match. They could match a percentage of an employeeâs contributions or do a dollar-for-dollar match, up to a limit.

What Does A 401k Do

A 401k allows employees of companies in the United States to save money in a defined contribution retirement account that is tax deferred. This deferral is an incentive for people to save so they will have an income stream upon retirement. Typically, any income contributed to a 401k in a given year will not be subjected to tax in that same year .

The IRS places limits on individual contributions every year, although the United States government allows for top ups in certain situations if you are over the age of 50.

The money will only be taxable when it is removed from the account.

The 401K was introduced in 1978 and the name refers to the section of code assigned to it – Section 401. Plans similar to that of a 401k exist in other countries. In Australia, the program is called Superannuation, in Canada it is referred to as an RRSP and in Japan it is called iDeCo.

Read Also: What Is The Interest Rate On A 401k

Make Sure Your Payroll Integration Scales With Your Business

If you do get a payroll integration for your 401, youll want to be sure that it works as your business scales up. Most businesses need to upgrade to new payroll systems around the 50 employee mark, as this is when compliance and reporting needs become too complex for simple small business payroll systems to handle. If the provider you choose doesnt integrate with payroll systems suited for larger businesses, you may need to change providers. And trust us, doing this can be a huge hassle.

What Is The Main Benefit Of A 401

A 401 plan lets you reduce your tax burden while saving for retirement. Not only are the gains tax-free but it’s also hassle-free since contributions are automatically subtracted from your paycheck. In addition, many employers will match part of their employee’s 401 contributions, effectively giving them a free boost to their retirement savings.

Also Check: Is A 401k Considered An Annuity

When You Can’t Open A 401 Without An Employer

To be eligible for most retirement accounts, you need to have earned income during that year. If you don’t have an employer and received only unemployment income for the year, you won’t be eligible to contribute to many of these retirement account options.

The one exception to this is the Roth IRA. If you have a significant amount of savings, you can contribute up to the limits set by the IRS.

However, if you are employed, and your employer doesn’t offer a retirement plan, you can still participate in the Traditional and Roth IRAs.

How Long Does It Take To Set Up A 401

Theres no set timeframe for establishing a 401. It really depends on how long it takes you to complete the steps we just discussed. For many businesses, it typically takes less than 60 days.

One way you can speed and streamline the process is to partner with a 401 third party administrator to handle a lot of the tasks for you and take some of the responsibility off your plate. As you evaluate potential partners, youll want to ask how easy it is to get your plan up and running and whats required of you during the process.

For example, all providers will ask you to fill out some documents but find out if you will get a dedicated point of contact to help you navigate the tasks involved and ensure you correctly complete the forms.

Youll also want to ask if they offer automatic enrollment for a hassle-free onboarding process that also increases participation. To make it even easier on your employees, find out whether the interface theyll be using is simple and intuitive for tasks like monitoring their account or making changes to their salary deferrals.

Also Check: How To Access Your 401k Money

Understanding The True Cost Of 401 Administration Costs And Expenses

It’s difficult to get accurate ranges on a 401 plans average cost because plan costs can vary widely. For example, plans with less than $1 million in assets may cost $5,000-$10,000 per year: an initial startup fee of $500-$3,000, quarterly per-participant charges of $15-$40, and $800-$1,000 in administrative fees².

Employees generally pay most 401 fees related to investing. Depending on plan design, employers may cover 401 administration costsor, pass them to employees as flat fees or as a percentage of assets in the plan.

How Does A 401 Earn Money

Your contributions to your 401 account are invested according to the choices you make from the selection your employer offers. As noted above, these options typically include an assortment of stock and bond mutual funds and target-date funds designed to reduce the risk of investment losses as you get closer to retirement.

How much money you contribute each year, whether or not your company matches your contribution, how your contributions are invested and the annual rate of return on those investments, and the number of years you have until retirement all contribute to how quickly and how much your money will grow. And provided you don’t remove funds from your account, you don’t have to pay taxes on investment gains, interest, or dividends until you withdraw money from the account after retirement , in which case you don’t have to pay taxes on qualified withdrawals when you retire).

What’s more, if you open a 401 when you are young, it has the potential to earn more money for you, thanks to the power of compounding. The benefit of compounding is that returns generated by savings can be reinvested back into the account and begin generating returns of their own. Over a period of many years, the compounded earnings on your 401 account can actually be larger than the contributions you have made to the account. In this way, as you keep contributing to your 401, it has the potential to grow into a sizable chunk of money over time.

Also Check: Can You Cash Out 401k Early

Setting Up A 401 & Profit

These are two separate plans that can be combined as a powerful tool to help you save for retirement, decrease your taxes, attract and retain top talent, and help your employees save for retirement.

As a small business owner, you are constantly thinking of how to reinvest in your company to make it more successful, create stability, and keep employees happy and engaged.

One way to do this is to focus on their financial well-being and investing in their retirement. You can do this by creating a 401 and profit-sharing plan that will invest in your own future to save up to $67,500 a year for your own retirement, which may allow you to save up to $24,975 in federal taxes and help your employees future retirement.

To Maximize Savings For Business Owners Or Key Employees

Sheltering money from income taxes and allowing it to grow over time is a very powerful way of building wealth. And for some small businesses, its especially important that their owners and key employees are able to contribute as much of their income as they can to the retirement plan. In order to reach the annual contribution limit of $56,000 – and potentially push the companys retirement tax benefits even higher – youll need to be clear on this objective so you can choose the right partners and optimize your plan design accordingly.

Don’t Miss: Which Investments Should I Choose For My 401k

What Happens If You Leave A Company Before You Are Vested

4.3/5Leaving before youvestedYouyouryou when you leave a jobyoukeep youryou are vestedread here

Some employees are allowed to exercise options before they vest, known as early exercising. If any of the option shares you exercised are still unvested when you leave your job, the company has to pay to repurchase those shares from you.

Additionally, what does it mean when your vested? Vesting in a retirement plan means ownership. This means that each employee will vest, or own, a certain percentage of their account in the plan each year. An employee who is 100% vested in his or her account balance owns 100% of it and the employer cannot forfeit, or take it back, for any reason.

Keeping this in view, can vested options be taken away?

After your options vest, you canexercise them that is, pay for the stock and own it. It may be couched in language such as company repurchase rights,redemption or forfeiture. But what it means is that the company canclaw back your vested stock options before they become valuable.

What happens to 401k money that is not vested?

If you leave a company that matched 401k contributions before the vesting schedule is complete, the nonvested money is returned to the employer. If your contributions have vested 80% upon your departure, the employer is returned 20%.

Employee Stock Option

Also Check: How Much Will Be In My 401k When I Retire

Why Employers May Not Offer A 401

Facilitating a 401 plan can be expensive for a company. The IRS requires testing and reporting to ensure retirement plans keep up with regulations. As a result, many small businesses simply can’t afford to administer a 401 plan.

If a company is brand new and trying to get off of the ground, they may not have the time to organize a retirement plan for their employees. Since bringing in an outside firm costs even more money, usually, small businesses don’t have a 401 plan in place.

And because nearly a half of Americans work for small businesses, the amount of people left to their own means to save for retirement is significant.

You May Like: How To Stop Your 401k

Benefits Of Starting A 401

A 401 plan is an employer-sponsored retirement option that lets employees contribute pre-tax dollars to their accounts. As a result, the contribution reduces an employees tax liability and lets them save for retirement. But what about the business benefits of setting up a 401?

Setting up a 401 for small business can help you:

- Attract and retain employees: 68% of private industry workers have access to employer-provided retirement plans. Providing a 401 plan can help you stay competitive as an employer.

- Expand your employer benefits, tax-free: Employer matching and nonelective contributions to retirement plans are not subject to Social Security and Medicare taxes.

- Claim tax deductions: Eligible small businesses who start a new 401 plan and/or add an automatic enrollment feature to any 401 plan can lower their tax liability through 401 tax credits.

- Stay compliant in your state: For some employers, offering a retirement plan isnt a choice. Your state may require that you offer employees a retirement plan, like a 401.

One of the reasons small businesses hesitate on starting a 401 is the time and cost commitment. Recognizing this, Congress passed the SECURE Act in 2019. The act incentivizes small employers to begin offering 401s with expanded tax credits.

Be Prepared For The Large Plan Audit

Once the number of employees in your plan passes the 100 mark, you may have to undergo an annual 401 audit. As anyone whos ever been through one will tell you, these are a huge hassle that are costly and can eat up a ton of time. So our advice? Be sure to partner with a 401 provider that takes point on 401 audits.

You May Like: What Will My 401k Be Worth At Retirement

Traditional 401 Vs Roth 401

When 401 plans became available in 1978, companies and their employees had just one choice: the traditional 401. Then in 2006, Roth 401s arrived. Roths are named for former U.S. Senator William Roth of Delaware, the primary sponsor of the 1997 legislation that made the Roth IRA possible.

While Roth 401s were a little slow to catch on, many employers now offer them. So the first decision employees often have to make is between a Roth and a traditional .

As a general rule, employees who expect to be in a lower after they retire might want to opt for a traditional 401 and take advantage of the immediate tax break.

On the other hand, employees who expect to be in a higher bracket after retiring might opt for the Roth so that they can avoid taxes on their savings later. Also importantespecially if the Roth has years to growis that there is no tax on withdrawals, which means that all the money the contributions earn over decades of being in the account is tax-free.

As a practical matter, the Roth reduces your immediate spending power more than a traditional 401 plan. That matters if your budget is tight.

Since no one can predict what tax rates will be decades from now, neither type of 401 is a sure thing. For that reason, many financial advisors suggest that people hedge their bets, putting some of their money into each.