Fund Types Offered In 401s

Mutual funds are the most common investment option offered in 401 plans, though some are starting to offer exchange-traded funds . Both mutual funds and ETFs contain a basket of securities such as equities.

Mutual funds range from conservative to aggressive, with plenty of grades in between. Funds may be described as balanced, value, or moderate. All of the major financial firms use similar wording. Here is a list of the types of fund strategies you might find:

How Much Should I Invest

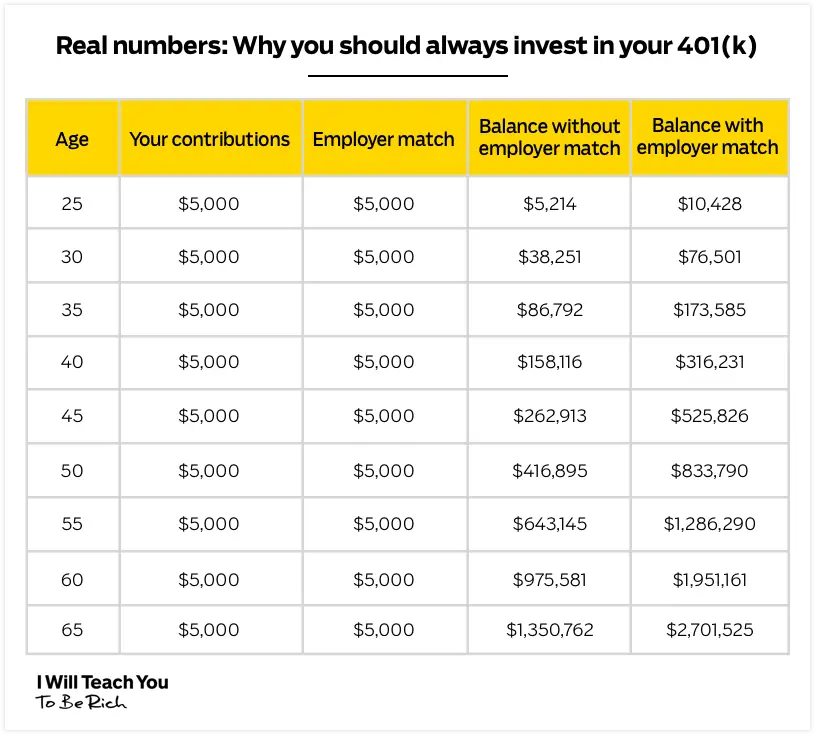

If you are many years from retirement and struggling with the here and now, you may think a 401 plan isn’t a priority. However, the combination of an employer match and a tax benefit should make it irresistiblethe employer’s match is tax-deferred money invested for you.

When starting out, the achievable goal might be a minimum contribution to your 401 plan. That minimum should be the amount that qualifies you for the entire match from your employer. You also need to contribute the maximum yearly contribution to get the full tax savings.

Never Buy An Investment That Sounds Too Good To Be True

If an investment seems like it’s too good to be true, beware, said Joseph Carbone, CFP, founder and wealth advisor at Focus Planning Group. “If it sounds boring, then it’s probably a good investment.”

Often, those too-good-to-be-true investments are expensive and illiquid, he said. Staple investments — such as stocks, bonds and certificates of deposit — might be better performers.

Don’t Miss: Can I Rollover My 401k

How Much Should You Contribute To Your 401

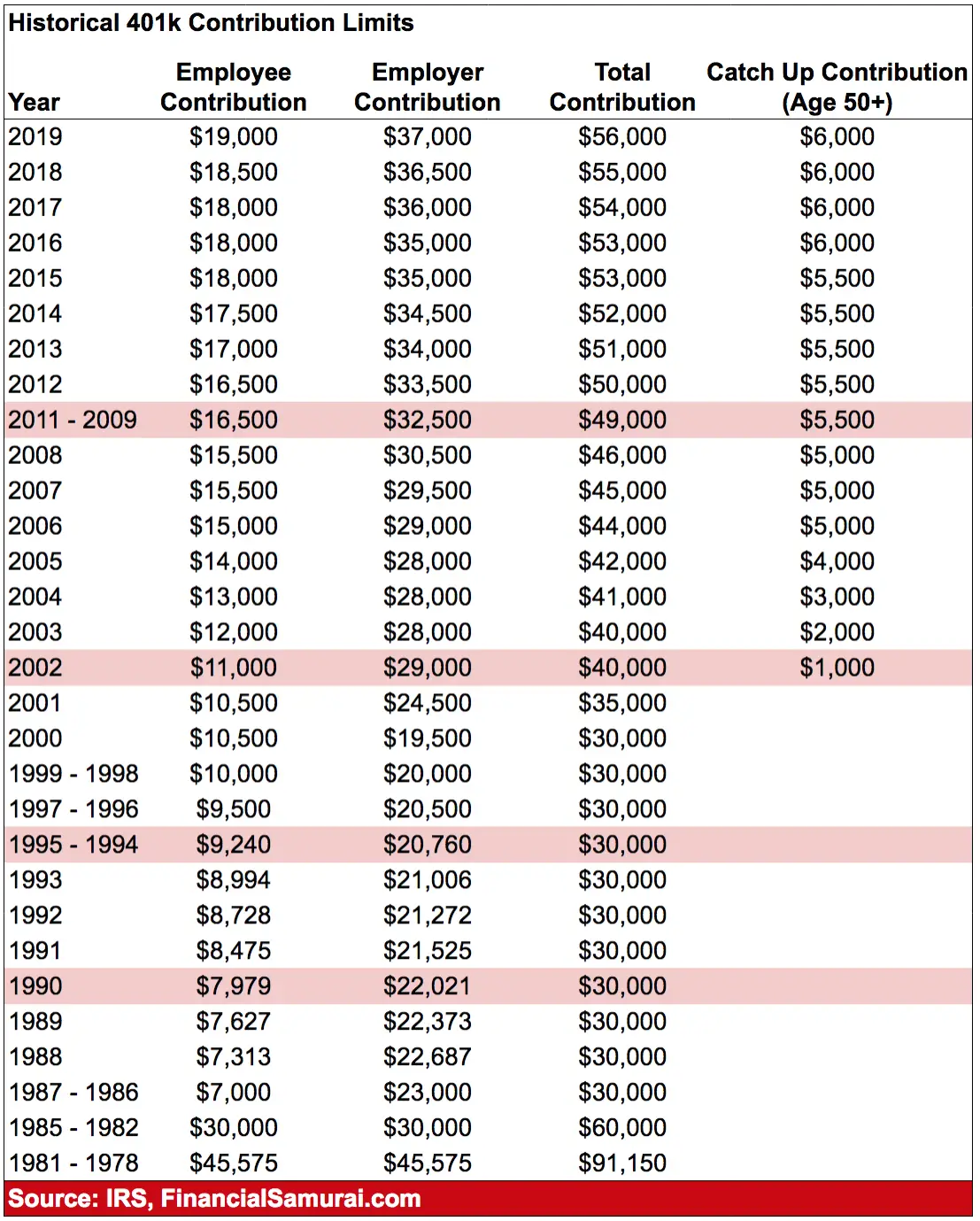

Most retirement experts recommend you contribute 10% to 15% of your income toward your 401 each year. The most you can contribute in 2021 is $19,500 or $26,000 if you are 50 or older. In 2022, the maximum contribution limit for individuals is $20,500 or $27,000 if you are 50 or older. For both years, those those age 50 and older can contribute an extra amount of $6,500. Consider working with a financial advisor to determine the best contribution rate.

Anything Else I Should Know

Yep. A few things, actually.

Once you contribute to a 401, you should consider that money locked up for retirement. In general, distributions prior to age 59½ will be hit with a 10% penalty and income taxes.

If you leave a job, you can roll your 401 into a new 401 or an IRA at an online brokerage or robo-advisor. The IRA can give you more control over your account and allow you to access a larger investment selection.

401s typically force you to begin taking distributions called required minimum distributions, or RMDs at age 72 or when you retire, whichever is later. You may be able to roll a Roth 401 into a Roth IRA to avoid RMDs.

Don’t Miss: How Long Do You Have To Transfer 401k

Can I Add More Money To My 401k Account Whenever I Want

Find out how and when to make a 401k contribution. You and Your 401K

When you find yourself between jobs or if your employer doesnt offer a 401k retirement account, you might wonder, Can I add money to my 401k? Unfortunately, employers dont allow you to contribute to your 401k outside of payroll, which means you cant add extra cash to your account unless its funneled from your paycheck via automatic deposit. Heres what you can do to prepare for retirement by maximizing your 401k contributions.

How To Transfer Money From 401 To Bank Account

Learn how to transfer money from 401 to bank, and the duration it takes to receive the money in your bank account.

When you quit your job or retire, you have to choose what to do with your accumulated 401 retirement savings. Usually, you can leave your retirement money with the former employer, rollover to an IRA, or transfer the money to your bank account. While it is a smart move to keep retirement money in a retirement account, you can cash out if you need money urgently.

To transfer money from a 401 to a bank account, you should send a withdrawal request to the 401 plan administrator. It can take up to seven business days for the withdrawal to be processed, and you can expect to receive your funds shortly thereafter. Usually, direct deposits take a shorter duration to arrive than paper checks.

Recommended Reading: How To Transfer 401k From Old Job To New Job

Extra Benefits For Lower

The federal government offers another benefit to lower-income people. Called the Saver’s Tax Credit, it can raise your refund or reduce the taxes owed by offsetting a percentage of the first $2,000 that you contribute to your 401, IRA, or similar tax-advantaged retirement plan.

This offset is in addition to the usual tax benefits of these plans. The percentage depends on the taxpayer’s adjusted gross income for the year and tax-filing status. The income limits to qualify for the minimum percentage offset under the Saver’s Tax Credit are as follows:

- For single taxpayers , the income limit is $36,750 .

- For married couples filing jointly, it’s $73,000 .

- For heads of household, it maxes out at $54,750 .

Withdrawing When You Retire

After you reach the age of 59 1/2, you may begin taking withdrawals from your 401. If you leave your job in the calendar year when you turn 55 or later, you can also begin taking penalty-free withdrawals from the 401 you had with that current company. If you are a public safety worker, this rule takes effect at the age of 50.

Once you reach 72, you are actually obligated to begin making required minimum distributions or RMDs.

Also Check: How To Roll Over 401k To New Employer Vanguard

Here’s What To Do When Your 401 Is Losing Money

Generally, the best move to make when you see your 401 balance go down is to do nothing at all.

This advice generally echoes investment experts’ guidance when any of your investments are affected by market downturns. Investing is a long-term game you take the short-term dips in exchange for the potential long-term growth, which, history has shown us, is what happens. Though past performance does not predict future performance, historically, any short-term losses have typically been outweighed by larger long-term gains.

“In the long run, stock prices are the world’s way of appraising the value of the underlying companies,” Winsett explains. “In the short term, prices can be chaotically random but over time, prices are firmly rooted in the real value of real companies whose products and services we use regularly, if not daily.”

Making an impulsive move like panic selling your 401 investments or withdrawing early from your 401 would have serious consequences. If you sell only to later jump back in the market, you may time it incorrectly and miss out on an upswing, or big recovery gains. Staying invested means as the market recovers, so, too, does your account balance. Dipping into your 401 funds before reaching the age of 59½, meanwhile, entails a 10% early withdrawal penalty on top of it being taxed.

When Should You Choose A Traditional Ira

If your income is too high to contribute to a Roth IRA, you can go with a traditional IRA. Like a Roth IRA, you can contribute up to $6,000 a year$7,000 if youre 50 or olderand you and your spouse can both have an account.4

Thats where the similarities end. Unlike a Roth IRA, there are no annual income limits. But youre required to begin withdrawing from a traditional IRA once you turn 72, and even though contributions to a traditional IRA are tax-deductible, youll have to pay taxes on the money you take from it in retirement.5

Still with us? Now, lets look at some other options you can explore if youre self-employed.

You May Like: How To Collect Your 401k

Don’t Miss: How Do You Access Your 401k

You Could Withdraw The Money

Technically, youre allowed to withdraw your money from your old 401, but unless youre facing some really dire financial circumstances, we advise against it. Early withdrawal comes with big penalties from the IRS, on top of whatever taxes youd owe on the money. and you dont deposit it into another retirement account.) In all, you could end up paying as much as 50% of the balance in your account to pull from it. Yeah ouch.

Boost An Emergency Fund

Experts often advise establishing an emergency fund with at least six months of living expenses before contributing to a retirement savings plan. Perhaps youve already done thatbut havent updated that account in a while. As your living expenses increase, its a good idea to make sure your emergency fund grows, too. This will cover you financially in case of lifes little curveballs: new brake pads, a new roof, or unforeseen medical expenses.

The money in an emergency fund should be accessible at a moments notice, which means it needs to be liquid. Youll also want to ensure the account is FDIC insured, so that your money is protected if something happens to the bank or financial institution.

Read Also: Can I Have A Solo 401k With Employees

Tips For Choosing The Type Of Ira That’s Right For You

There are two types of IRAs: a traditional tax-deductible IRA and a Roth IRA. For 2022, the annual contribution limit for both is $6,000 with a $1,000 catch-up if you’re age 50-plus.

However each IRA does have an income ceiling that will determine whether one or the other is right for you.

- Traditional tax-deductible IRAFor someone who doesn’t have a 401 or similar plan, a traditional IRA is fully tax-deductible. Upfront tax deductibility plus tax-deferred growth of earnings are two of the pluses of this type of IRA. However, if you participate in an employer sponsored retirement plan such as a 401, tax deductibility is phased out at certain income levels based on your Modified Adjusted Gross Income . For tax-year 2022, the levels are $68,000-$78,000 for single filers, $109,000-$129,000 for married filing jointly.

- Roth IRAWith a Roth IRA, you don’t get any upfront tax deduction, but you do get tax-free growth plus tax-free withdrawals at age 59½ as long as you’ve held the account for five years. And there’s no restriction if you participate in an employer plan. However, there are income phase-out limits based on your MAGI that determine whether you’re eligible to open and how much you can contribute to a Roth. In 2022, the limits are $129,000-$144,000 for single filers, $204,000-$214,000 for married filing jointly.

Potential Risks In 401 Investments

- Being too conservative: Some people may think that the best way to manage risk is not to take any, but being too conservative with your investments can be a risk, too. Many investors dont allocate enough of their retirement portfolios to stocks, which will likely have the highest returns over the long term. Instead, they stick to assets perceived to be low-risk investments such as bonds. While stocks are volatile, they should be an important part of investing for goals like retirement.

- Paying too much in fees: Fund expenses eat into the return you earn as an investor, so pay special attention to the fees associated with the funds you invest in. If a fund has an annual expense ratio above 0.50 percent, its likely you can choose something cheaper. Most index funds cost less than 0.10 percent each year.

- Investment losses: This is what most people think of when it comes to investment risk. Stocks and bonds can decline in value, especially over short periods of time. Stocks tend to rise over the long term, though, making them ideal assets for goals far in the future like retirement.

Read Also: Can I Have A Ira And 401k

Ways To Withdraw Money From Your 401k Without Penalty

This article was originally published on ETFTrends.com.

When hard times befall you, you may wonder if there is a way withdraw money from your 401k plan. In some cases you can get to the funds for a hardship withdrawal, but if youre under age 59½ you will likely owe the 10% early withdrawal penalty. The term 401k is used throughout this article, but these options apply to all qualified plans, including 403b, 457, etc.. These rules are not for IRA withdrawals see the article at this link for 19 Ways to Withdraw IRA Funds Without Penalty.

Generally its difficult to withdraw money from your 401k, thats part of the value of a 401k plan a sort of forced discipline that requires you to leave your savings alone until retirement or face some significant penalties. Many 401k plans have options available to get your hands on the money , but most have substantial qualifications that are tough to meet.

Your withdrawal of money from the 401k plan will result in taxation of the withdrawal, and if you do not meet one of the exceptions, a penalty as well. See the article Taxes and the 401k Withdrawal for more details about how the taxation works.

The list below is not all-inclusive, and each 401k plan administrator may have different restrictions or may not allow the option at all.

Well start with the obvious methods, all of which generally require the plan participant to leave employment:

1. Normal Begin after age 59½ after leaving employment at any age

A Roth 401another Option Worth Considering

Whether or not you choose to open an IRA, if your employer offers a Roth 401, you might also consider adding this to your retirement savings strategy. There are no income limits to participate in a Roth 401, and you can have both types of 401 at the same time. Having both doesn’t mean you can contribute more than the total annual 401 contribution limit, but you can split your contributions between the two, giving you a combination of both taxable and tax-free withdrawals come retirement time.

You May Like: How Do You Transfer 401k

How To Withdraw Money From A 401k After Retirement

Finance Writer

During your working years, youve probably set aside funds in retirement accounts such as IRAs, 401s, or other workplace savings plans. Your challenge during retirement is to convert those accounts into an income stream that can continue to provide adequately throughout your retirement years.

If youâre approaching the age that you want to hang your hat from working, you may be wondering how to withdraw money from your 401 after retirement. It isnât always exactly straightforward, which is why weâve broken down some of the basics of using your 401. Hereâs what you need to know.

Recommended Reading: How Do I Cash Out My Fidelity 401k

Dont Cash Out Your 401 Early

Another lesson: Whatever you do, dont cash out your 401 savings. If you leave your job, you are allowed to spend your 401 funds if you pay taxes on the amount, including a 10% penalty tax assessed on most withdrawals made before age 59 ½. You may be tempted to take the cash and spend it on a vacation before you start your next job, but thats not a very good idea.

Roll over that retirement money, sign up for the retirement plan with your new employer and take a nice and affordable staycation instead. Your retired self will be very grateful to your working self for making a small sacrifice that could have a big impact down the line.

Recommended Reading: What Percentage Should I Be Contributing To My 401k

Making Your 401 And Ira Work Together

The goal of all this is to give you the greatest opportunity to save, with the greatest flexibility. So my thought would be to first contribute enough to your 401 to capture the maximum company match. Then, if you’re eligible contribute to a tax-advantaged Health Savings Account . If your 401 has limited investment options consider opening either a traditional or a Roth IRA and contribute the annual maximum. Next, if you can, put more money in your company plan until you max it out. And if you get to the point where you can save even more , put that money in a taxable brokerage account.

The bottom line is you can’t really save too much, only too little. So use all the savings and investing vehicles available to you, including both an IRA and your 401, to save as much as you can, as early as you canand, at the same time, get the maximum tax break. You won’t regret it.

Have a personal finance question? Email us at [email protected]. Carrie cannot respond to questions directly, but your topic may be considered for a future article. For Schwab account questions and general inquiries, contact Schwab.

Our Best Stock Brokers For 2022

We pored over the data and user reviews to find the select rare picks that landed a spot on our list of the best stock brokers. Some of these best-in-class picks pack in valuable perks, including $0 stock and ETF commissions. Get started and review our best stock brokers for 2022.

We’re firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent does not cover all offers on the market. Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team.The Motley Fool has a disclosure policy.

Recommended Reading: When Can I Start My 401k