Check Every Corner Of Your 401

Once you gain access to your account online or review your statement, check how your money is invested.

Most 401 administrators automatically invest your money into a target-date fund. Target date funds are portfolios of various mutual funds and investments tailored to your estimated retirement date. Using your age, the percentage mix of these investments changes to match your risk tolerance as you near retirement.

If you don’t want to hold your money in a target-date fund, you have the option to change investments.

However, if your plan hasn’t automatically allocated your money, it may be waiting to be invested. In this case, your money will be sitting in your account, not growing in a glorified savings account.

Itâs a rare occurrence, but checking your 401 balance will help catch any funds not adequately invested.

Discover Where Your Funds May Have Been Transferred

If your former employer does not have your old 401, you can search on the Department of Labors abandoned plan database. You will be able to search for your plan using the information you already have, including your name, your employers name and more. If you had a traditional pension plan and it no longer exists, you can search the U.S. Pension Guaranty Corp. database to find your unclaimed pension.

Finally, you may want to search the National Registry of Unclaimed Retirement Benefits. This service is available nationwide and has records of account balances unclaimed by former retirement plan participants.

Is It Possible To Lose Your 401k

Its possible to lose money from your 401k if youre cashing it out and taking a big tax hit or your investments suffer losses. But simply changing jobs doesnt mean your old 401k is gone for good. It does, however, mean that you may need to spend time locating it if its been a while since you changed jobs.

Recommended Reading: What Should I Contribute To My 401k

Where Has My 401 Gone

There are a few scenarios in which someone might lose track of their 401.

If you did a bit of job-hopping early in your career, you may have moved on and forgotten about your 401 plan. Or perhaps your company merged with another, but your 401 plan didnt transfer over. In other cases, you may have automatically enrolled in your companys 401 plan without realizing it.

You know all the paperwork from human resources you ignored? The information youre looking for probably was in there.

Regardless of why you lost track of a 401 plan, the good news is that whatever contributions you made no matter how long ago that may have been are yours to keep and always will be. Heres what you need to know to track down your old 401 and make it work in your favor again.

Contact Your Former Employer

The first place you should look is your prior employer. Contact their human resources department. There, they should have all of the information as to the whereabouts of the 401 account you had with them.

They should send you the proper paperwork and be able to facilitate the transfer of your funds to whatever account you choose.

If they are unable to locate any information on your account, they should be able to provide you the contact information of the administrator who handled your 401 on their behalf.

Let the administrator know your situation, and just like the HR department, should be able to assist you in moving your money properly.

Also Check: How Do I Withdraw Money From My 401k

Prevent Losing Your 401s In The Future

Having a plan is the best way to prevent you from losing your 401s in the future. You should actively manage a 401 plan to ensure you’re on pace to meet your retirement goals.

Yearly or semi-yearly checkups are best. It’ll prevent you from analyzing your account’s performance and help you keep tabs on your account.

Having your 401 in the back of your mind, you more likely to remember to bring it with you when you leave your job.

Tags

Search The Abandoned Plan Database

If you cant find your lost money by contacting your old employer, searching the National Registry of Unclaimed Retirement Benefits, or the FreeERISA website, you have one last place to check, the Abandoned Plan Database offered by the U.S. Department of Labor.

Searching is simple, you can search their database by Plan Name or Employer name, and locate the Qualified Termination Administrator responsible for directing the shutdown of the plan.

Recommended Reading: Should I Rollover My 401k To A Traditional Ira

Retirement Funds Are Different

They are not turned over to the state, which means, its possible that nothing will happen to your money until something happens with your company ).

A common scenario is when you leave a company and move, perhaps you even change your email address.

Perhaps months or even years have gone by, or youve moved to the other side of the country. Then something happens with your employer and they need to contact you for instructions of what to do with your account.

Where Is My 401

When you leave your employer you have three options for the money youâve accumulated in your old 401 account. You can either:

- Leave it alone and keep it in the same account

- Roll over the funds to your new employerâs 401 plan or

- Roll over the funds to an IRA.

Most people leave their 401âs alone, either from neglect or they donât bother with facilitating the transfer.

You can rollover your old 401 funds to an IRA as soon as youâd like. If your IRA is already set up then it can accept the funds immediately.

However, if your new employer implements a waiting period before you can participate in their 401 program, then you have no choice but to leave it alone until youâre eligible.

This is where things fall through the cracks. Unattended 401âs can end up in a few different places: the old account you have with your former employers, an automatic safe harbor rollover account set up by your plan, the unclaimed property department in the state, or your old 401s could have been cashed out already if the balance was less than $5,000 when you left the job.

Read Also: How Do I Start A Solo 401k

Do I Need My Social Security Number To Find An Old 401k

Generally, yes, youll need your Social Security number to find a lost 401k account. This is because your Social Security number is used to verify your identity and ensure that the plan youre inquiring about actually belongs to you.

- Mon-Thu 5:00 AM – 7:00 PM PT

- Fri-Sun 5:00 AM – 5:00 PM PT

Home Loans General Support:

- Mon-Fri 6:00 AM 6:00 PM PT

- Closed Saturday & Sunday

- Mon-Thu 8:00 AM 8:00 PM EST

- Fri 8:00 AM – 7:00 PM EST

- Closed Saturday & Sunday

- Mon-Thu 5:00 AM – 7:00 PM PT

- Fri-Sun 5:00 AM – 5:00 PM PT

How Do I Find My Old 401

If you’re not sure where your old 401 is, there are three places it could likely be. Here’s where to find your old 401:

Right where you left it, in the old account set up by your employer.

In a new account set up by the 401 plan administrator.

In the hands of your states unclaimed property division.

Heres how to start your search:

Recommended Reading: Should I Manage My Own 401k

Contact The Plan Provider

Start your search by visiting the website of the 401 plan provider. You may be able to provide your name, birth date, and email address to reset your login information. This process may also require contacting customer support to verify your identity and complete any additional steps. Here are links to the three most significant 401 providers:

Find 401s With Your Social Security Number

All your 401s are linkedin to your social security number when you enrolled. Theoretically you should be able to find all your 401s with your SSN. However, in practice it’s pretty hard for one to do so. As far as we know, Beagle is the only company that simplifies this process and can conduct a comprehensive 401 search using your SSN. Once they find your 401s, they also help you with the tedious rollover process.

Also Check: How To Become A 401k Plan Administrator

Looked For Unclaimed Money

“Ghosted” 401 money certainly qualifies as missing money, and it could be uncovered on digital money-funder platforms like missingmoney.com.

The site, run by the National Association of Unclaimed Property Administrators, runs free searches for not just retirement funds, but for money in old bank accounts, safe deposit boxes, escrow accounts, and insurance policies. According to the website’s directions, if you get a “hit” on the site, just claim the property and fill out the requested details, then submit and you will receive instructions on the next steps from the state where you made the claim.

Don’t Leave Your 401 Behind Here’s How To Reclaim Your Hard

Switching jobs pulls your mind in several directions at once, and it’s easy for your old 401 to get lost in the shuffle. But you can’t afford to forget about it for good. Building a nest egg to sustain you for decades is tough, so you can’t afford to leave any old retirement accounts behind. If you’ve lost track of your old 401, take these steps to find it and put that money to good use.

Don’t Miss: How To Do Your Own 401k

Government And Military Pension Resource

Depending on your role in the military, some pensions are available to both veterans and their survivors. Be sure to refer to the U.S. Department of Veterans Affairs website for more information.

- Department of Veteran Affairs: If you or your deceased spouse is a veteran, you can find information on your pension at the VAs pension website.

- State government websites: If you were an employee of your state or local government, be sure to check your states government website to search for information regarding your pension.

- Federal and military resources: Other government employees and military members can find information regarding federal and military pensions through the Thrift Savings Plan, Department of Defense and Office of Personnel Management websites.

Why You Should Recover Your Old 401k

Theres a simple reason why you should attempt to recover a lost 401k account: Its your money. Whether your old 401k plan holds a lot of money or a little, every penny counts when staying on track with your retirement savings.

Another important point to consider: If youve changed jobs multiple times, its possible that you could have more than one lost 401k and taken together, that money could make a surprising difference to your nest egg.

Last, if you were lucky to have an employer that offered a matching 401 contribution, your missing account may have more money in them than you think. For example, a common employer match is 50%, up to the first 6% of your salary. If you dont make an effort to find old 401k accounts, youre missing out on that free money as well.

Don’t Miss: Can I Borrow From My 401k To Start A Business

Find Lost 401k: How To Find Out If You Have Lost Or Forgotten Retirement Accounts

Here is a guide for how to find lost money a lost 401k or other unclaimed retirement benefits.

Finding a lost 401k or other retirement account is more tedious than metal detector treasure hunting,but perhaps more rewarding.

A few years ago, I received a strange notice in the mail: a former employer was discontinuing their retirement plan and I had 30 days to either roll my balance into a different account or receive a distribution from the plan. This sort of thing happens quite often when people change jobs and leave their retirement account in the old employers plan. The strange thing about this notice was, I had no idea Id been participating in the plan while I worked there!

Could the same thing have happened to you? If youre looking for ways to increase your retirement savings, you just may want to look for lost or forgotten retirement accounts.

What To Do With A Lost Retirement Account When You Find It

Once youve found a lost retirement account, what you do with it depends on what type of plan it is and where its located.

Old 401k balances can be rolled into your current employers plan or rolled into an IRA in a trustee-to-trustee transfer. You can also request a payout of the plan balance, but if you are under the age of 59.5, the payout will be subject to income taxes and a 10% penalty for early withdrawal.

If you find an old pension through the PBGC, youll have to go through a process to verify your identity. Once the PBGC has established that you are owed the benefits, you can apply for them at any time once youve reached retirement age.

Its not uncommon for former employees to leave funds in a former employers retirement plan, believing theyll get around to dealing with it later. Years pass by, and maybe youve forgotten about a few old accounts. Even if they didnt amount to much at the time, a few hundred dollars here and there combined with some market growth over the years just might add up to a nice addition to your retirement savings. Its worth a look!

Recommended Reading: How Can I Find All Of My 401k Accounts

Contact Your 401s Administrators

Your human resources department or administrator will be able to help you check your 401 balance.

You have most likely been mailed statements of your 401 accounts yearly or quarterly unless there is a different address on file.

Speak with your representative to verify that your contact information and address are up to date to prevent future lapses in correspondences.

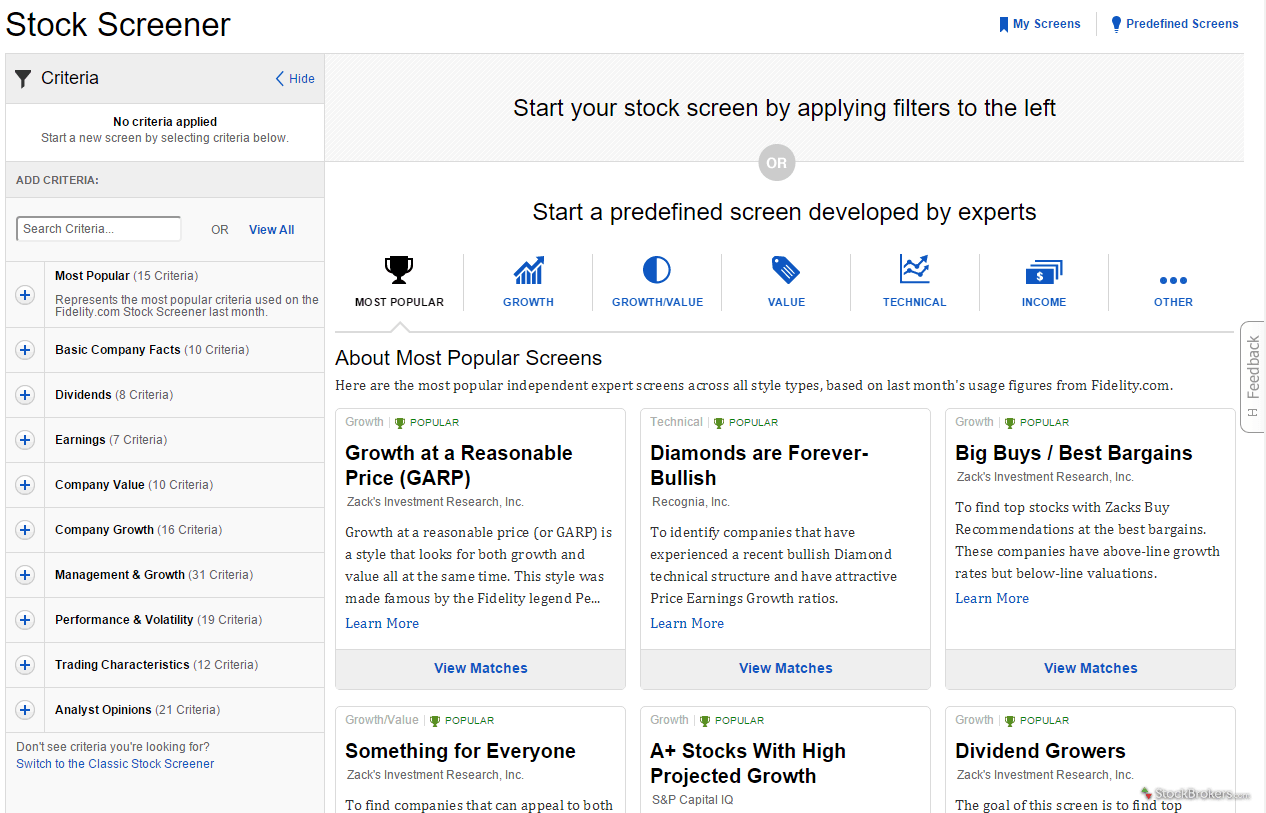

If your 401 plan’s administrator uses an online portal, similar to your online banking platform, they can help you get set up.

Online access to your 401 is excellent in checking your 401 balance and how your funds are performing. Some 401 platforms allow you to research the various funds, as well as reallocate your investments right on the platform.

Checking With The Department Of Labor

Different types of retirement plans, including 401k plans, are required to keep certain information on file with the IRS and the Department of Labor . One key piece of information is DOL Form 5500. This form is used to collect data for employee benefit plans that are subject to federal ERISA guidelines.

So how does that help me find my 401k? The Department of Labor offers a Form 5500 search tool online that you can use to locate lost 401k plans. You can search by plan name or plan sponsor. If you know either one, you can look up the plans Form 5500, which should include contact information. From there, you can reach out to the plan sponsor to track down your lost 401k.

Recommended Reading: How To Move 401k To Another Company

Pros And Cons: 401 Vs Ira

401 Pros |

|

|---|---|

|

|

|

|

How To Find A Lost 401 Account

Think you may be one of the millions with forgotten 401 money floating around somewhere? Start by scouring your personal email or laptop for any old 401 plan statements that you may have saved in the past.

“Your statement will provide your account number and plan administrator’s contact information,” Corina Cavazos, managing director, advice and planning at Wells Fargo Wealth & Investment Management, tells Select. Your former coworkers may have old statements that you can reference, too.

If you don’t have any luck, Cavazos says that your best bet is to contact your former employer’s HR or accounting department. By providing your full name, Social Security number and dates of employment with that company, you can have them check their 401 plan records to see if you were once a participant.

If you’ve tried contacting your 401 plan administrator or former employer to no success, you may be able to find old retirement account funds on the National Registry of Unclaimed Retirement Benefits. Upon entering your Social Security number, the secure website allows you to conduct a free database search to see if there’s any unpaid retirement money in your name.

Another search database is the FreeERISA website, which indicates if your former employer rolled your 401 funds into a default participant IRA account on your behalf. FreeERISA requires you to register before performing a search, but it is free to do so.

You May Like: What Happens To 401k When Changing Jobs

What Are Your Options For Old Retirement Plans

You generally have four options for dealing with money thats in an employer-sponsored retirement account when youre no longer working at the company:

- Leave the money where it is: Although you might not be able to contribute to the account any longer, you may be able to leave the money in your former employers plan. Sometimes, you may need to meet a minimum account balance to qualify, such as $200 for a TSP or $5,000 for some 401s.

- Transfer funds to a new employer-sponsored plan: If you have a new job with a company that sponsors a retirement plan, you may be able to roll over the money into your new employers plan. When this is an option, compare the previous and new plans fees, terms, and investment options to see which is best.

- Roll over to an individual retirement account: You can also move the money into an individual retirement account . An IRA may give you more control as you can choose where to open the account and invest in a wider range of funds. Its also fairly easy to move from one IRA to another as the account isnt tied to your employer. However, IRAs could have more fees, especially if you dont have a lot of assets and dont qualify for lower-cost investment funds.

- Cash out: You can also take the money out of retirement accounts completely. But unless youre 59½ or older , you may need to pay a 10 percent early withdrawal penalty in addition to income taxes on the money.