What Information Are 401 Plan Administrators Required To Provide Participants

Plan administrators must provide plan participants with a variety of different documents on a regular, specified schedule. When an employee joins the plan they should receive a Summary Plan Description , which details the rules of that particular plan. If the SPD is amended, the administrator should provide a summary of material modifications .

Each year, the administrator should also provide a Summary Annual Report, describing the plan’s financial condition. Either quarterly or annually, depending on the plan, administrators must provide each participant with an individual benefits statement showing how much money they have in their account and how much of it is currently vested. Those are some of the most important documents, but there are others, as well.

We’re Your Expert 401 Third

Guidant is your trusted partner to start your small business or franchise strong. As part of your Rollovers for Business Startups funding, well help you set up a new 401 plan for your business. But were not a one-and-done firm: were here for you for the life of your business. Our Third-Party Plan Administration services help keep your 401 plan compliant with the IRS and DOL so you dont have to worry about anything but the success of your business.

Decide Which Plan Is Right For You

Youll need to choose a 401 plan with terms that you can afford and that has the flexibility to change with your business. When choosing a 401 plan, consider these questions:

- How much can my business commit? Determine how much you can afford to contribute to your employees retirement. If you are able to match employee contributions, you will need a different type of plan than if you cant afford to make a contribution.

- How much do my employees want to contribute? Ask your employees about what they are looking for in a retirement plan and how much they want to put in to the account. Highly-paid employees with more expendable income will likely want an account that allows them to save more, while employees with a lower salary may not have the budget for higher contributions.

Also Check: What Should I Do With My Old Company 401k

The 401 Training & Certification Program

401 plan implementation, communication, and administration are some of the hardest and most complex tasks undertaken by organizations.

Our 401 Plan Training & Certification Program is loaded with information on plan design, administrative options, and compliance requirements – all written in non-legal terms and supported with numerous tips, examples, and interactive questions – that help you to understand the many and complex 401 rules. There is also a special “Bookmark” feature so you can learn at your own pace.

You can test to earn a “Certified 401 Plan Administrator” designation upon completion of the Program. This Program also qualifies for eight hours of both SHRM and HRCI re-certification credits!

- What documentation is required to implement and operate a 401 plan

- Which employees can be specifically included or excluded from plan participation

- How to properly handle loans, distributions, vesting, and taxation

- How to properly administer plan forfeitures

- To understand and comply with non-discrimination rules and/or perform non-discrimination tests

- What fidiciary responsibilities your organization has

- To comply with annual reporting requirements

Organizations enrolling three or more individuals also receive our Management Interface at no cost. This interface lets managers view employee progress, test scores, and any incorrectly answered test questions – great for remedial training!

- Loans and Withdrawals

- Reporting requirements

What Is The Role Of A 3 Plan Administrator

One of the things that makes a HealthEquity Retirement 401 plan different than most is that HealthEquity Retirement signs and acts as your 3 Plan Administrator. As we explain this to prospective clients, especially those implementing a plan for the first time, they often ask questions about the role and responsibilities of a 3, so we thought wed break it down for you.

Recommended Reading: How To Maximize Your 401k

Who Is A 401k Trustee

A 401 trustee is a party that has the fiduciary responsibility to ensure plan assets are managed in the best interests of the plan participants. They are appointed by the plan sponsor, and their names are included in the registration of the plan accounts.

As a fiduciary to the plan, the trustee can exercise discretionary authority over the management of the plan assets. Typically, the trustee can be held responsible for the misuse of plan assets.

Recordkeeper With Fiduciary Responsibility Services Provider

In addition to handling ministerial tasks, some recordkeepers are also willing to handle some fiduciary-level responsibilities. These are typically recordkeepers or TPAs who sell 3 services for an additional fee . These services can be attractive, especially to smaller employers, who lack the staff to keep up with signing distribution forms and other discretionary issues.

Most service providers who offer 3 services dont step fully into the role of 3 Plan Administrator. Instead, they have a list of specific services for which theyll make fiduciary decisions or take fiduciary responsibility. Some tasks a 3 service provider may agree to take over in a fiduciary capacity include:

-

Taking responsibility for preparing and signing a plans annual Form 5500

-

Ensuring loans meet IRS guidelines

-

Securing a fidelity bond

The list of 3 services a service provider is willing to provide is unique to each provider. Plan sponsors should fully review and understand exactly what fiduciary responsibilities the provider willor will nottake on. It’s a good idea to check the service agreement to look for limitations on the services, fees for services in excess of those limitations, and any excluded services.

Recommended Reading: How To Get Your Money Out Of 401k

Communicate With Your Plan Service Provider

Communicate frequently with your plan service provider and/or payroll department for:

- New hires, re-hires, terminations and compensation changes

- Accurate payroll compensation amounts for each participant

- Census data for determining plan eligibility and benefit payments

- Data necessary to accurately identify highly compensated employees

- Plan terms for defining employee contributions, plan payments and loans

- Any plan amendments, for example, changes to the plans:

- definition of compensation

- contribution or allocation formulas

What Is A 401k Plan Administrator

An administrator is the individual or entity who handles the administration of an employer-sponsored plan like the 401k. The 401k administrator is often hired by the 401k plan sponsor to handle the day to day activities and reporting of the 401k plan.

With a Solo 401k plan, your business it the plan sponsor. Therefore, your business can choose who will be the Solo 401k plan administrator. To keep record-keeping clean and easy, and to cut the fat of extra costs, most Solo 401k accountholders will act as their own Solo 401k plan administrator.

A 401k plan administrator will often handle the plan contributions, distributions, and other aspects of plan paperwork. This leaves the trustee to handle the investments. With the Solo 401k plan, it is common for the same person to act as 401k administrator and 401k trustee.

Don’t Miss: How Much Can You Contribute 401k

K Plan Administrator Trends

Here are three trends influencing how 401k plan administrators work. 401k plan administrators will need to stay up-to-date on these developments to keep their skills relevant and maintain a competitive advantage in the workplace.

The Need for a More Flexible Work Environment

The need for a more flexible work environment is becoming increasingly important as more and more employees are looking for ways to balance their work and personal lives. This trend is having a major impact on the retirement planning industry, as plan administrators will need to find ways to make their plans more flexible.

One way to do this is by offering features that allow employees to manage their 401k accounts online, which would allow them to access their funds whenever they want. Additionally, plan administrators can offer services that help employees find other ways to balance their work and personal lives, such as by providing resources for finding childcare or helping them find time for exercise.

More Focus on Retirement Planning

As people get older, they are starting to realize the importance of retirement planning. This is leading to an increased focus on retirement planning among all age groups.

Greater Attention to Employee Engagement

Employee engagement has become a top priority for many businesses in recent years. This is because companies have realized that engaged employees are more productive and likely to stay with the company for longer periods of time.

Who Is A 401k Plan Sponsor

A 401 plan sponsor is the entity responsible for establishing and maintaining the 401 plan for the company and its employees. Most often, the employer is the plan sponsor, but other entities like unions could also be 401 plan sponsors.

The plan sponsor establishes the plan, determines plan membership requirements, and makes contribution payments to the plan. They must be up-to-date with any changes to retirement plans, and make any required amendments to the plan.

Plan sponsors are responsible for outsourcing plan management to plan administrators, investment managers, and trust companies.

Don’t Miss: Can You Use 401k To Buy A Home

Helpful Hints For The Solo 401k Plan Administrator

As your own Solo 401k plan administrator, youâll want to ask yourself the following:

Because you are allowed to be your own plan administrator with the Solo 401k plan, there is no need for the expense or bureaucratic burden of an outside administrator. By following the simple record keeping best practices, handling your investments wisely and with respect to compliance, and staying on top of reporting for your plan, being your own 401k administrator with a Solo 401k plan can afford you the freedom of total self-direction and checkbook control in your retirement funds.

Employee Participation Standards Must Be Met

In general, an employee must be allowed to participate in a qualified retirement plan if he or she meets both of the following requirements:

- Has reached age 21

- Has at least 1 year of service

- plan may require 2 years of service for eligibility to receive an employer contribution if the plan provides that after not more than 2 years of service the participant is 100% vested in all plan account balances. However, the plan must allow the employee to participate by making elective deferral contributions after no more than 1 year of service.)

A plan cannot exclude an employee because he or she has reached a specified age.

Leased employee. A leased employee is treated as an employee of the employer for whom the leased employee is providing services for certain plan qualification rules. These rules apply to:

- Nondiscrimination requirements related to plan coverage, contributions, and benefits.

- Minimum age and service requirements.

- Vesting requirements.

- Limits on contributions and benefits.

- Top-heavy plan requirements.

Certain contributions or benefits provided by the leasing organization for services performed for the employer are treated as provided by the employer.

Recommended Reading: How To Get My 401k Money From Walmart

Make Your 401k Policy

Put it in writing. Announce the introduction of the 401k policy to your staff. Outline who can contribute, when they can enroll, and how much the employer contributions will be. Answer the common questions about the tax implications and when the contributions will become vested . Youll also be asked about fees and when they can withdraw their money, so have those answers in there.

Other Questions Related to How to Start a 401k for My Small Business:

K Plan Administrator Work Environment

The work environment for a 401k plan administrator is usually in an office setting, working with other administrators and customer service representatives. The job may require some travel to meet with clients or attend conferences. The workweek is typically 40 hours, but overtime may be required during busy periods or to meet deadlines. The job is generally sedentary, but some light physical activity may be required, such as lifting file boxes or moving furniture. The job can be stressful at times, but most 401k plan administrators find it to be rewarding and satisfying.

Read Also: Who Can Open A Solo 401k

Determine A 401k Provider

Determining a 401k provider may not be as difficult as it sounds. You may be thinking of reaching out to various financial institutions for their advice but consider first what youre looking for in a provider and ask these questions:

- Whats Your Investment Lineup Like? How many funds do you offer? How diversified is the portfolio and how well has it done previously? Best to ask these tough questions now, and see how the answers stack up to their competitors.

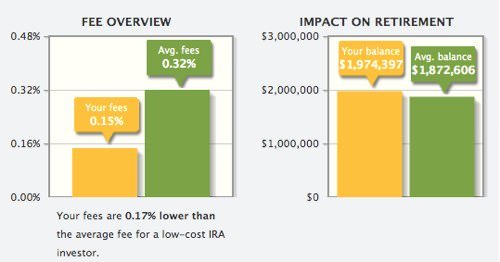

- What Are the Total Fees? Perhaps the funds the institution you are considering look attractive. But how much will the investing, record keeping and administration expenses cost you and your employees? Are there any surprise service fees or occasional costs that if you dont ask about now youll only find out about later? Great returns could be offset by heavy fees. Ask exactly what this is going to cost from month to month.

- How Easy Is the Administration of the Plan? How easy will this plan be to administer to your employees? Will it require a lot of day to day management or will it practically run itself? Will your employees be able to access their plans online? What digital tools will the institution offer that will help you and your employees get the information they need, or navigate the site?

What Does A 401k Do

A 401k allows employees of companies in the United States to save money in a defined contribution retirement account that is tax deferred. This deferral is an incentive for people to save so they will have an income stream upon retirement. Typically, any income contributed to a 401k in a given year will not be subjected to tax in that same year .

The IRS places limits on individual contributions every year, although the United States government allows for top ups in certain situations if you are over the age of 50.

The money will only be taxable when it is removed from the account.

The 401K was introduced in 1978 and the name refers to the section of code assigned to it – Section 401. Plans similar to that of a 401k exist in other countries. In Australia, the program is called Superannuation, in Canada it is referred to as an RRSP and in Japan it is called iDeCo.

Don’t Miss: Can I Get My Own 401k Plan

Tips For Evaluating 401k Auditors

There are many companies, including CPA firms, that perform 401k audits. Because you will likely have several options to choose from, here are some key factors to look for before you hire a 401k auditor.

Our recommendation is that you ask for references from the TPAs youre considering and talk to them before you decide who to hire. References are the best way to learn what it will be like to work with a TPA.

How To Become A 401 Administrator

- Oil20 hours ago

The reasons for the import/export discrepancy are actually fairly straightforward. Chief among them: Foreign oil is cheaper: The cost of extraction is

Like

- 2 hours ago

Over more than a decade on ABC’s “Shark Tank,” billionaire Mark Cuban has seen his share of good investments and bad ones. Last week, Cuban told the

Like

-

The big switch that most people think about when they consider retirement is going from working every day to not working at all (or at least reducing

Like

-

Everyone knows that chasing violent storms is risky for your life. But it turns out that yield chasing in the S& P 500 can be risky for your

Like

Read Also: How To Find Previous Employer’s 401k

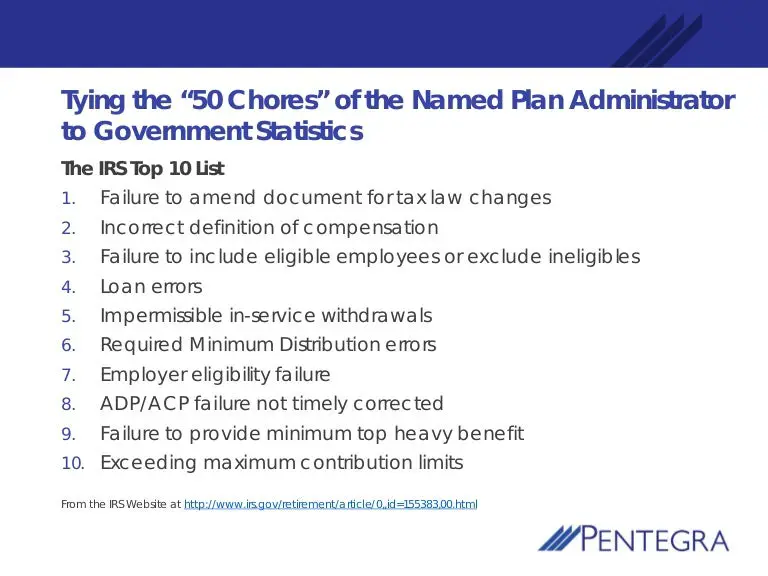

What Are The Risks Of Being A 3 Plan Administrator

As you can imagine there is a certain amount of risk associated with this role and its associated responsibilities. Most administrative mistakes on a plan are a result of an oversight by the 3 Plan Administrator. And when your plan gets audited by the DOL, IRS, or EBSA, not only is it the Plan Administrator that has to comply with the requests of the audit, but it is also their list of responsibilities and required tasks that are being scrutinized. Penalties from audits and necessary plan corrections are typically onerous and expensive and much easier to avoid than fix.

What Programs Should You Take If You Want To Become A 401k Specialist

When advisors ask me what programs they should start with, I typically recommend they first go through the process of understanding that what drives the decision when choosing a designation ultimately needs to be based on what theyre trying to accomplish.

Then I refer them to the Retirement Plan Professionals Designation & Certification Guide to understand whats available.

And finally, I provide the following recommendation.

FIRST

If youre just starting out, then Id recommend you go through the 401 Practice Builder Certificate Program by National Association of Plan Advisors . Heres how its described on the NAPA website:

If you are an advisor who is new to 401 plan sales and need some help getting started, or if you have some experience but want to grow your assets, the NAPA 401 Practice Builder is just for you. This five-module, fully interactive online course is simple, practical, fast, convenient and cost-effective.

The NAPA 401 Practice Builder provides straightforward explanations of complex industry topics. Every topic is explained in relation to your day-to-day sales encounters. Work on the modules at your own pace on your PC or tablet the whole course should take you less than three hours. The Practice Builder Course costs just $275 but is free to NAPA members. NAPA Members should register and sign in to their account receive the free course.

SECOND

THIRD

Or the Certified Plan Fiduciary Advisor program by NAPA.

Theyre both excellent next steps.

Recommended Reading: How Much Does 401k Cost Per Month