Government And Military Pension Resource

Depending on your role in the military, some pensions are available to both veterans and their survivors. Be sure to refer to the U.S. Department of Veterans Affairs website for more information.

- Department of Veteran Affairs: If you or your deceased spouse is a veteran, you can find information on your pension at the VAs pension website.

- State government websites: If you were an employee of your state or local government, be sure to check your states government website to search for information regarding your pension.

Leverage The National Registry

The National Registry, run by Pen Check, a retirement plan distribution firm, is a nationwide, secure database listing of retirement plan account balances that have been left unclaimed by former participants of retirement plans.

The site offers an easy, free-of-charge way to locate lost or forgotten employee retirement accounts. You can conduct as many searches as you want, using just your Social Security number. The site is safe, encrypting any information you input on a secure server.

How To Find Out If You Had A 401

Keeping track of your 401 benefits is essential to retirement planning.

Saving enough money to retire often means taking advantage of multiple retirement savings accounts. Employers only match your 401 contributions while you are on the payroll. However, the money in your account still belongs to you after you leave your job. If you arent sure if you had a 401 with a previous employer, there are several ways to find out.

Also Check: How To Change A 401k To A Roth Ira

You May Like: What Age Is Retirement For 401k

But Why Would I Max Out My Roth Ira Before My 401k If Its So Good

Theres a lot of nerdy debate in the personal finance sphere about this very question, but our position is based on taxes and policy.

Assuming your career goes well, youll be in a higher tax bracket when you retire, meaning that youd have to pay more taxes with a 401k. Also, tax rates will likely increase in the future.

The Ladder of Personal Finance is pretty handy when considering what to prioritize when it comes to your investments, but it is just a tool. For more about the Ladder of Personal Finance and how to make it work for you, check out THIS video where I explain it.

PRO TIP: The video is less than three minutes long. It is worth your time.

How To Find Old 401 Accounts

To corral all your accounts, you first must locate all your retirement plans. This is often the most time-consuming step in the process of organizing and streamlining your retirement portfolio, as youll sometimes have to do a bit of legwork to identify and find your old plans. The more jobs youve held, the more work youll need to do if you havent already rolled over those plans into other retirement accounts.

These suggestions can help you figure out how to find your 401k.

You May Like: Should I Invest My 401k

You May Like: How To Collect My 401k

Taking Money Out Of A 401 Once You Leave Your Job

If you no longer work for the company that sponsored your 401 plan, first contact your 401 plan administrator or call the number on your 401 plan statement. Ask them how to take money out of the plan.

Since you no longer work there, you cannot borrow your money in the form of a 401 loan or take a hardship withdrawal. You must either take a distribution or roll your 401 over to an IRA.

Any money you take out of your 401 plan will fall into one of the following three categories, each with different tax rules.

Search Form 5500 Directory

All employers that provide 401 plans to their employees are required to fill out a 5500 form every year with the DOL. Websites like FreeERISA* allow users to search by company name to locate the correct Form 5500. Another option is to search theDOLs 5500 database. Both simple searches will provide you with additional contact information.

For further assistance in finding lost 401 plans, the U.S. Department of Labor has an Abandoned Plan Search, which helps participants and others find out whether a particular plan is in the process of beingor already has beenterminated. The name of the Qualified Termination Administrator responsible for the termination will be listed as well, giving you a good idea of who to contact .

But beware: some companies, even legitimate ones, can acquire your information about unclaimed retirement accounts and offer to assist you with your search, often with a percentage fee for their services.

When it comes to planning and saving for retirement, its vital to have all your assets accounted for. Locating an old 401 plan is like finding cash in the pocket of an old pair of jeans. Its money you forgot you had but are happy you found. So if you know youve contributed funds to a 401 account but cant figure out where those funds are, the resources listed above may help you find past retirement accounts that may have been lost along your employment journey.

Also Check: How To Put 401k Into Ira

Don’t Miss: When Can I Borrow From My 401k

How To Find An Old 401 And What To Do With It

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

The investing information provided on this page is for educational purposes only. NerdWallet does not offer advisory or brokerage services, nor does it recommend or advise investors to buy or sell particular stocks, securities or other investments.

There are billions of dollars sitting unclaimed in ghosted workplace retirement plans. And some of it might be yours if youve ever left a job and forgotten to take your vested retirement savings with you.

But no matter how long the cobwebs have been forming on your old 401, that money is still yours. All you have to do is find it.

Us Department Of Labor

Even if your former employer abandoned its retirement plan, your money isnt lost forever. The U.S. Department of Labor maintains records for plans that have been abandoned or are in the process of being terminated. Search their database to find the Qualified Termination Administrator responsible for directing the shutdown of the plan.

Don’t Miss: How Can I Check How Much Is In My 401k

Leave Your Retirement Savings In Your Former Qrp If The Qrp Allows

While this approach requires nothing of you in the short term, managing multiple retirement accounts can be cumbersome and confusing in the long run. And, you will continue to be subject to the QRPs rules regarding investment choices, distribution options, and loan availability. If you choose to leave your savings with your former employer, remember to periodically review your investments and carefully track associated account documents and information.

Features

- Your former employer may not allow you to keep your assets in the plan.

- You must maintain a relationship with your former employer, possibly for decades.

- You generally are allowed to repay an outstanding loan within a short period of time.

- Additional contributions are generally not allowed. In addition to ordinary income tax, distributions prior to age 59½ may be subject to a 10% additional tax.

- RMDs, from your former employers plan, begin April 1 following the year you reach age 72 and continue annually thereafter, to avoid IRS penalties.

- RMDs must be taken from each QRP including designated Roth accounts aggregation is not allowed.

- Not all employer-sponsored plans have bankruptcy and creditor protection under ERISA.

If you choose this option, remember to periodically review your investments, carefully track associated paperwork and documents, and take RMDs from each of your retirement accounts.

Prevent Losing Your 401s In The Future

Having a plan is the best way to prevent you from losing your 401s in the future. You should actively manage a 401 plan to ensure you’re on pace to meet your retirement goals.

Yearly or semi-yearly checkups are best. It’ll prevent you from analyzing your account’s performance and help you keep tabs on your account.

Having your 401 in the back of your mind, you more likely to remember to bring it with you when you leave your job.

Tags

You May Like: How To Contribute To 401k Without Employer

Start Living On A Budget And Tracking Your Expenses

The fact is that until you know where your money is going each month youre going to have a hard time finding money to set aside for retirement savings.

The reason its so important to discover and track where your money is going each month is so that you can identify wasteful spending and reroute it toward causes that are more important to you.

Many people find when they start tracking expenses that they are spending money in $5, $10 and $20 increments that seems like its not a lot but adds up to hundreds or thousands of dollars each month.

When my family started tracking expenses in 2013, we were able to cut them down by nearly $1,000 a month and we were making well under $100,000 per year at the time.

By trimming grocery expenses, cutting back on entertainment costs and being more mindful of each purchase, we found a lot of waste in our spending. We were able to use what we were wasting for much more important things, such as paying off our debt.

You May Like: How Much Do I Need In My 401k To Retire

What Can I Do With An Old Ira Account

What Should You Do With That Old Retirement Account?

Recommended Reading: How To Take Out 401k Money For House

How To Check Your 401 Balance

If you already have a 401 and want to check the balance, it’s pretty easy. You should receive statements on your account either on paper or electronically. If not, talk to the Human Resources department at your job and ask who the provider is and how to access your account. Companies dont traditionally handle pensions and retirement accounts themselves. They are outsourced to investment managers.

Some of the largest 401 investment managers include Fidelity Investments, Bank of America – Get Bank of America Corporation Report, T. Rowe Price – Get T. Rowe Price Group Inc. Report, Vanguard, Charles Schwab – Get Charles Schwab Corporation Report, Edward Jones, and others.

Once you know who the plan sponsor or investment manager is, you can go to their website and log in, or restore your log-in, to see your account balance. Expect to go through some security measures if you do not have a user name and password for the account.

Much of this should be covered when you initiate the 401 when you are hired or when the retirement account option becomes available to you. Details like contributions, company matching, and information on how to check your balance history and current holdings should be provided.

Finding a 401 from a job you are no longer with is a little different.

Read more on TheStreet about how to find an old 401 account.

Locate An Old 401 Statement

If youâre having trouble getting a hold of your former employerâs HR department, refer to an account statement of your old 401.

If youâre still living at the same address, you should have yearly or quarterly statements mailed to you. Check your statement for information on where your account is held and any contact information.

The information on your statements will come in handy in identifying how much money youâll be transferring over to make sure nothing is left behind.

You May Like: How Can I Take Money Out Of My 401k

Case : You Have An Outstanding 401 Loan

There are many reasons why it doesnt make sense to take a loan from your 401. Heres one more: You cant deduct the interest payments that you make on your 401 loan. This means you wont receive an interest statement like the one you receive when paying mortgage interest .

As long as you keep up with your agreed payment schedule and you pay your loan in full within five years , you wont have to do anything special on your taxes. However, defaulting on your loan turns the remaining unpaid balance into a taxable distribution and triggers the same rules described under case 2b above. Even worse, you are no longer eligible to do an indirect rollover and are likely to trigger additional penalties from your plan and state government.

Also Check: How To Pull Out 401k Without Penalty

How To Find Your 401 With Your Social Security Number

Knowing how to find your old 401s with your social security number can save a lot of time and headache. There are tools you can use to find your 401 and roll them over.

If you’re like most, you’ve changed jobs quite a bit during your career. According to a Department of Labor study, the average American will have had about 12 jobs during their career. All of that moving around is bound to cause some things to get lost in the shuffle. And if you’ve participated in any company-sponsored 401 plan, your retirement money may have been left behind. Luckily, there are ways to find your 401s using your social security number.

The sad fact is billions in retirement funds are left behind in 401 plans where the participant no longer works for that company.

401s that have been left behind with former employers can be cumbersome at best to find. However, it’s vital in building your retirement to locate your old funds and bring them back into your active portfolio.

The first step would be to contact your former employer’s human resources department. If you can get in touch with them, they should have the best route to getting a hold of your old 401s.

Next would be to reference your old 401s summary plan description. In that, you should be able to find your plan administrator’s contact information and what they do with former employees’ 401s.

Read Also: How Old Do You Have To Be To Get 401k

Check On Your 401 Periodically

As mentioned, its essential to check how much is in your 401 throughout the year. Ideally, more than once, however, annual checks are enough.

The reason to monitor your retirement savings is to keep up with your retirement goals. For instance, as you near retirement, you may want to move your money to safer investments like bonds. Or, if one area has over-performed others, you might decide to reallocate your money to limit your exposure to one category.

Typically these drastic swings in your portfolio wont happen that quickly. But by scheduling an annual check of your 401 balance, youll get a good picture of your 401 portfolio.

Tags

Types Of Money That Might Vest

Examples of money types that are most likely to have a vesting schedule include:

- Employer matching: Any funds you receive as a result of your own contributions to the plan.

- Employer profit-sharing: Money you might get regardless of whether or not you contribute.

- Others, potentially

Examples of contributions that would generally not require any wait for vesting:

- Qualified non-elective contribution : An employer contribution thats typically used to fix mistakes or solve failed discrimination tests. For the contribution to work, it must be 100% immediately vested.

- Qualified matching contribution : Similar to a QNEC, above, but handled differently.

- Rollover: Funds that you roll into your plan from a previous employers 401, 403, your IRA, etc.

IRA-based accounts, including SEPs and SIMPLEs, do not have vesting schedules. Once the money goes into your account, its yours to do with as you please. However, its critical to learn about potential tax consequences of moving or withdrawing funds from any retirement account.

Important: Speak with your tax advisor and your plan administrator before making any decisions. The information here might not apply to your plan, it may be outdated, or there may be errors or omissions that you need to address with a professional.

You May Like: Who Can Open A 401k Plan

How Does The Employer Match Work

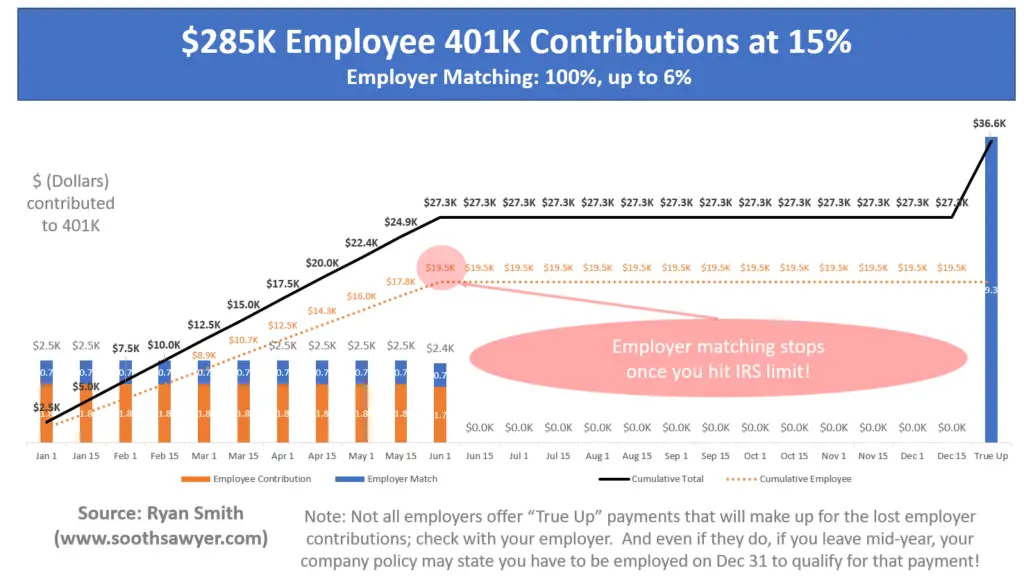

Employer 401 match programs usually incorporate two figures when calculating a total possible match contribution: a percentage of the employees own contribution and a percentage of the employees salary. Employers might match 25%, 50%, or even 100% of an employees contribution up to a set percentage of the employees salary.

Some companies may match contributions dollar for dollar, while others match at a smaller percentage. Other employers may set a hard dollar-based cap instead of limiting match contributions to a percentage of the employees total salary. Total employer contributions cannot exceed 25% of eligible employees annual salary or compensation.

No matter what your companys match program is, its important to strategize. Retirement experts regularly encourage employees to contribute enough to reach the maximum possible employer contribution, or at least as much as they can comfortably contribute. This ensures employees arent leaving money on the table, especially since its part of their total compensation.

Average 401k Balance At Age 45

When you hit your 50s, you become eligible to make larger contributions towards retirement accounts. These are called catch-up contributions. Make sure that you take advantage of them! Catch-up contributions are $6,500 in 2022. So if you contribute the annual limit of $20,500 plus your catch-up contribution of $6,500, thats a total of $27,000 tax-advantaged dollars you could be saving towards your retirement.

Read Also: Can Anyone Open A 401k

Recommended Reading: How Do I Start A 401k For Myself