K Savings Potential By Age

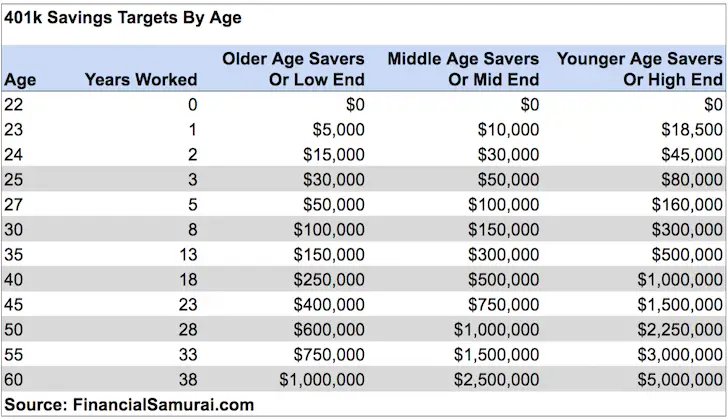

The following chart depicts 401k savings potential by age, based on several assumptions. So this is how much you could have saved. These numbers can seem high to many people, especially if you are older and started your retirement savings when the contribution limit was much lower. It can still be used as a guide for your target total retirement savings amounts, including your IRA, Roth IRA, and after-tax savings. While its designed for one person, it can also be used as a guide for a married couple if one spouse decides to no longer work.

The assumptions we used for this chart include:

| AGE | |

|---|---|

| $869,000.00 | $6,439,708.09 |

*Generally, financial planners say the expected rate of return for a 401k is between 8% and 10%.

So, how do you stack up? Are you on the high end? The low end? Do you think these numbers are realistic?

Average 401 Balance By Age

Retirement savings grow with compound interest, which means account balances increase with time. Like other types of retirement accounts, money saved in a 401 grows like a snowball, with interest earning interest on itself. The older you are, the more time you’ve had to build up your savings.

Note: In 2022, employees can contribute up to $20,500 in their 401. Employees over 50 can contribute an additional catch-up contribution of $6,500.

With compounding interest, the earlier money is put into an account, the more opportunity it has to grow, and the greater the possible returns. In retirement accounts like 401s, building retirement savings early means a greater opportunity for growth.

Here’s the average amount people have saved for retirement by age group, according to Vanguard’s data.

|

$107,147 |

$29,095 |

While a large disparity in savings exists, women often need greater retirement savings than men to retire comfortably. Women tend to live longer and could therefore need more long-term care than men, which could require greater spending in retirement.

How To Stay On Track

The point of benchmarks isnt to make you feel superior or inadequate. Its to prompt action, coupled with a guidepost to inform those actions, even if that means staying the course. If youre not on track, dont despair. Focus less on the shortfall and more on the incremental steps you can take to rectify the situation:

-

Make sure you are taking advantage of the full company match in your workplace retirement plan.

-

If you can increase your savings rate right away, thats ideal. If not, gradually save more over time.

-

If you have a company retirement plan that enables automatic increases, sign up.

-

If you are struggling to save, many employers offer financial wellness programs or other tools that can help with budgeting and basic finances.

Use these savings benchmarks to get more comfortable with planning for retirement. Then go beyond the rule of thumb to fully understand your potential retirement expenses and income sources. Beyond your savings, think about what you are saving for and how you envision spending your time after years of hard work. After all, thats the reason why you are saving in the first place.

Past performance cannot guarantee future results. All investments are subject to market risk, including the possible loss of principal. All charts and tables are shown for illustrative purposes only.

View investment professional background on FINRA’s BrokerCheck.

202204-2128727

Also Check: Can You Rollover A 401k Into A Traditional Ira

Key Takeaways: Are You On Track To Retire

- 401 balances can average roughly $6,000 at the age of 24 to more than $255,000 at the age of 65.

- Knowing the average and median 401 savings by age can help you figure out where you stand and how you can be better prepared for the future.

- As soon as a 401 becomes available to you, its best to consider taking advantage of this benefit.

- There are various ways to prepare for retirement, such as:

- Improve your 401 balance

- Prioritize your retirement savings

- Learn from your 401 balance

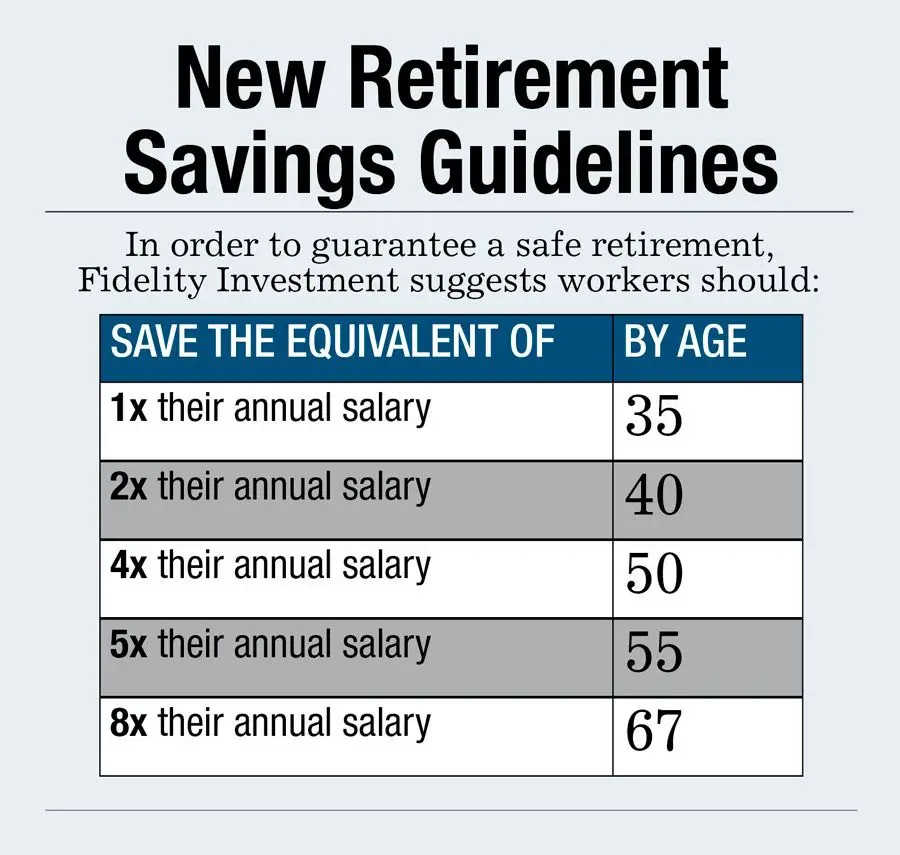

How Much Should I Have In My 401k At My Age

This is how much experts at Fidelity recommend you have saved for retirement at every age: By 30, you should have the equivalent of your salary saved. By 40, you should have three times your salary saved. By 50, you should have six times your salary saved.

How much should a 40 year old have in 401K?

Financial Samurai 401k Savings Guideline From the results, the average 40 year old should have between $200,000 $750,000 saved up in their 401k, depending on company match and investment performance.

How much should a 40 year old have in retirement savings?

Also Check: Why Rollover Old 401k To Ira

Average 401k Balance At Age 45

When you hit your 50s, you become eligible to make larger contributions towards retirement accounts. These are called catch-up contributions. Make sure that you take advantage of them! Catch-up contributions are $6,500 in 2022. So if you contribute the annual limit of $20,500 plus your catch-up contribution of $6,500, thats a total of $27,000 tax-advantaged dollars you could be saving towards your retirement.

Have A Realistic Understanding Of When You Want To Retire

Having clearly defined goals will help you determine how much you should have saved based on your personal goals. Your savings objectives will be different if you plan to retire at 50 than if you plan to continue working past 70. Additionally, its important to determine as accurately as you can what your cost of living will be in retirement. How much do you need to spend per year to maintain the lifestyle that you want for the rest of your life? Have a good sense of what your costs will be so you can factor that into your overall retirement strategy. Really evaluate how long you want to continue working, and what retirement age is realistic for you based on your income and your current level of savings.

Don’t Miss: How To Move My 401k To An Ira

Planning For Retirement By Age

The most important element of retirement saving is making and executing on your plan as early as possible. Over the years, your needs, priorities and preferences will shift. But setting a solid foundation and sticking closely to experts’ guidelines will give you the security of knowing you’re on pace for a retirement you can look forward to. As you take action to plan out your retirement, it’s also important to keep an eye on your credit. A flush retirement account will open up opportunities for you in retirement, and robust credit can help you attain goals throughout your life.

Recommendation To Growing A Large 401

Now that you know what the appropriate 401k savings by age is, its time to manage your finances like a hawk. To do so, sign up for Personal Capital, the webs #1 free wealth management tool. Personal Capital will enable you to get a better handle on your finances.

In addition to better money oversight, run your investments through their award-winning Investment Checkup tool. I will show you exactly how much you are paying in fees. I was paying $1,700 a year in fees I had no idea I was paying.

After you link all your accounts, use their Retirement Planning calculator. It pulls your real data to give you as pure an estimation of your financial future as possible using Monte Carlo simulation algorithms. Definitely run your numbers to see how youre doing.

To track my 401k savings by age guide you must max out your 401k each year. With investments returns coupled with company matching, youll be amazed how much you will accumulate over the years.

Ive been using Personal Capital since 2012. In this time, I have seen my net worth skyrocket thanks to better money management.

Read Also: Should I Transfer My 401k To An Annuity

Average 401 Balance By Industry

According to Vanguard data, balances also vary widely among industries. One possible explanation for this is that retirement-savings matches, in which an employer matches an employee’s contributions to their savings up to a given percentage, may be more common in some industries than others. Earnings could also affect how workers in a specific industry save.

Here’s how the average balances break down by industry, according to Vanguard’s data.

|

Industry |

What Is The Maximum 401k Contribution Amount

Starting in 2020 , you can contribute up to $19,500 each year to your 401k if you are under 50. If you are over the age of 50, you may be able to make catch-up contributions. This provision lets you invest up to an additional $6,500 in your 401k .

PRO TIP: You need to be behind in your 401k contributions to make catchup contributions.

When compared to a Roth IRA, where you can only contribute up to $6,000/year, this is an amazing opportunity especially since your pre-tax money is being compounded over time.

You May Like: Can I Transfer From 401k To Roth Ira

Average 401 Balances At 30

Many financial experts recommend that your savings at age 30 equal at least one year of your salary. The Bureau of Labor Statistics reports the average salary for workers ages 25 to 34 is $48,620. That means many 30-year-olds in the U.S. have an average balance that falls short of the recommended amount.

Age : Planning Starts In Your 20s

Many Americans dont sign up for a 401 in their 20s, meaning they arent taking advantage of a potential employer match.

An employer match on your 401 is free money, but roughly a quarter of employees are leaving free money on the table by not taking advantage of their match, said Brian Walsh, a certified financial planner and financial planning manager at SoFi.

He added that in some cases, planning for retirement can trump paying down debt.

Many young people we work with hate being in debt and strive to pay off their debt as quickly as possible, he said. That is admirable, but sometimes it simply does not make sense to aggressively pay down debt instead of saving. While eliminating debt is important, you also need to prioritize saving for your future. We consider any debt with an interest rate below 7% to be good debt and suggest saving some of your money before aggressively paying that debt down.

Read Also: Is Tiaa Cref A 401k

Contributing To Your 401

You can contribute a portion of your earnings to a 401 account tax-free each pay period, subject to annual limits set by the Internal Revenue Service . Some employers even offer matching programs, where they contribute an equal amount to help grow your fund. It’s clear to see how it makes sense to put in as much as possible and maximize your 401.

But there may be reasons to hold back. Your financial situation should play a role in how much you decide to put in an employer-sponsored retirement plan. So should the specifics of the plan. Consider whether your company’s 401 is high in quality with solid growth rates and company matching. Make sure your own money base is solid, ensuring that you can afford to put some of your earnings away.

Maxing out your contributions probably isn’t your best choice if you’re struggling to pay bills each month, still working on other aspects of your finances, or if your 401 options aren’t great.

There are many key financial goals to meet as you get older and plan for retirement. Think about paying off high-interest debt, building an emergency fund, and securing overall financial wellness.

Im 35 What Should I Have Saved

There is a lot of research showing that people tend to rely on approximations or rules of thumb when it comes to financial decisions.

With this in mind, many financial firms publish savings benchmarks that show the ideal levels of savings at different ages relative to an individuals income. A savings benchmark isnt a replacement for comprehensive planning, but it is a quick way to gauge whether youre on track. Its much better than the alternative some people useblindly guessing! More importantly, it can act as a catalyst to take action and start saving more.

However, for the benchmark to be useful, it needs to be realistic. Setting the target too low can lead to a false sense of confidence setting it too high can discourage people from doing anything. Articles on retirement savings goals have generated spirited discussion about the reasonableness of the targets.

So, to answer the question, we believe having one to one-and-a-half times your income saved for retirement by age 35 is a reasonable target. Its an attainable goal for someone who starts saving at age 25.

For example, a 35-year-old earning $60,000 would be on track if shes saved about $60,000 to $90,000.

Savings Benchmarks by AgeAs a Multiple of Income

Recommended Reading: Does Mcdonald’s Offer 401k

Dont Rely Only On Social Security

Based on Personal Capitals recent retirement survey, we found that a quarter of Americans expect Social Security to be their primary source of income during retirement. With half of Americans planning to retire at 65 or younger, its crucial to save in other investment vehicles, such as a 401k, in order to maintain your desired lifestyle in retirement.

We recommend not relying on Social Security it may not fully be there when you retire!

Average Balances Vs Median Balances

Its important to remember that averages dont always give an accurate picture of data. Thats because outliers on the high and low ends can skew the numbers.

While it is often thought that with the average, there may be a few big accounts at the high end that are pulling things up, its just as true that we regularly have people joining our platform with a zero balance, either because they are just joining the workforce, are just now joining a company that offers a 401 or they may have just switched jobs and rolled their 401 savings into an IRA, says Shamrell.

Its helpful to look at median balances by age as well to help determine if outliers are present.

For example, we already have 1.2 million Gen Z employees on our 401 platform, and their average balance is $5,300. In looking at the median, Gen Z participants in the 90th percentile still only have $13,700, Shamrell says.

Recommended Reading: How Do I Open A Roth 401k

Learn Whether You Can Qualify To Supplement Your Income

For many Americans, the balance of their 401 account is one of the biggest financial assets they own but the money in these accounts isnât always available since there are restrictions on when it can be accessed.

401 plans are meant to help you save for retirement, so if you take 401 withdrawals before age 59 1/2, youâll generally owe a 10% early withdrawal penalty on top of ordinary income taxes.

However, there are limited exceptions. For instance, if you incur unreimbursed medical expenses that exceed 10% of your adjusted gross income, you can withdraw money from a 401 penalty-free to pay them. Similarly, you can take a penalty-free distribution if youâre a military reservist called to active duty.

Because the exceptions are narrow, most people must leave their money invested until 59 1/2 to avoid incurring substantial taxes. However, there is one big exception that could apply if youâre an older American who needs earlier access to your 401 funds. Itâs called the ârule of 55,â and hereâs how it could work for you.

Recommended Reading: How To Use Your 401k

How Much Should You Be Saving For Retirement

There is no one-size-fits-all approach for how much you should save for retirement. That figure depends largely on the lifestyle you want for yourself and your family.

But Fidelity recommends saving 15% of your salary over the course of your career to be prepared for retirement. Here are the benchmarks Fidelity recommends you follow at every age:

- By age 30, you should have the equivalent of your salary saved

- By age 40, you should have three times your salary saved

- By age 50, you should have six times your salary saved

- By age 60, you should have eight times your salary saved

- By age 67, you should have ten times your salary saved

Don’t Miss: What Is Qualified Domestic Relations Order 401k

Average 401 Balances By Gender

Gender can also impact 401 balances. In particular, men have much higher average balances than their female peers.

This is explained by many factors, including the gender wage gap and the fact that women may have fewer years on the job because they are more likely to take time off due to caregiving responsibilities.

The table below shows the average and median 401 balances by gender.

Table source: How America Saves, Vanguard.| Gender | |

|---|---|

| $107,147 | $29,095 |

Unfortunately, women often face an uphill battle in investing enough for a secure future — especially since they tend to live longer than men and need larger balances as a result.

Average 401 Retirement Balances

Based on Fidelitys 2020 study, here are the average retirement balances for the IRA, 401, and 403. Expect the balances to be 5-10% higher for 2022 after a huge 2021 and a poor 2022.

- The average IRA balance was $111,500, a 13% increase from last quarter. It is slightly higher than the average balance of $110,400 in 2019.

- The average 401 balance increased to $104,400 in Q22020, a 14% increase from Q1 but down 2% from a year ago. For 4Q2020, the average 401 balance rose to roughly $120,000.

- Average 403 account balance increased to $91,100. This is an increase of 17% from last quarter and up 3% from a year ago.

Based on Fidelitys latest 2022 report, the average 401 balance is $121,700 as of 1Q 2022. Heres a more filtered breakdown of the average 401 balance by age range in 2022.

- Age 20-29: $14,600

- Age 50-59: $206,100

Also Check: What Is The Safest Investment For My 401k