Fund The Llc Using Self

After the LLC bank account has been opened, the next step is to fund with solo 401k funds. Funding the LLC bank account can be done by check or by wire, and the funds have to flow directly from the solo 4o1k bank account to the LLC bank account. If funding is done by check, the check will need to be made payable in the name of the LLC not your personal name.

Key Considerations With 401 Loans

- Some plans permit up to two loans at a time, but most plans allow only one and require it be paid off before requesting another one.

- Your plan may also require that you obtain consent from your spouse/domestic partner.

- You will be required to make regularly scheduled repayments consisting of both principal and interest, typically through payroll deduction.

- Loans must be paid back within five years .

- If you leave your job and have an outstanding 401 balance, youll have to pay the loan back within a certain amount of time or be subject to tax and early withdrawal penalties.

- The money you use to pay yourself back is done with after-tax dollars.

Although getting a loan from your 401 is relatively quick and easy, the benefit of paying yourself back with interest will likely not make up for the return on investment you could have earned if your funds had remained invested.

Another risk: If your financial situation does not improve and you fail to pay the loan back, it will likely result in penalties and interest.

You May Like: How To Take Out 401k After Leaving Job

How An Investment Adviser Helps: Participant Advocate

The participant needs to know that there is someone in their corner looking after their interests. Investment advisers are plan fiduciaries, which means they have an obligation to look after the best interests of the participants. There is a whole language that recordkeepers speak thats foreign to the average participant. Investment advisers can help participants to translate obscurity into clarity.

You May Like: Is An Annuity The Same As A 401k

Financial Institutions That Offer 401 Plans

While there are many banks and financial institutions that can help businesses implement a 401 plan, not all offer plans that specifically target small businesses.

Here are a handful of companies that can help small businesses set up a 401:

Of course, while these are all fine options, the best thing any small business can do is to shop around and find the best partner for your specific needs. Each financial company offers its own fees for helping to manage your 401, so research is key here. You can also speak with your financial advisor or current bank to see what they recommend.

Each financial company offers its own fees for helping to manage your 401, so research is key here.

How Much Does Offering A 401 Cost An Employer Pricing And Fees

According to SHRM, 93% of employers offer a traditional 401. Since retirement plans, like 401s, are an important recruitment and retention tool, its important to consider offering one at your workplace. But, if youre like many businesses, you may be worried about just how much it will cost you to provide the benefit.

Since 2003, Complete Payroll has been helping clients create competitive benefit plans for their workers. Many of our clients include a 401 as part of their overall benefits strategy. But before they do, What will a 401 plan cost me? is a question we get a lot.

To help you understand what expenses youll be responsible for if you decide to offer a 401, well explain all the costs. After reading this article, youll be equipped to decide if a 401 fits within your budget.

Recommended Reading: How Do I Get My 401k From Walmart

The 5 Most Popular Small Business 401 Plan Features

- The 5 Most Popular Small Business 401 Plan Features

Tens of thousands of dollars are on the line.

This might sound a bit sensational, but when it comes to choosing the right type of 401 plan, this is true a lot more often than many small business owners realize.

Over the years, our firm has helped thousands of business owners design a 401 plan for their company. During these consultations, we cant tell you how many times weve seen a business save thousands in annual contribution expenses by choosing one type of 401 plan over another, while still meeting their plan goals.

And its not just money thats at stake.

Choosing the wrong type of 401 plan can result in failed nondiscrimination testing, countless hours of administrative hassle, and can ultimately make it more difficult for the plan to achieve its goals.

So it goes without saying that choosing the right plan is important. The problem? 401 plans are complex, and it can be really difficult to know which type of 401 plan is best for you.

Our goal today is to make it easy.

Using data gathered in our study of 3,975 small businesses, well break down the 5 most popular types of 401 plans. Well explain how they work and why theyre so popular, helping you come to the quickest decision as to which type is best for you.

Before we dive in though, theres a common misconception well need to clear up…

Avoid 401k Debit Cards At All Costs

Many consumers are looking for easy access to additional funds since the financial crisis and recession. Even though the recession is technically over, many are still feeling the pinch. As a result, there has been a bigger move toward tapping retirement accounts as emergency funds.

One of the ways that it has been made easier to get a 401 loan is by adding a debit card to the account.

Recommended Reading: Where Can I Move My 401k Without Penalty

How Much Does It Cost To Set Up A 401 For A Small Business

Costs to set up a 401 plan will vary depending on the size of your business and the types of benefits you select. Initial setup fees can generally run anywhere from $500 to $3,000, depending on the chosen retirement service provider. Other costs to consider are fees associated with rolling assets over from another plan and initial consulting costs for investment advice.

Included In Your Plans Price Ubiquity Will:

- Provide administrative assistance to set up your 401 plan

- Facilitate contributions, including profit-sharing add-ons

- Administer 401 loans if you need to borrow against your retirement account

- Submit annual tax forms and provide tax compliance support .

- Provide customer service, Monday through Friday between 8:30 am and 5:30 pm, Pacific Time.

Read Also: How Much Tax On 401k Withdrawal

Choose A Plan That Meets Your Business Goals

Plan design optionsThe big difference between 401 plan designs is how and when an employer makes contributions on behalf of its employees. Here are three types of plan designs, their requirements, and some other implications:

What other 401 plan features should I consider?Offering retirement benefits is a great way to attract and retain talent. But specific plan features can really boost participation and make your small business 401 plan even more enticing.

Traditional vs. Roth 401. Whats the difference?Generally speaking, the key difference between the two is when employee contributions are taxed. With traditional accounts, contributions are made before taxes are taken out of pay. Under Roth accounts, contributions are taxed first and then deposited. When an employee retires, withdrawals from traditional accounts are taxed at ordinary income rates, whereas Roth withdrawals can generally be made on a tax-free basis.* Read more about traditional vs Roth accounts.

Should I match employee contributions?Matching contributions can be hugely beneficial for both employees and employers. For employees, theyre an additional form of compensation that can help maximize their retirement savings.

Who Is Eligible For Individual 401 Plans

A common misconception about the solo 401 is that it can be used only by sole proprietors. In fact, the solo 401 plan may be used by any small businesses, including corporations, limited liability companies , and partnerships. The only limitation is that the only eligible plan participants are the business owners and their spouses, provided they are employed by the business.

A person who works for one company and participates in its 401 can also establish a solo 401 for a small business they run on the side, funding it with earnings from that venture. However, the aggregate annual contributions to both plans cannot collectively exceed the IRS-established maximums.

Also Check: What Do You Do With 401k When You Retire

How Many Employees Do You Need To Have A 401 Plan Can Small Businesses Even Offer A 401

Lets get this out of the way. Yes, any size business can offer a 401 plan. Traditionally, 401 providers charged small and mid-sized businesses exorbitant fees or ignored them altogetherleading millions of smaller businesses out in the cold without an easy way to offer meaningful retirement benefits. Guideline is changing that by offering small businesses an easy, affordable 401.

Review The Investment Choices

The 401 is simply a basket to hold your retirement savings. What you put into that basket is up to you, within the limits of your plan. Most plans offer 10 to 20 mutual fund choices, each of which holds a diverse range of hundreds of investments that are chosen based on how closely they hew to a particular strategy or market index .

Here again, your company may choose a default investment option to get your money working for you right away. Most likely it will be a target-date mutual fund that contains a mix of investments that automatically rebalances, reducing risk the closer you get to retirement age. Thats a fine hands-off choice as long as youre not overpaying for the convenience, which leads us to perhaps the most important task on your 401 to-do list …

You May Like: How Much Can I Put In My 401k Per Year

Fund Types Offered In 401s

Mutual funds are the most common investment options offered in 401 plans, though some are starting to offer exchange-traded funds . Both mutual funds and ETFs contain a basket of securities, such as equities. Mutual funds range from conservative to aggressive, with plenty of grades in between. Funds may be described as balanced, value, or moderate. All of the major financial firms use similar wording.

Why A Retirement Plan Is A Smart Move

A 401 plan can be a very powerful benefit for your company and your employees. But offering a 401 plan is a big commitment. How do you know if its right for your company?

Here are some reasons starting a 401 plan is a smart move.

- Attract and retain employees: It can be difficult to find and keep the right people for your business. A 401 might help. According to a Glassdoor study, 401 plans are one of the top five benefits employees care about.

- Deferred tax growth: A traditional 401 plan offers deferred tax growth to help fuel retirement. If you participate in your plan that means both you and your employees are reaping that benefit.

- Tax deductions: Not only can a 401 plan be good for your financial health, it can be good for your business health. Any contributions that you make to your employees plan are tax-deductible. And your business may even be eligible for a $500 tax credit for the first three years after setting up your plan.

- Offer solutions:48% of people 55 and over have nothing set aside in a retirement plan. This isnt good for anyone. Offering a retirement plan can help your employees protect their financial future and show that you care about their wellbeing.

Also Check: What Happens To Your 401k When You Die

Look For The Right Investment Selection

More than anything, participants want an investment selection that matches their wealth creation strategies. For instance, if a high percentage of employees are reaching retirement age, the plan should offer more investment options catering to those investment preferences. The plan sponsor has a fiduciary obligation to carefully select and monitor the investment line-up in the plan.

What Are The Maintenance Costs For Setting Up A 401

Once you establish a 401, your business will have ongoing costs in the form of administrative fees and any matching contributions. Fees generally fall into three categories: day-to-day operations, investment fees, and individual service fees.

There are also potentially fees or penalties associated with being non-compliant with regular 401 benchmarking, which you’ll want to avoid at all costs. A few examples of 401 penalties include:

- Non-compliance with ERISA for failing to meet certain filing and notification requirements

- Failing to file Form 5500 with the IRS each year

- Not providing 402 notices to plan participants who are seeking distributions from their retirement plan accounts

One way to avoid fines and penalties is working alongside a knowledgeable retirement services provider that can help ensure compliance when it comes to retirement plan forms, deadlines, and notifications.

Also Check: How To Open A Self Directed 401k

How Much Should Employees Contribute

Like the employer, employees are free to contribute as much as they like to the plan, within IRS limitations. For 2022, salary deferrals are $20,500, plus a catch-up contribution limit of $6,500 for employees 50 and older. Consider ways to help employees improve their financial wellness and increase their 401 participation. Doing so could benefit your business in the form of happier, less-stressed employees who are more engaged and productive.

Set It But Dont Forget It

Once youve decided how much to contribute and selected your investments, your retirement savings will begin to grow. Monitoring your 401 on a daily basis likely isnt necessary, but tracking the performance of your investments over an extended period of time can help maximize your returns. Also consider increasing your contributions, especially after receiving raises.

Don’t Miss: How Old Do You Have To Be To Get 401k

Avoid Choosing Funds With High Fees

It costs money to run a 401 plan. The fees generally come out of your investment returns. Consider the following example posted by the Department of Labor.

Say you start with a 401 balance of $25,000 that generates a 7% average annual return over the next 35 years. If you pay 0.5% in annual fees and expenses, your account will grow to $227,000. However, increase the fees and expenses to 1.5%, and you’ll end up with only $163,000effectively handing over an additional $64,000 to pay administrators and investment companies.

You can’t avoid all of the fees and costs associated with your 401 plan. They are determined by the deal your employer made with the financial services company that manages the plan. The Department of Labor has rules that require workers to be given information on fees and charges to make informed investment decisions.

The business of running your 401 generates two sets of billsplan expenses, which you cannot avoid, and fund fees, which hinge on the investments you choose. The former pays for the administrative work of tending to the retirement plan itself, including keeping track of contributions and participants. The latter includes everything from trading commissions to paying portfolio managers’ salaries to pull the levers and make decisions.

Kick Start Employee Participation

A good adviser will help you make sure that on day one of your plan, your employees are able to enroll in the plan, find answers to their questions about saving money and investing, and understand how to use their 401 plan to help them reach their own goals for retirement. Talk to your adviser about offering on-site support for enrollment day, including group presentations about the workings of your 401 plan, and one-on-one sessions for interested employees to share their private questions and concerns.

Setting up your new 401 is all about building a retirement plan your employees will use and appreciate, and aligning that plan with the goals for your business. As you review your adviser options and consider your needs, remember that by offering your new 401, youre giving your employees a new chance to prepare for the future as they work for you today.

You May Like: How To Buy Gold In Your 401k

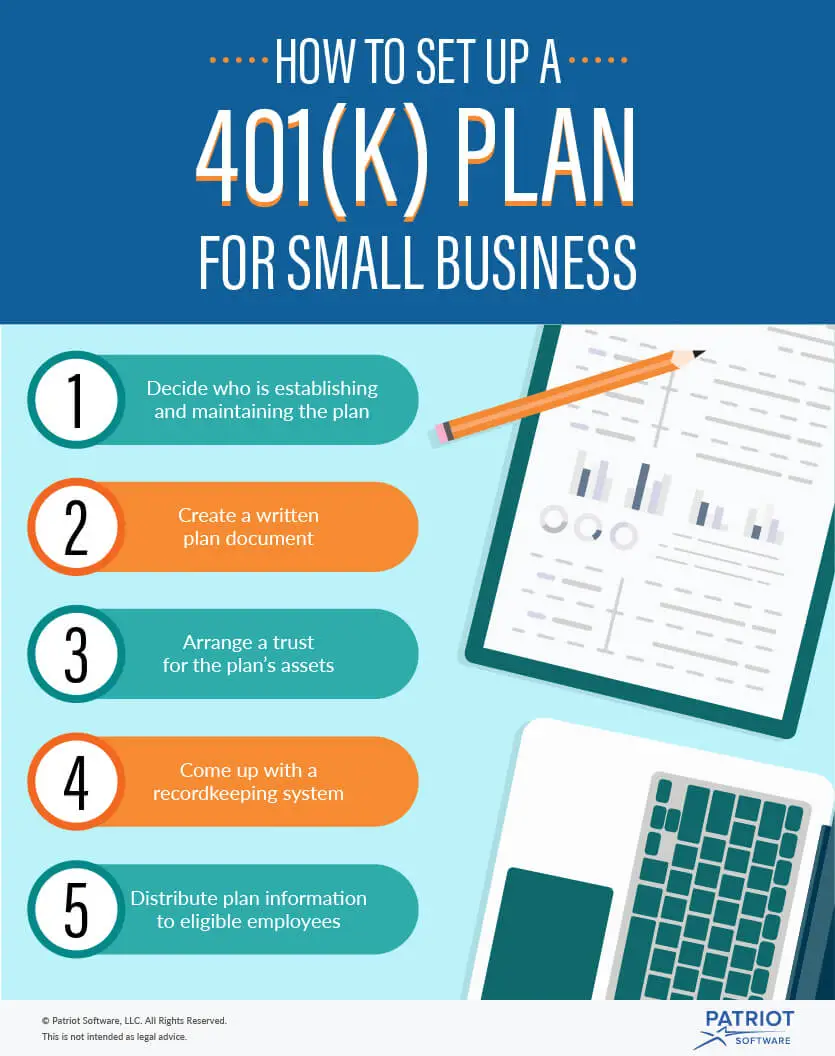

Setting Up A 401 Plan

Finally, heres the nitty-gritty left to do to start your companys retirement plan:

1. Collect employee data. In order to make sure employees qualify for enrollment in the new plan, youll need to prepare an accurate census of employee information, including names, birth dates, hiring dates, salary information, and more.

2. Identify a Plan Manager. You as the employer will manage the plan, some small businesses may have another employee, like an HR manager, be named as the official Plan Manager for your plan. In addition to the business owner acting as a fiduciary, the person chosen as Plan Manager may also have fiduciary responsibilities. Itll be their job to work with your adviser and other providers to facilitate plan administration.

3. Determine the new plans start date. You will also need to decide when you want to roll out the plan and allow employees to enroll. Often, you can set up your plan to start by the following month’s payrollwhich means employees will be able to start saving for retirement into the plan.

4. Set up payroll. Finally, youll need to make sure that your payroll system is set up to handle employee deferrals according to your plan design. Fisher specifically helps our clients with this step as it can be tricky depending on your payroll provider.

Determine The Best 401k Plan For Your Small Business

When considering your investment choices, keep in mind that the number of employees impacts the type of plan you should set up. Even still, there are several options for small employers.

Before we dive into the different types of plans, lets first discuss contributions. You have options for determining how you will contribute to your employees retirement plan as the investment manager. Will you contribute at all? Will you match your employee contributions plan? Will you make outright contributions?

Knowing this information ahead of time is essential because it can factor into your decision, as some require employer contributions and some let you decide. Keep this in mind as you review the different plan options below.

Also Check: How To Withdraw Your 401k After Leaving A Job