Why Does Slavic401k Reimburse All Revenue Paid By The Funds

Also Check: How To Open A Solo 401k

Can I Borrow Against My 401k Plan Not If You Can Help It

July 31, 2016 by Justin

It can be tempting. You spend years and years building up a stockpile of money that just sits in an account and doesnt seem to do anything for you in the present. Sure you know your savings is for retirement. But that seems so far away. What about my problems and needs for today? Can I borrow against my 401k and use the money to tide me over for a little while?

This line of thinking is exactly the rationale that gets many people into trouble with their retirement savings. Sometimes when youve got a decent chunk of money stashed away in your IRA or 401k, it can be very tempting to think that you should be able to help yourself to even a small portion of it if needed.

The IRS recognizes this too. Although your employer can restrict the terms of the loan, they do have to be reasonably available to all participants of the retirement plan. Some of the common reasons people decide to borrow against their 401k include:

- Paying for education expenses

Can I Borrow Against My 401k Not If You Want to Succeed:

While borrowing from your 401k can be tempting, there is one major setback that you should strongly consider:

- It will reduce the overall growth potential of your entire balance.

Lets look at a simple example: Say youve got two employees that are exactly the same. They both contribute $6,000 to their 401k balance , and it grows at an average annualized rate of 8% each year.

So how much more money does Employee A have over Employee B after 30 years?

What Are Some Alternatives To A 401 Loan

When cash is tight, borrowing from your 401 plan and paying yourself interest may seem like a good idea. But before you borrow, weigh all your options. Here are a few.

Read Also: Can I Use 401k To Buy A Home

Borrowing From Your 401 To Buy A House

Buying a home is an exciting milestone, but it often requires a significant financial investment. While it’s important to calculate how much home you can afford and how your monthly mortgage payments will affect your budget, there are other costs to consider.

Two of the most important are your down payment and closing costs. According to the National Association of Realtors, the median home down payment was 12% of the purchase price in 2019. That would come to $24,000 for a $200,000 home. Closing costs, which include administrative fees and other costs to finalize your mortgage loan, add another 2% to 7% of the home’s purchase price.

While the seller may pay some of the closing fees, you’re still responsible for assuming some of the costs. You can borrow from a 401 to buy a house if you don’t have liquid cash savings for the down payment or closing costs. Here’s what to consider before you make that move.

Consider A 401 Rollover

If you take a distribution from your 401 and roll it over to a qualifying IRA within 60 days, there are no taxes or penalties on the money transferred. Like an IRA rollover, this is an option for obtaining a short-term loan after retirement. If you already have an IRA, consolidating all your retirement funds in one account can be easier to manage. Just be sure to deposit all of the funds into the new IRA account in time to avoid taxes or an early withdrawal penalty if you are under age 59 1/2.

You May Like: Can I Transfer My Work 401k To A Roth Ira

Compare Your Options For Cash Withdrawals And Loans

Following are overviews of your options for making withdrawals or receiving loans from each plan type. For details, see Eligibility and Procedures for Cash Withdrawals and Loans.

| Cash Withdrawals | ||

|---|---|---|

| Not Available | ||

| Former Employee | Employee contributions and earnings at any age, university contributions and earnings at age 55 or older | Not Available |

|

At age 59½ or older hardship disability |

At any age |

| Current Employee | At age 59½ or older one-time withdrawal if account is less than $5,000 when specific conditions are met. See below for details. | At any age |

|---|---|---|

| Fidelity 457 only |

Debt Relief Without Closing My 401k

Before borrowing money from your retirement account, consider other options like nonprofit credit counseling or a home equity loan. You may be able to access a nonprofit debt management plan where your payments are consolidated, without having to take out a new loan. A credit counselor can review your income and expenses and see if you qualify for debt consolidation without taking out a new loan.

8 MINUTE READ

Recommended Reading: How Can I Find All Of My 401k Accounts

Failing To Repay A 401 Loan

If you fail to make scheduled payments for a 401 loan, the entire remaining balance of the loan will be treated by the IRS as a distribution. Also, if you leave your job before repaying the loan, you have a limited amount of time to repay it or it will be treated as a distribution. A 401 loan thats treated as a distribution is classified as taxable income by the IRS. In addition, workers below age 59 1/2 in this situation are subject to a 10 percent IRS penalty for early withdrawal from their retirement account. Retired workers with reduced incomes should carefully consider 401 loan repayment after leaving the job to avoid the tax penalties for defaulting.

Ways To Help Manage A Margin Line Of Credit

To ensure that youre using margin prudently, it may be possible to manage your margin as a line of credit by employing the following strategies:

- Have a plan. You should never borrow more than you can comfortably repay. Think about a process for taking out the loan and ensuring that it aligns with your financial situation, and consider how youll respond in the event of various market conditions. Among other things, you should know how much your account can decline before being issued a margin call. Find out more on managing margin calls

- Set aside funds. Identify a source of funds to contribute to your margin account in the event that your balance approaches the margin maintenance requirement. This can be anything from cash in another account to investments elsewhere in your portfolio .

- Monitor your account frequently. Consider setting up alerts to notify you when the value of your investments declines by an amount where you need to start thinking about the possibility of a margin call.

- Pay interest regularly. Interest charges are automatically posted to your account monthly. Its important to have a plan for reducing your margin balance to minimize the interest amount youre charged which you can do by selling a security or depositing cash into your account.

Don’t Miss: How To Collect My 401k Money

Disadvantages Of Closing Your 401k

Whether you should cash out your 401k before turning 59 ½ is another story. The biggest disadvantage is the penalty the IRS applies on early withdrawals.

First, you must pay an immediate 10% penalty on the amount withdrawn. Later, you must include the amount withdrawn as income when you file taxes. Even further down the road, there is severe damage on the long-term earning potential of your 401k account.

So, lets say at age 40, you have $50,000 in your 401k and decide you want to cash out $25,000 of it. For starters, the 10% early withdrawal penalty of $2,500 means you only get $22,500.

Later, the $25,000 is added to your taxable income for that year. If you were single and making $75,000, you would be in the 22% tax bracket. Add $25,000 to that and now youre being taxed on $100,000 income, which means youre in the 24% tax bracket. That means youre paying an extra $6,000 in taxes.

So, youre net for early withdrawal is just $16,500. In other words, it cost you $8,500 to withdraw $25,000.

Beyond that, you reduced the earning potential of your 401k account by $25,000. Measured over 25 years, the cost to your bottom line would be around $100,000. That is an even bigger disadvantage.

Those Who Truly Need It

It really comes down to need. If you need to withdraw your money, then withdraw your money. Thats really the essence of the CARES Act. It simply makes a need-based withdrawal less harmful. If you dont need to, then dont, says Brandon Renfro, a financial advisor and assistant professor of finance at East Texas Baptist University.

Its important to consider what things will be like after you take a withdrawal and once things are back to a new normal. Under the CARES Act, you have to repay your withdrawal within three years. If you just need a withdrawal to get you through the next few months before you start earning regular paychecks again, it could be a good option.

Don’t Miss: How To Transfer 401k Without Penalty

Youll Still Need To Be Mindful Of Taxes

Youll still owe income tax on your distribution from any tax-deferred retirement account. However, if you pay the distribution back within three years, you can file for a refund of the taxes you paid on that distribution.

Also worth noting: The income can be claimed all at once in 2020 for tax purposes, or spread evenly over the next three years. In many cases, dividing it evenly over three years may result in a better tax situation, as its less likely to bump you into a higher tax bracket in any single year.

If your income is expected to be lower in 2020 than the subsequent two years, though, it could make sense to claim all of the income on your 2020 tax return. Not only might this minimize the effective tax rate you pay on this income, but youll also have two years to pay back the distribution and ultimately get a refund.

Keep in mind that if you have a Roth IRA, it may still be a better choice for withdrawals than your 401 or IRA. Thats because savers can always withdraw contributions from their Roth IRA penalty- and tax-free.

Your Retirement Money Is Safe From Creditors

Did you know that money saved in a retirement account is safe from creditors? If you are sued by debt collectors or declare bankruptcy, your 401k and IRAs cannot be liquidated by creditors to satisfy bills you owe. If youre having problems managing your debt, its better to seek alternatives other than an early withdrawal, which will also come with a high penalty.

Don’t Miss: How To Buy Gold In Your 401k

Other Alternatives To A 401 Loan

Borrowing from yourself may be a simple option, but its probably not your only option. Here are a few other places to find money.

Use your savings. Your emergency cash or other savings can be crucial right now and why you have emergency savings in the first place. Always try to find the best rate on an online savings account so that youre earning the highest amount on your funds.

Take out a personal loan. Personal loan terms could be easier for you to repay without having to jeopardize your retirement funds. Depending on your lender, you can get your money within a day or so. 401 loans might not be as immediate.

Try a HELOC. A home equity line of credit, or HELOC, is a good option if you own your home and have enough equity to borrow against. You can take out what you need, when you need it, up to the limit youre approved for. As revolving credit, its similar to a credit card and the cash is there when you need it.

Get a home equity loan. This type of loan can usually get you a lower interest rate, but keep in mind that your home is used as collateral. This is an installment loan, not revolving credit like a HELOC, so its good if you know exactly how much you need and what it will be used for. While easier to get, make sure you can pay this loan back or risk going into default on your home.

Hardship And Loan Distributions

Hardship and loan distributions are only available through Fidelity. You may request a hardship distribution from the contributions you have through Fidelity provided that certain IRS requirements are met for this type of distribution. Please reference the Instructions for requesting a Hardship Distribution.

You may also be eligible to take out a loan against your contributions to the plan. When you take out a loan, you are simply borrowing money from your retirement plan account. You will repay the loan amount and interest to Fidelity on a monthly basis. The interest you pay on the loan is not tax deductible. However, there are no taxes or penalties unless you default on the loan. If you default on your repayments, you will be taxed as if the outstanding balance of your loan was distributed to you and might possibly include a 10 percent penalty, if you are under the age of 59 ½. Contact Fidelity to apply for a loan. Learn more about the Duke loan program.

Also Check: Can You Move Money From Ira To 401k

Those Who Can Stomach The Loss In Stock Value

Because a 401 is an investment account, you should also consider the trade-off of missing the market rebound if you withdraw funds right now. Any money that you borrow from your 401 now wont be there when the market turns around, Renfro says. This would compound the adverse effects of an early 401 withdrawal if you dont truly need one.

Echoing that, Levine says many 401 balances have been hit hard, and taking a loan while theyre down essentially locks in the losses.

Taking an early withdrawal from your 401 can have long-term adverse effects on your financial health. However, so can the ramifications of COVID-19, especially if youve been particularly affected by the disease. The CARES Act gives options to those who need it most. Theres no right answer, but in times of uncertainty and struggle, those options can be a life raft.

Dont Miss: How To Find Your 401k Account Number

If Your Financial Situation Deteriorates You Could Lose Even More Money

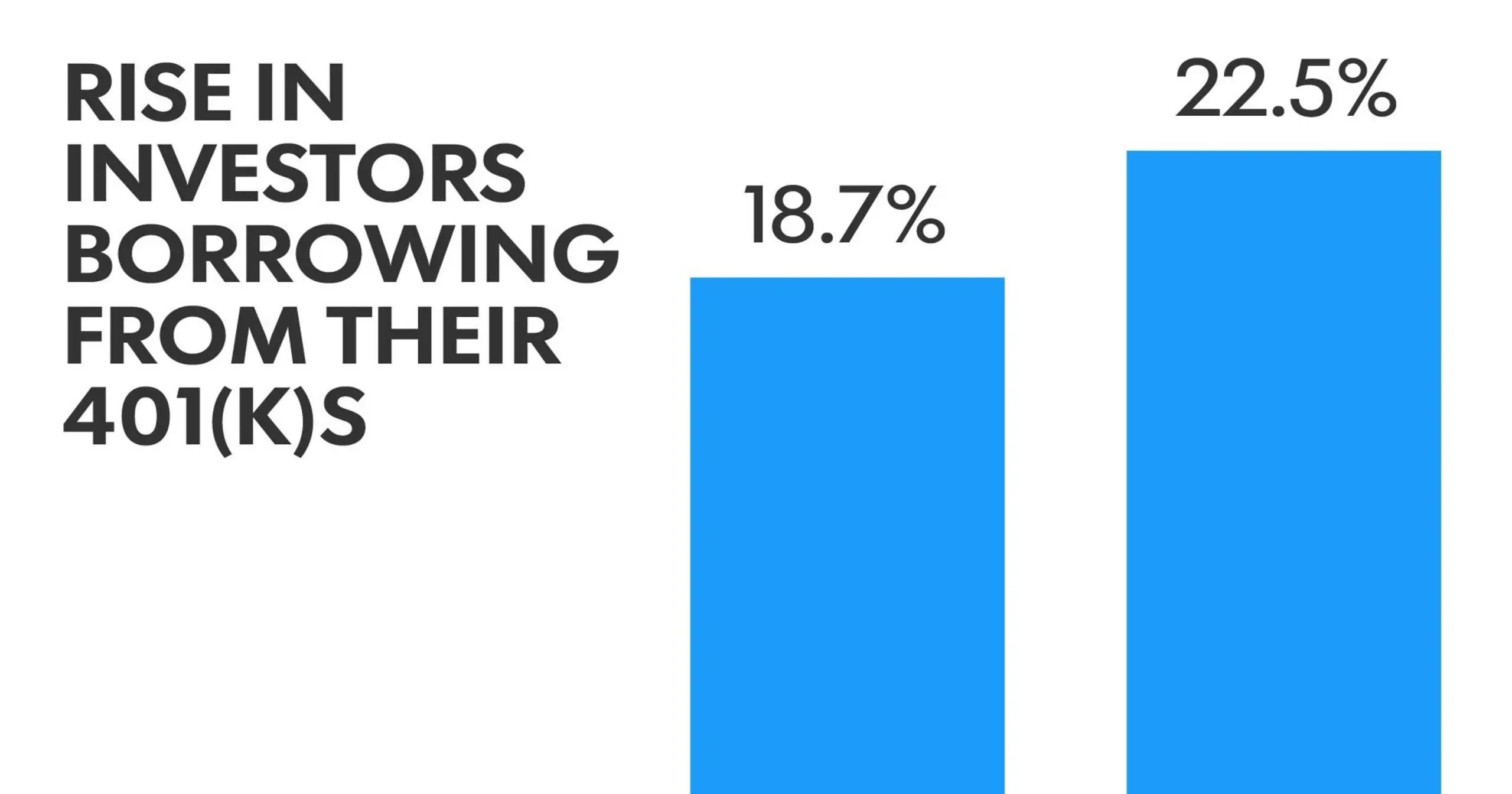

The drawbacks above assume you’ll be able to make the scheduled payments to your fund on time and without undue hardship. And the vast majority90%, in factof those who borrow from their 401 plans are able to do just that, according to a study by the Wharton Pension Research Council.

However, should you be unable to repay the loan, its financial implications go from bad to worse. That’s because, should you default on a 401 loan, the loan is converted to a withdrawal. As a result, unless you happen to qualify for a hardship withdrawal, the outstanding loan balance will be subject, at minimum, to taxation at your current income tax rate. If you’re under the age 59½, you’ll also be assessed a 10% early withdrawal penalty on the amount you’ve borrowed.

Don’t Miss: When Can You Use Your 401k

Alternatives To 401 Loans

Before taking out a 401 loan, whether retired or still working, you should look at other alternatives for borrowing. This is especially true if you want to pay off credit card debt or pay college tuition. Many banks offer low-interest alternatives. For example, a home equity loan may offer a similar interest rate and will not affect your retirement savings. Another thing to consider before taking a loan in retirement is whether youre taking on too much debt, especially if your main source of income is fixed. The Consumer Financial Protection Bureau suggests that monthly payments for debt should be no more than 43 percent of your gross income.