Disadvantages Of Roth Iras

Roth IRAs come with an income limit. As per the IRS, individual taxpayers who make $140,000 or more in 2021 , or married couples filing jointly who make up to $208,000 or more , are not eligible for Roth IRA contributions.

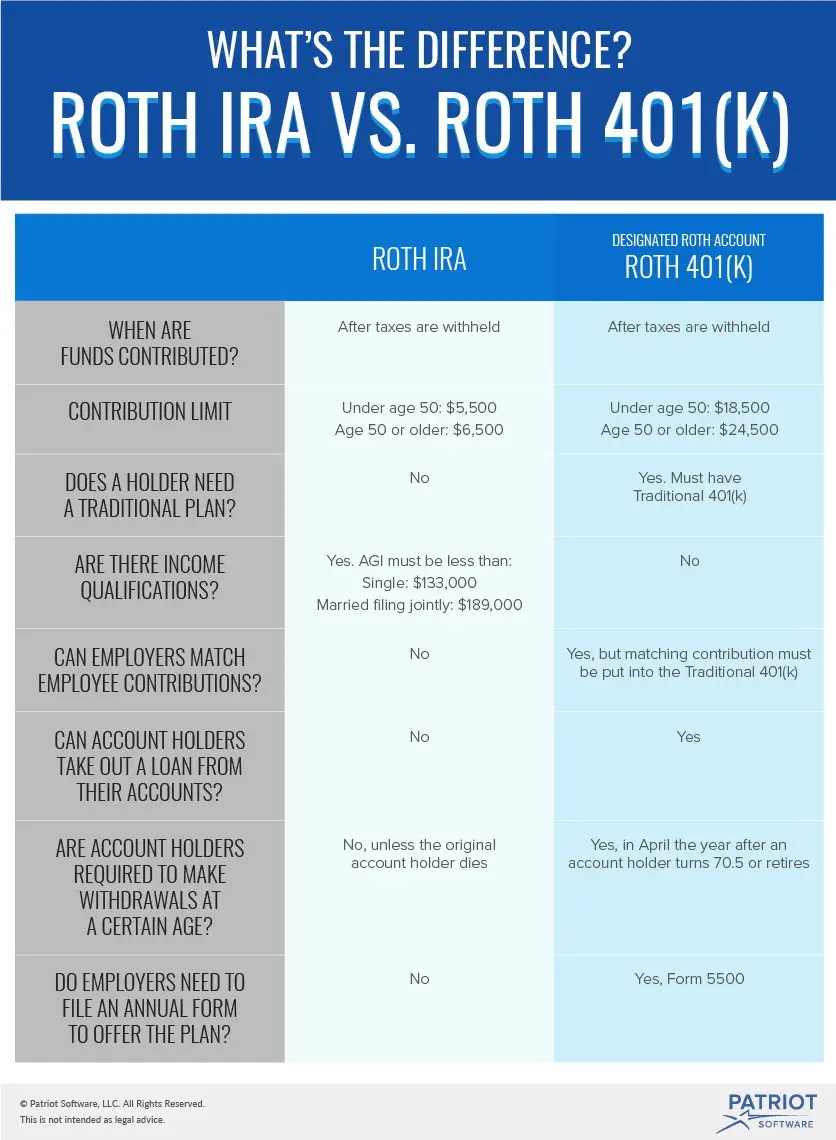

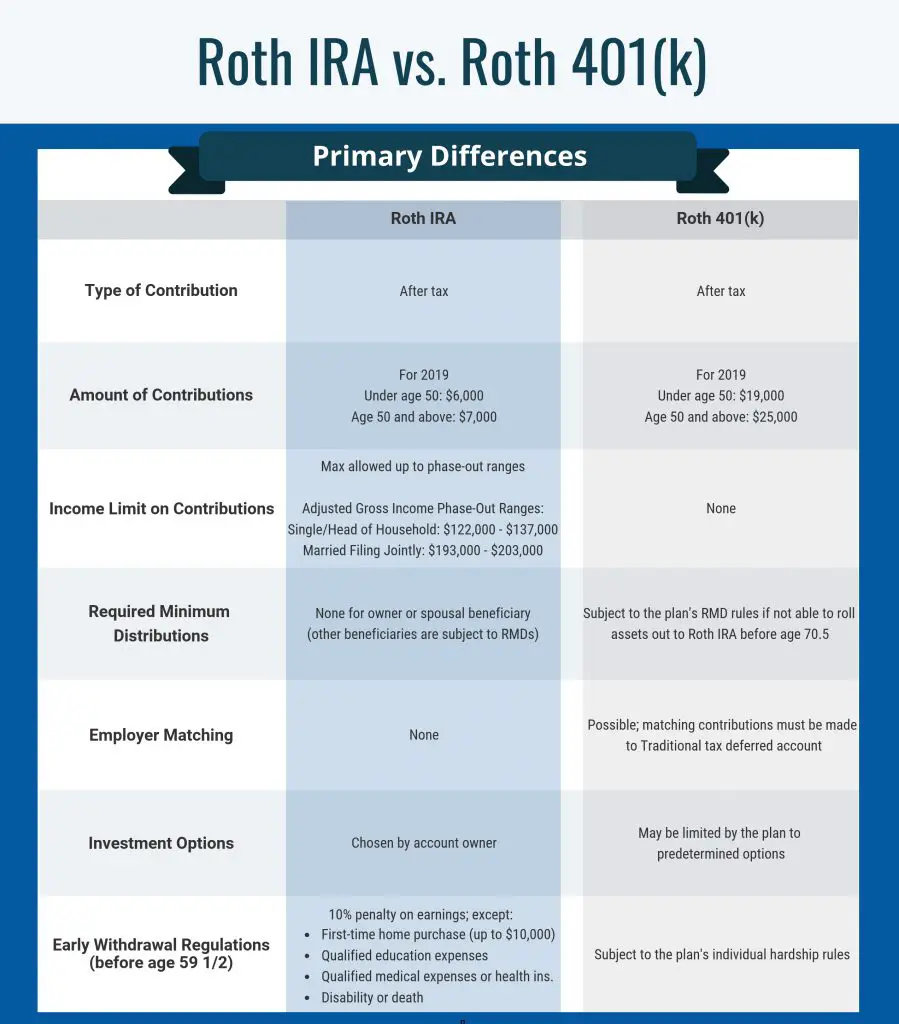

Roth IRAs also have a lower contribution limit$6,000 per year , compared to $19,500 in 2021 for a Roth 401and do not allow for matching contributions.

Unlike Roth 401s, Roth IRAs dont allow loans. However, there is a way around this: initiate a Roth IRA rollover. During this period, you have 60 days to move your money from one account to another. As long as you return that money to it or to another Roth IRA in that time frame, you are effectively getting a 0% interest loan for 60 days.

Dont Miss: How To Find My 401k From Previous Employer

Why Contribute To A Roth 401

There are many advantages to contributing to a Roth 401. Subscribing to a Roth 401 is possible for individuals at any level of income because it does not have an income limit. Roth 401s also allow employers to match the contributions of their employees. As a matter of fact, employees are even given tax incentives to match contributions. Another reason to contribute to a Roth 401 is that you will be permitted to take a loan against your balance. The cap for this loan is the lower of 50% of your balance or $50,000.

When You Leave Your Company

If things come to an end, and you move on, you may not want to leave your retirement money behind in an old 401. Its easy to lose track of old plans, and companies can merge or even go out of business. Then it can become a real hassle to find your money and get it out.

You can usually roll this money into your new companys plan, or consider rolling it into an IRA, which may give you more control over your investment choices.

Recommended Reading: How Often Can I Change My 401k Investments Fidelity

How Much Does An Ira Earn Per Year

Roth IRAs, unlike ordinary savings accounts, do not earn interest on their own. A Roth IRA account begins as an empty investment basket, which means you wont earn any interest unless you choose investments to place within the account.

Compound interest is earned on Roth IRAs, which allows your money to grow faster. Any dividends or interest earned on your investments are applied to your account balance. After that, you get interest on interest, and so on. That implies your money will increase even if you dont contribute to the account on a regular basis.

How your money grows in a Roth IRA is influenced by a number of factors, including how well-diversified your portfolio is, when you want to retire, and how much risk youre prepared to take. Roth IRA accounts, on the other hand, have typically provided yearly returns of between 7% and 10%.

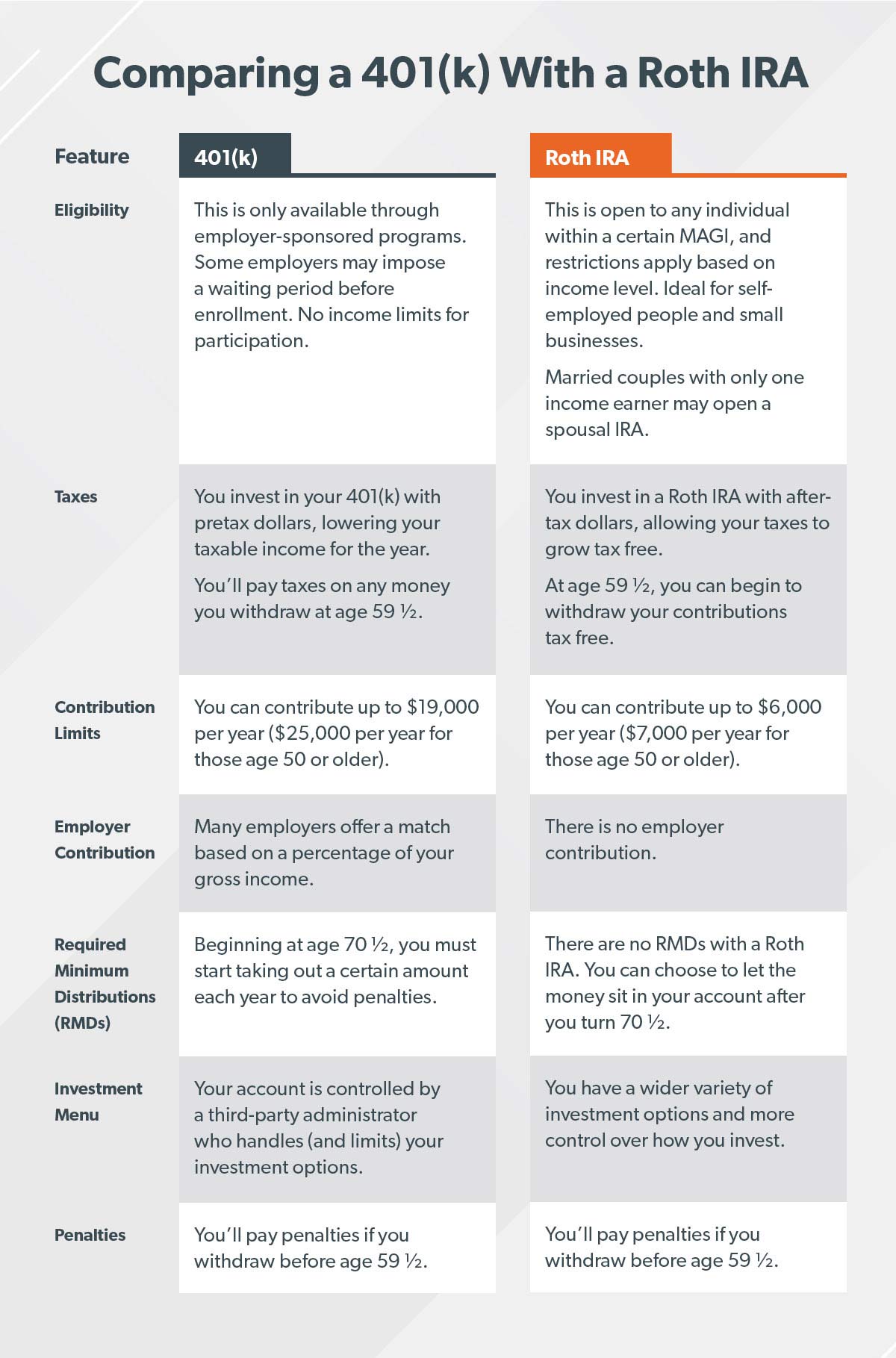

What Are The Differences Between A 401k And An Ira

When employers want to give employees a way to save for retirement, they may offer participation in a 401, a retirement plan outlined in IRS tax code section 401. They may also offer employees a SEP IRA or, if the company has fewer than 101 employees, a SIMPLE IRA. Individuals can open a ROTH or Traditional IRA separately from an employer, but a 401 can only be obtained when offered by an employer which, for the self-employed, includes an owner/employee.

Recommended Reading: Who Does Amazon Use For 401k

The Importance Of Risk In A Portfolio

It would be great of there was a way to make money without taking on any risk. Many investors struggle to take on riskier investments, like stocks, because they fear loss.

There is no way to overstate how important risk is to growing your money. When safe investments like government bonds are compared to stocks , the importance that risk plays becomes very apparent.

Staying in safe investments like government bonds and money market accounts will help to ensure that you dont lose much, but there is also little chance that your portfolio will ever grow at more than 4% per year.

If you are already established, a 4% yield might be ok, but if you are 22 years old and have a portfolio that is worth $1,000, you need to introduce some risk into your investments. Tax-deferred retirement accounts are great, but it wont mean much if your portfolio only grows by 2% per year.

Can You Lose Money In An Ira

Unfortunately, yes, you can lose money in an IRA. Since an IRA is an investment account, you might experience highs and lows based on market volatility. Depending on the types of investments that you choose, your risk associated with the account may be higher or lower. If you have less appetite for risk, then you should choose investments that are generally safer in nature. However, these investments typically have lower returns as well. If you choose high risk investments, you might see a great return on those funds, but you could also lose a lot of money as well. You should generally attempt to diversify your portfolio and invest in a combination of low risk and higher risk items. This will balance the potential for higher returns with more stable investments that are not as likely to lose value.

You May Like: How To Avoid Penalty On 401k Withdrawal

How Do I Open A Solo 401

You can open a solo 401 through most financial institutions and online brokers. You just need your employer identification number to apply. Youd most likely need to sign a plan adoption agreement and fill out an application.

Moving forward, a solo 401 works like most retirement plans. You can build a diversified portfolio with a variety of funds like stocks, bonds and mutual funds. But you must fill out IRS form 5500-SF if your plan has more than $250,000.

Islamic Ruling On 401k Roth Ira & Rrsp Investing

We did some research on this topic and sourced information from the experts. Staring off with Mufti Muhammad Ibn Muneer. He completed his masters in Hadith from the university of Madinah to pursue his islamic education. Mufti completed his masters in Hadith and is currently pursuing his PhD .

He states that 90% of the time, the money people contribute to their 401K, ends up being invested in haram stocks or companies that they might not know about. The lack of knowledge on where the contributions are going makes it too risky and most likely haram .

Investing in companies in the following industries are known to be haram and are known to be non permissible for muslims :

- Alcohol

- Music, cinema or broadcasting

- Highly leveraged businesses

He makes a compelling point that some employees working at specific companies are able to ask about the stocks and mutual funds and request that it be invested in more halal-friendly companies .

Interest is another point he makes, if the contributions you make end up making you more money but from interest , then that is considered haram.

Heres what he had to say:

Recommended Reading: Is Fidelity A 401k Plan Administrator

If Your 401 Investment Choices Stink

If you have a good mix of mutual funds in your 401, or even some target date funds and low-fee index funds, your plan is probably fine. But, some plans have very limited investment options, or are so confusing that people cant make a decision and end up in the default investmenta low interest money market fund.

If this is the case, you might want to limit your contributions to the amount needed to get your full employer match and put the rest in an IRA.

What To Do If You Are Self

In some cases you might be in a situation where you do not even have access to an employer-sponsored 401 at all. If you are a business owner, freelancer, contractor or other self-employed individual, then you should go ahead and open a solo 401 account. As long as your business has no other employees, then you can open this account and begin making contributions. Going this route will maximize the amount of money that you are allowed to put away. Since you are both the employer and employee, you can contribute all the way up to $58,000 into your 401 when you take into account the employer contributions as well. You will also get a big break when it is time to file your tax return as well because your contributions are tax deferred and will not be considered taxable income in the current year.

Once you have maxed out your solo 401, then you should go ahead and open an IRA. It is likely that you will be unable to deduct your contributions if you make enough money to max out your 401, but your investments in the account still grow tax-free. You can also avoid the tax penalty by waiting until age 59 1/2 to withdraw money from the account.

Read Also: Can I Transfer Money From 401k To Ira

How Much Should I Invest In A Roth 401

We recommend investing 15% of your income into retirement savings. If you have a Roth 401 at work with good mutual fund options, you can invest your entire 15% there. Lets say you make $60,000 a year. That means you would invest $750 a month in your Roth account. See? Investing for the future is easier than you thought!

You May Like: How To Access An Old 401k Account

See Gold Retireds Top

That will be only for this article in which we have discussed the difference between a 401 and an IRA is. I hope you found it helpful, and that with the information presented here, you will be in a better position to make a more informed decision about which option you will rely on as you plan for your retirement years. Let me know if you have any questions about this topic, and whether you need any help to decide whether a self-directed IRA is the best option for you.

I wish you well,

You May Like: How Do I Get My 401k

You Have Just 4 Days To Apply For Latest Stimulus Checks See How You Can Get Cash

Meanwhile, there is no matching under an IRA since its not an employer-sponsored plan.

IRAs also come with stricter contribution limits per year. The most individuals under 50 can contribute to their IRAs per year is $6,000, whereas the maximum is $19,500 for 401ks.

Knowing that now, it must seem like a 401k is a drastically better plan. Yet an IRA does beat a 401k plan in a couple of areas.

Logan Murray, financial planner and tax preparer at Pocket Project, notes that IRAs hold an advantage over 401ks when it comes to fees and the ability to trade in the entire public investment universe.

The plan may have very limited, or very expensive options which would make the IRA more appealing, he said.

401s typically have fees for using the account, whereas IRAs do not.

For example, you may only get to choose from 20 investments under a 401k.

Typically, there arent restrictions to where you can invest under an IRA. And under an IRA, you can pick any brokerage that you want.

Simple Ira Vs 401 Plans

Choosing the right retirement plan for your employees is an important decision, and requires thorough research. To evaluate different options, such as SIMPLE IRA vs. 401 plans, here are some key preliminary questions to ask:

- Who and what type of employees are you trying to benefit?

- What benefits do you want to offer the selected group of employees?

- What benefits administration costs are you able to pay?

- Will you provide these benefits to part-time employees?

Once you’ve answered these questions, it’s time to investigate the different retirement plan choices.

Don’t Miss: Who Can Open An Individual 401k

Simple Retirement Plans For Small Businesses

Savings Incentive Match Plan for Employees plans are designed for businesses with 100 employees or fewer who earn $5,000 or more per year. A SIMPLE plan can apply for both 401 and IRA plans. SIMPLE plans are easy to set up, with lower initial and ongoing costs than other retirement savings options, but they don’t offer all the features found in a traditional employer-sponsored 401.

How Does An Ira Work

An Individual Retirement Account is a financial institution account that allows a person to save for retirement with tax-free or tax-deferred growth. Each of the three primary types of IRAs has its own set of benefits:

- Traditional IRA You contribute money that you might be able to deduct on your taxes, and any earnings grow tax-deferred until you withdraw them in retirement. 1 Many retirees find themselves in a lower tax band than they were prior to retirement, therefore the money may be taxed at a lower rate due to the tax deferral.

- Roth IRA You contribute money that has already been taxed , and your money could possibly grow tax-free, with tax-free withdrawals in retirement, if certain conditions are met.

- 2

- Rollover IRA You put money into this traditional IRA that has been rolled over from a qualifying retirement plan. Rollovers are the transfer of qualified assets from an employer-sponsored plan, such as a 401 or 403, to an individual retirement account .

Whether you choose a regular or Roth IRA, the tax advantages allow your investments to compound faster than they would in a taxed account. Calculate the difference between a Roth and a Traditional IRA using our Roth vs. Traditional IRA Calculator.

Don’t Miss: How To Close Out Your 401k

What Is An Ira

An IRA is another way to save and invest for your retirement, but it’s something you can do on your own instead through an employer. You would open an IRA for yourself at a bank, credit union, investment firm, broker or through a mutual fund provider. The different types of IRAs are as follows.

- Traditional: You can save pretax earnings and, as long as you qualify, those contributions will reduce your taxable income. So if your salary is $40,000 and you save $5,000, your taxable income will be $35,000. Your contributions are instead taxable only when you begin to withdraw the funds.

- Roth: With this IRA, you contribute after-tax earnings. Your contributions and the money they make are not treated as income when they’re withdrawn, so will not be subject to income tax.

- Spousal: You can open a separate traditional or Roth IRA so a working spouse can make contributions in the name of a non-working spouse. This way, both partners will have their own retirement account to tap into when the need arises.

- Rollover: When you switch employers, you can transfer the money in a 401 plan to a rollover IRA. While you may be able to remain with your employer’s plan, the rollover IRA can reduce fees and provide you with greater control over your investments.

Smaller companies that don’t offer 401 plans have special IRAs available to them:

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

Recommended Reading: How To Increase 401k Contribution Fidelity

The Takeaway: Solo 401 Vs Sep Ira

If youre deciding between a solo 401 and a SEP IRA, and you have employees, the choice is easy: SEP IRA. You cant open a solo 401 plan if you have an employee other than your spouse.

But if youre self-employed with no employees, the choice depends on how much you plan to save. If you cant put away more than $6,000, you should go with the SEP IRA until you can afford to save more. If you dont want to defer taxes, you may want to open a solo Roth 401 or a Roth IRA, depending on how much you can save.

Difference Between Roth Ira And 401k

Here are the differences between a Roth IRA and a 401K

Reminder: We are not investing professionals and we recommend you to do your research and seek advice from financial experts.

Don’t Miss: How To Cancel My Fidelity 401k

Will Roth Iras Go Away

Thats wonderful for tax folks like myself, said Rob Cordasco, CPA and founder of Cordasco & Company. Theres nothing nefarious or criminal about that thats how the law works.

While these tactics are lawful, they are attracting criticism since they are perceived to allow the wealthiest taxpayers to build their holdings essentially tax-free. Thiel, interestingly, did not use the backdoor Roth IRA conversion. Instead, he could form a Roth IRA since he made less than $74,000 the year he opened his Roth IRA, which was below the income criteria at the time, according to ProPublica.

However, he utilized his Roth IRA to purchase stock in his firm, PayPal, which was not yet publicly traded. According to ProPublica, Thiel paid $0.001 per share for 1.7 million shares, a sweetheart deal. In a year, his Roth IRA increased in value from $1,700 to over $4,000.