What Are Rocket Dollars Fees

Each account carries a $360 setup fee, plus a $15/month maintenance fee. Depending on your balance, this can be an incredible deal. Any other fees you incur are on top of these fees charged by Rocket Dollar.

Rocket Dollar also has RocketDollar Gold, which allows an expedited funding option with a $600 fee and is $30/month. This is really for people who need to close a deal very quickly and want support.

These fees are more expensive than the free solo 401k plans offered by the major brokerage firms. However, by going this route, you get the ability to control and invest in so much more.

How Do They Compare

Rocket Dollar isn’t the only company in this space, but honestly, there aren’t many. If you’re looking for a Solo 401k or a Self-Directed IRA, you’re going to be looking at just a few companies to help.

Make sure you check out our full comparisons here: Best Self Directed IRA Providers and Best Solo 401k Providers.

Here’s how Rocket Dollar compares:

| Header |

|---|

Youre Our First Priorityevery Time

NerdWallet, Inc. is an independent publisher and comparison service, not an investment advisor. Its articles, interactive tools and other content are provided to you for free, as self-help tools and for informational purposes only. They are not intended to provide investment advice. NerdWallet does not and cannot guarantee the accuracy or applicability of any information in regard to your individual circumstances. Examples are hypothetical, and we encourage you to seek personalized advice from qualified professionals regarding specific investment issues. Our estimates are based on past market performance, and past performance is not a guarantee of future performance.

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Also Check: Where To Deduct Solo 401k Contribution

Loans From A Solo 401k

One potential advantage of a solo 401k is that they often allow you to borrow from the account. This can be helpful in the event of an unexpected cost.

You are allowed to borrow up to $50,000 from a 401k or 50% of your balance, whichever is less. Loans must be paid back with interest within five years.

Interest rates can vary depending on the administrator. They are usually a percentage point or two higher than the prime rate. Currently, this rate is about 3.25%.

Not all brokers allow for solo 401k loans. Be sure to check the fine print when researching plans.

Taking out a loan from your 401k should only be done when its absolutely necessary. Whenever you take money from an account , you could reduce the amount you will accumulate over time.

Generally speaking, youll earn more in the long run if you leave the funds alone.

What Is A High Fee For 401k

There are no fees. 401s should have a minimum contribution of 50%. Anything over 1% is getting into a territory that is more beneficial to the plan manager than the savers than the plan manager than the savers than the plan manager than the savers than Added to that, you’re probably going to save money on the fees if you get matched contributions from your employer.

Also Check: How To Find Out If You Have 401k Money

This Works Great For Solo 401k Owners

Even though many companies don’t allow in-service distributions and after-tax contributions, for solopreneurs that have a solo 401k, this can be a great option to maximize your Roth money.

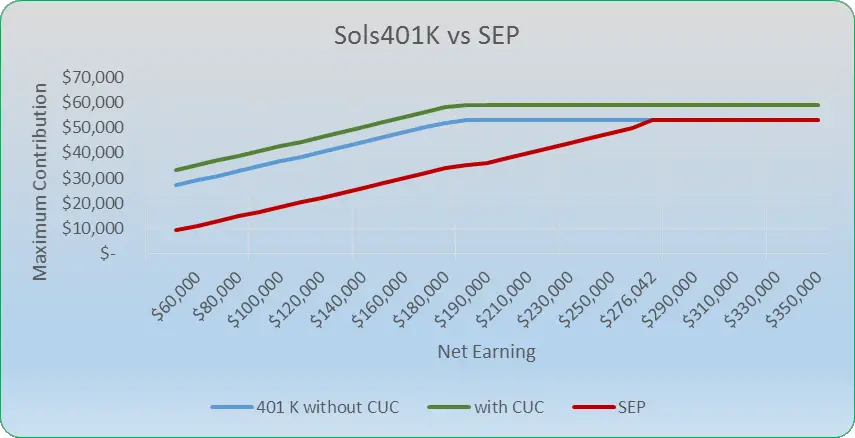

With a solo 401k, you can only contribute roughly 25% of your pre-tax income to your 401k plan. For many business owners, this may not hit the limit of $61,000 . However, since you’re the keeper of your own plan, you can ensure that your plan allows after-tax contributions AND in-service withdrawals.

So, let’s say you can only contribute:

- $20,500 in elective contributions

- $20,500 in profit sharing contributions

That only adds up to $41,000 in contributions. You could theoretically contribute another $20,000 in after tax contributions to your solo 401k, which you could then roll over as a mega-backdoor Roth IRA. That’s huge!

The trick here is to create a plan that allows this. You cannot do these plans at any of the “free” solo 401k providers.

Take a look at the following as they should allow it if you ask for it to be created as part of your plan:

- RocketDollar – Create a self-directed solo-401k with checkbook control. Read our RocketDollar Review.

- My Solo 401k – They can create a custom plan for $550 plus an annual fee of $125. Read our MySolo401k Review.

Contribution Limits In A One

The business owner wears two hats in a 401 plan: employee and employer. Contributions can be made to the plan in both capacities. The owner can contribute both:

- Elective deferrals up to 100% of compensation up to the annual contribution limit:

- $20,500 in 2022 , or $27,000 in 2022 if age 50 or over plus

If youve exceeded the limit for elective deferrals in your 401 plan, find out how to correct this mistake.

Total contributions to a participants account, not counting catch-up contributions for those age 50 and over, cannot exceed $61,000 for 2022 .

Example: Ben, age 51, earned $50,000 in W-2 wages from his S Corporation in 2020. He deferred $19,500 in regular elective deferrals plus $6,500 in catch-up contributions to the 401 plan. His business contributed 25% of his compensation to the plan, $12,500. Total contributions to the plan for 2020 were $38,500. This is the maximum that can be contributed to the plan for Ben for 2019.

A business owner who is also employed by a second company and participating in its 401 plan should bear in mind that his limits on elective deferrals are by person, not by plan. He must consider the limit for all elective deferrals he makes during a year.

Read Also: Can I Sign Up For 401k Anytime

Is A Solo 401k Worth It

The flexibility around solo 401 contributions, investment options, and relatively low management requirements makes the plan an attractive alternative for small business owners or sole proprietors who want to save for retirement proactively.

Both the salary deferral and the income-sharing contributions are optional and can be adjusted at any time. You could contribute to your solo 401 using either method or not contribute at all in a given year based on the fluctuating profitability of your business.

Contributions to your solo 401 also allow you to leverage other tax incentives that could amount to significant savings in the long run.

How Much Does A 401 Cost

401 Fees and Why the Cost Is Worth It

In recent years, a lot of media attention has been focused on 401 cost and the fees business owners and their employees are paying for 401 investments and recordkeeping services and for good reason.

Differences in fees as small as 0.1% per year can lower your account balance by thousands of dollars by the time you retire.

Fee example: Assume an employee with 35 years until retirement has a current 401 account balance of $25,000 and earns an average investment return of 7% per year until retirement. Without any additional contributions, here is how 401 fees could affect the account balance at retirement.

Total 401 Fees

Department of Labor, A Look at 401 Plan Fees

Also Check: How To Locate Lost 401k

What Do They Offer

MySolo401k offers self-administered solo 401k plans as well 401k Business Financing and IRA LLCs. In today’s article, we’ll reviewing its self-directed 401k plans.

Self-administered 401ks are different from fully-administered or brokerage Solo 401k plans. Fully-administered plans are offered by Schwab, Vanguard, Fidelity, and many other brokerages. And many of these plans are FREE.If fully-administered solo 401k plans are often free, why would someone go with MySolo401k? To answer that question, lets first go over what a solo 401k is.

Where Can I Find My Fidelity 401k Fees

Whether due to my own ineptitude, or through deliberate camouflaging on Fidelitys part, I could not for the life of me figure out what these additional fees were. The info that I sought is information that your 401 provider must supply youyet I could not locate and account for these mysterious fees. A few days after giving up on Fidelitys website, I happened to receive an email with Fidelitys annual prospectus disclosure and viola, a CTRL F later and I finally uncovered the fees that were eating up nearly one percent of my account on an annual basis. You can find this required disclosure information under the Plan Information and Documents tab on your account.

Assuming Im not the only one who sucks at navigating an unfamiliar financial services website, I wanted to spell out those fees in somewhat plain English. For those who dont have a 401k plan through Fidelity, this information should still prove somewhat valuable, as it allows you to compare the fees in your own plan to another provider. I had a next-to-impossible time finding my own 401k providers fees, never mind search for those of competing plans.

Now, lets take a look at the Fidelity 401k fees that Im paying.

Recommended Reading: Who Has The Best 401k Match

Who Should Get A Solo 401

Solo 401 plans are best for business owners who want the most flexibility in how they save for retirement. Before signing up for a Solo 401, you may also want to consider a SEP IRA or SIMPLE IRA as well.

Solo 401 plans take more paperwork to get started but offer more flexibility in what you are able to contribute. For example, SEP plans only accept employer contributions, while a solo 401 takes contributions from either the employee or employer. SIMPLE IRAs are available to businesses with up to 100 employees. SEP IRAs dont have that limit.

Best Solo 401 Providers For 2022

Tom has 15 years of experience helping small businesses evaluate financing options. He shares this expertise in Fit Small Businesss financing content.

A Solo 401 plan allows small business owners to save up to $58,000 per year for retirement through tax-free salary deferrals and company contributions. Choosing the right provider is an important part of successfully using a Solo 401. From a regulatory standpoint, Solo 401 plans are very similar to traditional 401 plans. However, those using Solo 401s will have different goals and objectives for investing and thus will need to decide on a provider a bit differently than they would with other plans.

Weve reviewed many Solo 401 options based on costs, investment choices, customer service, and other features. Here are the six best Solo 401 providers.

| Provider |

|---|

Recommended Reading: How To Close Your 401k Early

Other Financial Benefits Of A Solo 401

The solo 401 can be an excellent choice for those with a side gig as well, especially if theyre already able to live comfortably on their main salary. With the solo 401 you can go above the usual limits of a 401.

While you may contribute to multiple 401 accounts, your total employee contribution to all types of 401s may not exceed the annual maximum contribution, that is, $19,500 in 2020 and 2021.

But the solo 401 can be valuable even if you already have a 401 plan and even if youve maxed out that other plan for a given year. Thats because you can still make an employer contribution, allowing you to exceed the smaller employee-only contribution amount. So the solo 401 allows you to save more with the employer contribution, reducing your business taxes.

Another benefit of the solo 401 is that it doesnt prevent you from taking advantage of other retirement plans such as the IRA. You can still contribute up to the annual maximum there. If youre an individual looking to set up a traditional IRA or Roth IRA, then youll want to look at the benefits of those plans.

Like the typical 401 plan, the solo 401 also allows you to take out a loan against your account. loan.)

While I generally encourage clients to avoid that strategy, it can come in handy at times, Conroy says.

What Are The Average Fees For A 401k

The average expense ratio for a 401 plan is one. A third of assets are invested in plans, plus any fees employers are charged for account maintenance. Fees from mutual funds and service providers are included in this calculation. While you can’t do much to reduce the provider’s fees as an employee, you can select low-cost funds for your plan.

Don’t Miss: How To Find My Fidelity 401k Account Number

Alternatives To A Solo 401

If you arent sure if a Solo 401 plan is right for you, you may want to consider a different type of retirement benefit account. Simplified employee pension individual retirement accounts and traditional IRAs both offer some tax benefits and, as IRAs, they avoid the administrative costs that can come with some 401 plans.

Best For Active Traders: Td Ameritrade

TD Ameritrade

Most retirement-focused investors would do well to stick with a passive investment style. However, if youre into active investing, TD Ameritrade offers industry-leading platform options and tools.

-

Choose between multiple web, mobile, and desktop platforms

-

Access the advanced thinkorswim trading platform with no added costs

-

Roth contributions and 401 loans are supported

-

Accounts will move to Charles Schwab in the future

-

Advanced platforms may be overwhelming for newer traders

TD Ameritrade is another renowned discount brokerage and our choice as best for active traders. It offers an individual 401 account with no recurring fees and commission-free stock and ETF trades. Its solo 401 also supports Roth contributions and 401 loans, although you might want to check with the company if loans are still available. Its standout feature for active traders, though, is the thinkorswim active trading platform, which is available on desktop, mobile, and the web.

Before diving into other details, its important to note that this brokerage has been acquired by Charles Schwab. TD Ameritrade accounts will become Schwab accounts at some point in the future. However, as you can see from its review on this list, were fans of Schwab as well and look forward to seeing the combined capabilities once the integration is complete.

Read our full TD Ameritrade review.

Don’t Miss: How Do I Cash Out My 401k With Fidelity

Charles Schwab: Best For Additional Banking Services

|

Investment Options: |

| Visit Charles Schwab |

Why We Like Charles Schwab: Charles Schwab offers a Solo 401 thats ideal for small business owners who need additional brokerage or banking services. Charles Schwab offers clients a full array of services ranging from investment advice to consumer banking as well as several lending options for its customers.

Charles Schwab doesnt offer an active administration service and, like many larger investment firms, only provides participants with pertinent tax information on an annual basis.

Benefits Of A Solo 401

One advantage of a solo 401 is the opportunity to choose the type of plan and the investment options that work best for you. Traditionally employed workers are limited to what their company offers, which might not be what’s best for their money. When you’re the boss, you select how you’re going to invest your funds based on your risk tolerance. You also get to decide which type of 401 provides you with the best tax advantages.

Solo 401s come in two varieties: traditional and Roth. Traditional solo 401s are tax-deferred. You make contributions with pre-tax dollars, and these reduce your taxable income for the year. But then you must pay taxes on your solo 401 distributions in retirement. It’s a smart play for those who think they’re earning more money right now than they’ll be spending annually in retirement. Delaying taxes until your income is lower will help you hold on to more of your hard-earned money.

Roth solo 401s work the other way. You pay taxes on your contributions this year, but the money grows tax-free afterward. When you withdraw the funds in retirement, you get to keep it all for yourself. This is a better choice for those who think they’re earning about the same as or less than what they expect to spend annually in retirement. In this case, paying taxes now will cost you a smaller percentage of your income than waiting.

Recommended Reading: How Does 401k Work At Retirement

Do You Qualify For A Solo 401k

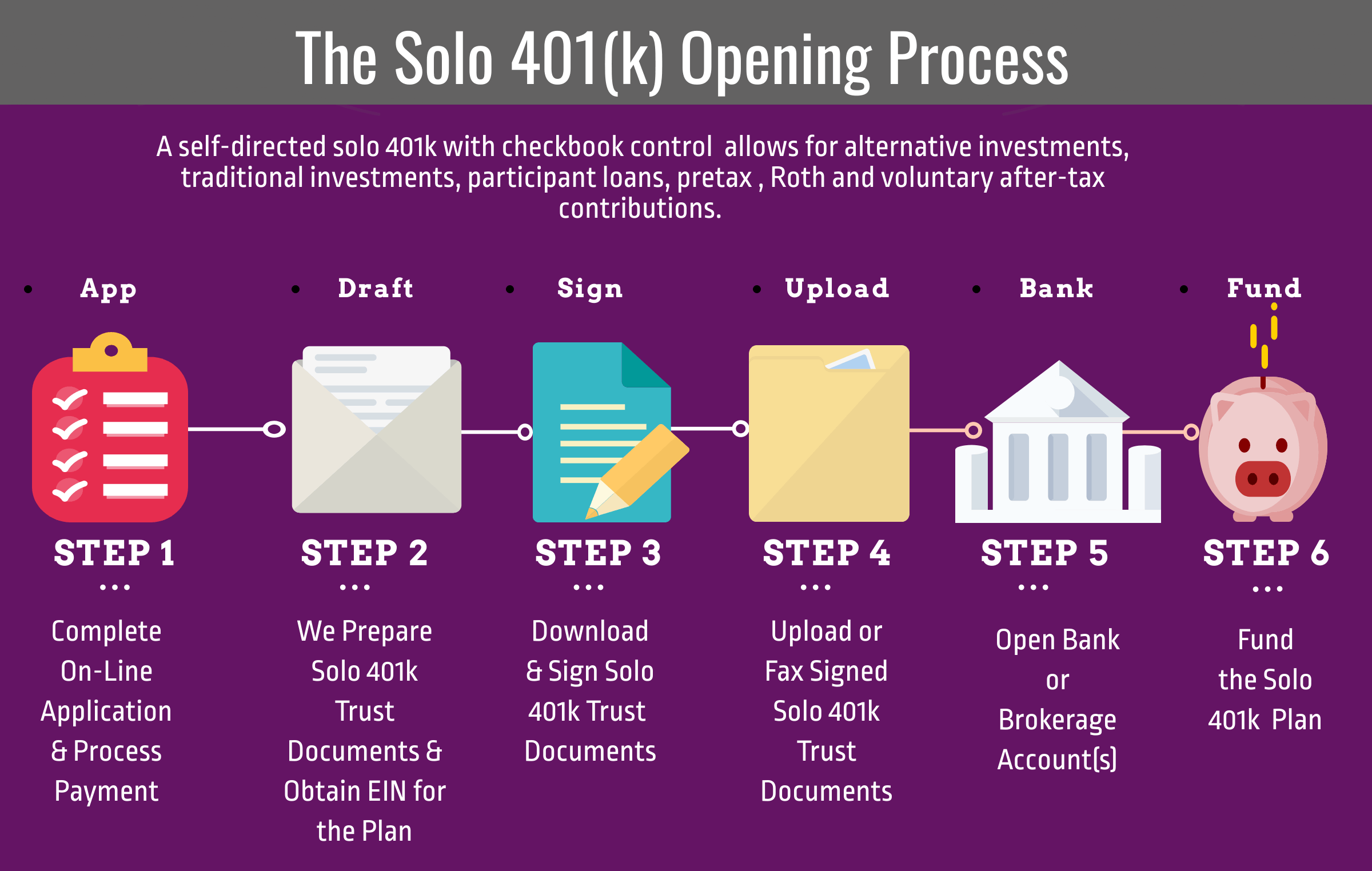

Solo 401 Account: Opening Solo 401 Next Steps: The Solo 401 is an Employee Benefit Plan that is exclusively for business owners that have no full-time employees besides themselves and a spouse. The Plan is adopted by a company, not an individual, that has earned ordinary income from the sale of goods or services.

Step 1: Select the plan that works best for you

Full Service $995

- Includes 60-minute consultation with a KKOS Associate Attorney

- Plan Set-Up with IRS Approved Documents and Plan EIN

- How-to Plan Binder

- Includes Plan Set-Up with IRS Approved Documents and Plan EIN

- How-to Plan Binder

- Includes Plan Set-Up with IRS Approved Documents and Plan EIN

- How-to Plan Binder

Step 2: Select your annual account

Custodial Account Option$350 for 1 account, $250 for eachadditional/annually

- Receipt of IRS Plan Amendments so that your Plan stays in compliance with the IRS and the DOL

- Directed Trust Company will handle your record keeping and the IRS Filings

- You can obtain checkbook control via a Trust Checking Account or investment Entity

Annual Compliance Plan $150/annually

- Receipt of IRS Plan Amendments so that your Plan stays in compliance with the IRS and the DOL

- Immediate checkbook control via a Trust Account at a bank of your choice

- You will be responsible for your own record keeping and IRS Filings