Self Directed 401 Plans Explained

A self-directed 401 lets you invest as you see fit. You can choose your own mutual funds, stocks and bonds rather than sticking to the pre-made funds typically associated with a 401. You can even invest in more unconventional assets like real estate and commodities if your employer allows it. The types of investments you can choose include:

- Real estate

- Tax liens

- Equipment leasing

- Foreign currency

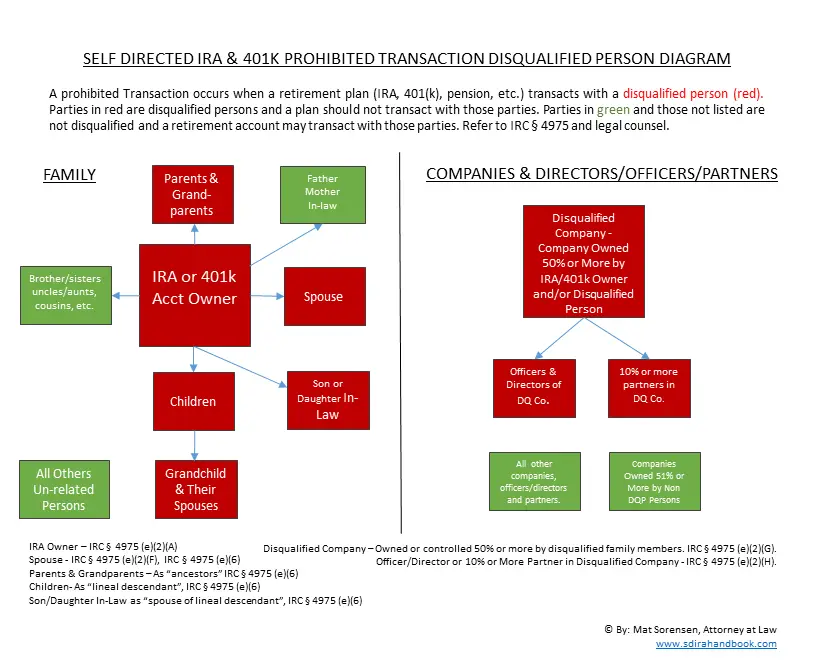

While self-directed 401 plans offer a much wider range of choices and greater flexibility, there are some limits on what you can invest in. For instance, you cant hold collectibles, like artwork or antiques, or insurance in one. There are also certain prohibited transactions, which we describe in greater detail below.

How To Utilize And Capitalize On Self

Since the virtual disappearance of the defined benefit pension, many employers have offered employees 401 plans, which are defined contribution plans. Under 401s, employees can contribute a certain portion of their wages on a pretax basis and invest those funds. In many cases, the employer will match these funds.

The plan provider has chosen a menu of investments for the participant to choose from, but the latest development in this plan is the arrival of the self-directed brokerage 401 account as an investment option . This kind of account can offer exciting new opportunities to plan participants, but it also increases the risk to the investor, so it is crucial to understand the plan to enable the most success.

Administering A Solo 401 Plan

Once your Solo 401 plan exceeds $250,000 in assets at the end of the year, the IRS requires you file an annual Form 5500 EZ. Or if you ever terminate the plan, you must also file a Form 5500 EZ.

Unlike Traditional 401 plans, there are no compliance testing requirements to ensure Solo 401 plans do not favor highly compensated employees and are non-discriminatory, as long as you have no employees participating in the plan.

These plans can be called Self-Directed 401, Individual 401, Individual Roth 401, Self-Employed 401, Personal 401 or One-Participant 401 depending upon the vendor offering the plan services.

You May Like: How Do I Get My 401k When I Retire

You Already Have Access To Investment Management

An increasing number of retirement plan sponsors offer professional investment management. Target date retirement funds provide hands-off investing with professional management and asset allocation. These increasingly popular mutual funds provide instant diversification with portfolios to gradually become more conservative as investors approach their targeted retirement date. However, the self-directed brokerage can open this diversified fund alternative if your retirement plan does not provide access to target-date funds.

No Investment Benefit Beyond Asset Returns

Self-directed 401 plan holders cannot earn extra funds through transactions linked to plan assets. For example, a plan holder can buy a real estate property under 401 plan rules but he or she cannot charge any management fees nor receive any commissions from the sale of that property.

Basically, a self-directed 401 plan participant cannot invest in any asset category that leads to that plan participant garnering a financial benefit that goes beyond the investment appreciation of that asset. That means not using 401 funds to purchase a personal residence or investing in assets like investments of collectibles (i.e. vehicles, paintings or jewelry or real estate properties that the plan participant personally uses.

Read Also: Which 401k Investment Option Is Best

What Are The Additional Risks Of An Sdba

The main risk is also the main benefit: The employee has more freedom and more investments to choose from, and fewer restrictions to trading. This can lead to emotional investing, not following prudent portfolio management techniques and not monitoring the investments closely. Someone could, for instance, put all of their 401 into a single stock or small basket of highly volatile stocks. They can attempt to time the market by making frequent trades and get whipsawed trying to do so. There is nothing there to protect them from themselves.

Perform Due Diligence On Investments

Once you decide on the sectors youd like to invest in, its time to perform due diligence. To do so, youll want to review all relevant materials such as financial records and performance. Looking into a potential investments liquidity ratio is a great start. Here are additional steps you should take:

Doing your due diligence will give you a better gauge on the return on investment of your self-directed IRA.

Don’t Miss: How To Pull Money Out Of My 401k

Types Of Solo 401k Contributions And Distribution Regulations

Here are the lists of rules that need to e followed in different cases-

Employee Contributions: the distribution of any salary deferrals is subject to certain conditions. These include the ending of the employment period, disability or death of the employee. The rules do not allow any distribution made previously to the occurrence of these conditions. However, in case of sufferings, the Solo 401k provides an in-commission distribution of such amounts. These apply to people who are 59 ½ or more.

Employer offerings: there are much stricter rules when it comes to handling employer offerings. The distributed amounts depend on certain Solo 401k participants conditions. These include the discontinuation of the employment, death, and disability. The withdrawal of the employers contributions can depend on the important factors stated below:-

- Getting to the age of 59 ½

- Suffering from a hardship such as lack of money.

- The withdrawn offerings have been collected in the Solo 401k plan for a minimum of two years

- The contributors have taken part in the Solo 401k plan for at least five years.

Post-tax and Rollover offerings: after filling out the whole distribution form, the Solo 401k plan contributor can withdraw any time. This can also happen if any percentage of the contributors account balance is as a result of post-tax and rollover offerings.

Solo 401k Contribution Calculator

If you are in doubt about how much you can contribute as both an employee and an employer in your Solo 401k plan, a great place to start is by using this handy contribution calculator. Make sure to select your business type from the drop down menu, either unincorporated or a single owner corporation. For the unincorporated sole proprietorship you would enter your net income after deductions. For a single owner corporation you would enter your W2 wages paid from the corporation. Of course enter your age and then hit calculate.

If you want you can also view the report that will break down your contributions into both employee and employer. Remember to always work with your tax professional to help you get your final numbers correct based on your businesses earnings.

You can also compare your Solo 401k contribution limits relative to other small business retirement plans like a Simple IRA, Sep IRA and Profit Sharing Plan. For any given self employment income, the Solo 401k allows for higher tax deductible contributions.

Read Also: What Is Max Amount You Can Put In 401k

What Are The Disadvantages Of A Self

Self-directed 401 plans have a few disadvantages.

-

These plans are expensive for employers to set up and monitor. The administrative costs of managing loans, early withdrawals, and other transactions require a great deal of costly oversight.

-

Since the employer chooses your investment options, you may not get a wide variety of choices, and you may be dissatisfied with the quality. If you dont have a range of index funds available, long-term management can be challenging.

-

The employer also sets the eligibility rules, so those who are part-time, new, or union members may be excluded, for example.

-

If you make a withdrawal from the plan before you are age 59 1/2, you may incur a 10% penalty, unless you retire in the calendar year you turn 55.

What Are My Investment Choices Now

Since 1980 when 401s first went into effect, 401s have generally been offered to employees with a limited palette of investment options. Most employers try to offer a variety of investment choices that are diversified, because they have to follow the rules and regulations under the Employee Retirement Income Security Act , but many plans come up short. The employee does not have input into these choices, so they can only make selections within the limited menu offered.

Also Check: Should I Roll My 401k Over To An Ira

Vs Ira: What You Need To Know

First, lets compare the differences between IRAs and 401s. To do so, we have to first distinguish between Roth IRAs and Traditional IRAs. Below, Ive provided the cliff notes for each:

Roth IRA

- All contributions are with after-tax dollars

- Penalty-free, tax-free withdrawals after age 59 ½

Traditional IRA

- All contributions are with pre-tax dollars

- Withdrawals after age 59 ½ are taxed as ordinary income

- 10% early contribution penalty if distributions are taken pre-retirement

In both cases, your investments grow tax-free in a sheltered savings account. However, their key distinction is that Roth IRAs consist of contributions that have already been taxed as regular income. Therefore, they wont be subject to taxation after one starts making withdrawals in their retirement. Withdrawals taken from Traditional IRAs are taxed as regular income at the time of withdrawal and are thus subject to ones marginal tax rate at that time.

In a nutshell, Roth IRAs are best suited for individuals who expect to be in a higher tax bracket when they start taking withdrawals in retirement .

A Traditional IRA, on the other hand, is the better option for those in higher tax brackets . Under this option, youre deferring high taxes today with the hope that you will be in a lower tax bracket in your retirement.

Why Work With Advanta Ira

Advanta IRA leads our industry with nearly two decades of experience and nearly $2 billion in client assets under management. We provide world-class service with a personal touch that you wont find anywhere else. You work with a dedicated account manager who assists you with all of your needs and ensures your account records comply with IRS regulations. Contact us for more information or to open your solo 401 today.

Also Check: How To Find Out What You Have In Your 401k

Have Your Custodian Complete The Transaction

The final step is to ask your custodian or trustee to finish the remaining tasks for the transaction. This usually involves deciding whether to settle the trade, which is a process that entails giving cash to the seller and transferring securities to the buyer.

From there, your custodian is responsible for safeguarding your assets and tracking any changes in your account.

To Mail Contributions To Fidelity

Fidelity InvestmentsCincinnati, OH 45277-0003

Recommended Reading: How Do I Open A 401k

Fiduciary Responsibilities For A Plan With Self

Many small self-directed retirement plans provide each participant with his/her own self-directed brokerage account rather than a platform of funds from which to choose. The approach is particularly popular in small professional practices. This article addresses the specific issues that apply to a plan that provides the SDBA as the only investment option.

Brokerage Windows: Do The Risks Outweigh The Rewards

More 401k and 403b plan sponsors are offering an investment option called a brokerage window. However, more choice isn’t always better when it comes to the investment menu. And some sponsors have the misconception that offering a brokerage window relieves some of their fiduciary responsibilities. That is not the case, while the Department of Labor does not prohibit the use of brokerage windows in retirement plans, it has shown increased interest in them in recent years.

Recommended Reading: Can I Roll Part Of My 401k To An Ira

Some Important Things To Remember

- You are the IRA owner

- Your IRA will own 100% of the LLC

- You do NOT own the LLC

These things may seem self-evident, but it is easy to get confused about these issues and confusion leads to mistakes. The entire tax benefit depends on these facts.

Now, please remember the following: For single member LLCs, such as your tax deferred plan, the Operating Agreement is of little practical use. It is only an agreement with yourself, which means you can change it at any time for any or no reason. In fact, in Wyoming, you are not required to have one. The bottom line is: It is not what you say, but what you do, that is important.

For example: You could include a line item in your Operating Agreement that states you will not engage in any prohibited transactions however, if you are found to have dealings with a disqualified individual, you will still be in trouble, regardless of what you wrote in the Operating Agreement. In fact, it may even go worse for you because the Operating Agreement will demonstrate that you were aware of the infraction beforehand.

Fiduciary Obligations With Respect To A Brokerage Window

This article reviews two recent cases that considered claims by participants in 401k participant-directed investment plans that plan fiduciaries failed to prudently monitor investments in what fiduciaries claimed were brokerage windows or “similar plan arrangements.” The article starts with a summary of what we know and what we donât know about the legal status of brokerage windows and similar plan arrangements.

Compared to their older counterparts, Millennials who invest through self-directed brokerage accounts may be investing more conservatively than they should be at that age, based on the results of an industry-leading benchmarking report.

Recommended Reading: How To Do A 401k Rollover

S For A Physician To Use A Retirement Account To Fund A Real Estate Deal

- Step 1: Open a Self-Directed Retirement Account

- The first step is to consolidate one or more of your multiple traditional retirement accounts into a self-directed retirement account. Your traditional retirement account are held by a custodian. Contact that custodian and tell them your plan for opening rolling over a traditional account into a self-directed account. Not all custodians offer self-directed retirement accounts. In that case, do some research and/or consult your account to get referrals for custodian that offer self-directed retirement accounts. After that, roll over your funds into your new self-directed retirement account. There are many types of self-directed retirement accounts. Self-directed IRAs and Solo 401k retirement plans are quite popular among investors planning to invest in alternative assets such as real estate, precious metals, or other digital assets.

Self-Directed IRA or Solo 401k Plan

You can choose between a self-directed IRA and a Solo 401k plan. Here is a brief comparison of these retirement accounts.

| Features |

| Yes |

To open a Solo 401k account, you must have some self-employment activity going on at the time of opening the account. What this means is, you need to be the owner of a small business, and be receiving a W-2 from your business to be able to contribute to solo 401k

Note: The income you make on self-directed IRA is subject to Unrelated Business Income Tax rates are similar to corporate tax

Invest In Cars Question:

A Solo 401k may passively invest in permissible investments but cant own & operate a business, including buying & refurbishing motor vehicles. You could borrow through a solo 401k participant loan up to 50% of the balance of your account and then use those funds however you wish including buying & refurbishing motor vehicles.

Don’t Miss: How Can I Get My 401k Money Without Penalty

How Everyone Can Save For Retirement When A 401k Isnt Offered At Work

Are you one of the millions of workers without a retirement plan at work? Or perhaps youre self-employed and dont have an employer at all? In either case, its imperative that you take your retirement savings and investments into your own hands.

Employer retirement accounts are great, but many businesses dont take on the added expense of helping their employees prepare for the future. If you dont get a 401K at work, you can use these strategies and accounts to save for retirement on your own.

Traditional Ira Vs Roth Ira

Individual retirement accounts come in two flavors: traditional and Roth. The difference between a Roth IRA vs traditional IRA comes down to taxes and contributions.

Traditional IRAs allow for tax-deferred growth, with no capital gains taxes, just like a Roth IRA. And depending on your annual income and filing status, you might also be eligible for a tax deduction for your traditional IRA contributions. Withdrawals in retirement are taxed as regular income.

As noted above, money you contribute to a Roth IRA has already been taxed. In exchange, there are zero taxes on withdrawals made once youre at least 59 ½ and first funded a Roth account at least five years before.

As an additional benefit, you can take out contributions at any time. This feature makes the Roth IRA a good choice for anyone whod like to build up an emergency fund while also saving for retirement.

The final major difference between a traditional IRA and a Roth IRA comes down to eligibility. Anyone who earns income may open and fund a traditional IRA, but there are annual income limits restricting who can directly contribute to a Roth IRA. High earners can use a backdoor Roth IRA conversion to get their money into a Roth IRA, though you may owe some taxes when you convert.

Also Check: How Much Can You Contribute To 401k

Note Transaction With Spouses Solo 401k Question:

Unfortunately, it would still be prohibited for your solo 401K to lend funds to your spouses solo 401K. Unfortunately, there is no way around this rule. The IRS still views your wifes solo 401k as a disqualified party because the solo 401k is for her benefit. Also, the rules do not allow for a solo 401k to obtain a loan for investing in tax liens or notes. However, the solo 4o1k plan can obtain a non-recourse loan when investing in real estate.