To Keep Your Living Arrangements Intact

Being at risk of eviction or foreclosure is a serious emergency for you and your family, in which case using retirement funds can be a viable option. If your landlord or mortgage lender hasn’t provided any options or assistance during this difficult time, you may consider paying your rent or mortgage with this money.

Traditional Approach: Withdrawals From One Account At A Time

To help get a clearer picture of how this could work, lets take a look at a hypothetical example: Joe is 62 and single. He has $200,000 in taxable accounts, $250,000 in traditional 401 accounts and IRAs, and $50,000 in a Roth IRA. He receives $25,000 per year in Social Security and has a total after-tax income need of $60,000 per year. Lets assume a 5% annual return.

If Joe takes a traditional approach, withdrawing from one account at a time, starting with taxable, then traditional and finally Roth, his savings will last slightly more than 22 years and he will pay an estimated $69,000 in taxes throughout his retirement.

Withdrawing from one account at a time can produce a tax bump midway in retirement

Note that with the traditional approach, Joe hits an abrupt tax bump in year 8 where he pays over $5,000 in taxes for 11 years while paying nothing for the first 7 years and nothing when he starts to withdraw from his Roth account.

In this scenario, a proportional withdrawal strategy in retirement cuts taxes by almost 40%

Read Also: How To Take Out 401k Money For House

What Are The Penalty

The IRS permits withdrawals without a penalty for certain specific uses, including to cover college tuition and to pay the down payment on a first home. It terms these “exceptions,” but they also are exemptions from the penalty it imposes on most early withdrawals.

It also allows hardship withdrawals to cover an immediate and pressing need.

There is currently one more permissible hardship withdrawal, and that is for costs directly related to the COVID-19 pandemic.

You’ll still owe regular income taxes on the money withdrawn but you won’t get slapped with the 10% early withdrawal penalty.

Don’t Miss: How Much Can You Take Out Of Your 401k

Withdrawals From A 401

-

401 hardship withdrawals If you find yourself facing dire financial concerns and need cash urgently, your 401 plan may offer a hardship withdrawal option. Unlike a 401 loan, you wont have to repay the money you take out, but you will owe taxes and potentially a premature distribution penalty on the amount that you withdraw. In addition, IRS 401 hardship withdrawal rules state that you may not take out more money than what is needed to cover your hardship situation. In order to qualify for a 401 hardship withdrawal, your plan administrator must offer this option and you must be facing an immediate and heavy financial need. According to the IRS, approved 401 hardship withdrawal reasons include:

- Postsecondary tuition for you or your family

- Medical or funeral expenses for you or your family

- Certain costs related to buying, or repairing damage to, your primary residence

- Preventing your immediate eviction from or foreclosure of your primary residence

If you experience a financial hardship from a circumstance not on this list, you may still be able to qualify for a hardship withdrawal, so check with your plan administrator.

- In-service, non-hardship withdrawals

This type of withdrawal is only allowed under certain plans and is mainly used by those who would like to explore other investment options. Learn more about in-service distributions. An Ameriprise financial advisor can provide more detailed information on in-service 401 distributions.

Major Provisions Of The Secure Act

The SECURE Act tweaked a number of rules related to tax-advantaged retirement accounts. Here’s what it does:

- Makes it easier for small businesses to set up 401s by increasing the cap under which they can automatically enroll workers in safe harbor retirement plans from 10% of wages to 15%.

- Provides a maximum tax credit of $500 per year to employers who create a 401 or SIMPLE IRA plan with automatic enrollment.

- Enables businesses to sign up part-time employees who work either 1,000 hours throughout the year or have three consecutive years with 500 hours of service.

- Encourages plan sponsors to include annuities as an option in workplace plans by reducing their liability if the insurer cannot meet its financial obligations.

- Pushes back the age at which retirement plan participants need to take required minimum distributions from 70½ to 72.

- Allows the use of tax-advantaged 529 accounts for qualified student loan repayments .

- Permits penalty-free withdrawals of $5,000 from 401 accounts to defray the costs of having or adopting a child.

- Encourages employers to include more annuities in 401 plans by removing their fear of legal liability if the annuity provider fails to provide, and also not requiring them to choose the lowest-cost plan.

Recommended Reading: What’s A Good Percentage For 401k

Withdrawing Money From A : Taking Cash Out Early Can Be Costly

An unexpected job loss, illness or other emergencies can wreak havoc on family finances, so its understandable that people may immediately think about taking a withdrawal from their 401. Tread carefully as the decision may have long-range ramifications impacting your dreams of a comfortable retirement.

Taking a withdrawal from your traditional 401 should be your very last resort as any distributions prior to age 59 ½ will be taxed as income by the IRS, plus a 10 percent early withdrawal penalty to the IRS. This penalty was put into place to discourage people from dipping into their retirement accounts early.

Roth contribution withdrawals are generally tax- and penalty-free contribution and youre 59 ½ or older). This is because the dollars you contribute are after tax. Be careful here because the five-year rule supersedes the age 59 ½ rule that applies to traditional 401 distributions. If you didnt start contributing to a Roth until age 60, you would not be able to withdraw funds tax-free for five years, even though you are older than 59 ½.

Ira Rollover Bridge Loan

There is one final way to borrow from your 401k or IRA on a short-term basis. You can roll it over into a different IRA. You are allowed to do this once in a 12-month period. When you roll an account over, the money is not due into the new retirement account for 60 days. During that period, you can do whatever you want with the cash. However, if its not safely deposited in an IRA when time is up, the IRS will consider it an early distribution. You will be subject to penalties in the full amount. This is a risky move and is not generally recommended. However, if you want an interest-free bridge loan and are sure you can pay it back, its an option.

You May Like: How Can I Find Out Where My 401k Is

Impact On Student Debt

The SECURE Act also allows people to withdraw up to $10,000 during their lifetime from their 529 plans, tax-free, in order to pay off their student loan debt. Originally, 529 plans were strictly for post-secondary education expenses, but that has been expanded to include K-12 expenses.

Under the SECURE Act, 529 funds can be used to pay off college debt. That said, not all states may allow the student loan benefit to come out tax-free at the state level.

Understanding Early Withdrawal From A 401

Withdrawing money early from your 401 can carry serious financial penalties, so the decision should not be made lightly. It really should be a last resort.

Not every employer allows early 401 withdrawals, so the first thing you need to do is check with your human resources department to see if the option is available to you.

As of 2021, if you are under the age of 59½, a withdrawal from a 401 is subject to a 10% early withdrawal penalty. You will also be required to pay regular income taxes on the withdrawn funds.

For a $10,000 withdrawal, when all taxes and penalties are paid, you will only receive approximately $6,300.

Recommended Reading: How To Change A 401k To A Roth Ira

Disadvantages Of Closing Your 401k

Whether you should cash out your 401k before turning 59 ½ is another story. The biggest disadvantage is the penalty the IRS applies on early withdrawals.

First, you must pay an immediate 10% penalty on the amount withdrawn. Later, you must include the amount withdrawn as income when you file taxes. Even further down the road, there is severe damage on the long-term earning potential of your 401k account.

So, lets say at age 40, you have $50,000 in your 401k and decide you want to cash out $25,000 of it. For starters, the 10% early withdrawal penalty of $2,500 means you only get $22,500.

Later, the $25,000 is added to your taxable income for that year. If you were single and making $75,000, you would be in the 22% tax bracket. Add $25,000 to that and now youre being taxed on $100,000 income, which means youre in the 24% tax bracket. That means youre paying an extra $6,000 in taxes.

So, youre net for early withdrawal is just $16,500. In other words, it cost you $8,500 to withdraw $25,000.

Beyond that, you reduced the earning potential of your 401k account by $25,000. Measured over 25 years, the cost to your bottom line would be around $100,000. That is an even bigger disadvantage.

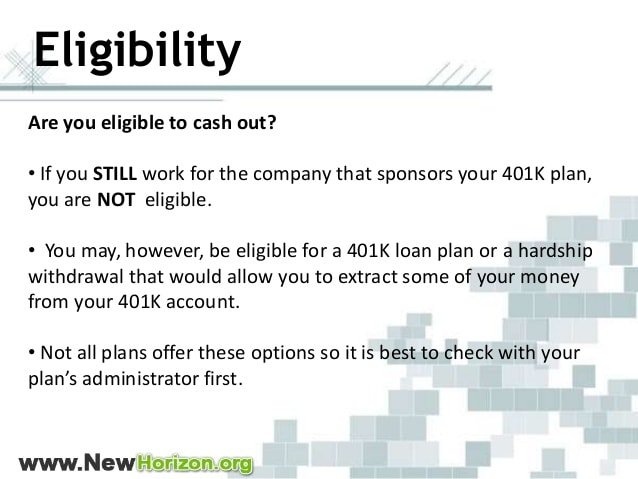

Eligibility And Procedures For Cash Withdrawals And Loans

Following is information on when you may qualify for a loan from your U-M retirement plans, when you may qualify for a cash withdrawal, and the procedures to request a loan or cash withdrawal.

-

Loans may be available from your retirement accounts as follows:

-

Basic Retirement Plan No loans are available at any time.

-

403 SRA You may borrow from your 403 SRA at any time, for any reason, regardless of whether your employment is active or terminated. However, loans are not available from TIAA once you have retired or terminated employment from U-M.

-

457 Deferred Compensation Plan You may borrow from your 457 Deferred Compensation Plan account at any time, for any reason, regardless of whether your employment is active or terminated. However, loans are not available from TIAA once you have retired or terminated employment from U-M.

To arrange for a 403 SRA or 457 Deferred Compensation Plan loan, contact TIAA or Fidelity and request a loan application. University authorization is not needed to take a loan.

Read Also: Can I Buy Individual Stocks In My 401k

Don’t Miss: Is There A Maximum You Can Contribute To A 401k

Rollover Money: An Easy Option

If youre still working and you cant get money out of your 401 with any of the techniques above, there might be another approach. If you ever made rollover contributions to your 401 into your existing 401, for example), you might be able to take those funds back out. You wont have access to your entire 401 account balance, but you might get a nice chunk of change outat any time, for any reason. Employers are often unaware of this option, so you may need to ask your employer to do some research with your Plan Administrator.

Again, you may have to pay income taxes and tax penalties, and youre raiding your retirement savings, so only use this option when you have no other choice.

How Holtzmans Tax Team Can Help

Like other tax legislation, the CARES Act includes many intricacies that can complicate taking advantage of early 401k withdrawals. Holtzmans team of accounting and tax advisors can help you determine whether you qualify for a hardship withdrawal and identify other opportunities to minimize your taxes. Contact our Tax Services team to learn how this important piece of legislation can benefit you.

You May Like: When Can You Take Out 401k

Retirement Savings Can Benefit

As you make loan repayments to your 401 account, they usually are allocated back into your portfolio’s investments. You will repay the account a bit more than you borrowed from it, and the difference is called “interest.” The loan produces no impact on your retirement if any lost investment earnings match the “interest” paid ini.e., earnings opportunities are offset dollar-for-dollar by interest payments.

If the interest paid exceeds any lost investment earnings, taking a 401 loan can actually increase your retirement savings progress. Keep in mind, however, that this will proportionally reduce your personal savings.

How Do You Withdraw Money From A 401 When You Retire

After retirement, one of the common questions that people ask is âhow do you withdraw money from a 401 when you retire?â. Find out the options you have.

As you plan your retirement, you should think about how you are going to live off your retirement savings once you are out of employment. You will need to figure out how to withdraw your retirement savings in your 401 post-retirement, and the best withdrawal strategies so that you donât exhaust your retirement savings.

When withdrawing your retirement savings from a 401, you can decide to take a lump-sum distribution, take a periodic distribution , buy an annuity, or rollover the retirement savings into an IRA.

Usually, once youâve attained 59 ½, you can start withdrawing money from your 401 without paying a 10% penalty tax for early withdrawals. Still, if you decide to retire at 55, you can take a distribution without being subjected to the penalty. However, any distribution you take after retirement is taxed, and you must include the distribution as an income when filing your annual tax return.

You May Like: How To Roll 401k To Ira

What Are The Disadvantages Of Withdrawing Money From Your 401 In Cases Of Hardship

- Taking a hardship withdrawal will reduce the size of your retirement nest egg, and the funds you withdraw will no longer grow tax deferred.

- Hardship withdrawals are generally subject to federal income tax. A 10 percent federal penalty tax may also apply if you’re under age 59½. contributions, only the portion of the withdrawal representing earnings will be subject to tax and penalties.)

- You may not be able to contribute to your 401 plan for six months following a hardship distribution.

When You Leave A Job

When you leave a job, you generally have the option to:

- Leave your 401 with your current employer

- Roll over the funds to an IRA

- Roll over the funds to your new employer’s 401.

If you choose any of those options, you will not owe taxes or a 10% penalty. You can also take this money as a distribution, but this will trigger early withdrawal penalties if you are under 59 1/2 .

You May Like: Do I Have A 401k Out There

Repaying Funds Now Vs Paying Taxes

If you have already taken a coronavirus-related distribution, the issue now is whether you recontribute the funds back to the plan , and whether you should pay taxes on the distribution if you don’t put the money back this year.

On the first front, replacing withdrawn funds from tax-deferred savings accounts as quickly as you can is generally a good idea.

The length and costs of the average American’s retirement continue to increase, and you may live to regret spending retirement savings now.

“The quicker you repay it, the quicker it begins earning a return again,” said Luscombe of Wolters Kluwer.

The timing could be better.

Individuals who took distributions earlier this year, missed out, at least to a degree, on one of the strongest recoveries from a bear market in history. People reinvesting withdrawals back into the stock market now will be doing so at much higher valuations.

As for how to account for the distribution and when to pay taxes on it, it depends on your financial circumstances.

If you lost your job or took a hit to income this year, but expect your situation to improve, you can return the funds within the next three years and file an amended return.

This way, you get a refund of the taxes you paid in the years the withdrawal was included in your income.

However, if you ultimately can’t repay the money within three years, you will owe taxes and possible penalties.

He recommends people pay taxes on one-third of the distribution this year.

Substantially Equal Periodic Payments

Substantially equal periodic payments are another option for withdrawing funds without paying the early distribution penalty if the funds are in an Individual Retirement Account rather than a company-sponsored 401 account.

SEPP withdrawals are not permitted under a qualified retirement plan if you are still working for your employer. However, if the funds are coming from an IRA, you may start SEPP withdrawals at any time.

There is an exception to this rule for taxpayers who die or become permanently disabled.

SEPP must be calculated using one of three methods approved by the Internal Revenue Service : fixed amortization, fixed annuitization, or required minimum distribution . Each method will calculate different withdrawal amounts, so choose the one that is best for your financial needs.

Read Also: How To Find Out 401k Balance

Three Consequences Of A 401 Early Withdrawal Or Cashing Out A 401

Taxes will be withheld. The IRS generally requires automatic withholding of 20% of a 401 early withdrawal for taxes. So if you withdraw $10,000 from your 401 at age 40, you may get only about $8,000. Keep in mind that you might get some of this back in the form of a tax refund at tax time if your withholding exceeds your actual tax liability.

The IRS will penalize you. If you withdraw money from your 401 before youre 59½, the IRS usually assesses a 10% penalty when you file your tax return. That could mean giving the government $1,000 of that $10,000 withdrawal. Between the taxes and penalty, your immediate take-home total could be as low as $7,000 from your original $10,000.

It may mean less money for your future. That may be especially true if the market is down when you make the early withdrawal. If you’re pulling funds out, it can severely impact your ability to participate in a rebound, and then your entire retirement plan is offset, says Adam Harding, a certified financial planner in Scottsdale, Arizona.